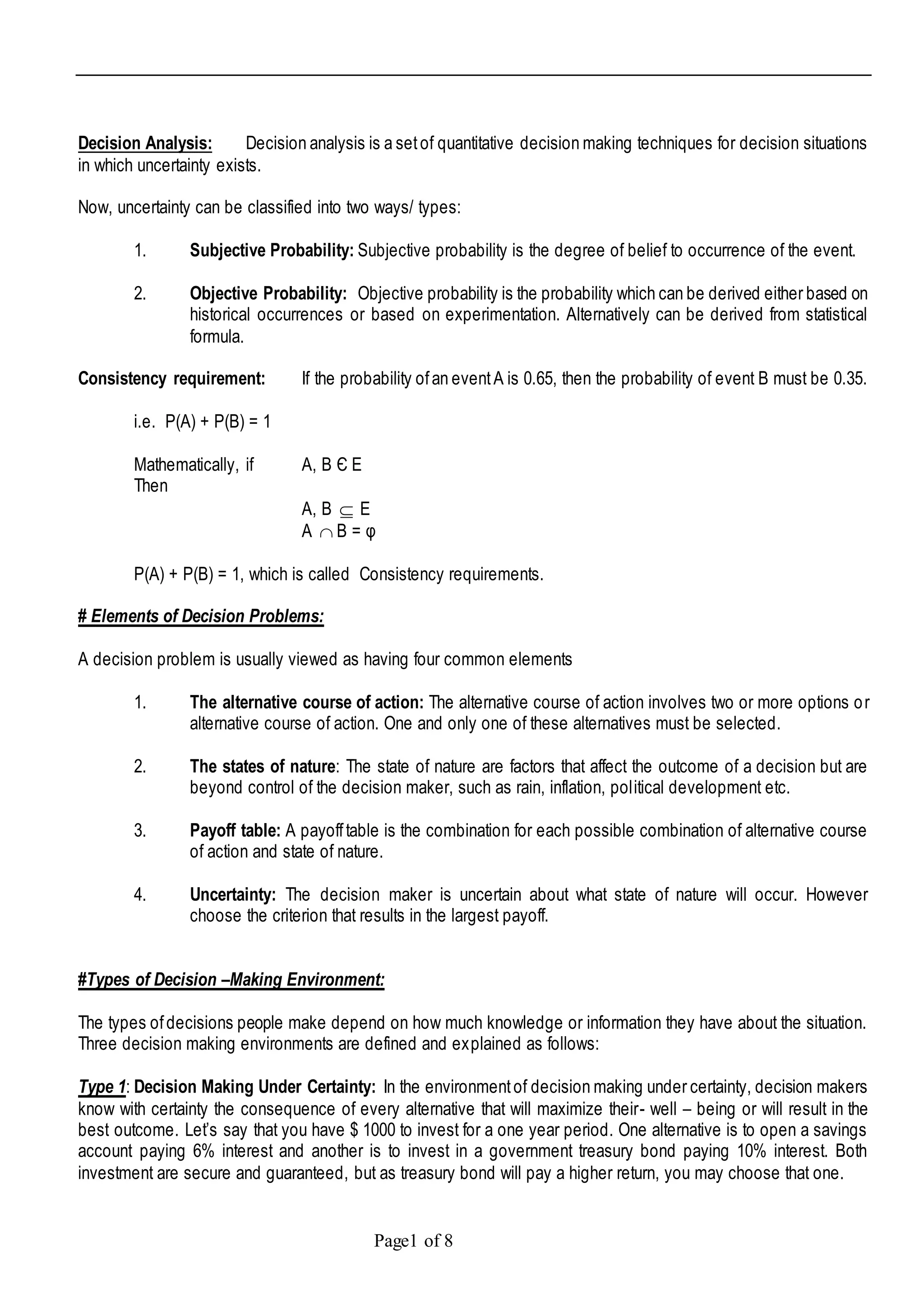

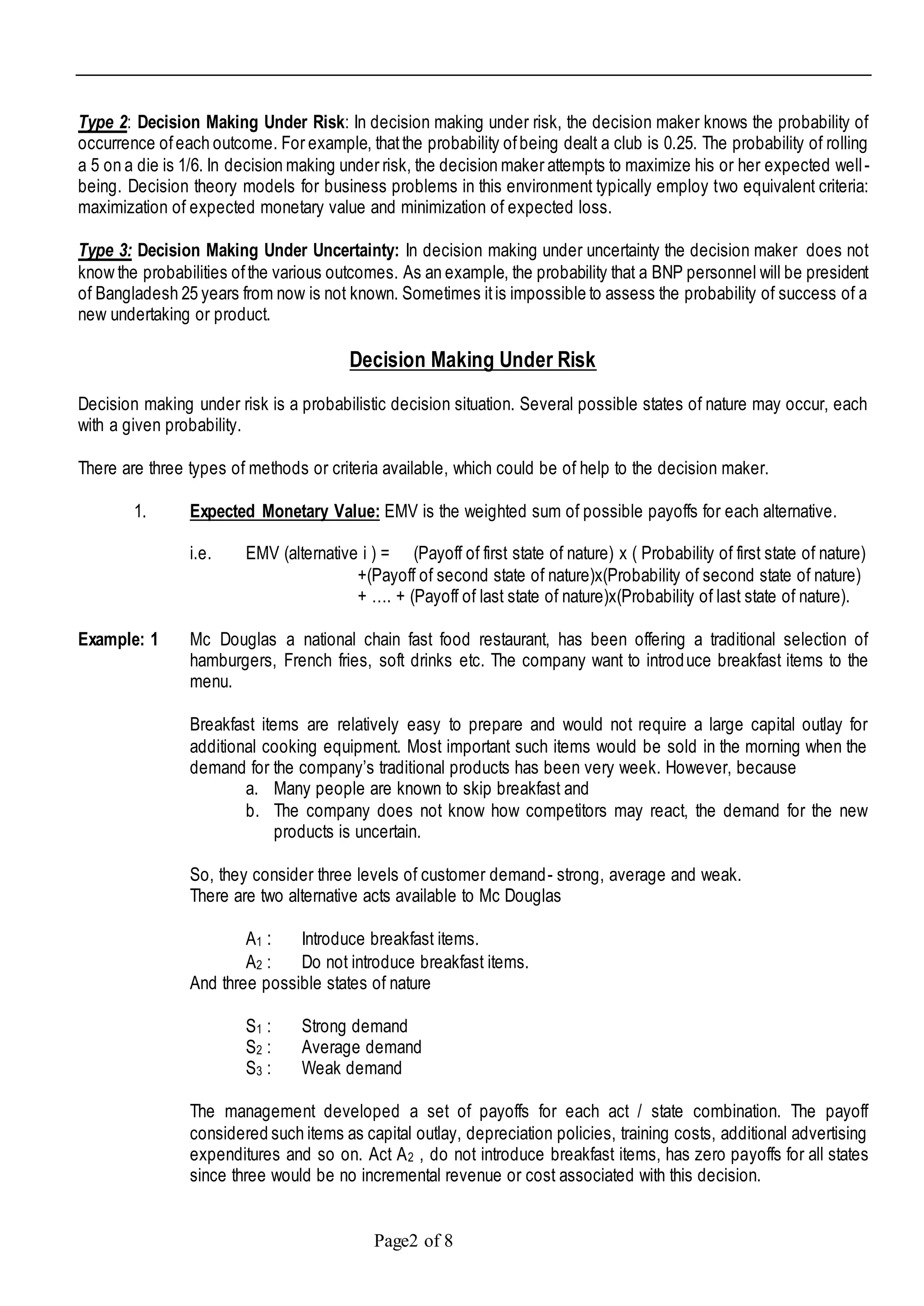

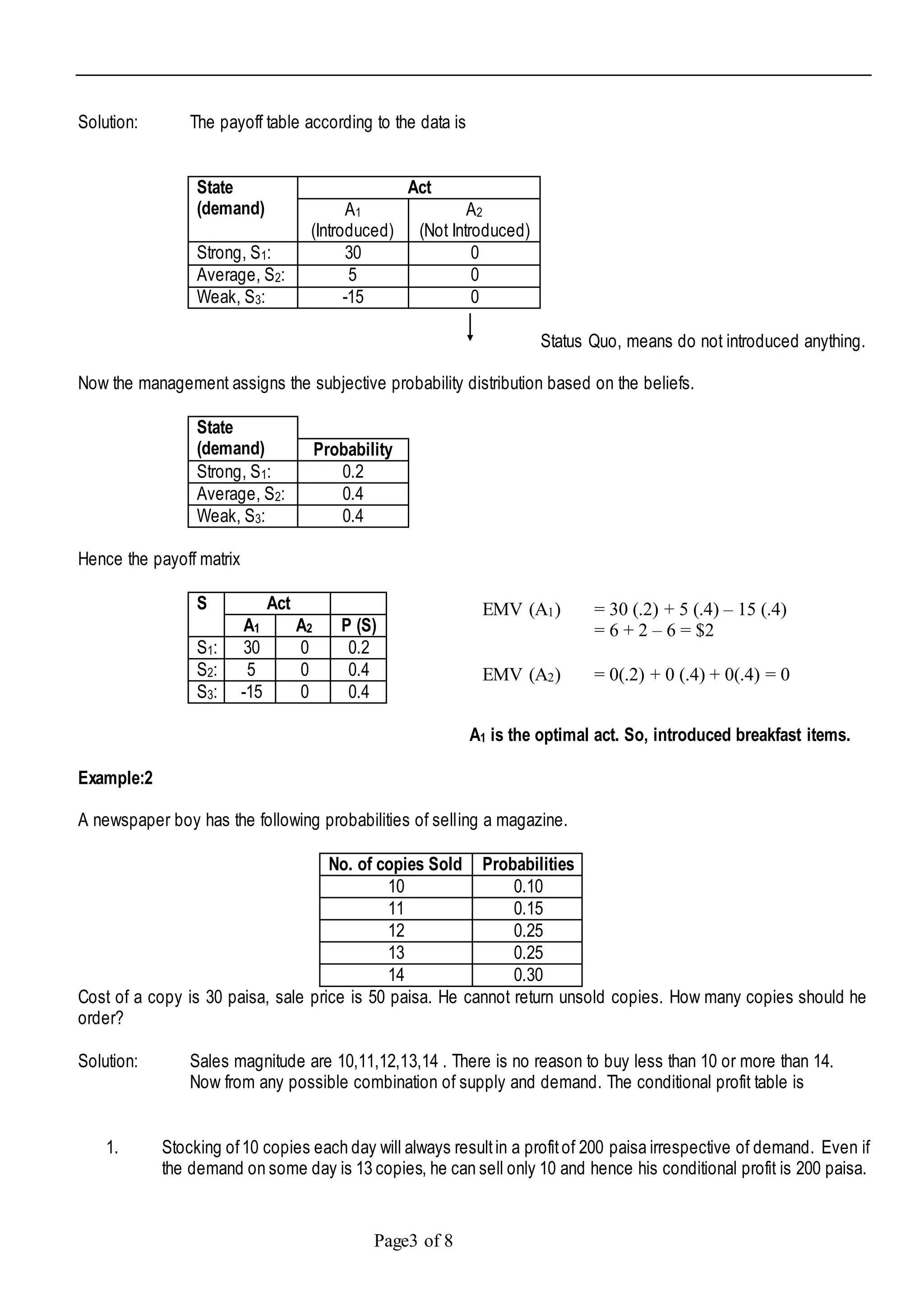

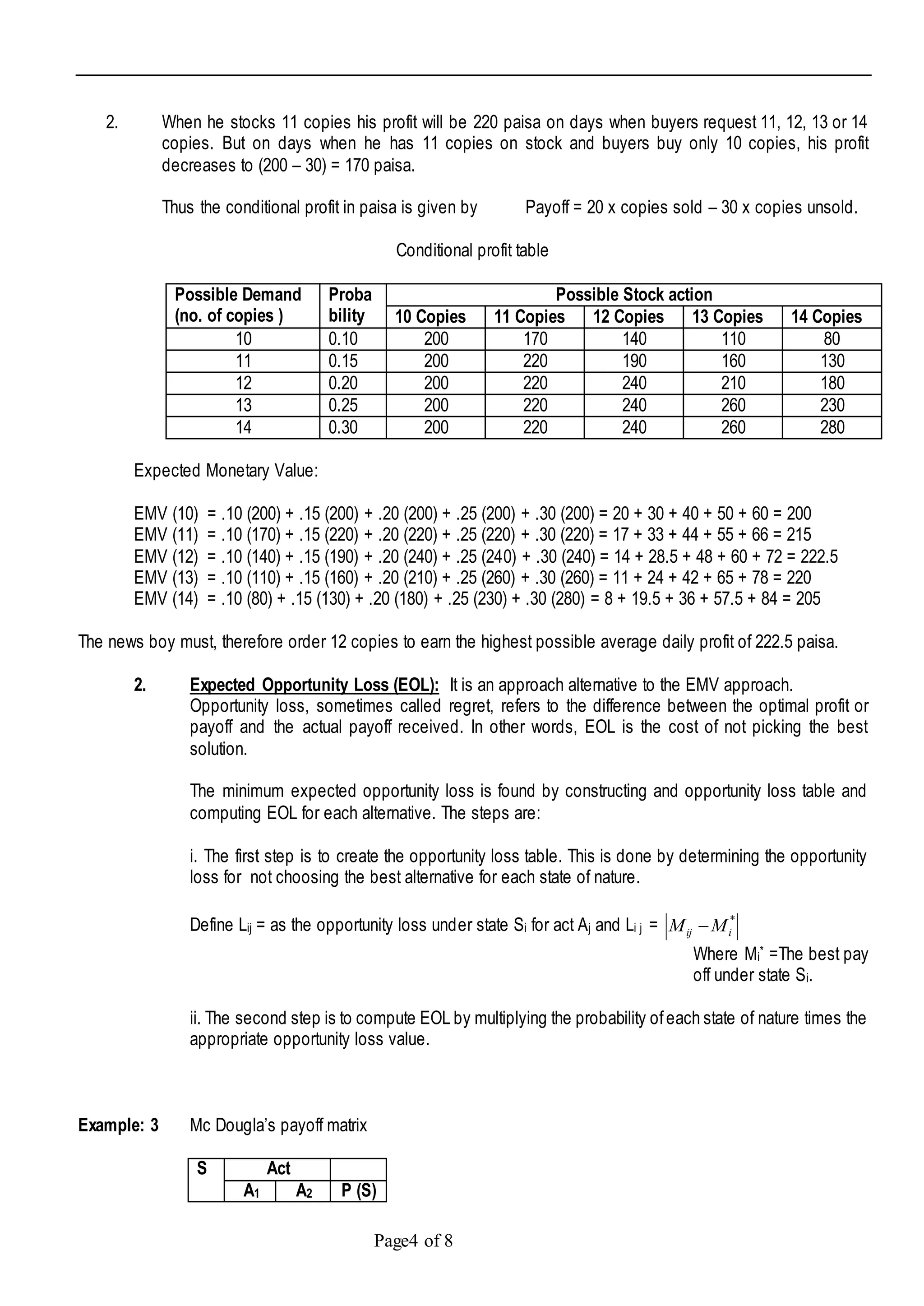

