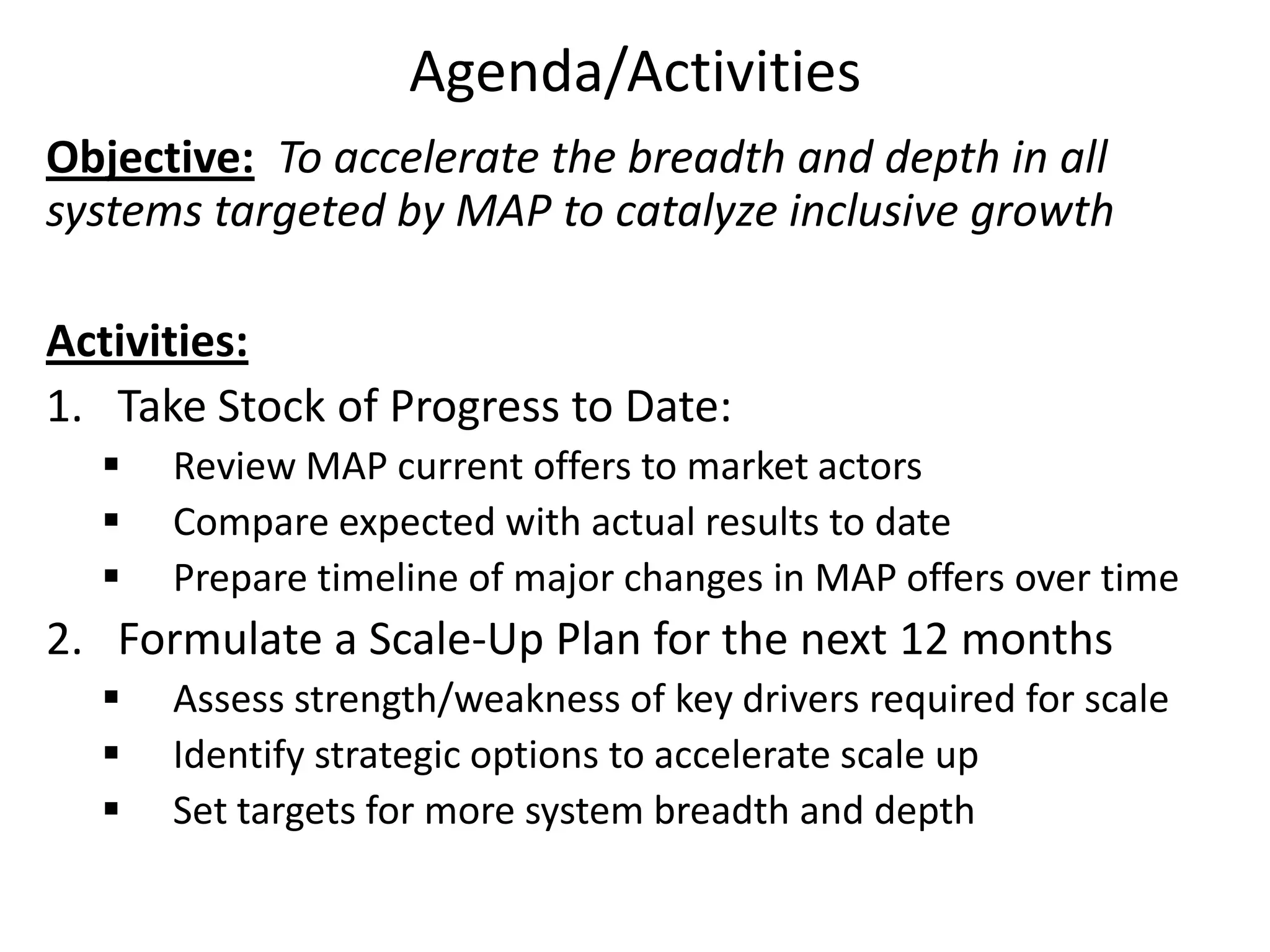

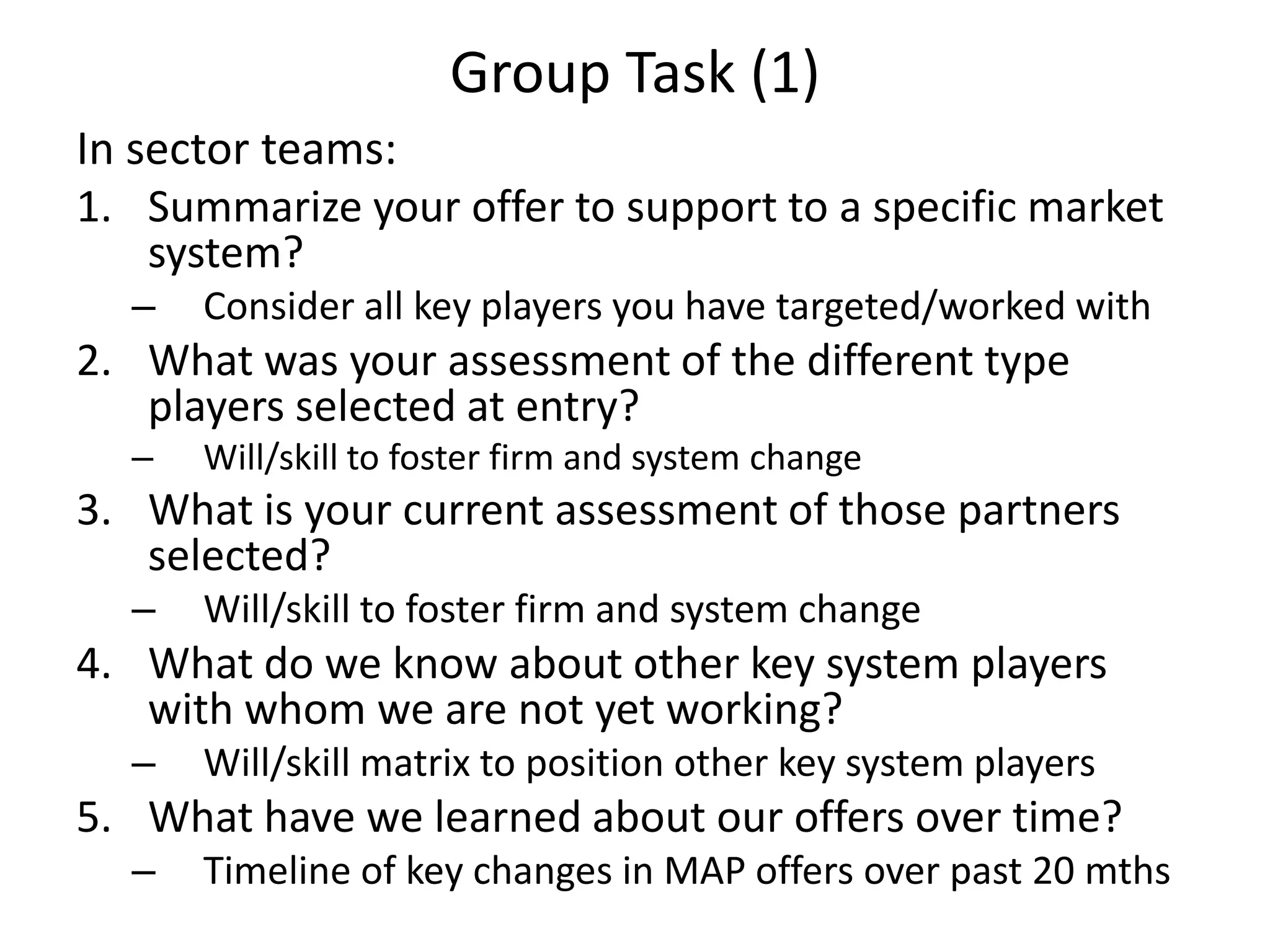

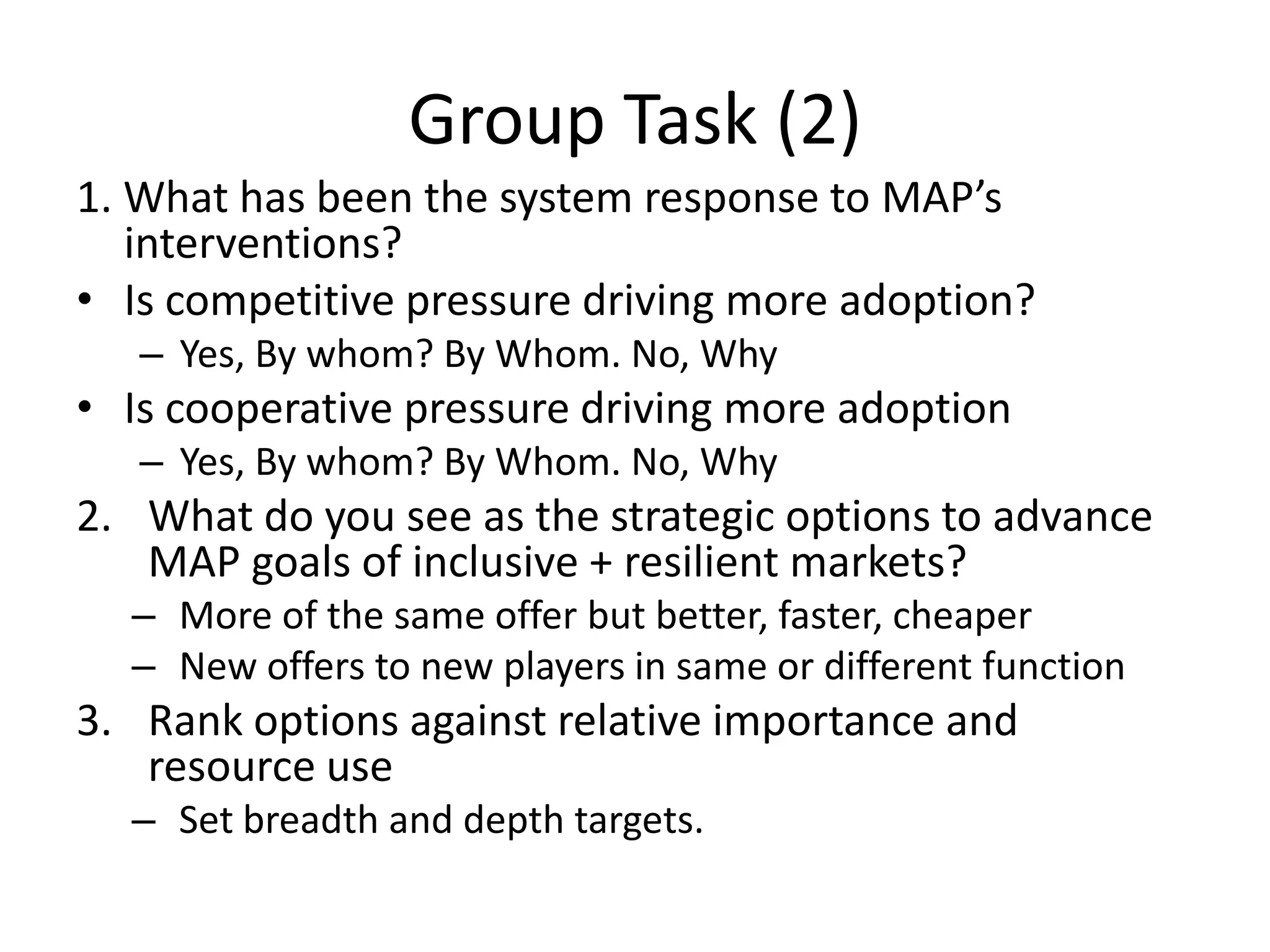

The document discusses strategies for MAP to accelerate inclusive growth through its portfolio. It aims to:

