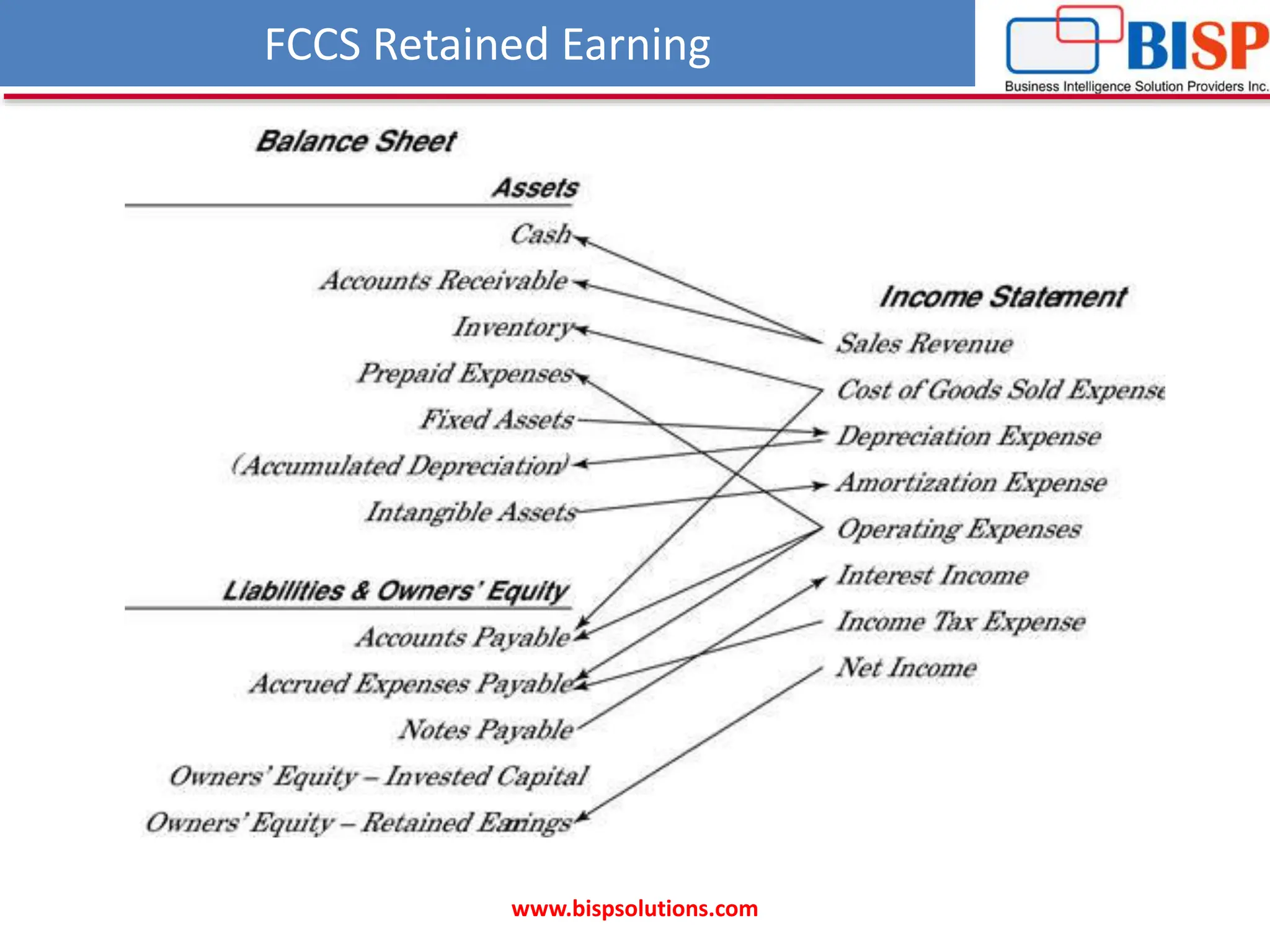

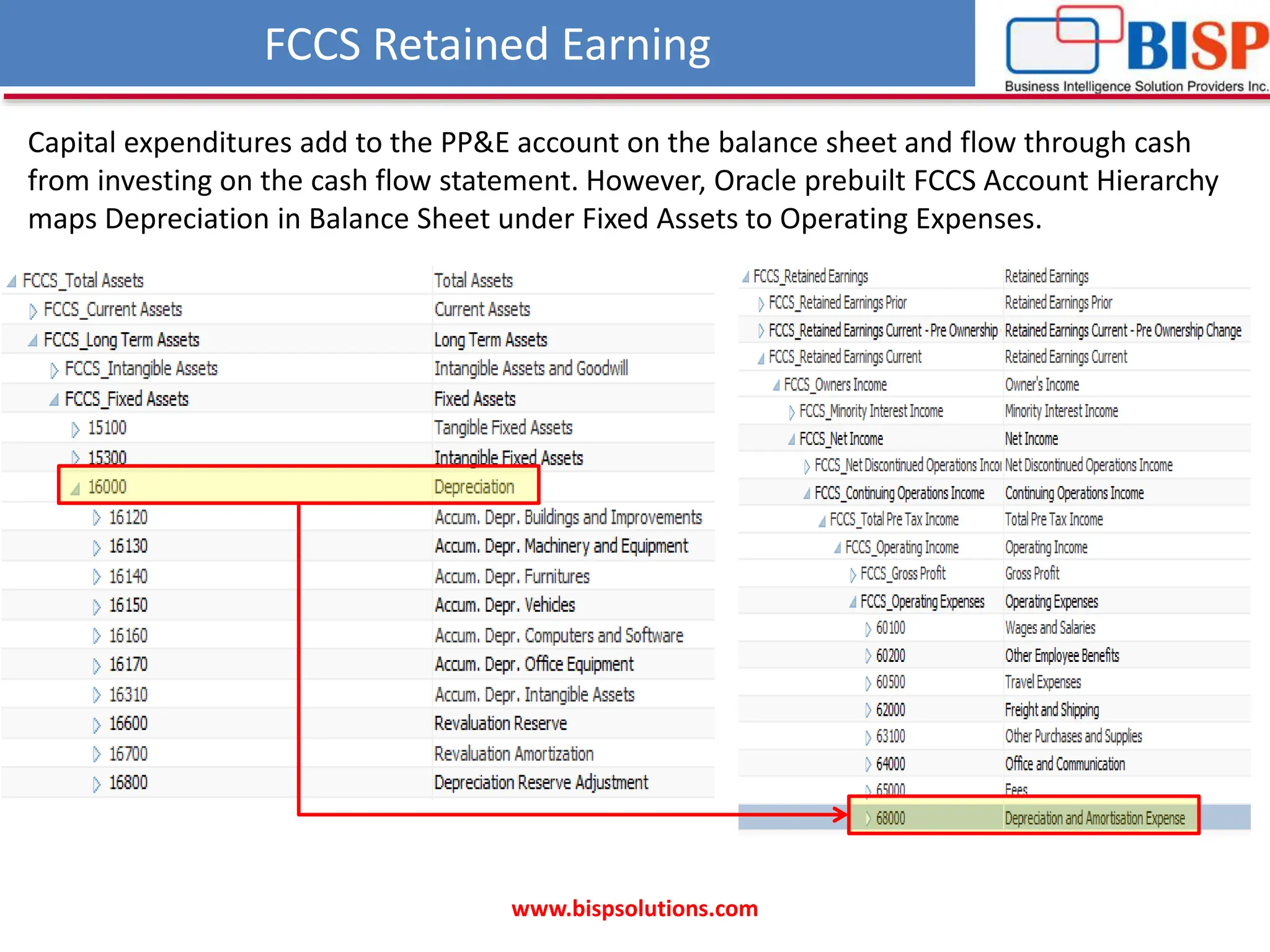

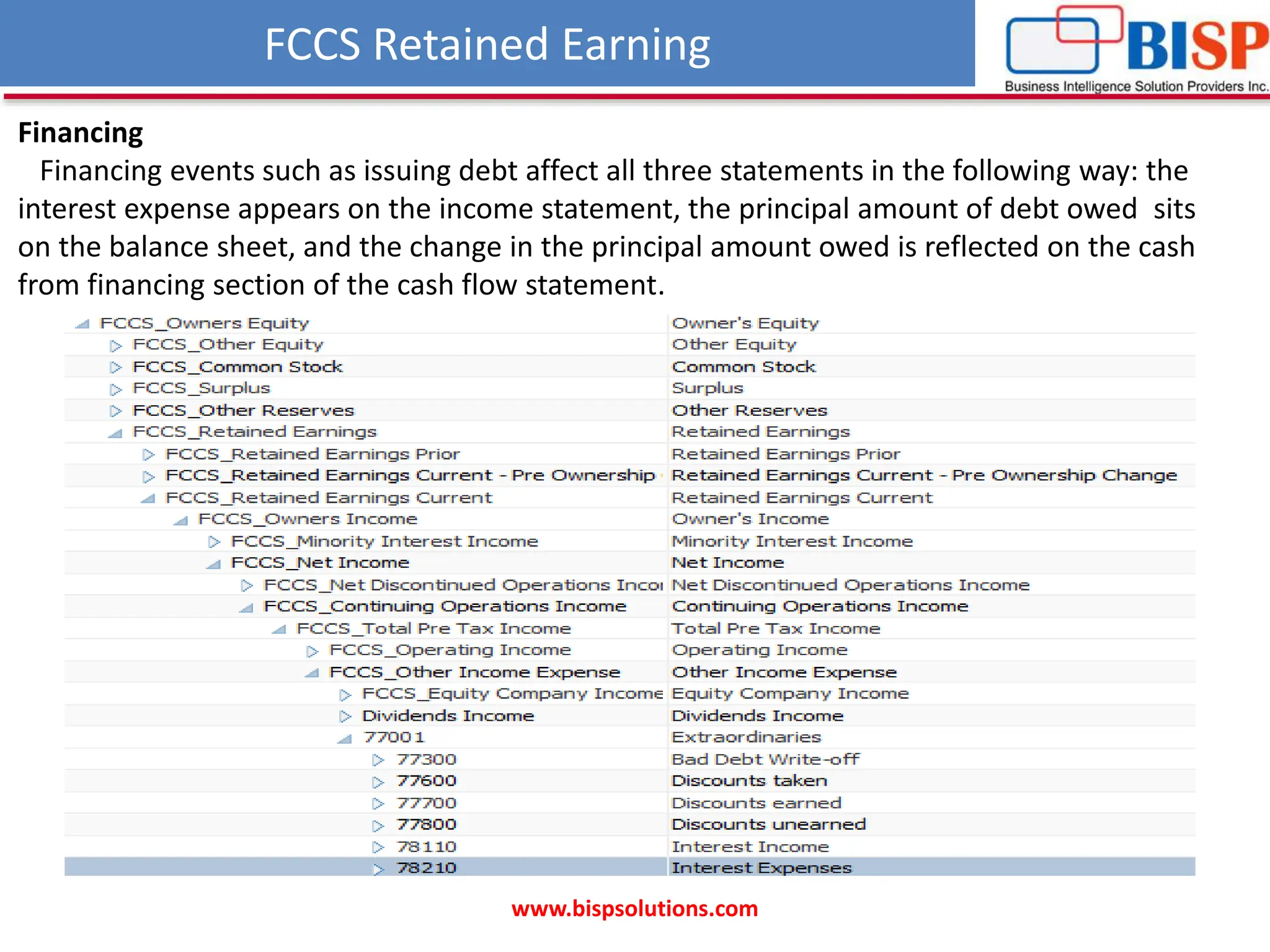