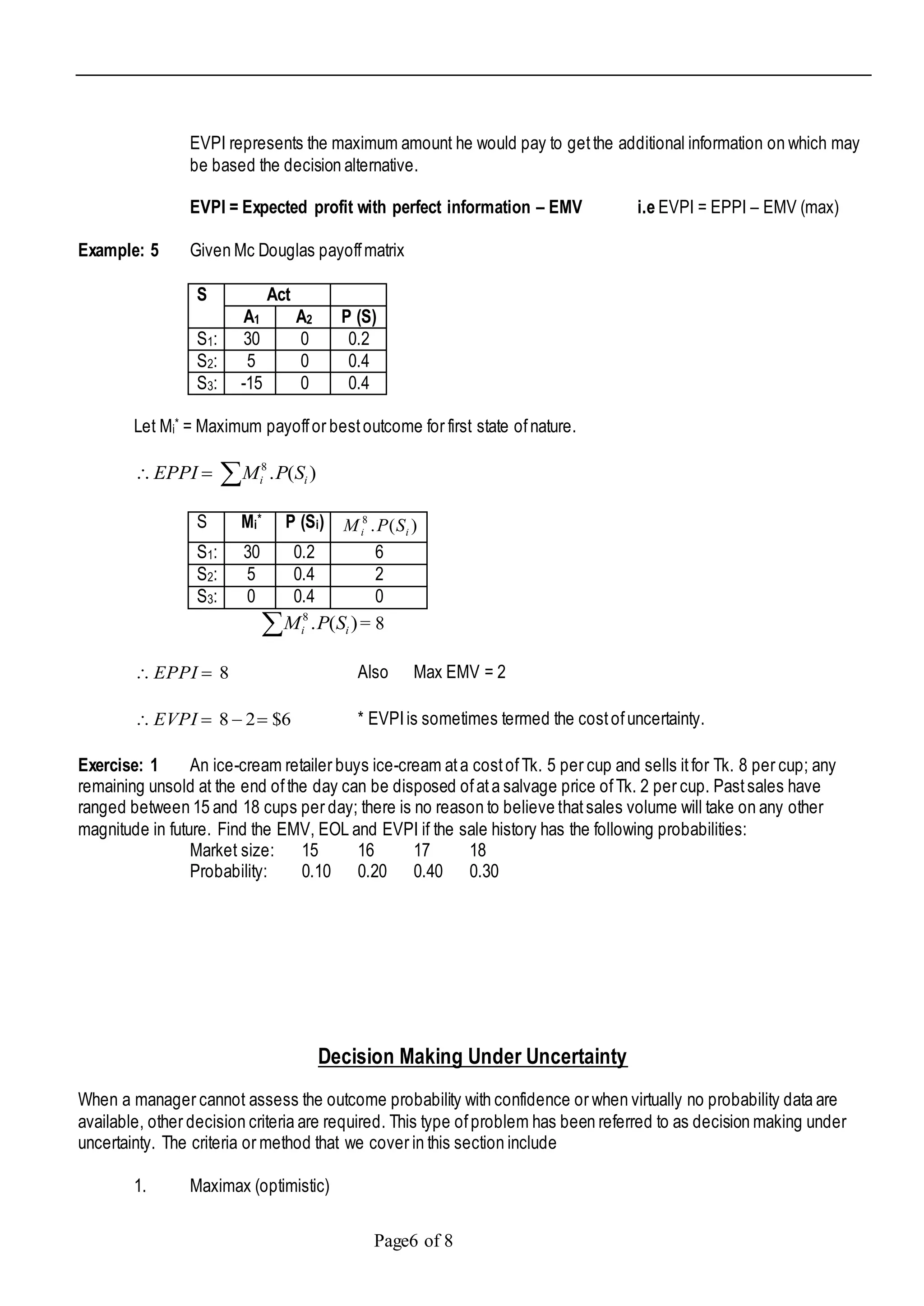

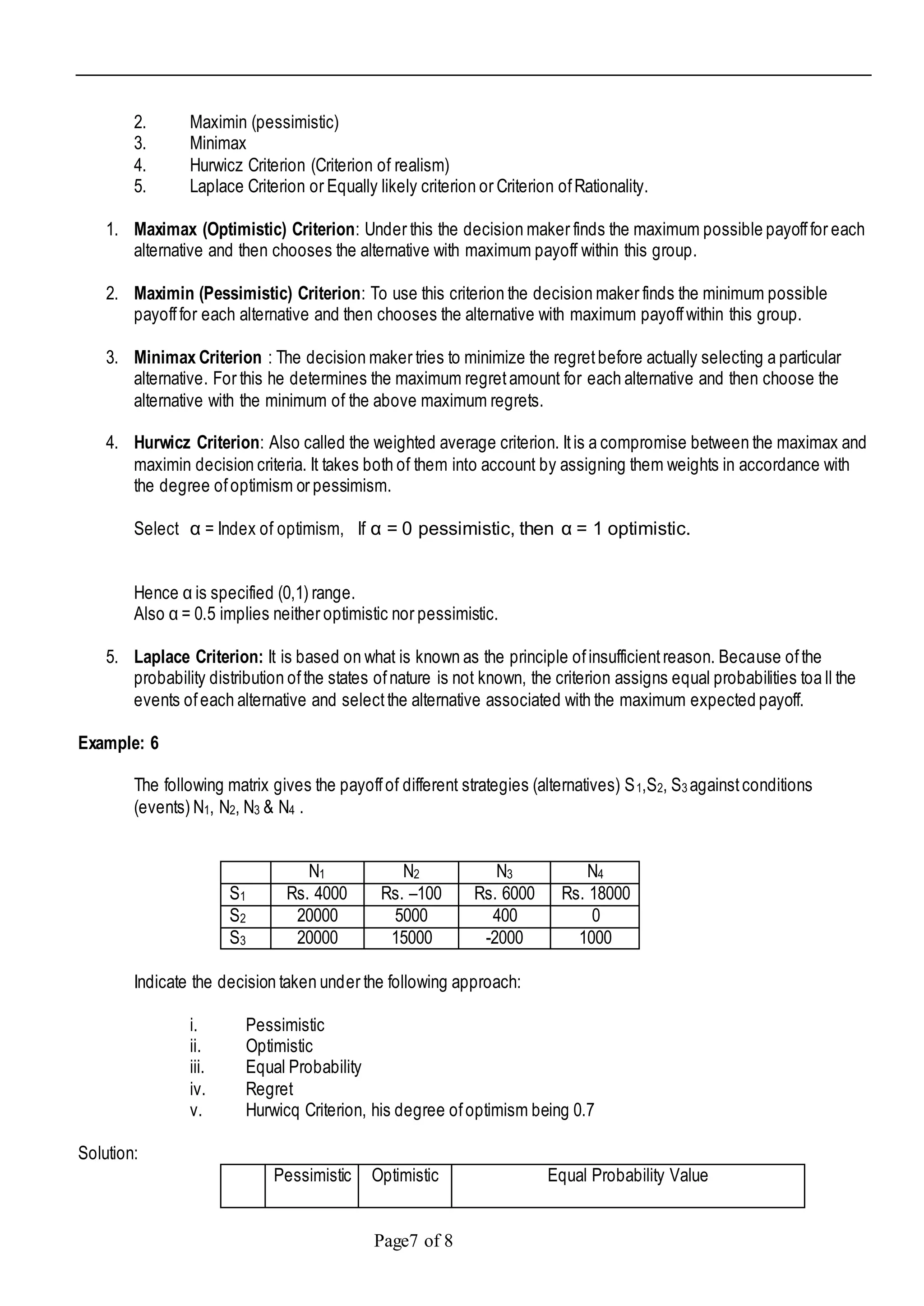

This document discusses various techniques for decision making under uncertainty. It defines subjective and objective probabilities, and consistency requirements for probabilities. It describes the key elements of decision problems including alternatives, states of nature, payoff tables, and uncertainty. It defines three types of decision making environments: certainty, risk, and uncertainty. For decision making under risk, it discusses expected monetary value, expected opportunity loss, and expected value of perfect information as decision criteria. It provides examples to illustrate these concepts and techniques. Finally, it outlines several criteria that can be used for decision making under uncertainty including maximax, maximin, and minimax.