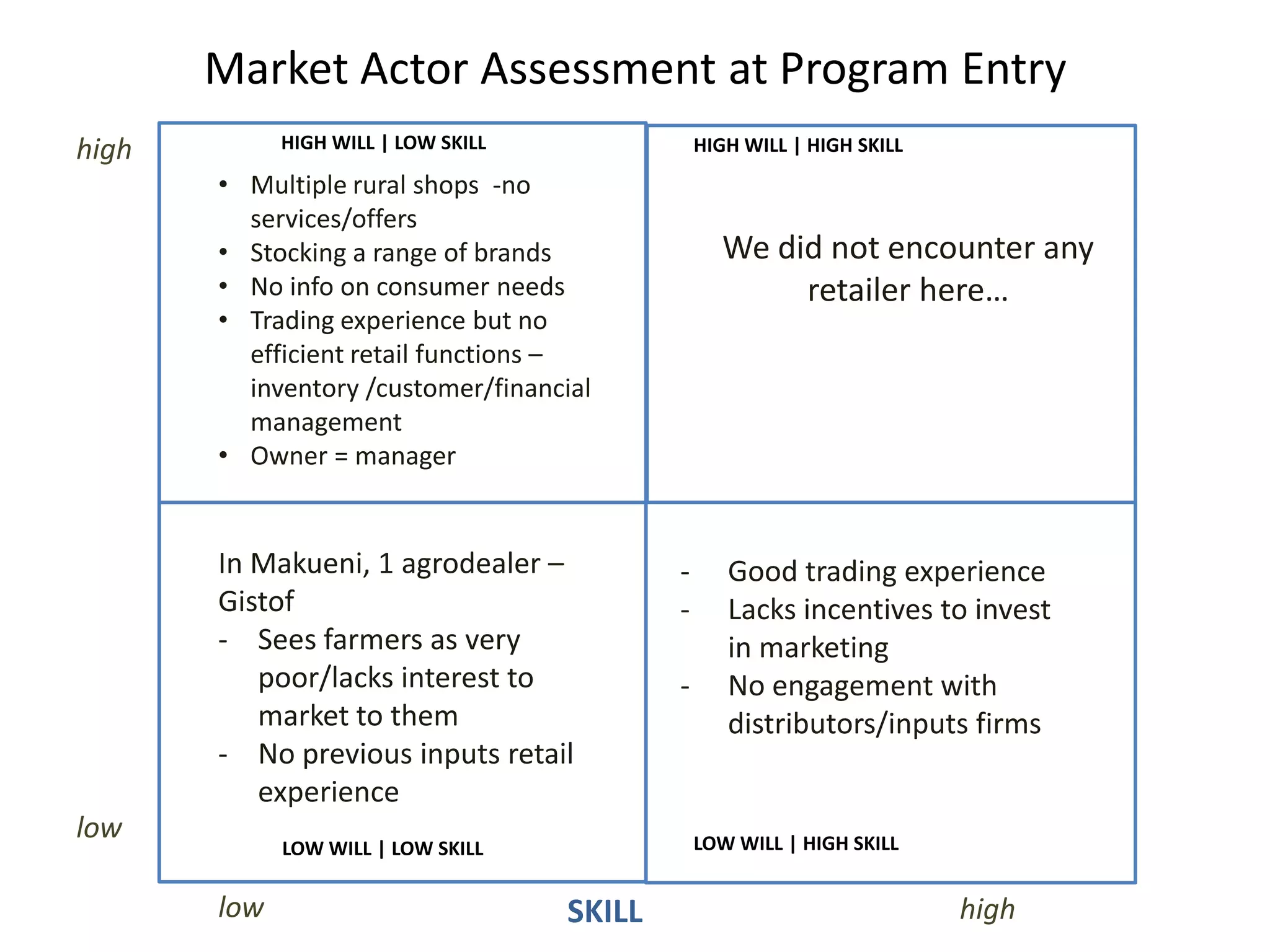

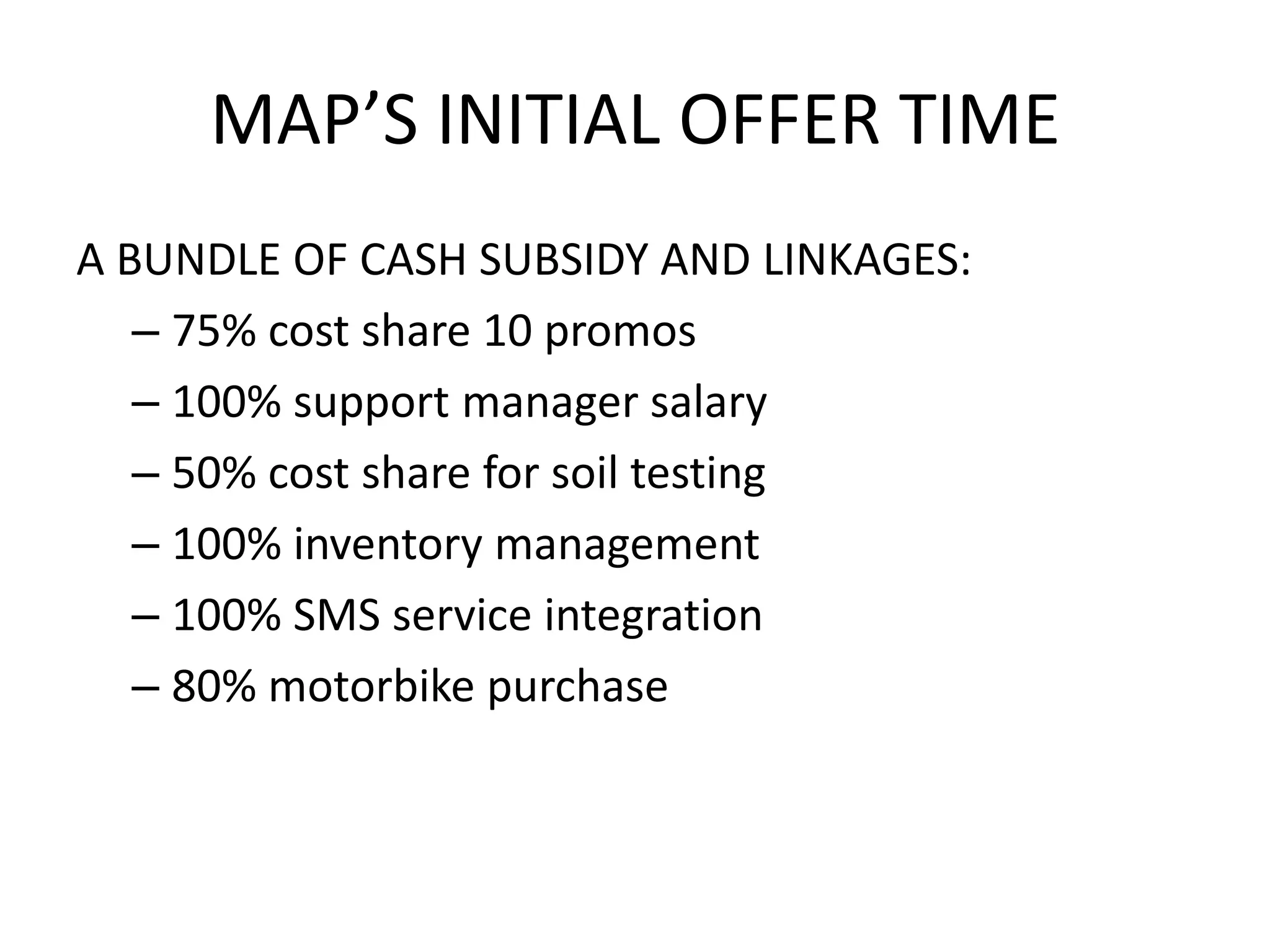

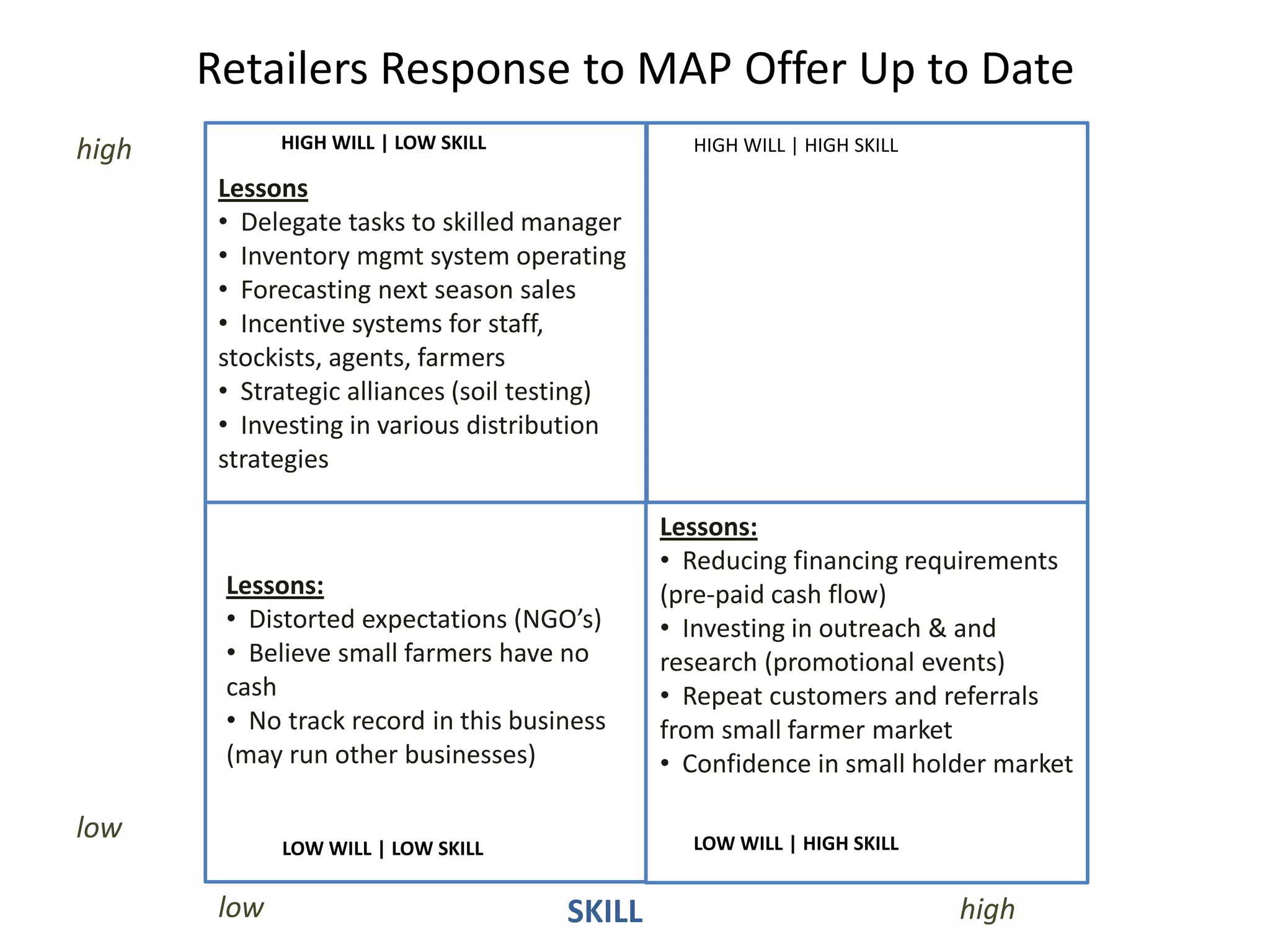

