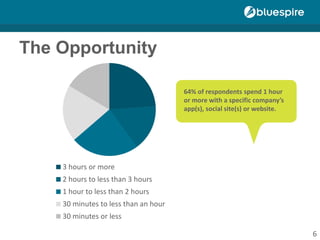

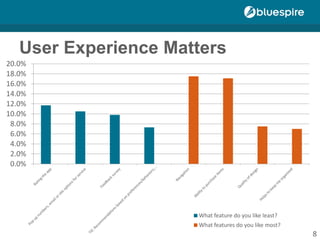

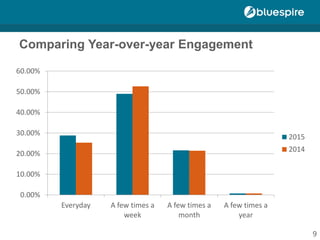

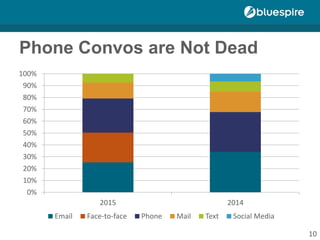

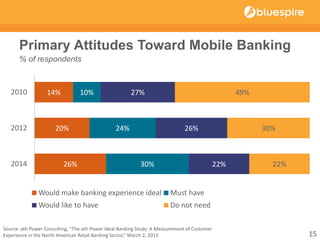

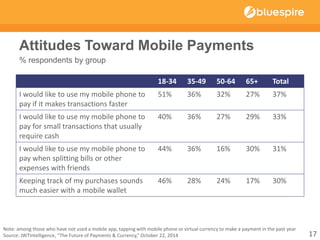

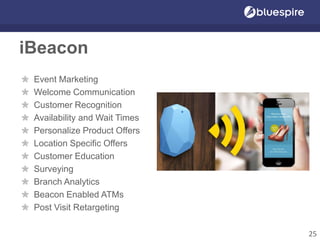

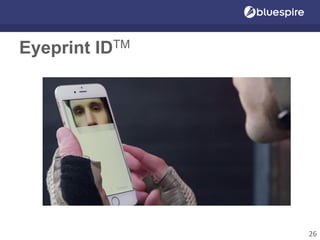

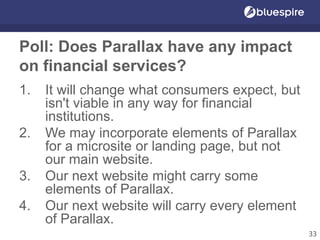

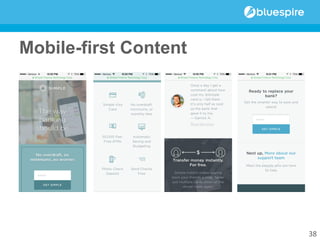

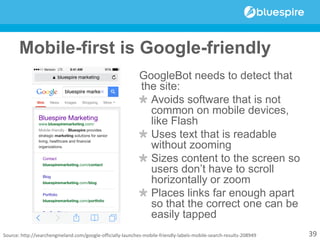

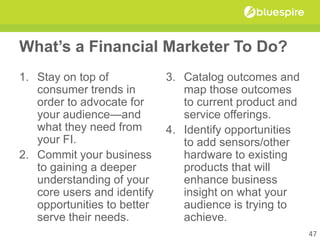

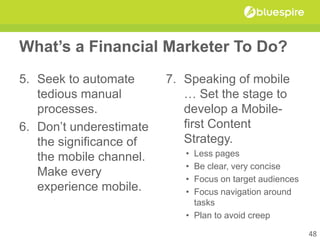

The presentation discusses the evolving landscape of digital marketing within the financial industry, highlighting trends such as increased consumer time spent on digital channels and the importance of user experience. It emphasizes the need for financial marketers to adapt by understanding consumer trends, implementing mobile-first strategies, and leveraging integrated marketing to enhance customer experiences. Key recommendations include automating processes, focusing on mobile content, and employing data-driven approaches to meet consumer needs.