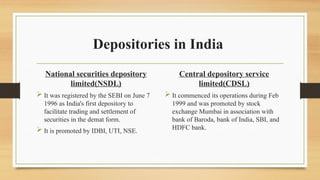

The document outlines the depository system's history, meaning, and importance, highlighting its introduction in India in 1996 and the operational framework governed by SEBI. It explains that depositories facilitate paperless trading of securities, with primary institutions including NSDL and CDSL. Key functions include transferring ownership of shares and mitigating risks associated with physical securities, leading to increased investor confidence and reduced paperwork.