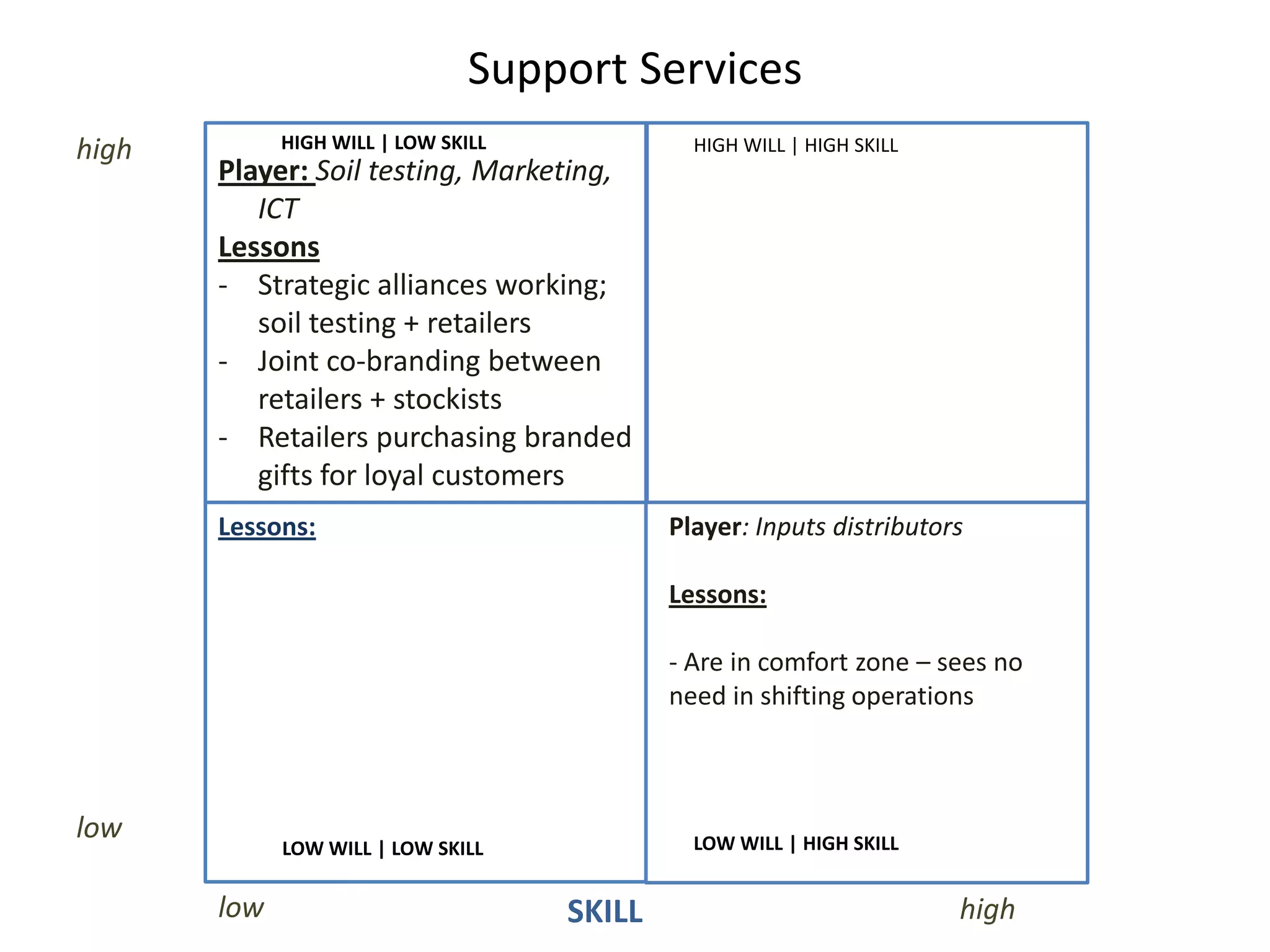

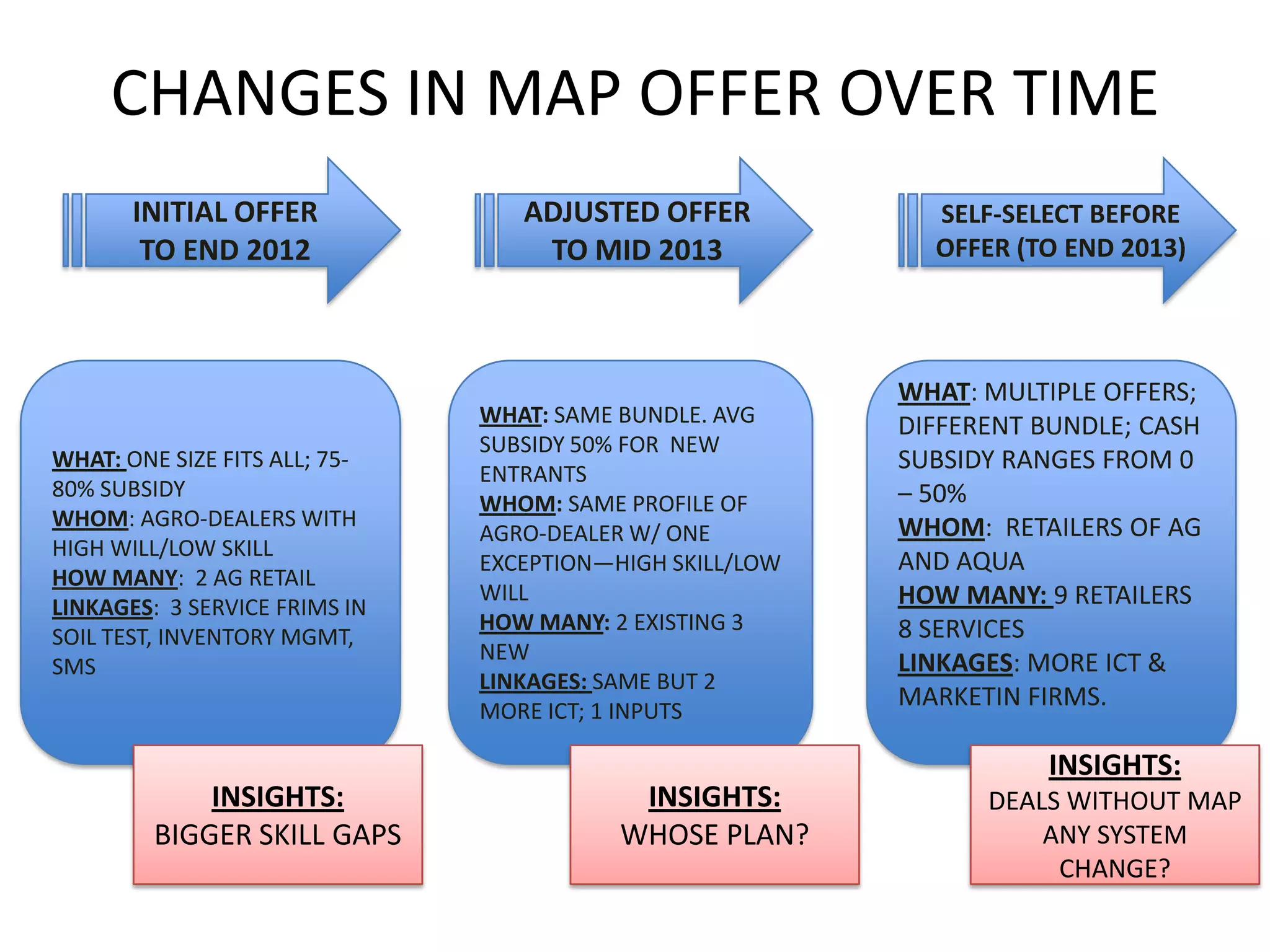

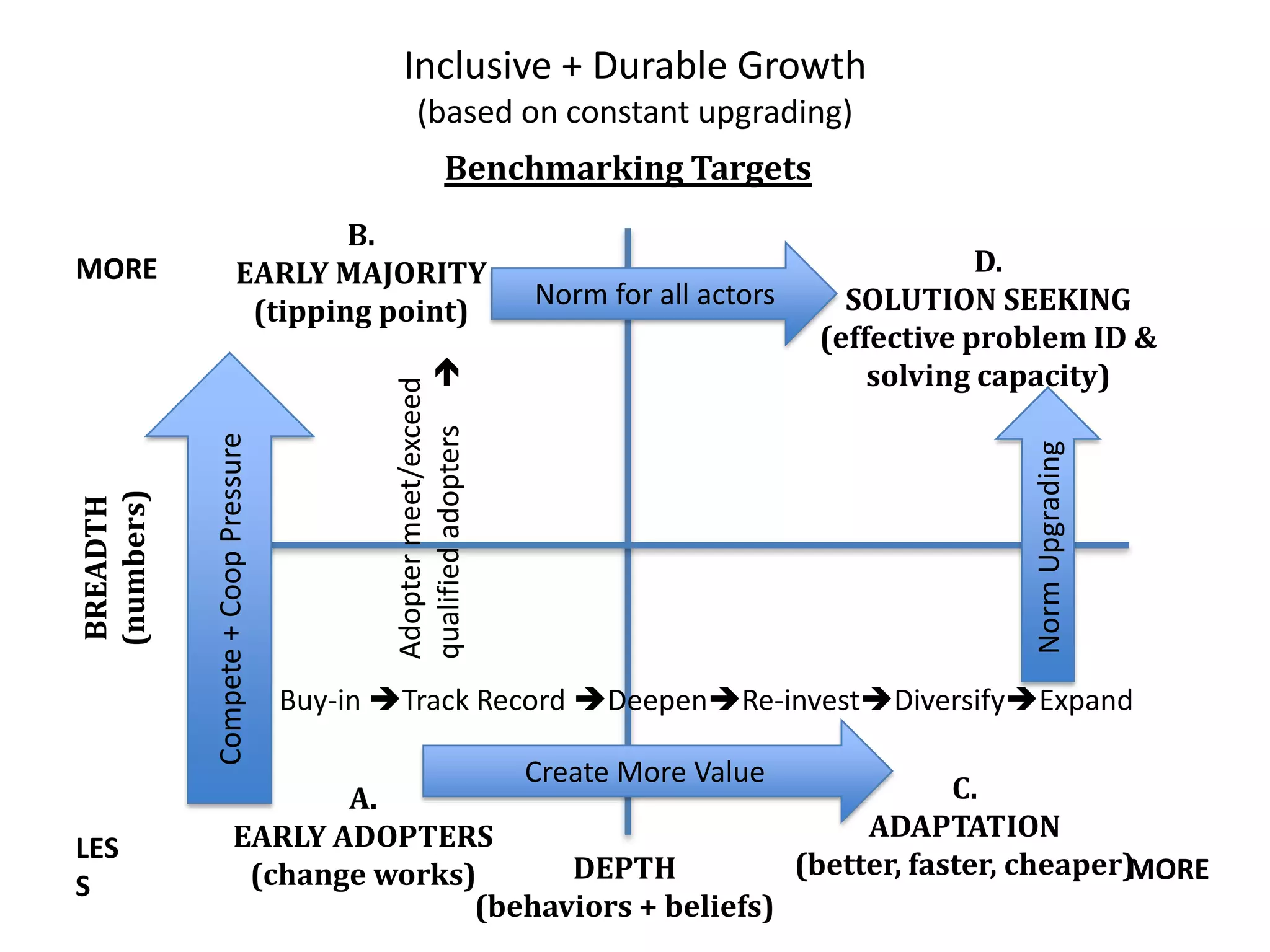

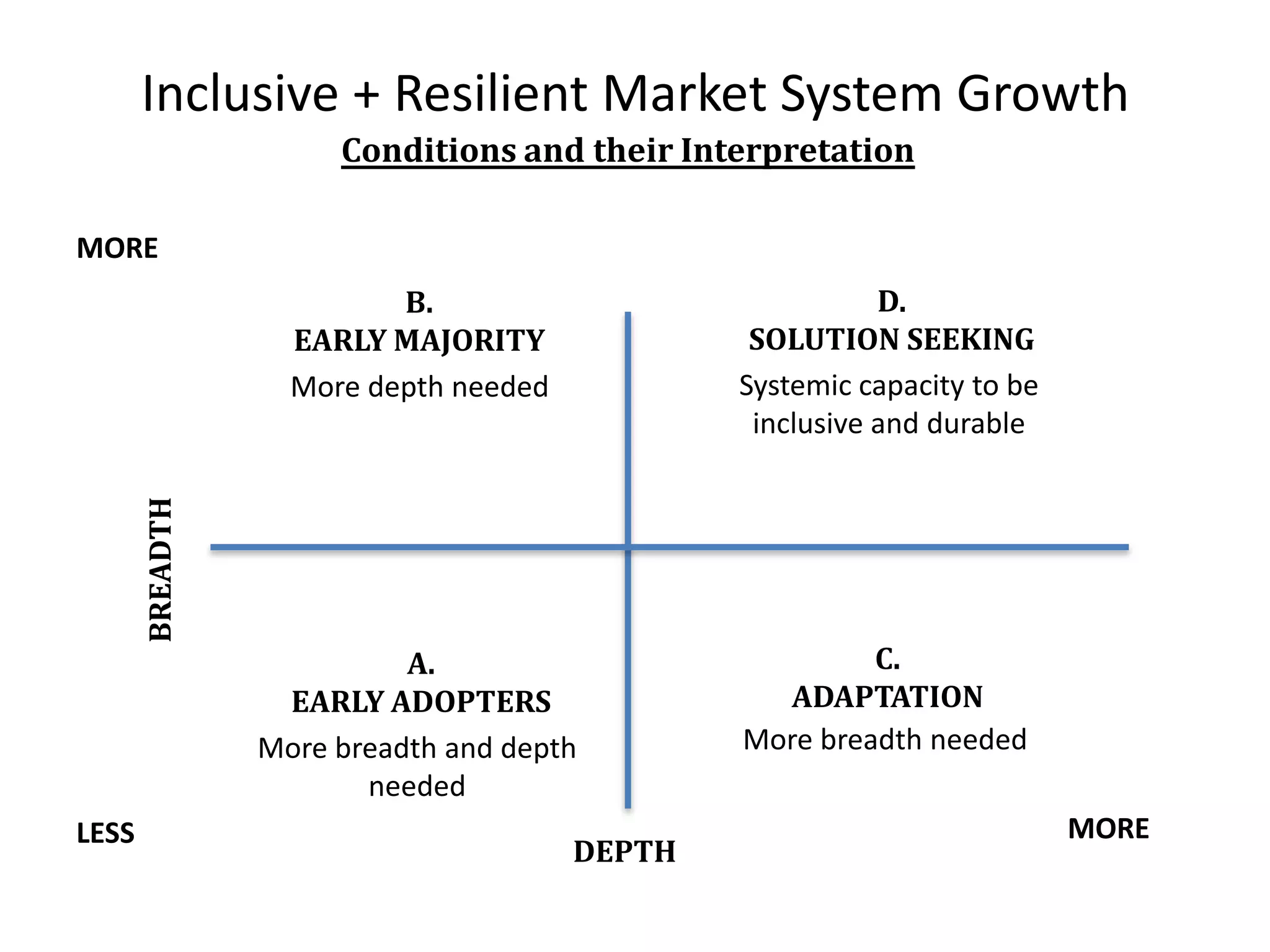

1) Take stock of progress to date by reviewing MAP offers and comparing expected vs. actual results to formulate a scale-up plan.

