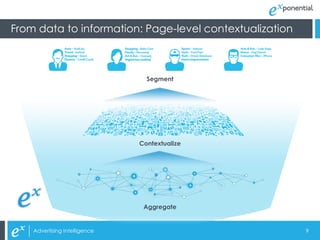

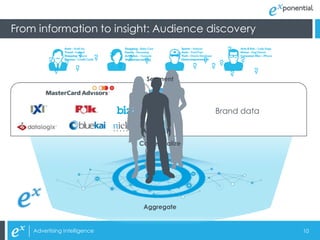

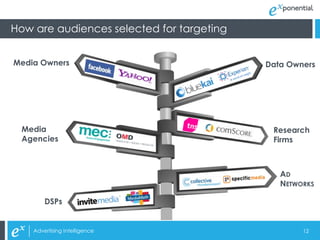

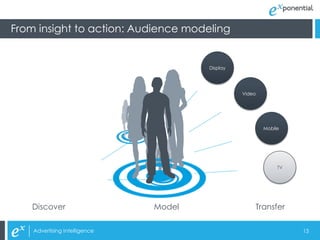

Exponential Interactive is a global advertisement intelligence provider, leveraging data and technology to help brands reach and engage their audiences online. Their audience engagement divisions focus on delivering impactful campaigns across various digital channels, targeting over 450 million unique users monthly. Key themes in digital advertising include big data, campaign measurement, technology stack challenges, and engagement strategies.