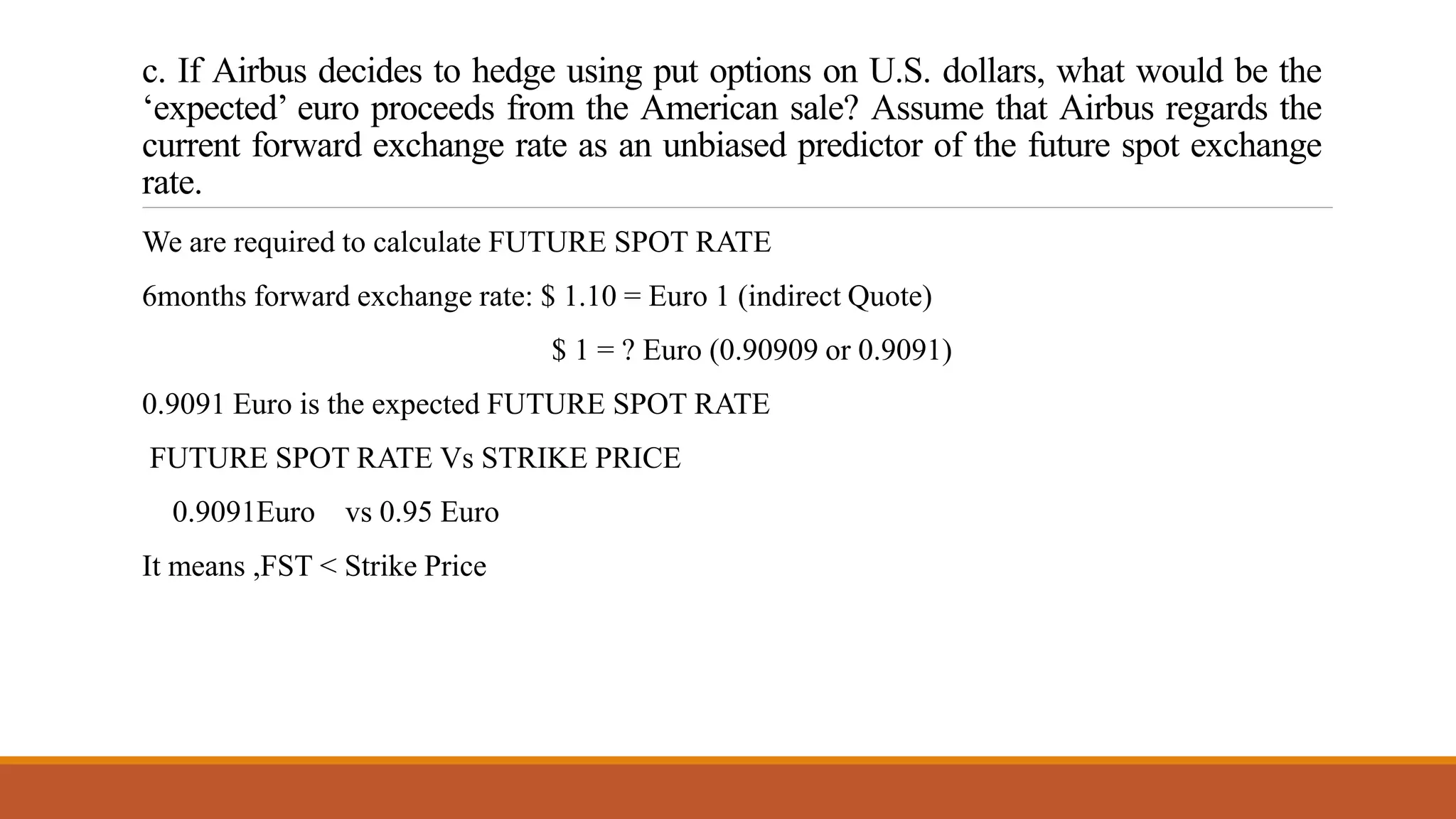