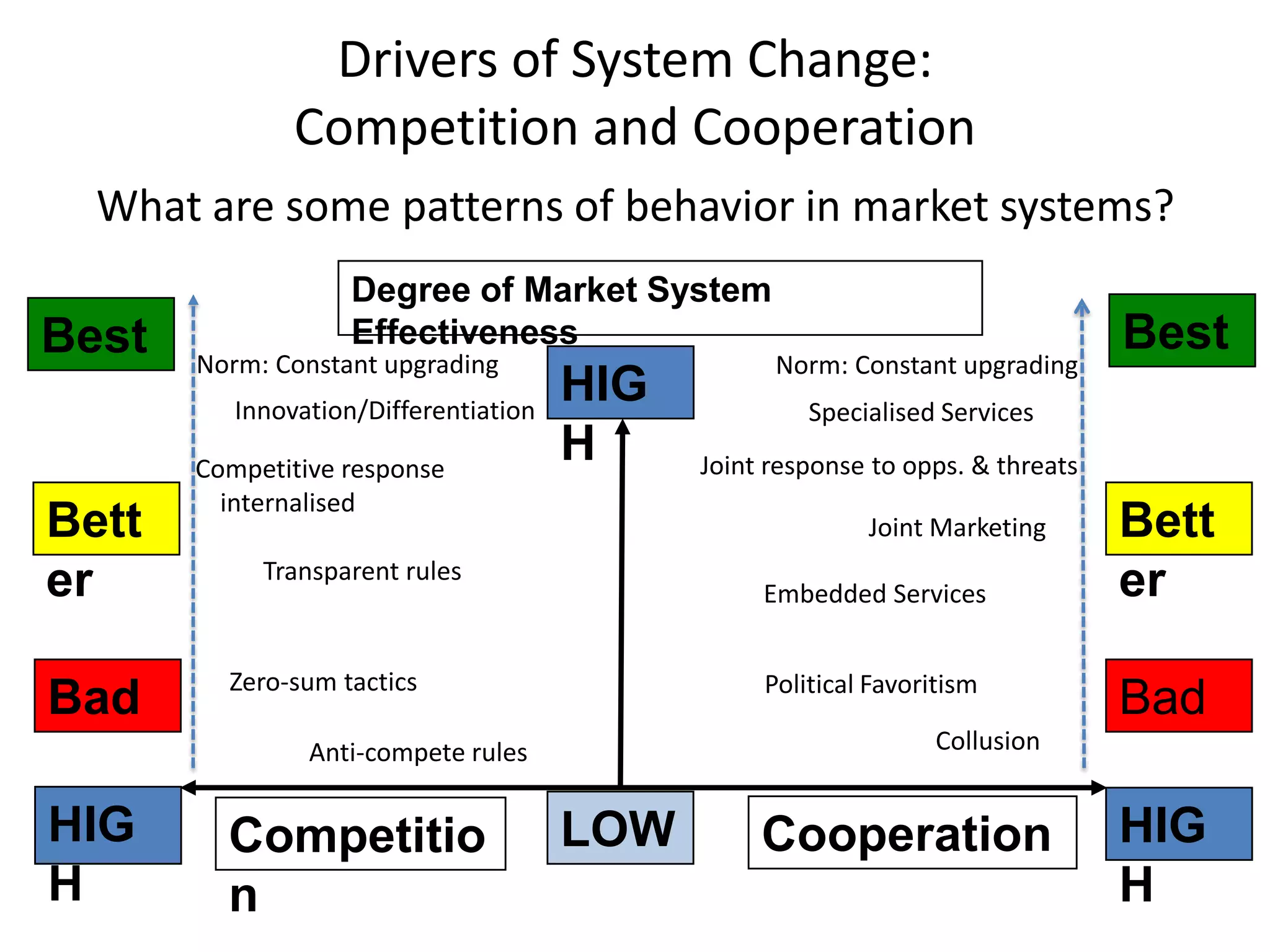

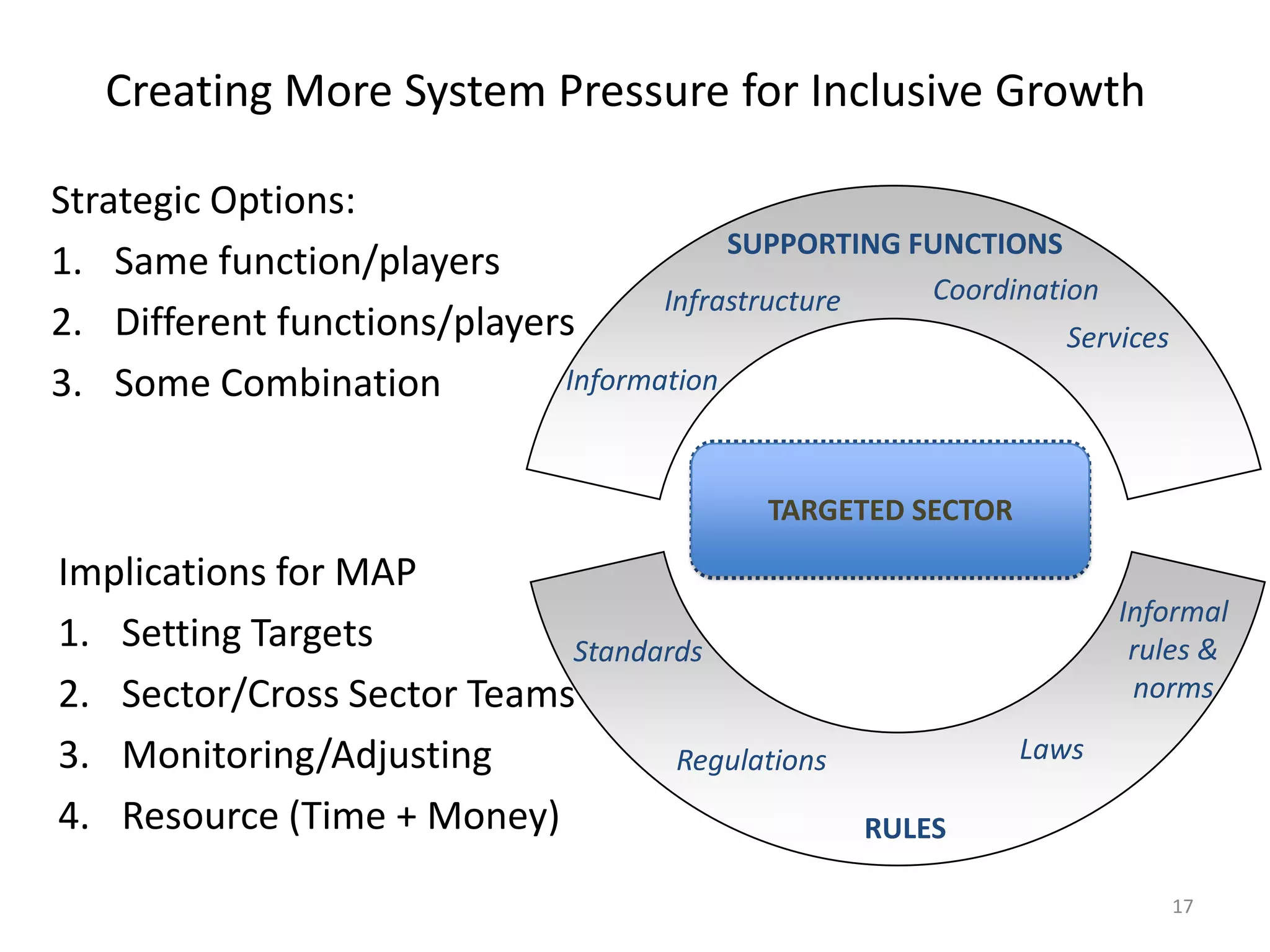

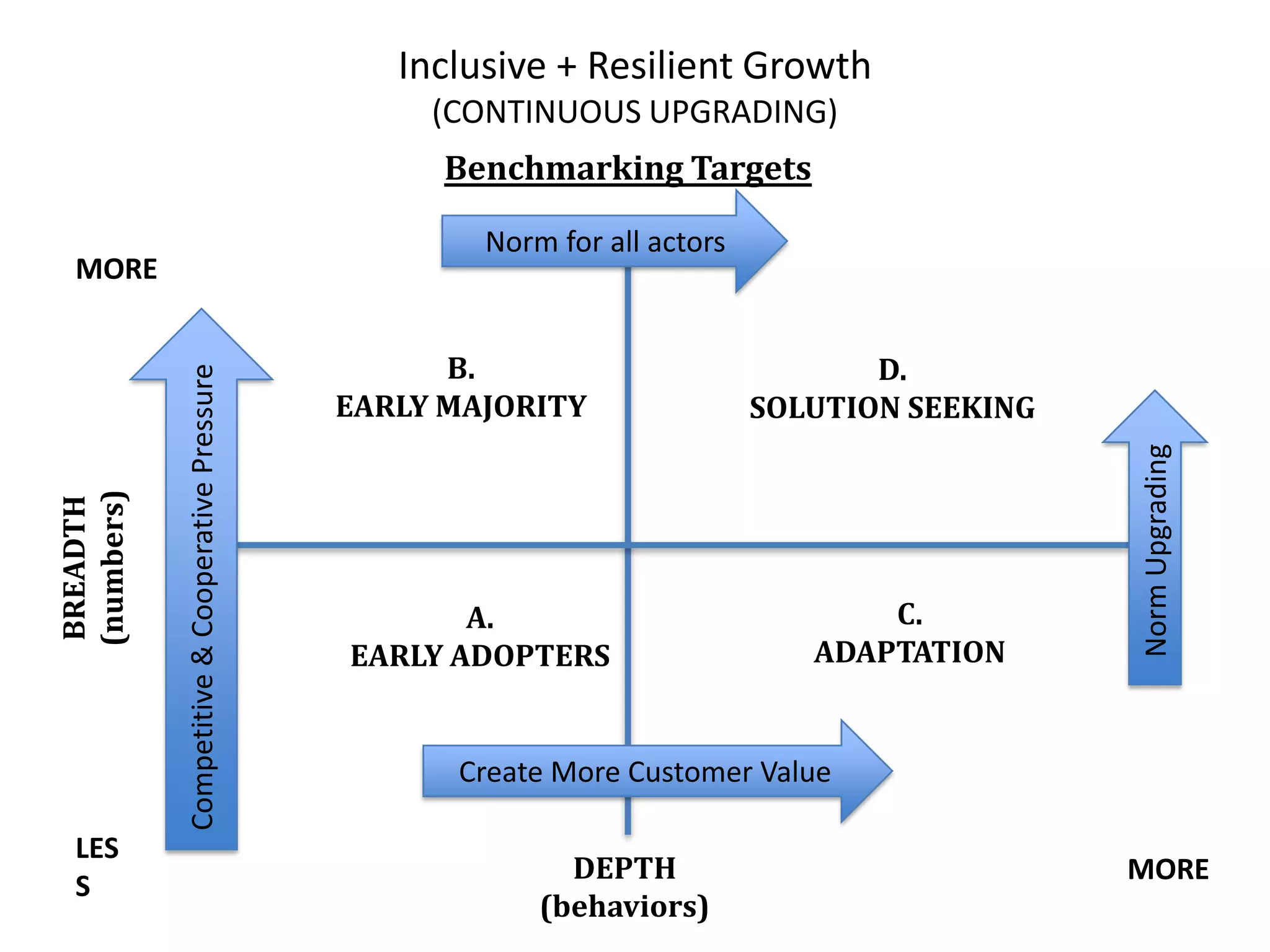

2) Formulate a 12-month scale-up plan by assessing drivers for scale, identifying strategic options to accelerate it, and setting targets for more system breadth and depth.

