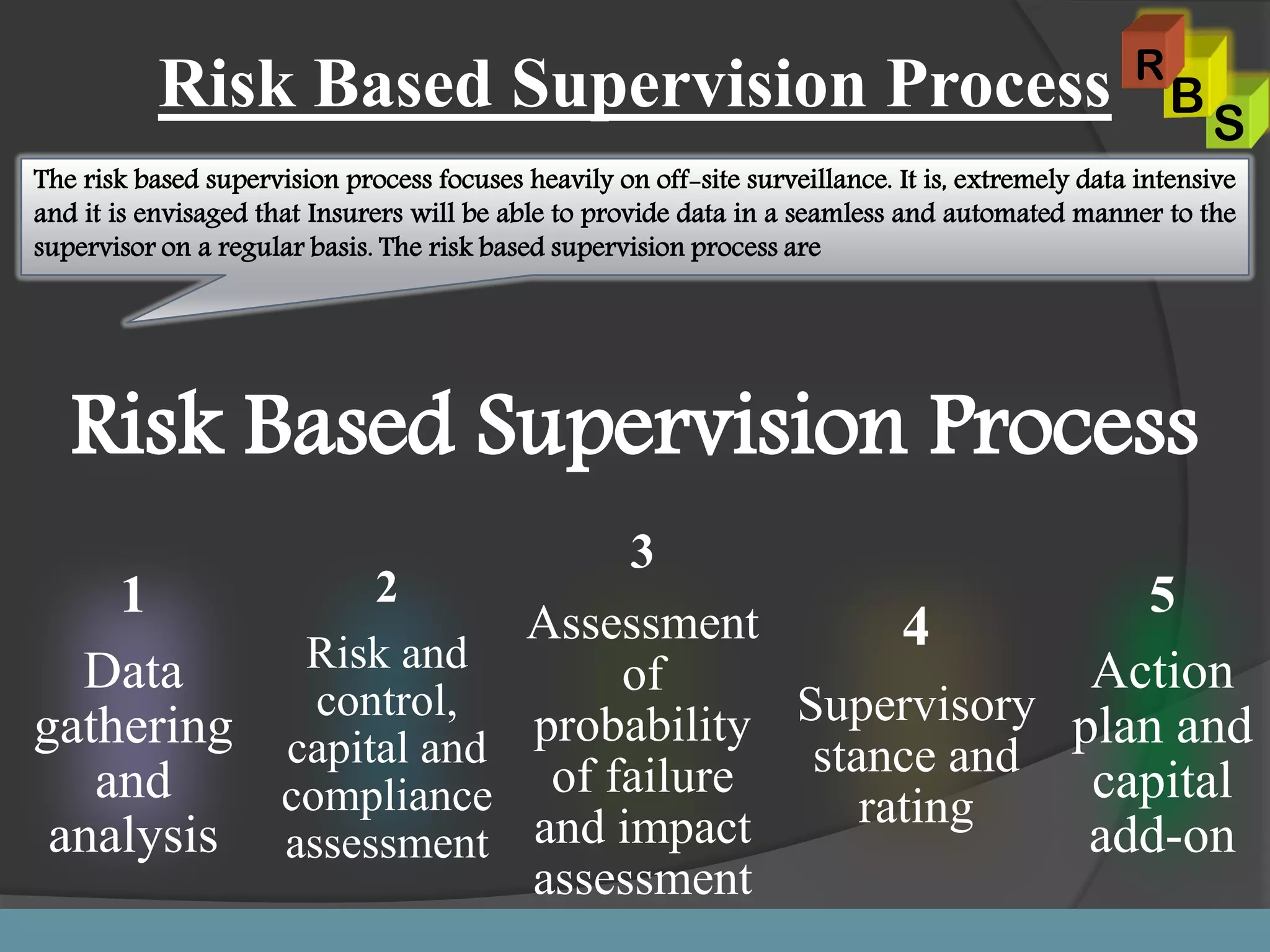

Risk-based supervision (RBS) assesses risks within the financial system, prioritizing resolution of the most critical risks. It is becoming the dominant regulatory approach worldwide. The RBS process identifies an individual insurer's most critical risks and evaluates risk management, financial vulnerability, and compliance through focused review. RBS is forward-looking, evaluating present and future risks to facilitate early intervention. It focuses on continuous data collection, on-site examinations, thematic reviews, increased audit/compliance reliance, and engagement between supervisors and management. The goal is continuous supervision and early corrective action.