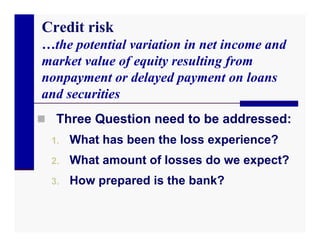

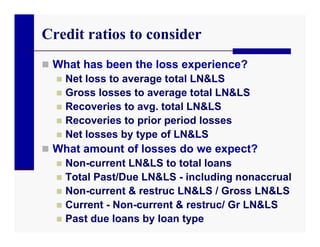

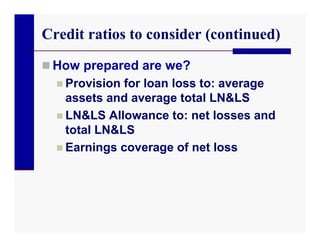

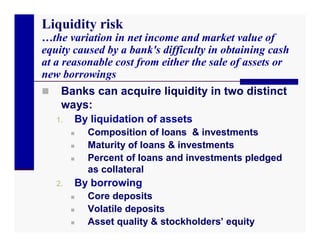

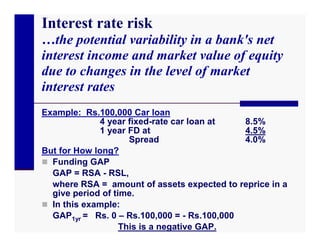

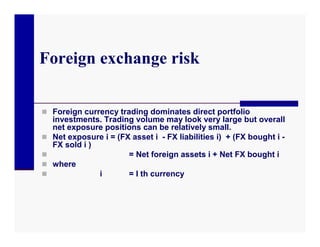

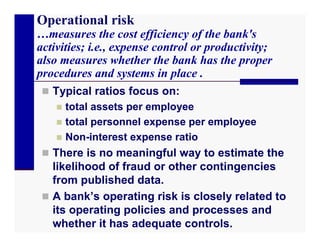

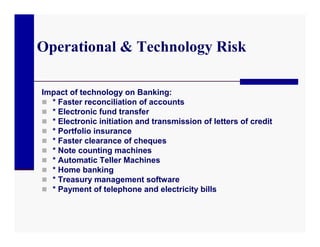

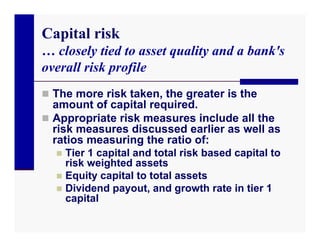

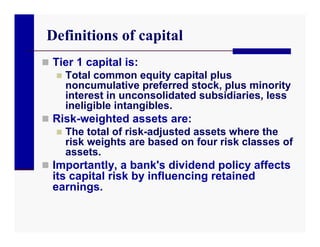

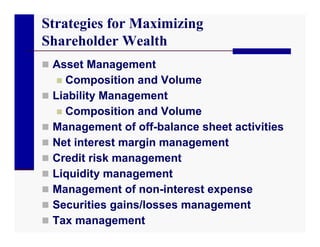

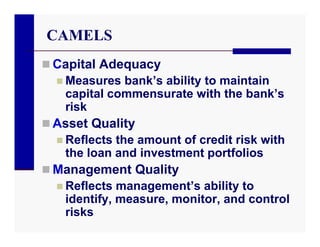

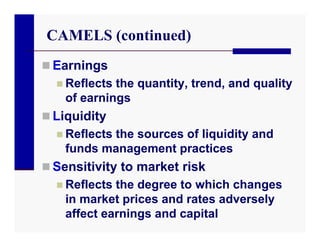

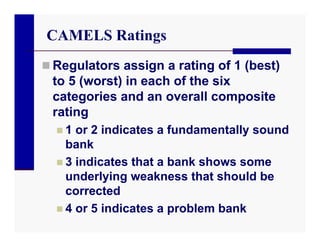

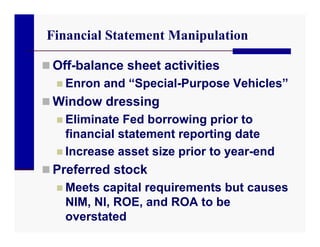

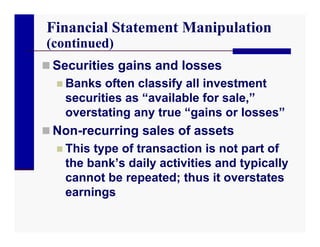

This document discusses the various types of risks faced by banks, including credit risk, liquidity risk, market risk, operational risk, capital risk, and others. It provides definitions and considerations for evaluating each type of risk, such as key ratios to examine for credit risk, balance sheet items that influence liquidity risk, and how changes in interest rates and exchange rates can impact market risk. The CAMELS framework for regulatory bank ratings is also summarized. Overall, the document provides an overview of fundamental risks in bank financial intermediation and how they can be assessed.