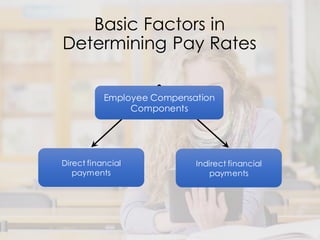

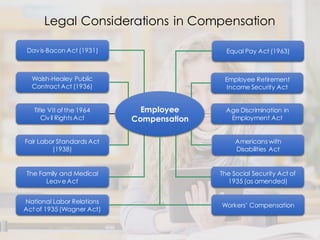

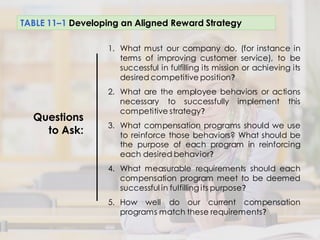

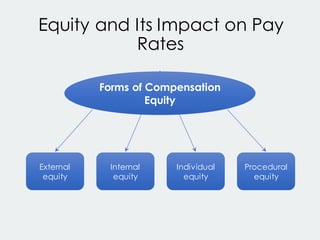

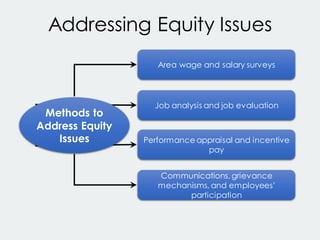

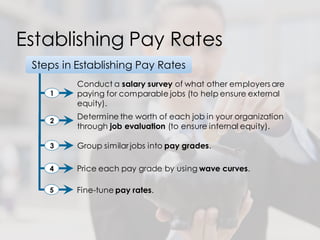

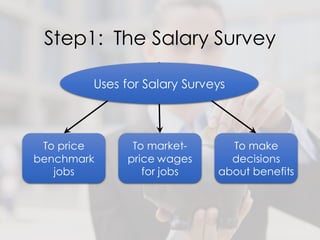

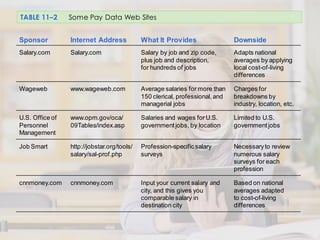

The document discusses the basic factors that determine pay rates, including job evaluations, salary surveys, and addressing issues of equity both within a company and compared to external market salaries. It provides steps for companies to establish pay rates, including determining the worth of jobs, conducting salary surveys, grouping similar jobs into pay grades, setting pay grade rates, and fine-tuning individual pay rates. Legal considerations that can impact compensation are also reviewed.

![Welcome toHUMAN RESOURCES

MANAGEMENT

CompensationBasic Factors in

Determining Pay Rates

Dyah Pramanik, MM

[ ]](https://image.slidesharecdn.com/topic7-161125123714/85/Topic7-1a-compensation-basic_factors_in_determining_pay_rates-new-1-320.jpg)