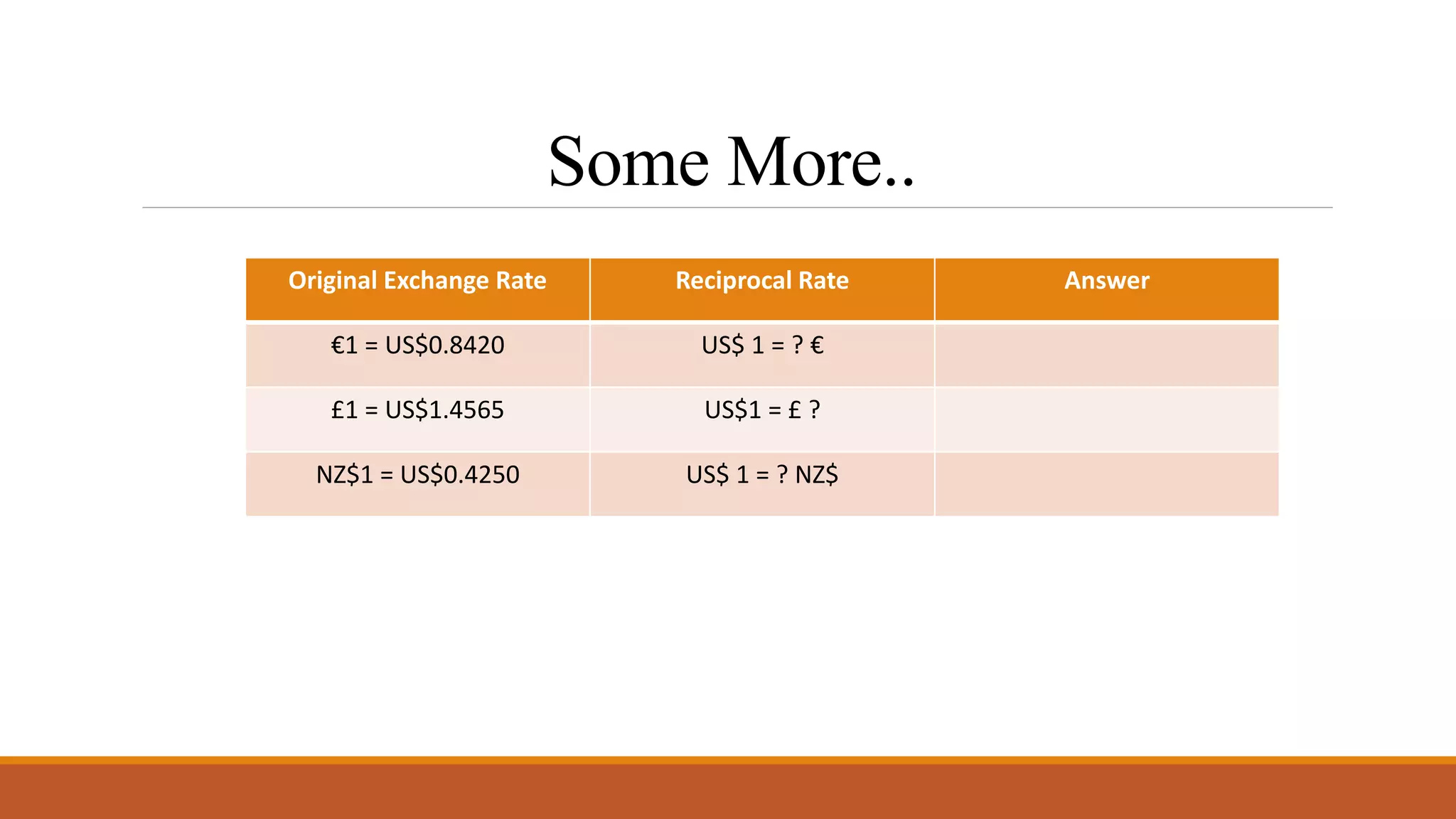

