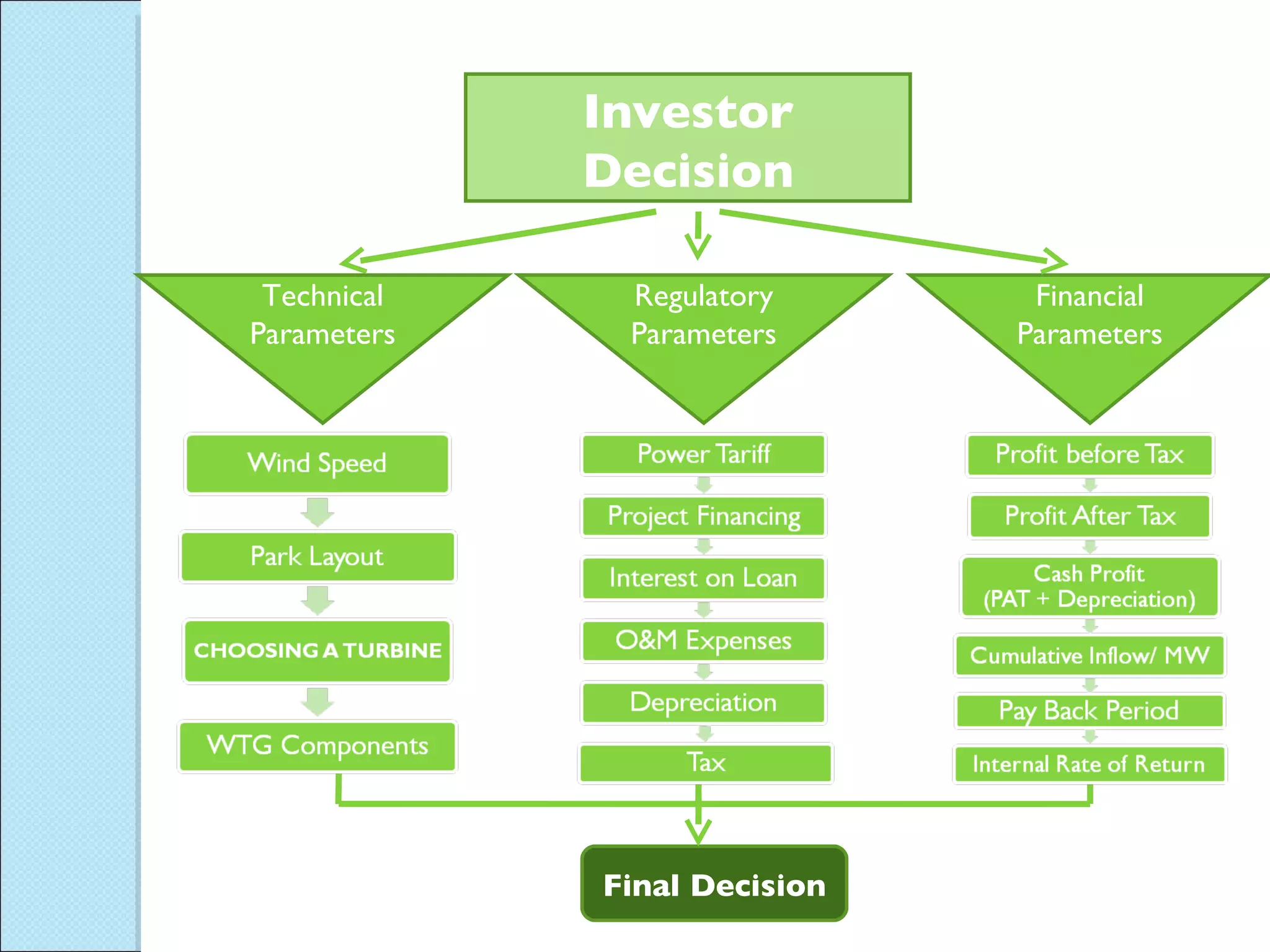

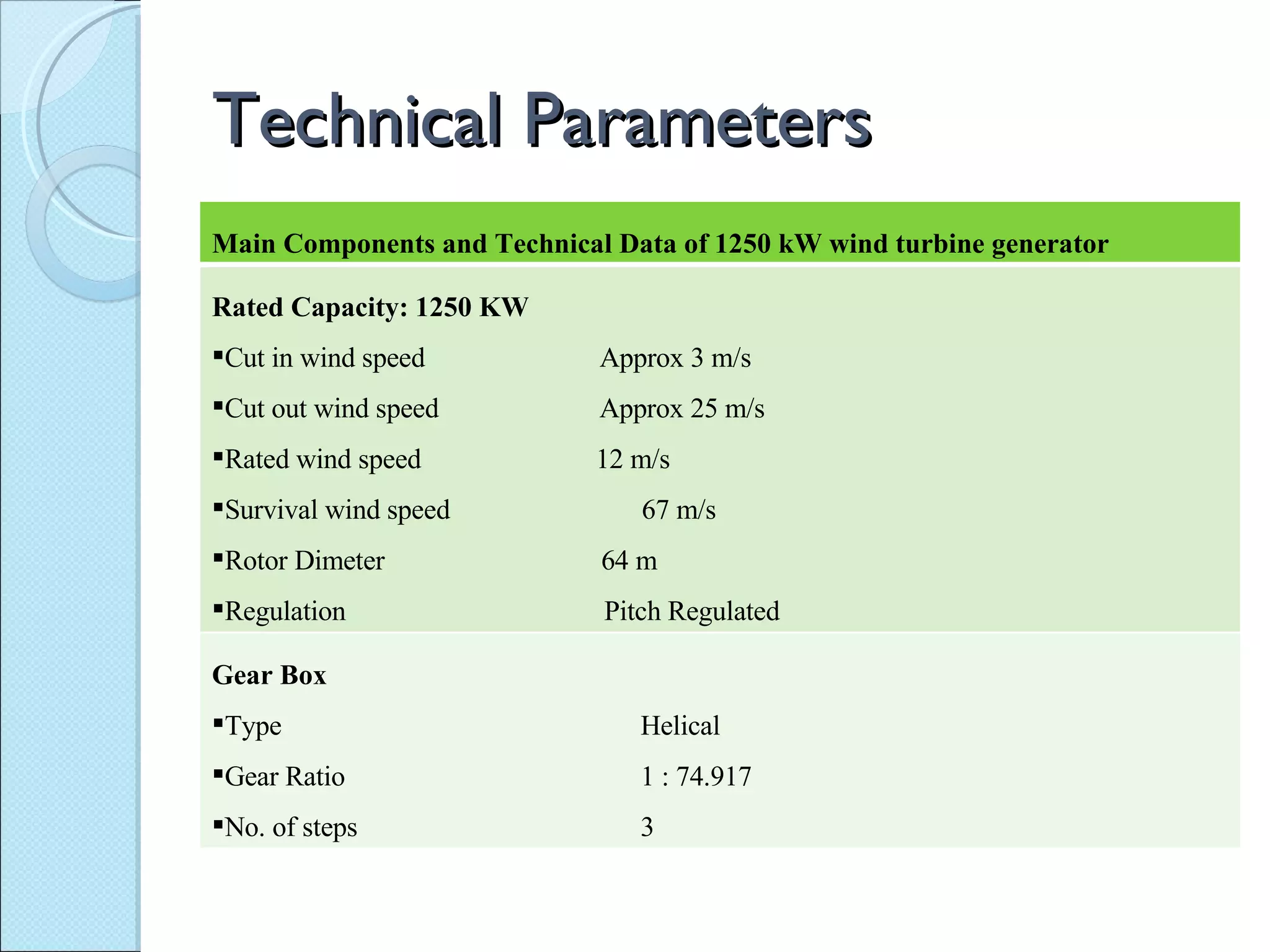

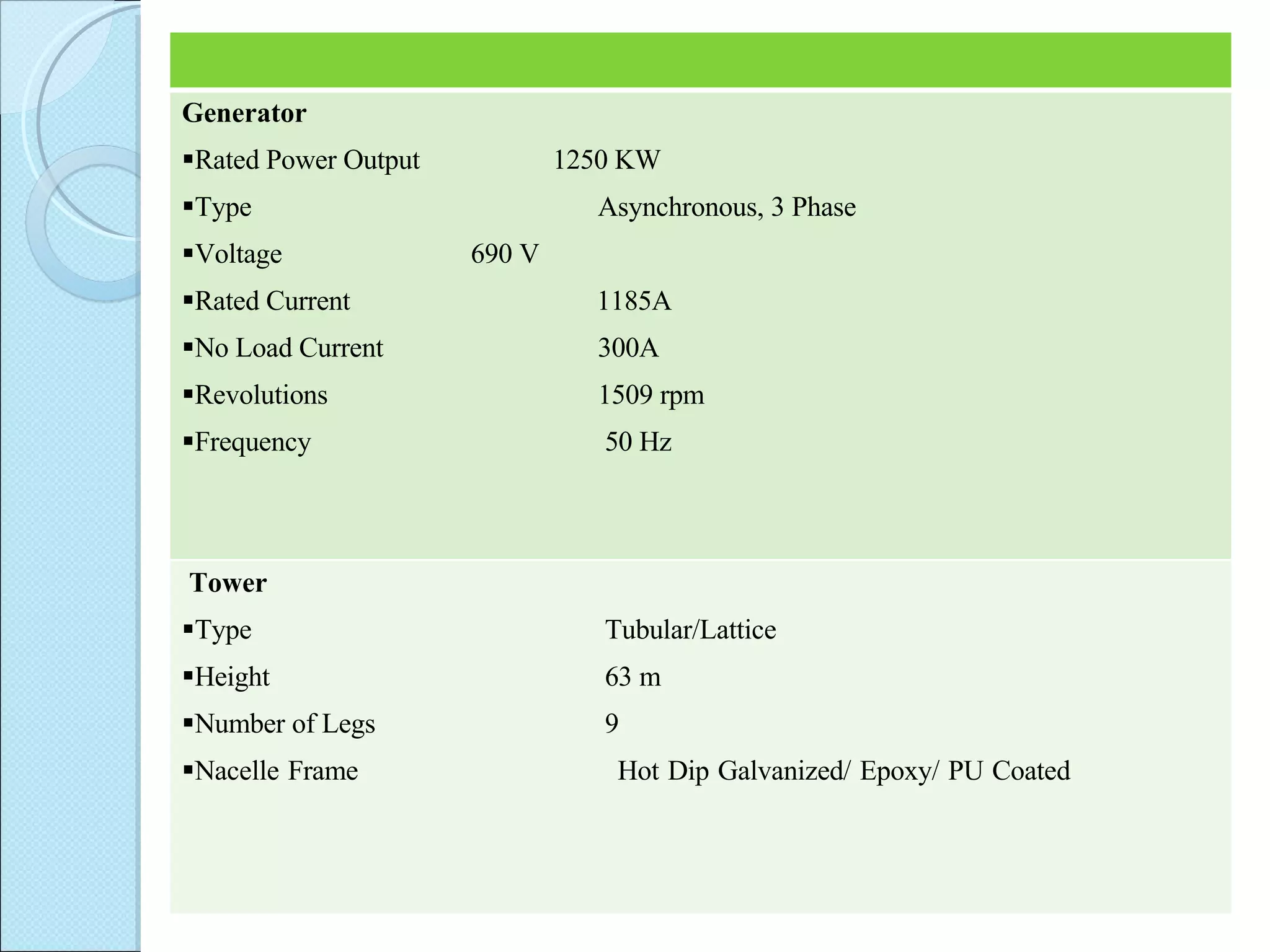