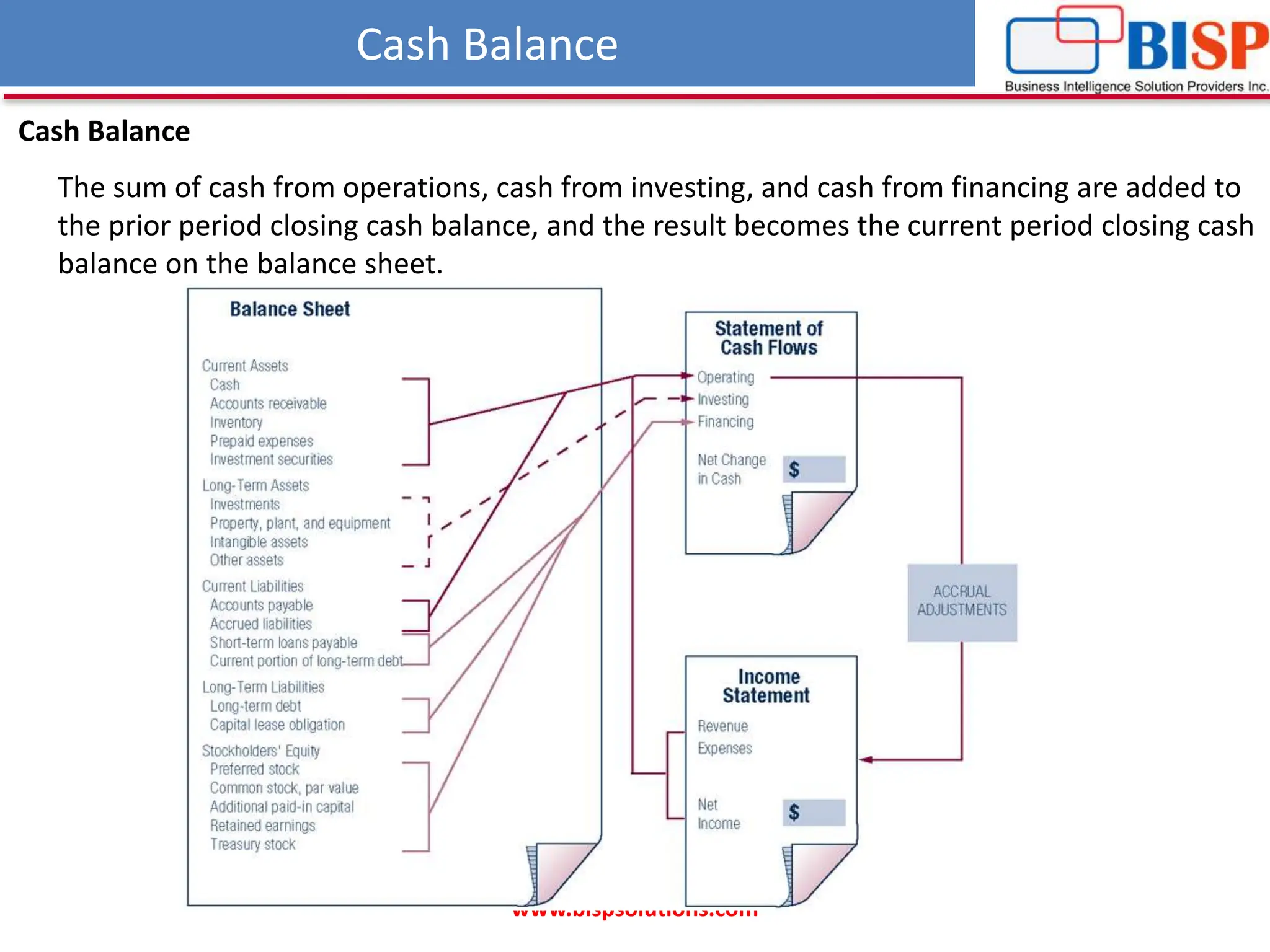

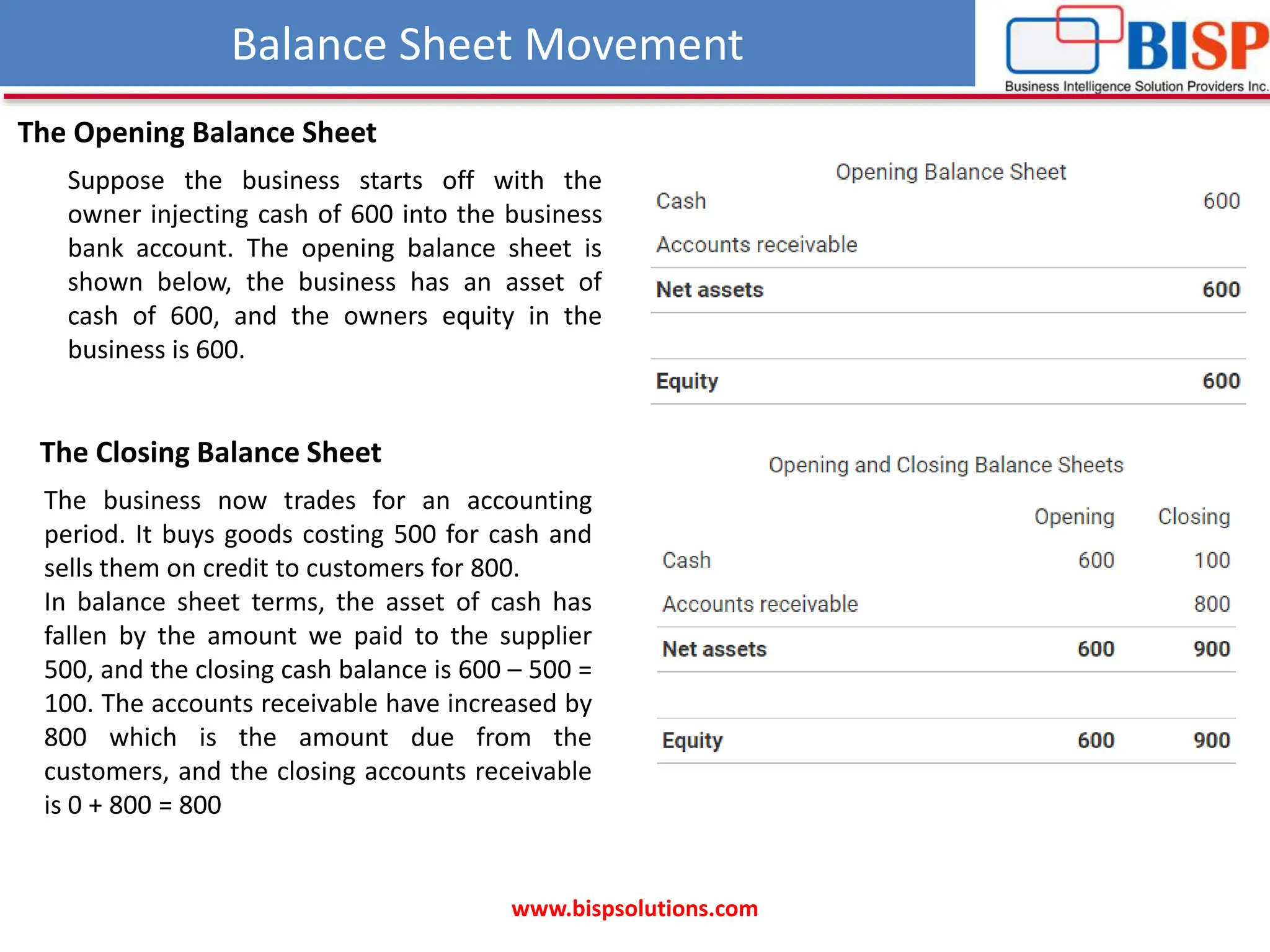

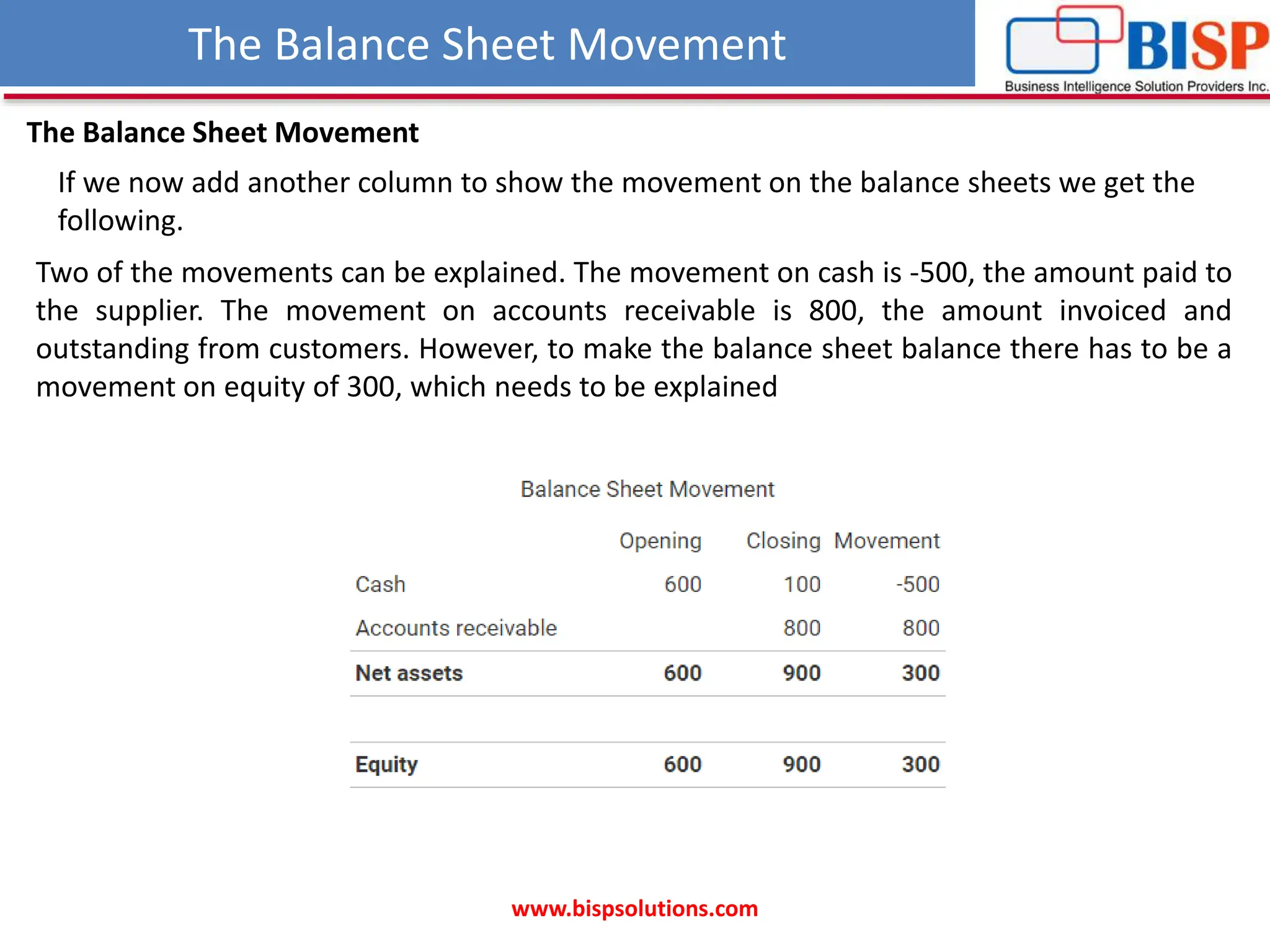

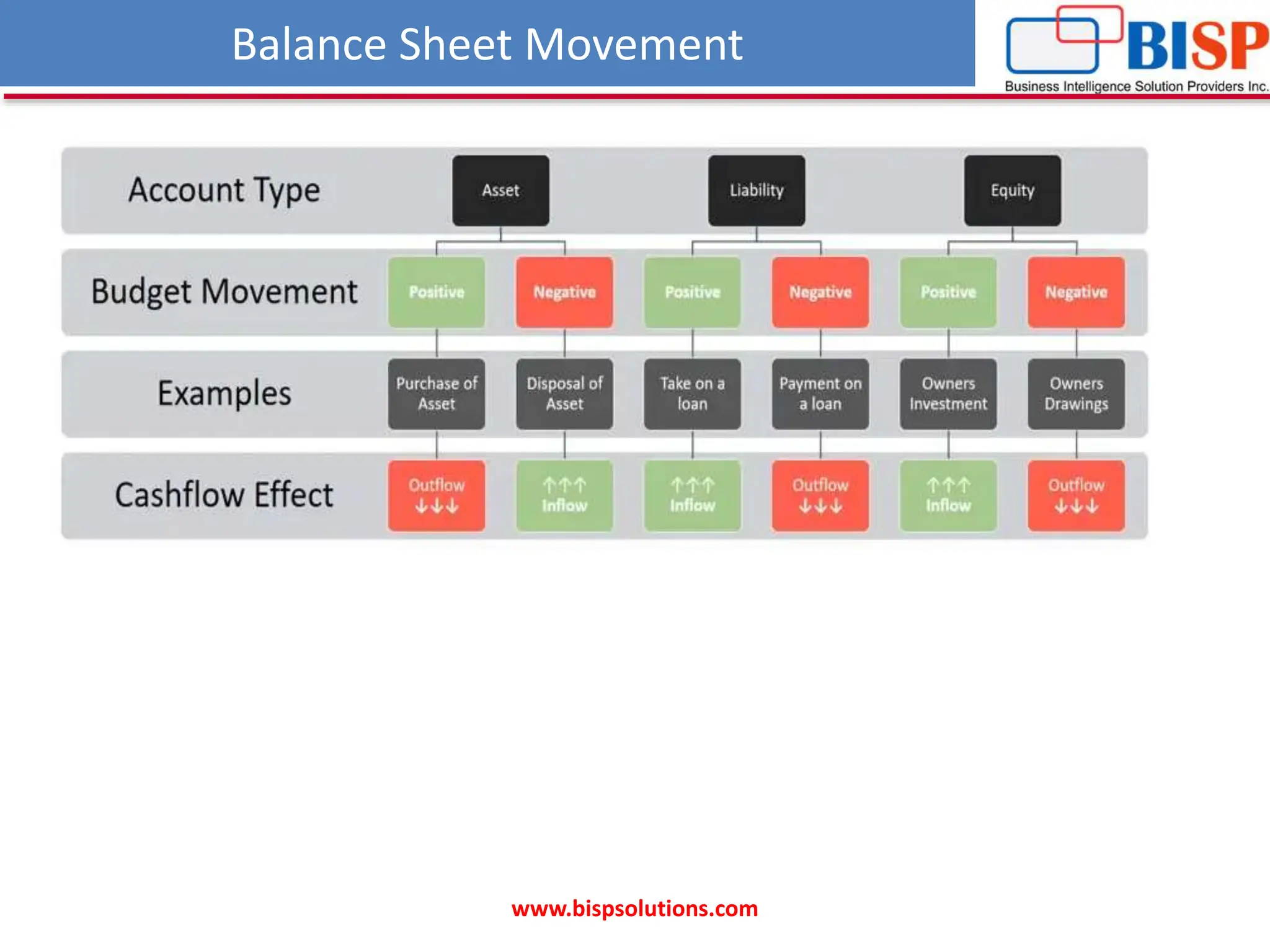

