The document outlines the rules and various sections (80C to 80U) under which taxpayers can claim deductions from their gross total income to compute their taxable income. It includes specific deductions for life insurance, pension contributions, medical insurance, disability expenditures, educational loans, and charitable donations, among others. Each category specifies the maximum allowable amounts and conditions for claiming these deductions.

![DEDUCTIONS IN RESPECT OF CERTAIN

PAYMENTS (SECTION 80)

Deduction In Respect Of Life Insurance Premia, Deferred Annuity,

Contributions To Provident Fund, Subscription To Certain Equity Shares

Or Debentures, Etc. [SEC. 80 C ]

In computing the total income of an assessee, being an individual or a Hindu

undivided family, there shall be deducted the whole of the amount paid or

deposited in the previous year, being the aggregate of the sums as does not

exceed one lakh rupees (Rs. 1,00,000 ).

However, amount of deduction u/s 80C is…

Gross Qualifying Amount or

Rs. 1,00,000

whichever is LESS.](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-4-320.jpg)

![ Deduction In Respect Of Contribution To Certain Pension Funds. [Sec. 80 CCC]

1. Where an assessee paid or deposited any amount out of his income chargeable to tax for any

annuity plan of Life Insurance Corporation of India or any other Insurance Company for

receiving pension from the fund, he shall be allowed a deduction in the computation of his

total income, of the whole of the amount paid or deposited (excluding interest or bonus

accrued or credited to the assessee’s account, if any) as does not exceed the amount of (Rs.

1,00,000) one lakh rupees in the previous year.

2. Where any amount received by the assessee or his nominee—

(a) on account of the surrender of the annuity plan whether in whole or in part, in any

previous year, or

(b) as pension received from the annuity plan,

the whole of the amount shall be the income of the assessee or his nominee in that previous

year in which such withdrawal is made shall be chargeable to tax as income of that previous

year.](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-5-320.jpg)

![ Deduction In Respect Of Contribution To Pension Scheme Of Central Government Or Any Other

Employers [ Sec. 80 CCD ]

Where an assessee on or after the 1st day of January, 2004, has in the previous year paid or deposited

any amount in his account under a pension scheme notified by the Central Government, he shall be

allowed a deduction in the computation of his total income, of the whole of the amount so paid or

deposited as does not exceed ten per cent ( 10%) of his salary in the previous year.

If the Central Government or any other employer makes any contribution to his account the assessee

shall be allowed a deduction in the computation of his total income, of the whole of the amount

contributed by the Central Government or any other employer as does not exceed ten per cent (10%) of

his salary in the previous year.

Where any amount standing to the credit of the assessee in his account , in respect of which a deduction

has been allowed in whole or in part, in any previous year,—

(a) on account of closure or his opting out of the pension scheme; or

(b) as pension received from the annuity plan purchased or taken on such closure or opting out,

the whole of the amount shall be deemed to be the income of the assessee or his nominee, and shall

accordingly be charged to tax as income of that previous year.](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-6-320.jpg)

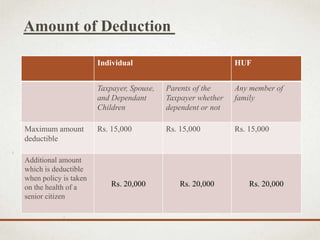

![ Deduction In Respect Of Health Or Medical Insurance Premia [ Sec.

80 D ]

Medical Pocity should taken on the health of the following persons:---

Tax Payer Insured Person

Individual On the health of the taxpayer, spouse,

patents or dependent children of the

taxpayer

Hindu Undivided Family (HUF)

On the health of any member of the family](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-7-320.jpg)

![Deduction In Respect Of Maintenance Including Medical Treatment Of

A Dependant Who Is A Person With Disability [Sec. 80 DD]

Where an assessee, being an individual or a Hindu undivided family, who is a

resident in India, has, during the previous year,-

incurred any expenditure for the medical treatment (including nursing),

training and rehabilitation of a dependant, being a person with disability; or

paid or deposited any amount under a scheme framed in this behalf by the

Life Insurance Corporation or any other insurer or the Administrator or the

specified and approved by the Board in this behalf for the maintenance of a

dependant, being a person with disability.

The assessee shall be allowed a deduction of a sum of fifty thousand rupees

(Rs.50,000) from his gross total income in respect of the previous year:

Rs.1,00,000 where such dependant is a person with severe disability

exceeding 80%](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-9-320.jpg)

![ Deduction In Respect Of Medical Treatment, Etc. [Sec. 80 DDB]

Where an assessee who is resident in India has, during the previous year,

actually paid any amount for the medical treatment of such disease or

ailment

for himself or a dependant, in case the assessee is an individual: or

for any member of a Hindu undivided family (HUF) , in case the assessee is a

Hindu undivided family (HUF),

the assessee shall be allowed a deduction of the amount actually paid or a

sum of forty thousand rupees (Rs.40,000), [ Rs. 60,000 for Senior Citizen]

whichever is less

Provided that no such deduction shall be allowed unless the assessee

furnishes with the return of income](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-10-320.jpg)

![ Deduction In Respect Of Interest Of Loan Taken For Higher

Education [Sec. 80 E ]

Any amount paid in the previous year, out of the income chargeable to tax,

by way of interest on loan taken by him from any financial institution or

any approved charitable institution for the purpose of pursuing his higher

education shall be allowed in computing the total income

in respect of the initial assessment year and seven assessment years

immediately succeeding the initial assessment year or

until the interest is paid by the assessee in full, whichever is earlier.](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-11-320.jpg)

![ Deduction In Respect Of Donations To Certain Funds, Charitable

Institutions, Etc. [ Sec. 80 G ]

The Claim in respect of such Donation to the Prime Minister’s National Relief

Fund, the Chief Minister’s Relief Fund, or the Lieutenant Governor’s Relief

Fund will be admissible u/s 80G of the Income Tax Act,1961 on the basis of

the certificate issued by the Drawing and Disbursing Officer (DDO) /

Employer in this behalf.

Amount of Deduction : 50% of Donation. Income some cases Donation is

restricted to 10% of Gross Totoal Income. 100% in some cases like National

Defence Fund.

Applicable to All Assessee.

Deduction is allowed only if made in Cheque / Draft.](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-12-320.jpg)

![ Deductions In Respect Of Rents Paid. [ Sec. 80 GG ]

In computing the total income of an assessee, there shall be deducted any

expenditure incurred by him in excess of –

• 10% of his total income towards payment of rent in respect of any furnished

or unfurnished accommodation occupied by him for the purposes of his own

residence,

• to the extent to which such excess expenditure does not exceed two

thousand rupees ( Rs. 2000 ) per month or twenty-five percent ( 25%). of his

total income for the year, whichever is less.

[ No Exemption is allowed to those who are in receipt of HRA & Claiming

Deduction U/s 10(13A) ]](https://image.slidesharecdn.com/directtaxlaws-191219145547/85/Direct-tax-laws-13-320.jpg)