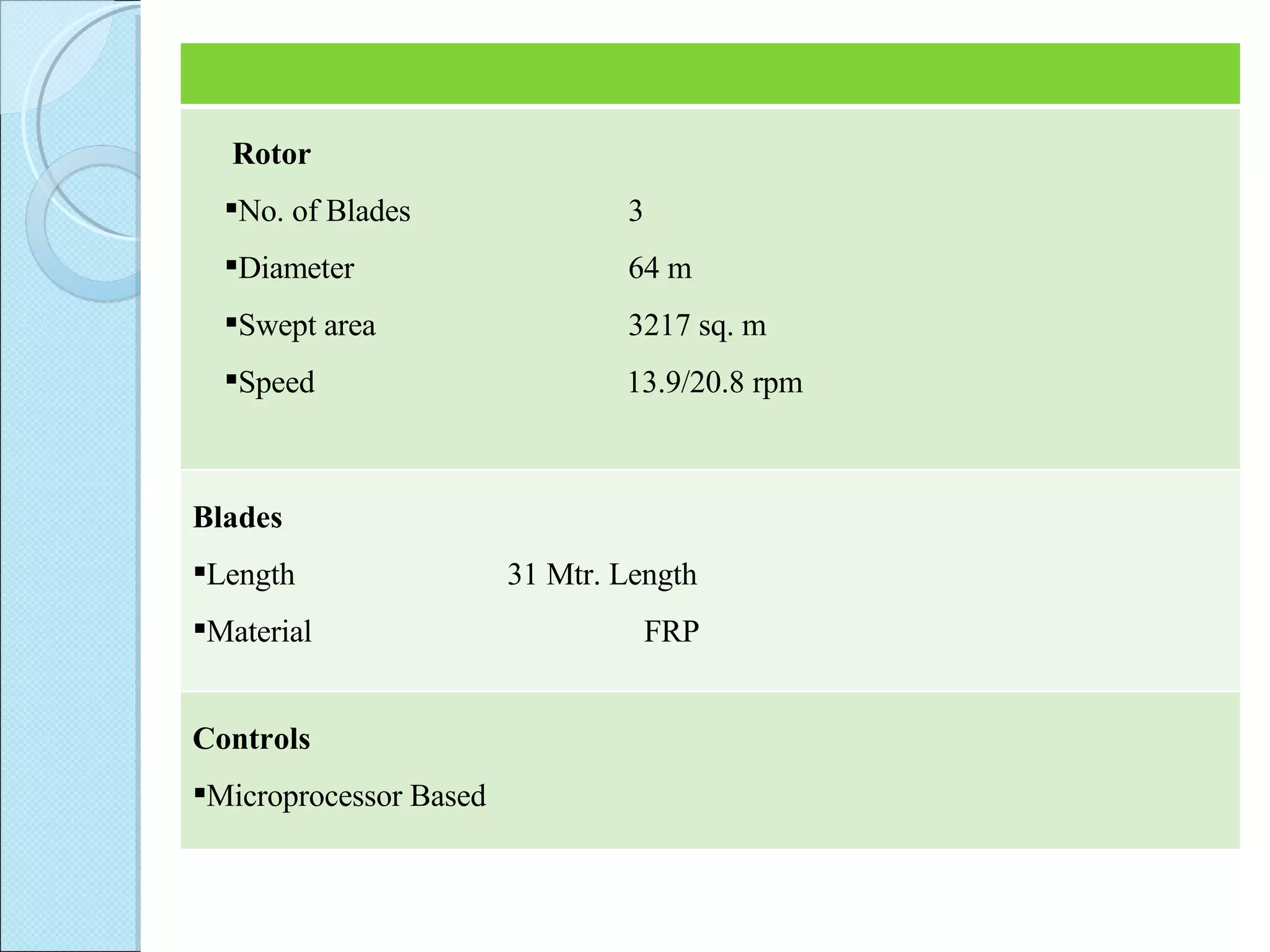

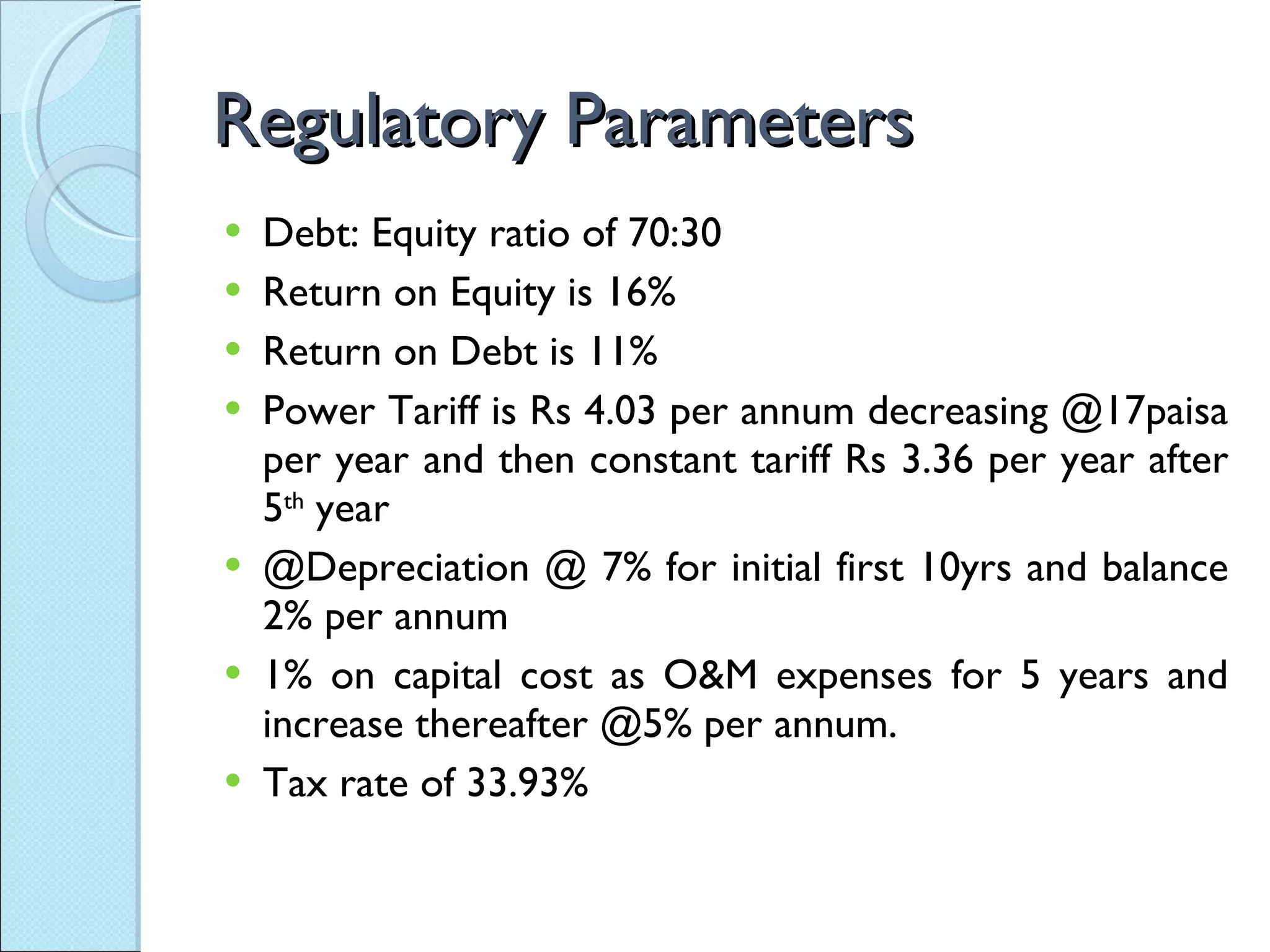

