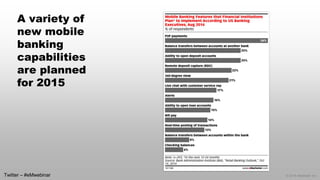

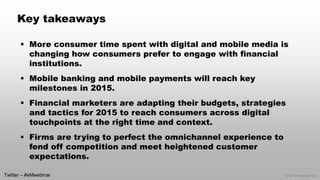

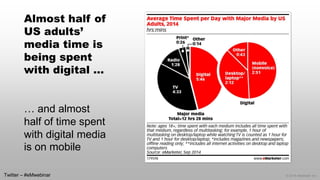

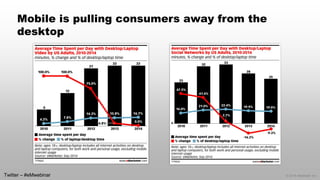

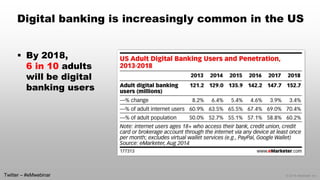

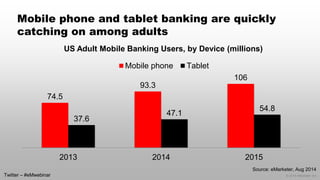

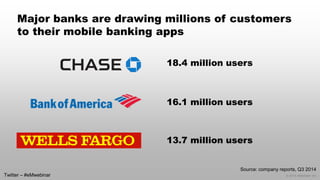

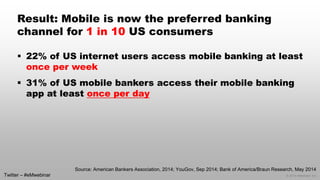

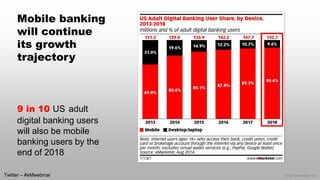

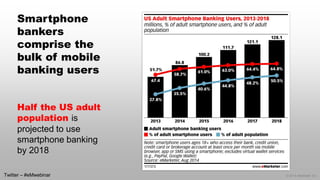

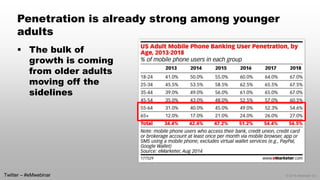

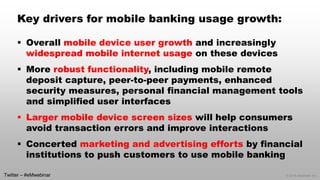

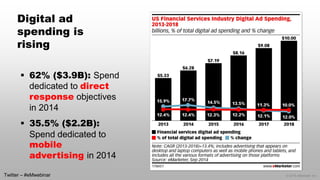

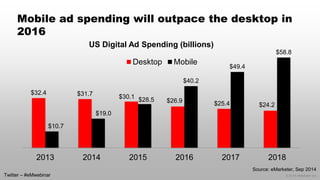

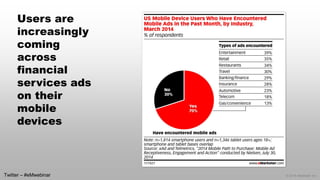

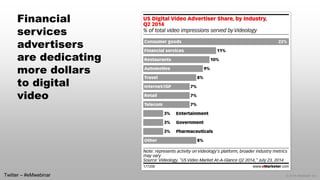

The document discusses trends in the financial services industry in 2015, with a focus on the increasing importance of mobile. It notes that consumer attention and activity are rapidly shifting to mobile devices, with almost half of US adults' media time now on digital platforms and half of that on mobile. As a result, financial marketers are significantly increasing their mobile investments and pushing for an omnichannel customer experience. The key takeaway is that mobile banking and payments will reach new adoption milestones in 2015 as consumers demand more options across channels.

![© 2014 eMarketer Inc.

Digital ad KPIs are also evolving as marketers become more sophisticated

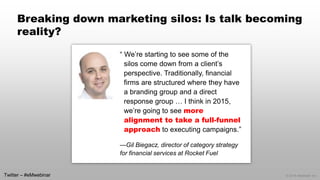

“ A lot of companies are using basic media metrics to optimize their programs. Not every [acquired] account is going to drive the same value to their business … More sophisticated clients are starting to think about, as well as implement, value-based KPIs.”

—Gil Biegacz, director of category strategy for financial services at Rocket Fuel

Twitter –#eMwebinar](https://image.slidesharecdn.com/emarketerwebinarfinancialservices2015outlook-141112135915-conversion-gate02/85/eMarketer-Webinar-Financial-Services-2015-Outlook-Mobile-Comes-into-Focus-27-320.jpg)