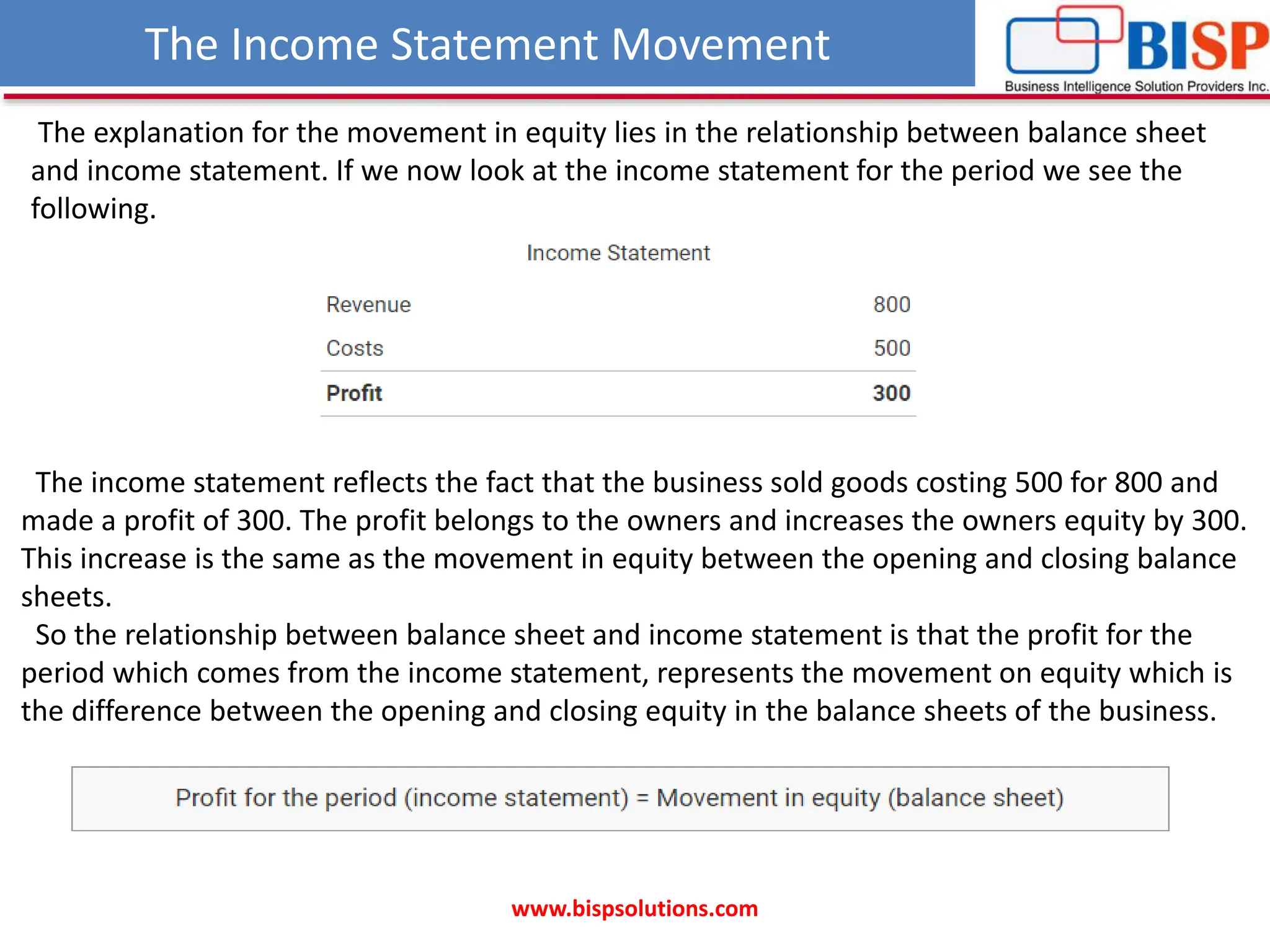

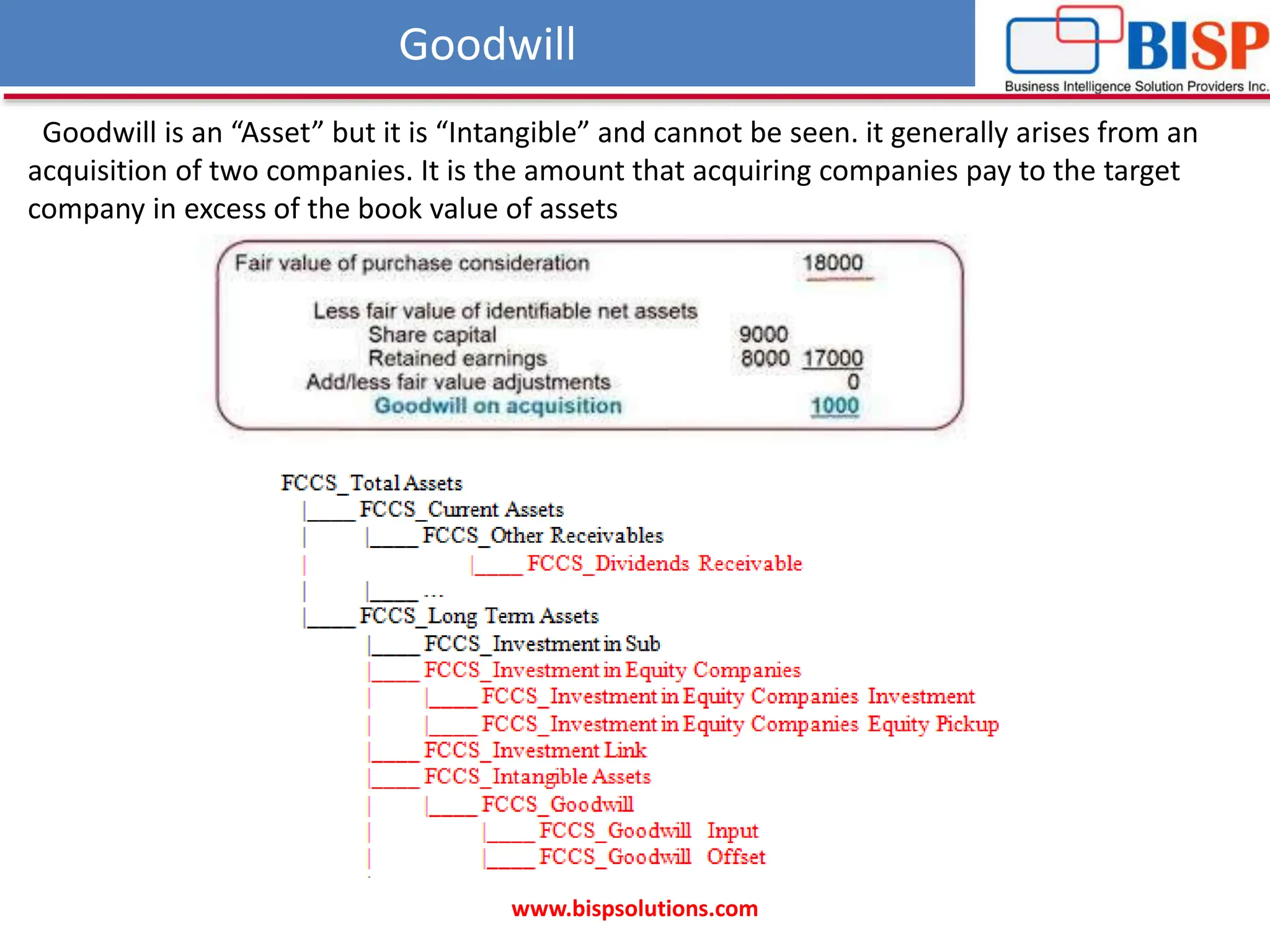

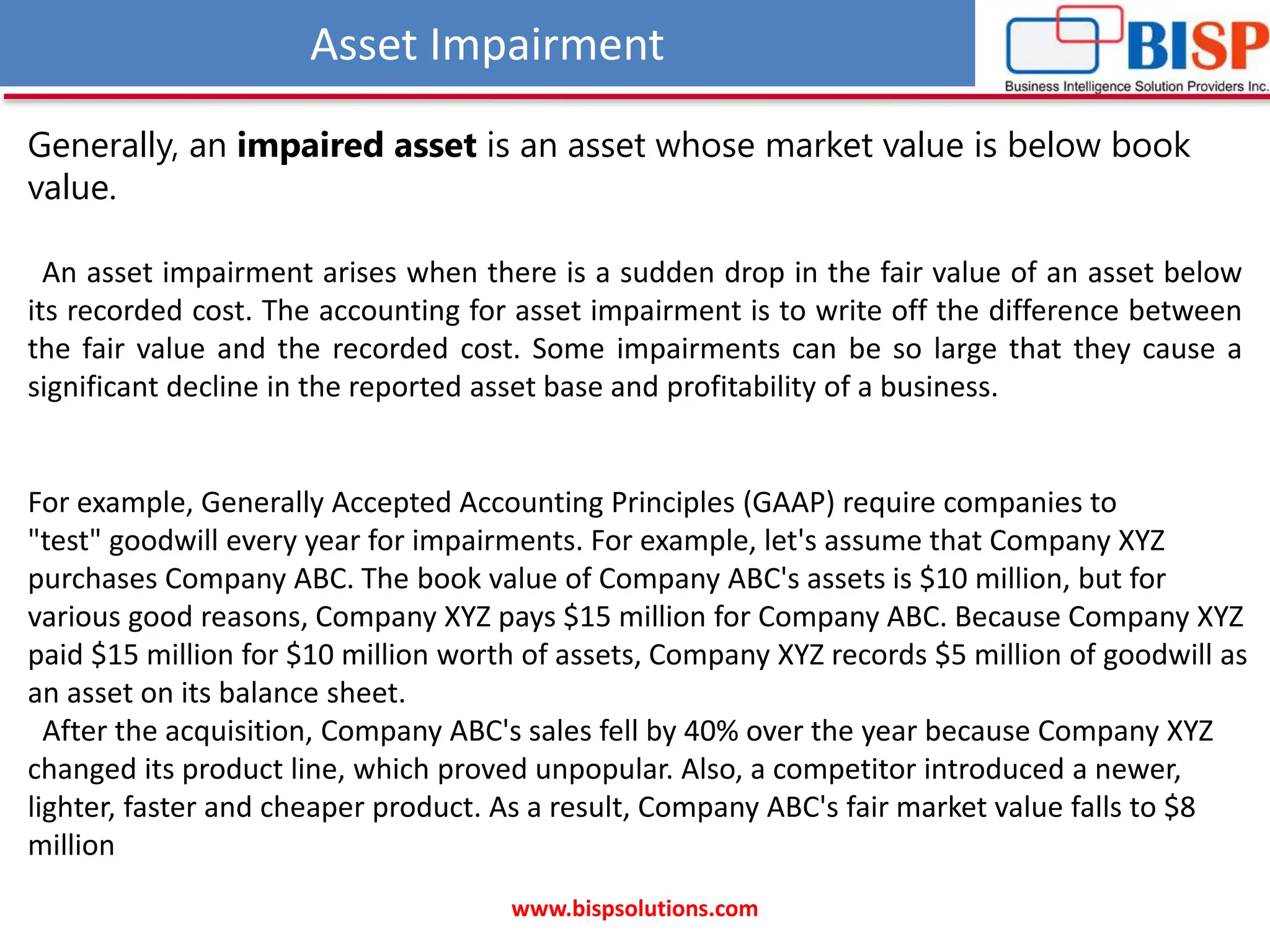

