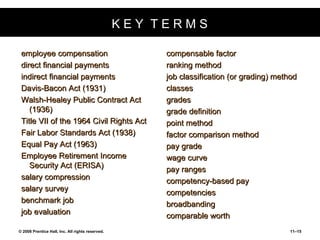

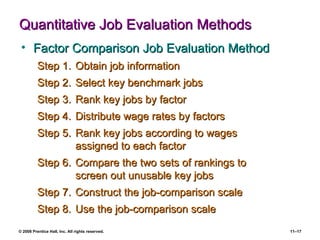

This document discusses establishing strategic pay plans and compensation trends. It covers basic factors in determining pay rates like equity, legal considerations, and salary surveys. Methods for evaluating jobs are discussed, like job analysis, evaluation, and grouping similar jobs into pay grades. Pricing managerial and professional jobs involves base pay, benefits, incentives. Competency-based pay and broadbanding are current compensation trends addressed. Key terms related to compensation and establishing pay rates are also defined.