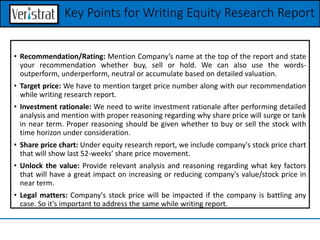

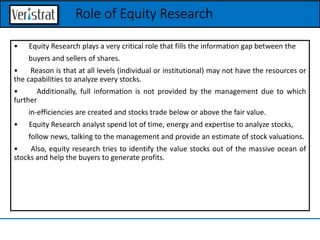

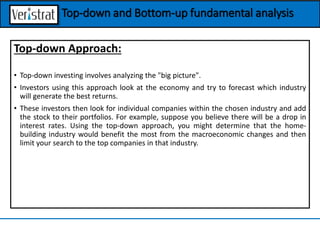

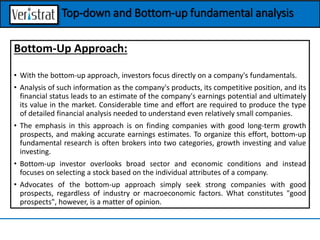

Equity research involves analyzing a company's business model, financial statements, and market conditions to provide investment recommendations like buy or sell. Analysts use various methodologies including fundamental analysis, macroeconomic factors, and valuation techniques to assess intrinsic values and compare them with market prices. The research report consolidates findings into actionable insights, detailing target prices, investment rationales, and critical company metrics.