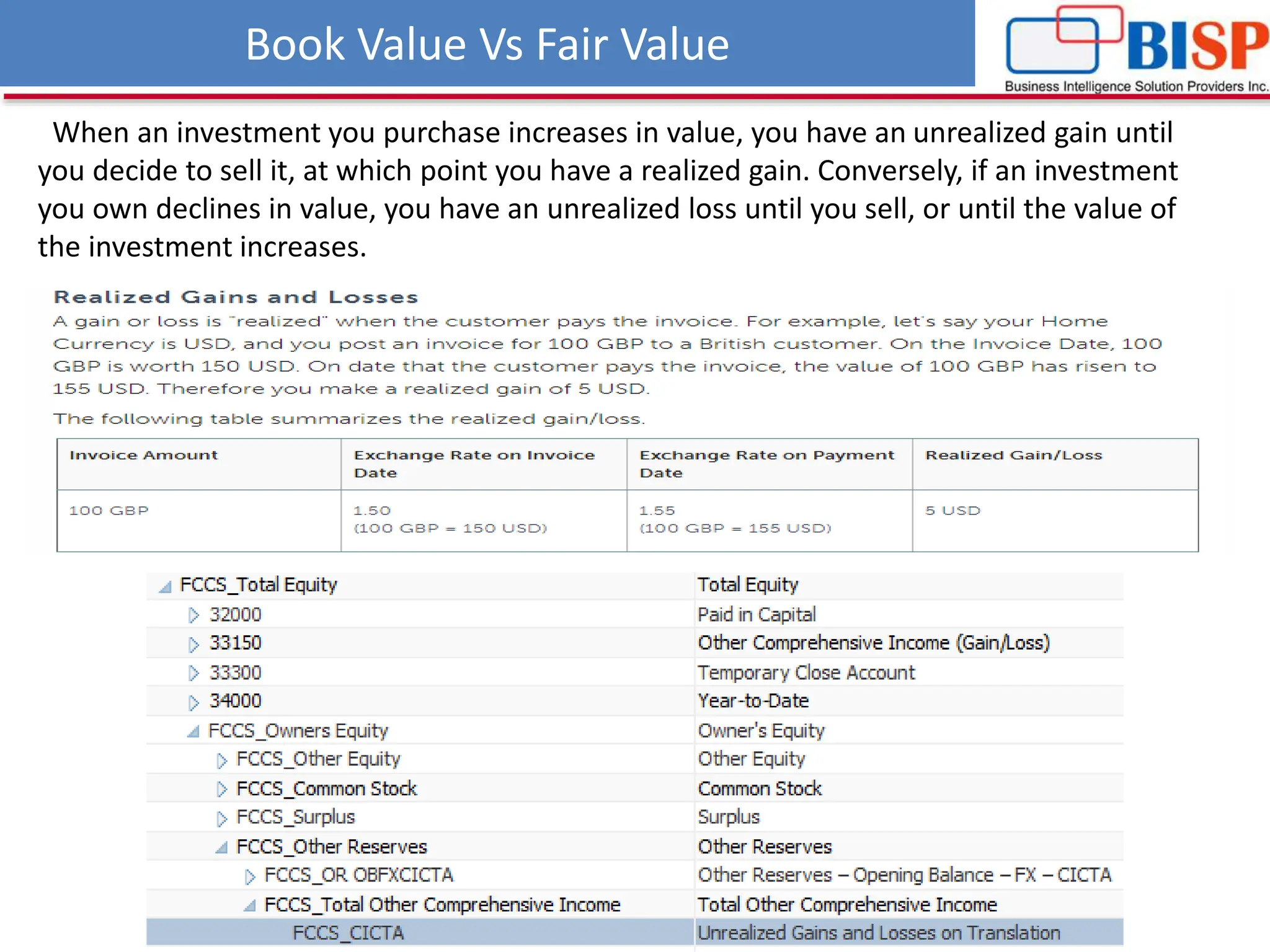

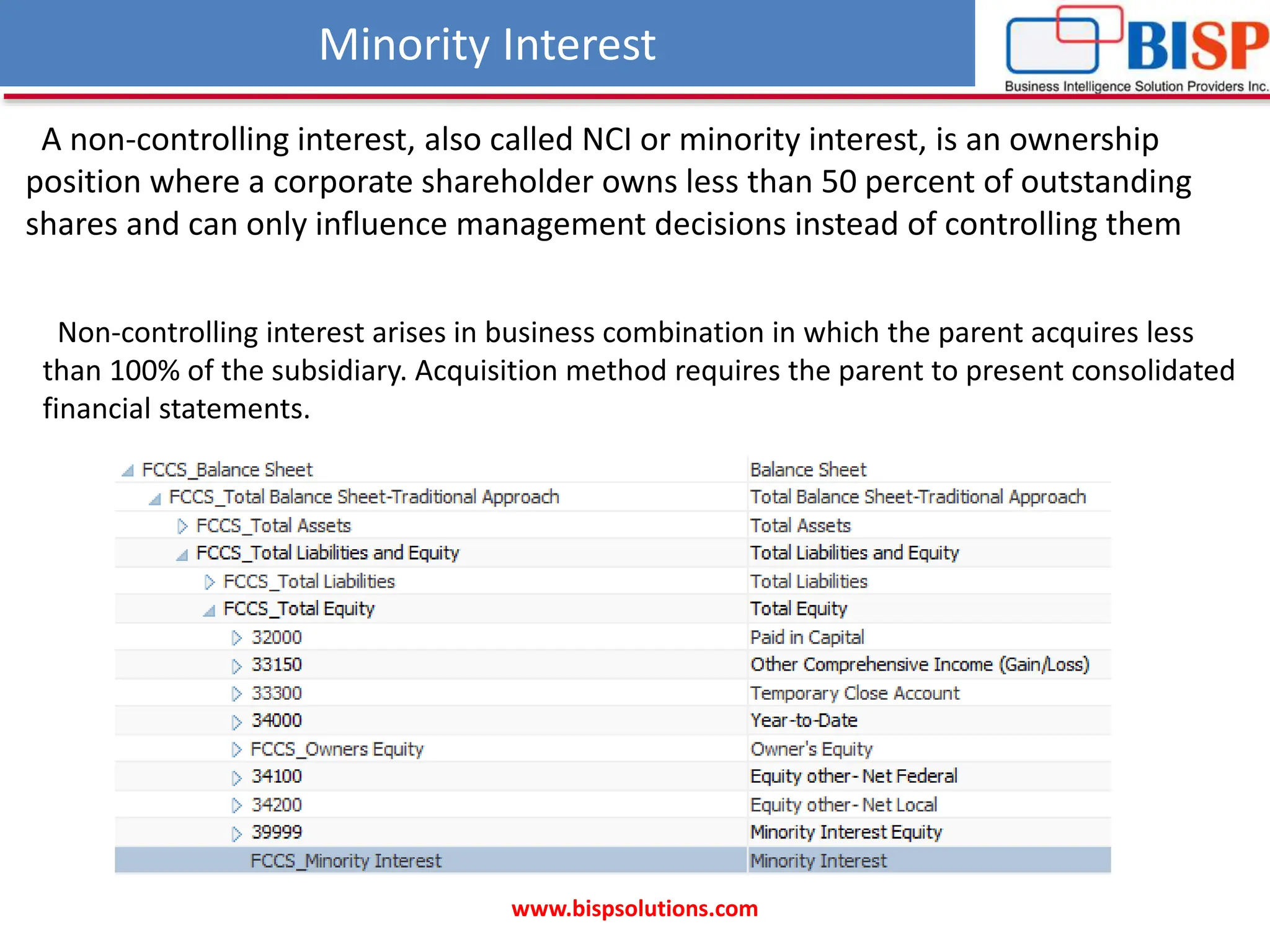

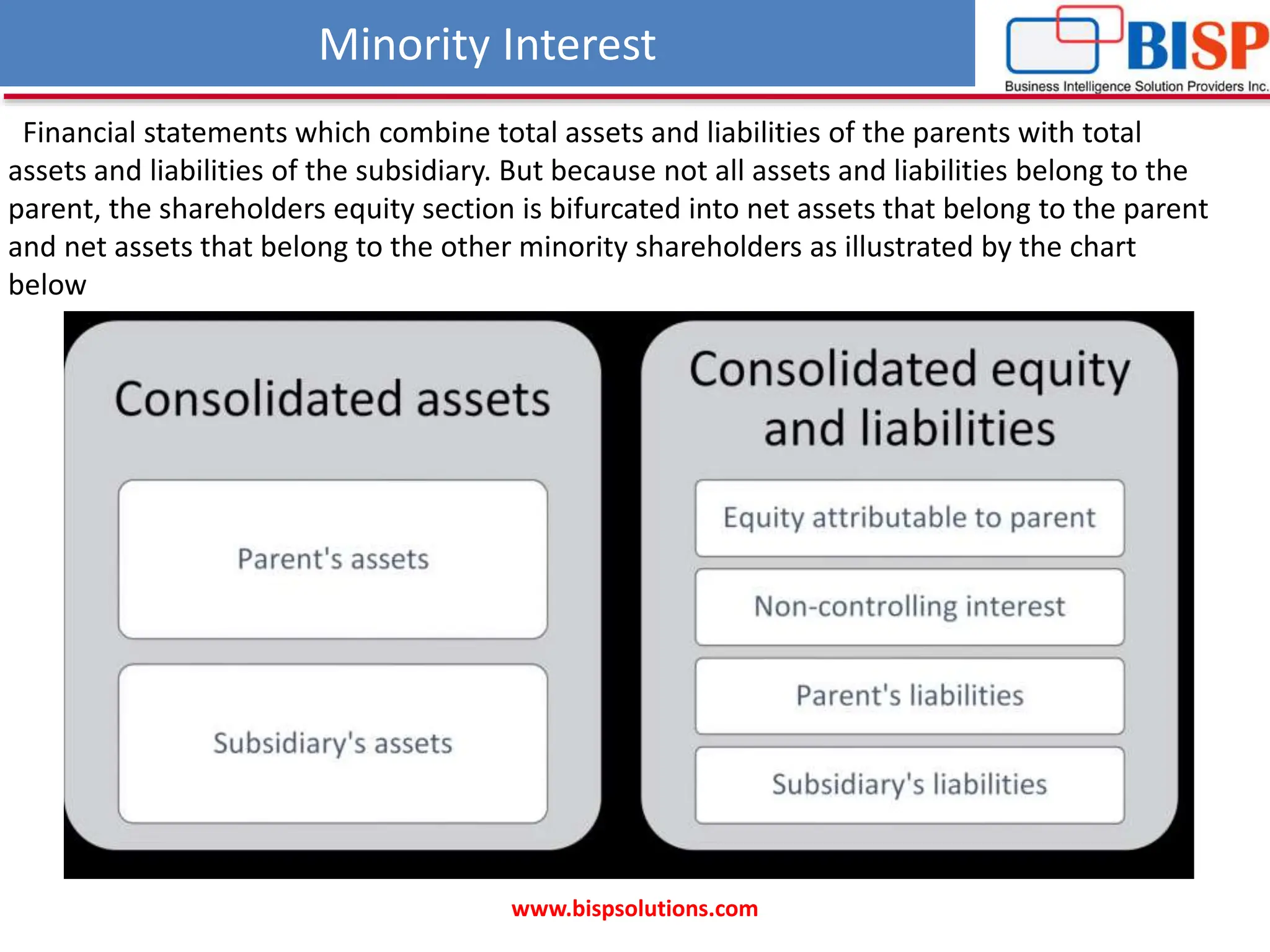

