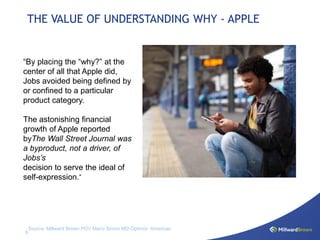

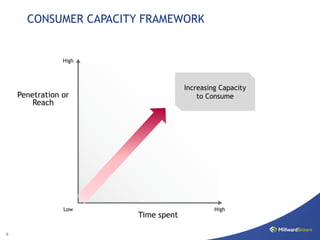

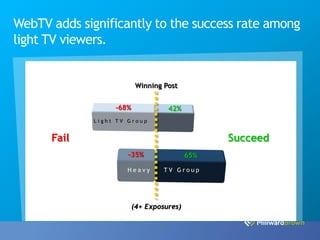

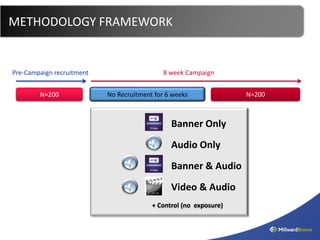

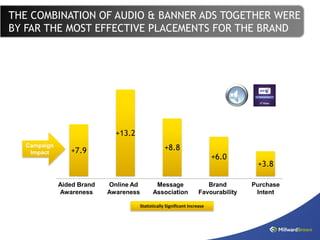

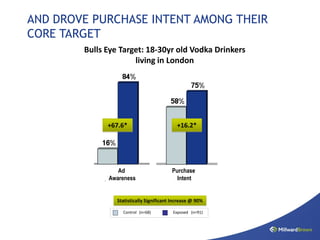

The document discusses evaluating new digital media opportunities and avoiding "fads" by understanding consumer value, commercial value, and brand value. It provides examples of how understanding consumer benefits and insights can maximize a new platform's potential, such as Apple focusing on self-expression over products. Case studies demonstrate how combining audio and banner ads, and targeting older age groups, increased brand perceptions. Listening to consumers and integrating social media thoughtfully also builds relevance and trust with the brand.

![THE DANGER OF FADS

Fad [fad]: a temporary fashion, notion, manner

of conduct, etc., especially one followed

enthusiastically by a group...

...to busy oneself with trifles...”

Source: dictionary.com](https://image.slidesharecdn.com/day1researchstream1700emergingdigitalplatformsmillwardbrown-110802053659-phpapp02/85/Day1-research-stream_1700_emerging_digital_platforms_millward_brown-2-320.jpg)