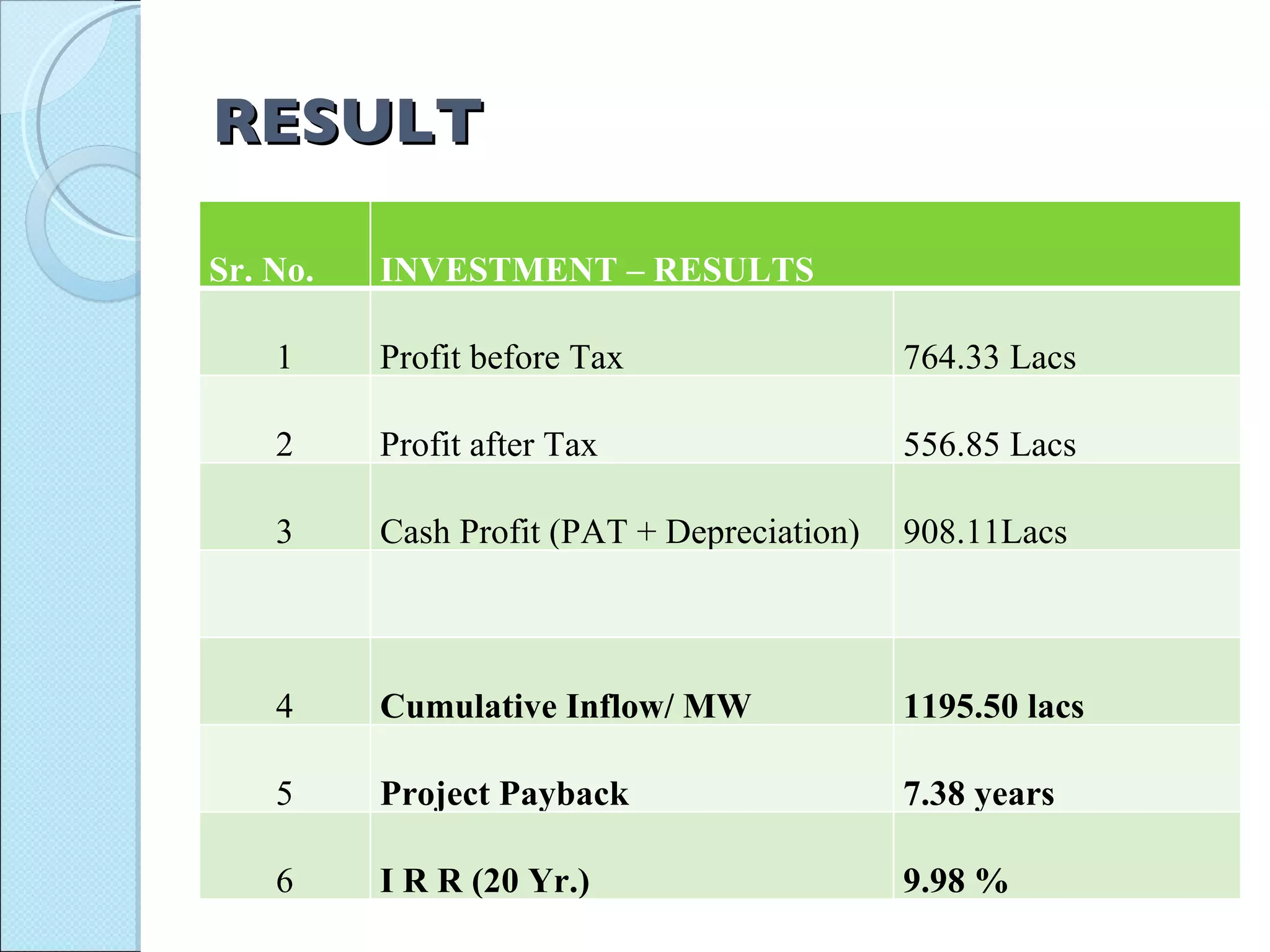

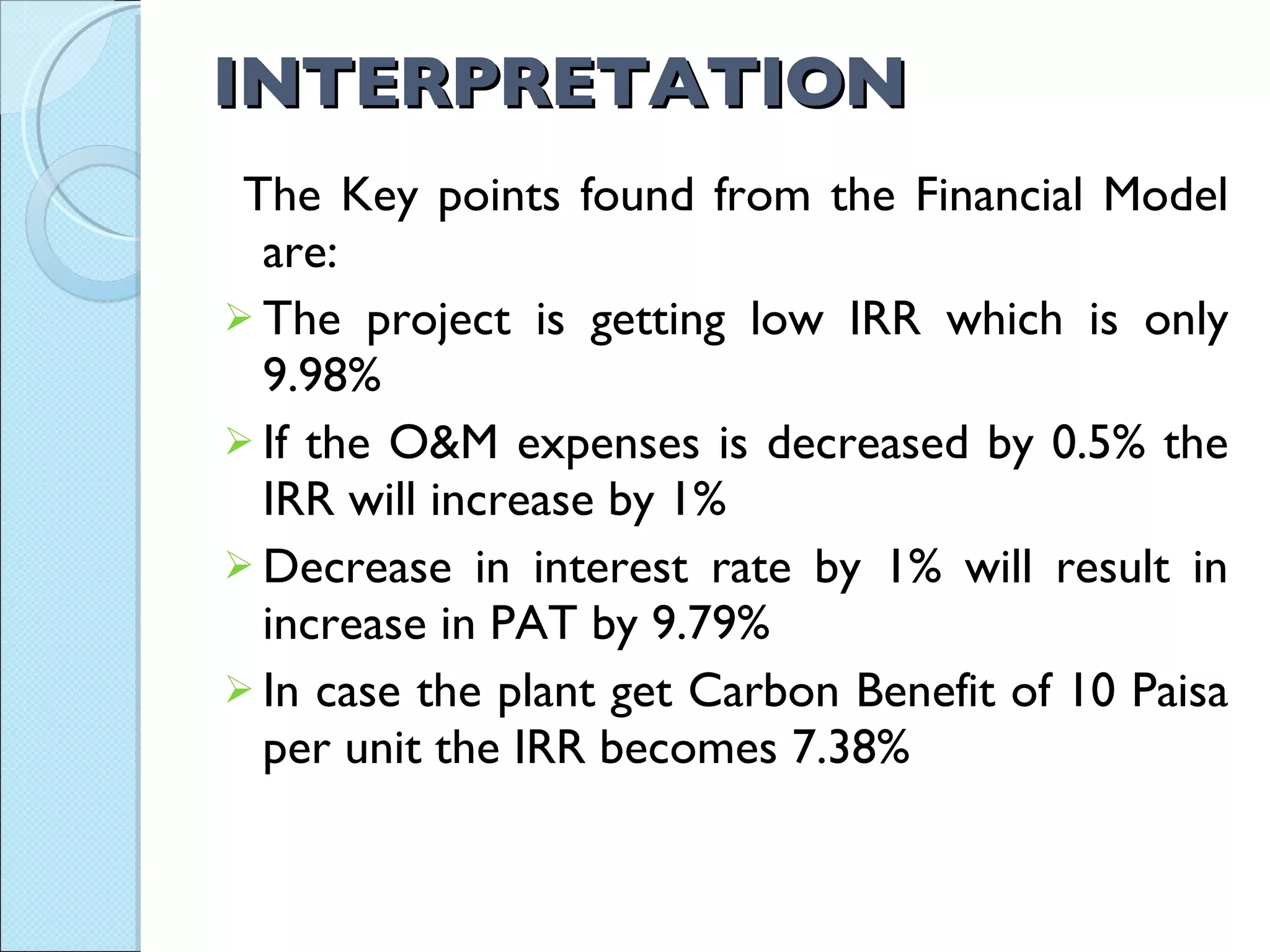

The document discusses setting up a wind power plant in Madhya Pradesh, India. It provides an overview of wind energy potential and capacity in the state. It then outlines the essential requirements for a wind farm and reasons for lack of investment. The document also describes the steps involved in building a wind farm and choosing turbine components. Finally, it presents a financial model analyzing the profitability of a potential wind power project.