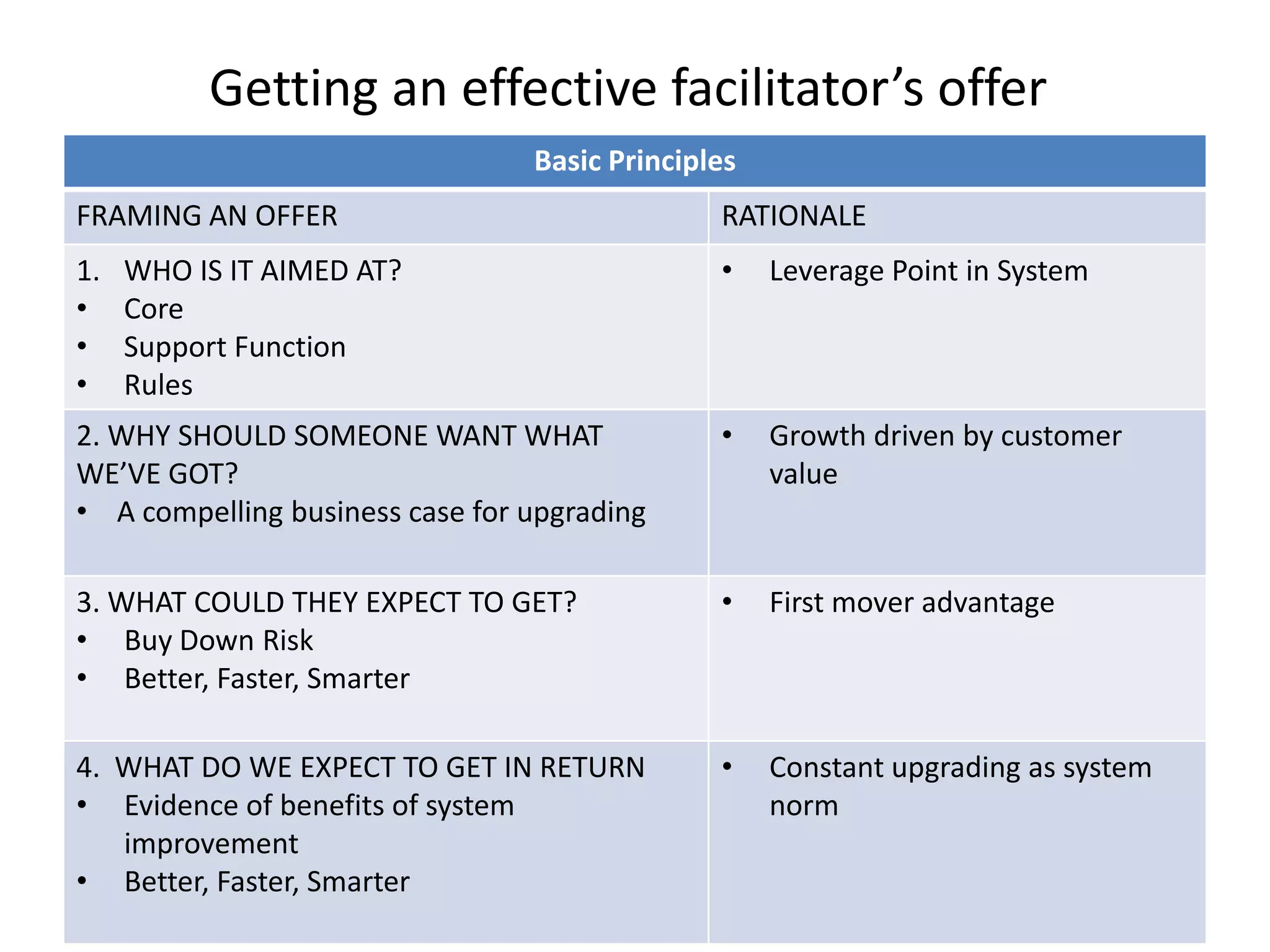

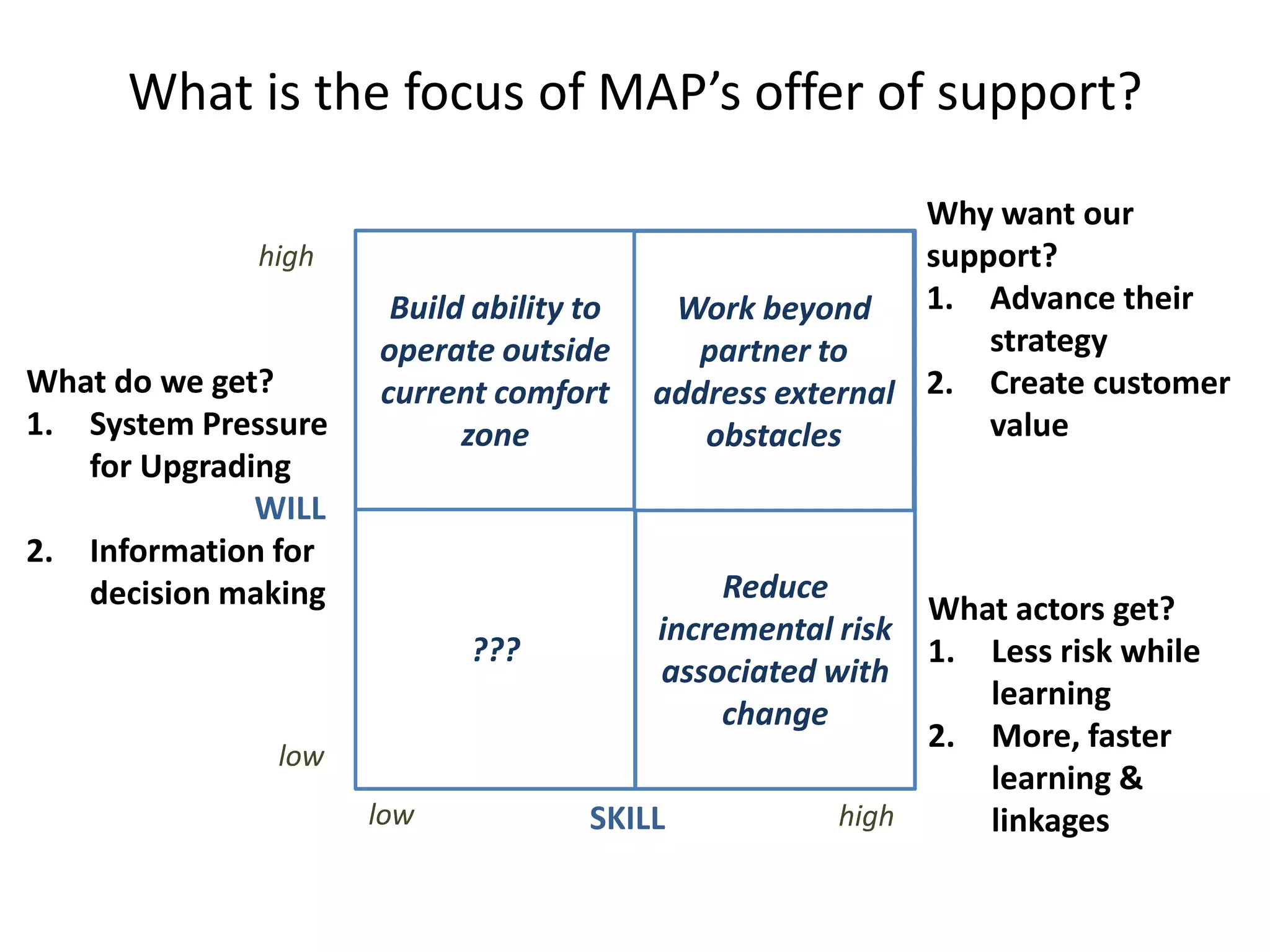

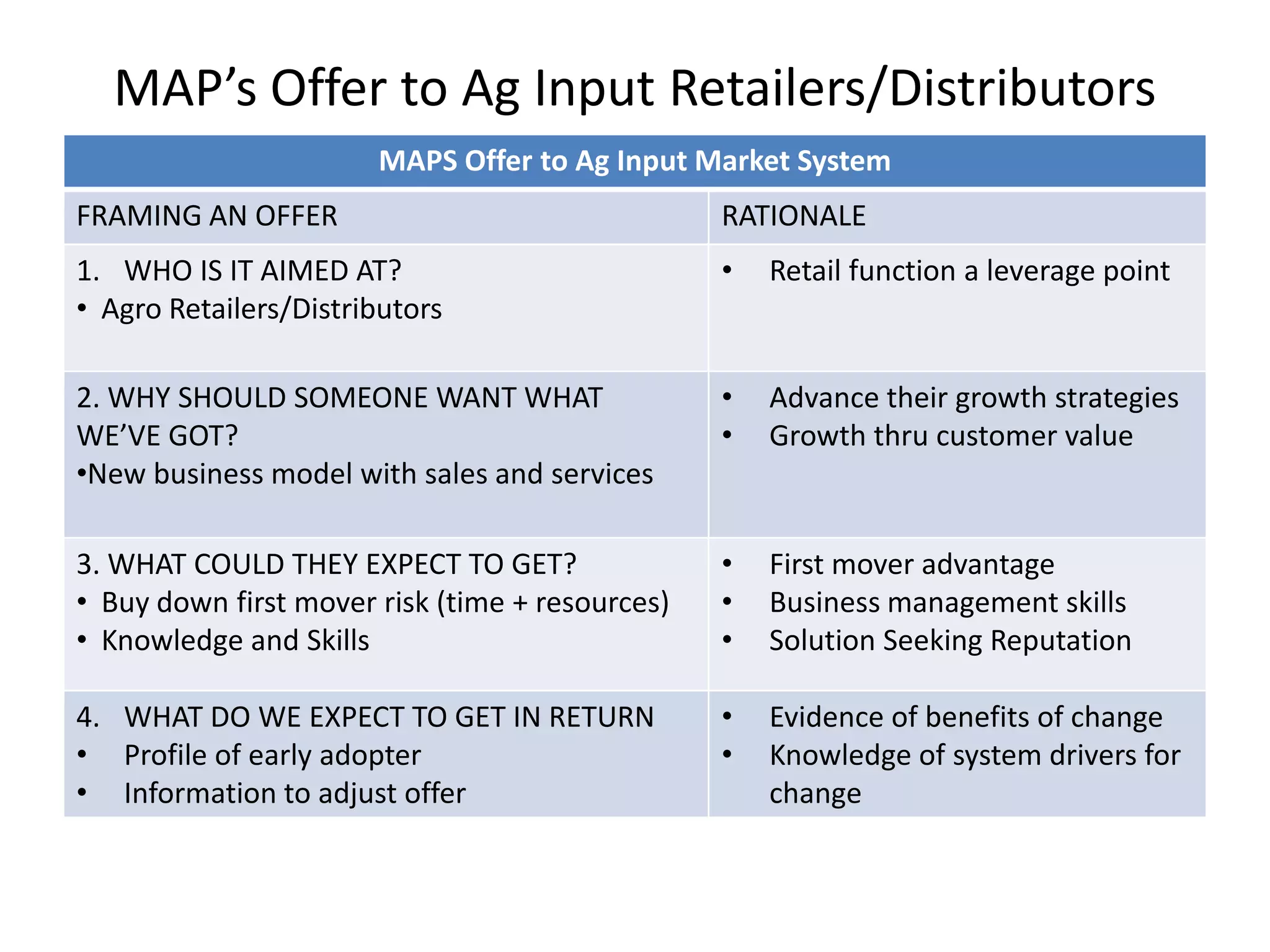

3) Provide guidance on framing effective offers by considering who the offer is aimed at, why actors should want it, what they would get, and what MAP expects to get in return.