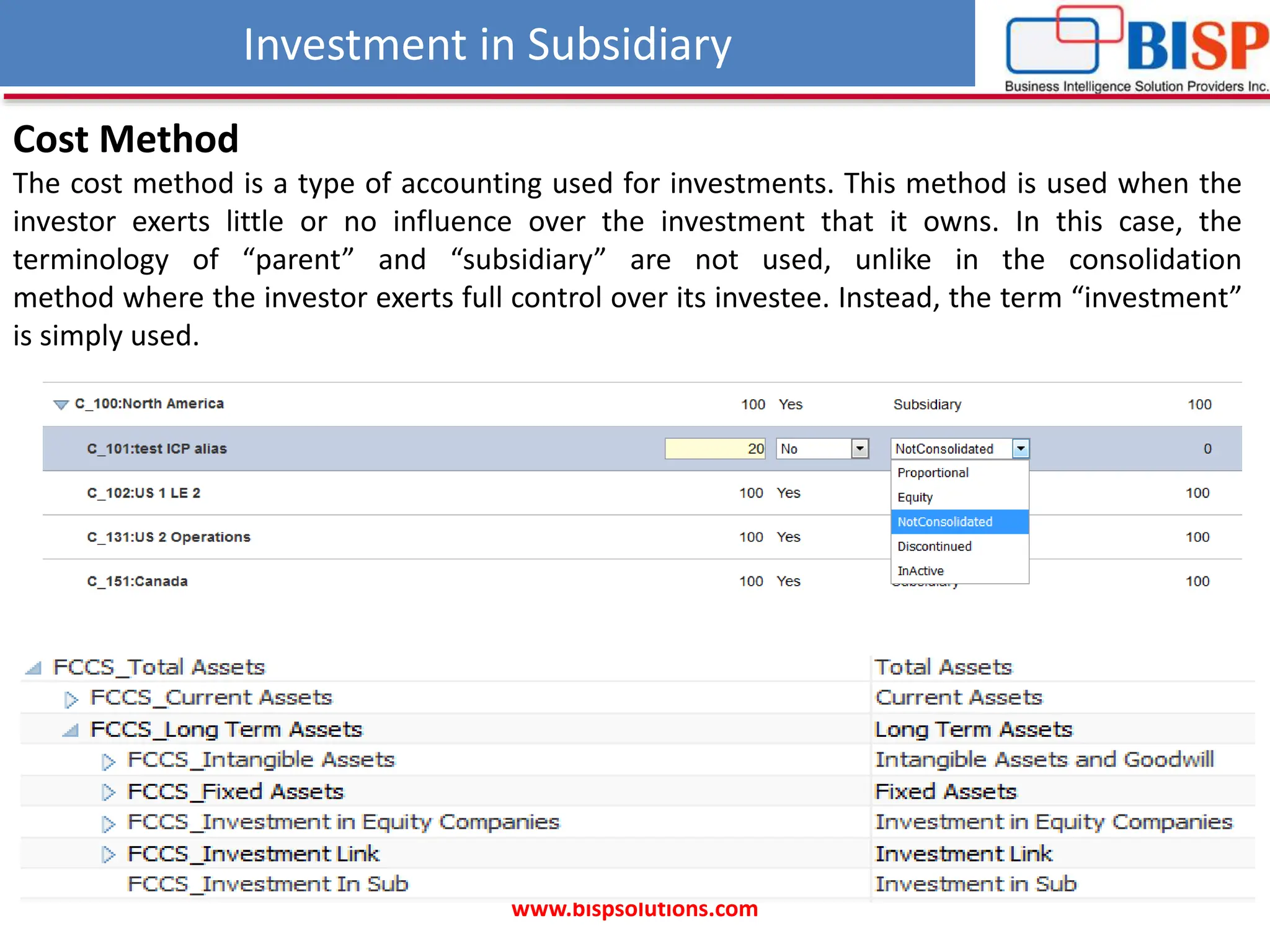

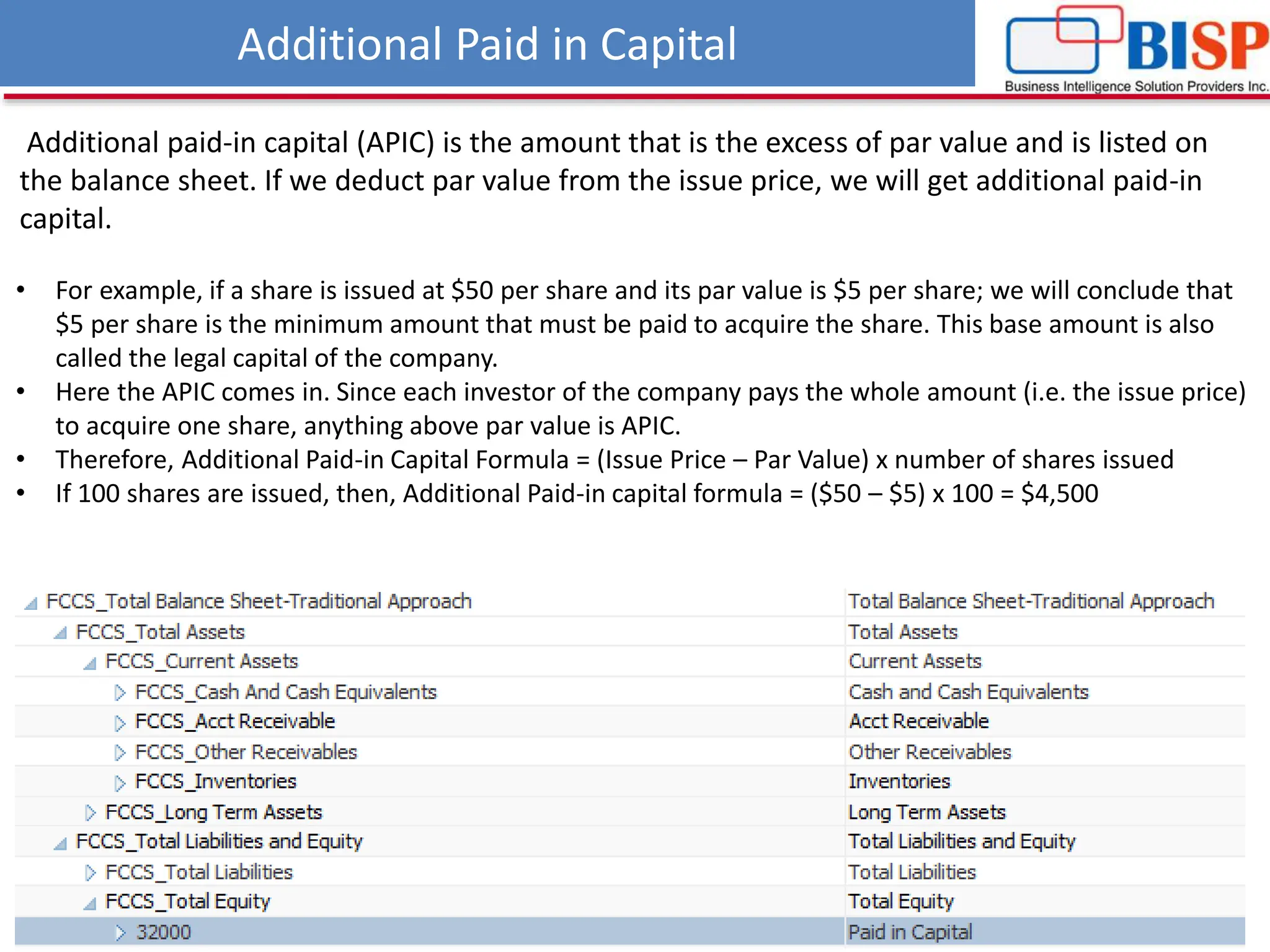

The document provides an overview of key financial statements including the balance sheet, income statement, and cash flow statement, highlighting their interconnections and components. It explains how profits, assets, liabilities, equity, and cash flows relate to each other, particularly in context to Oracle's FCCS financial hierarchy. Additional concepts such as goodwill, asset impairment, and minority interests are also discussed, emphasizing their implications on financial reporting.