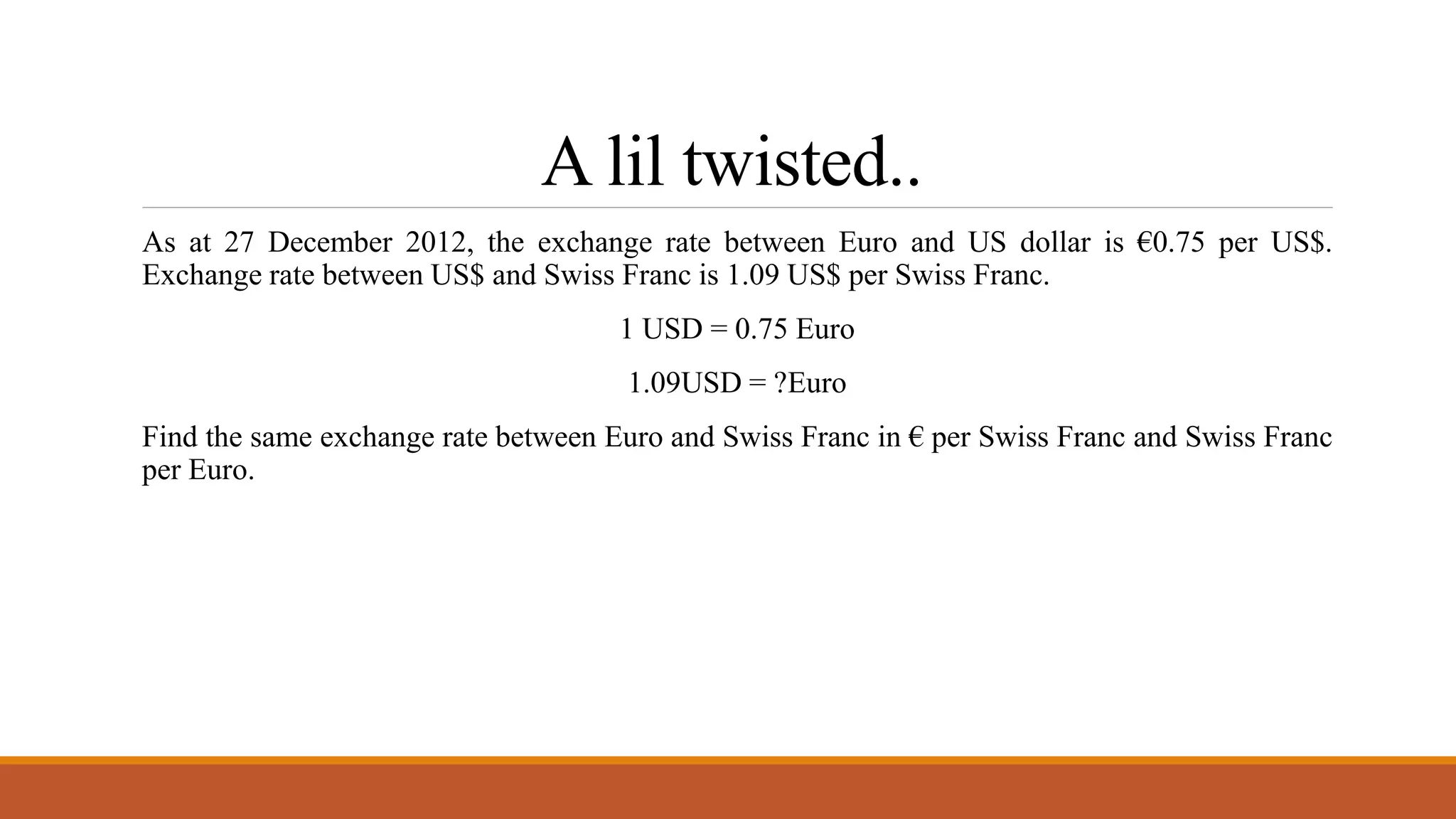

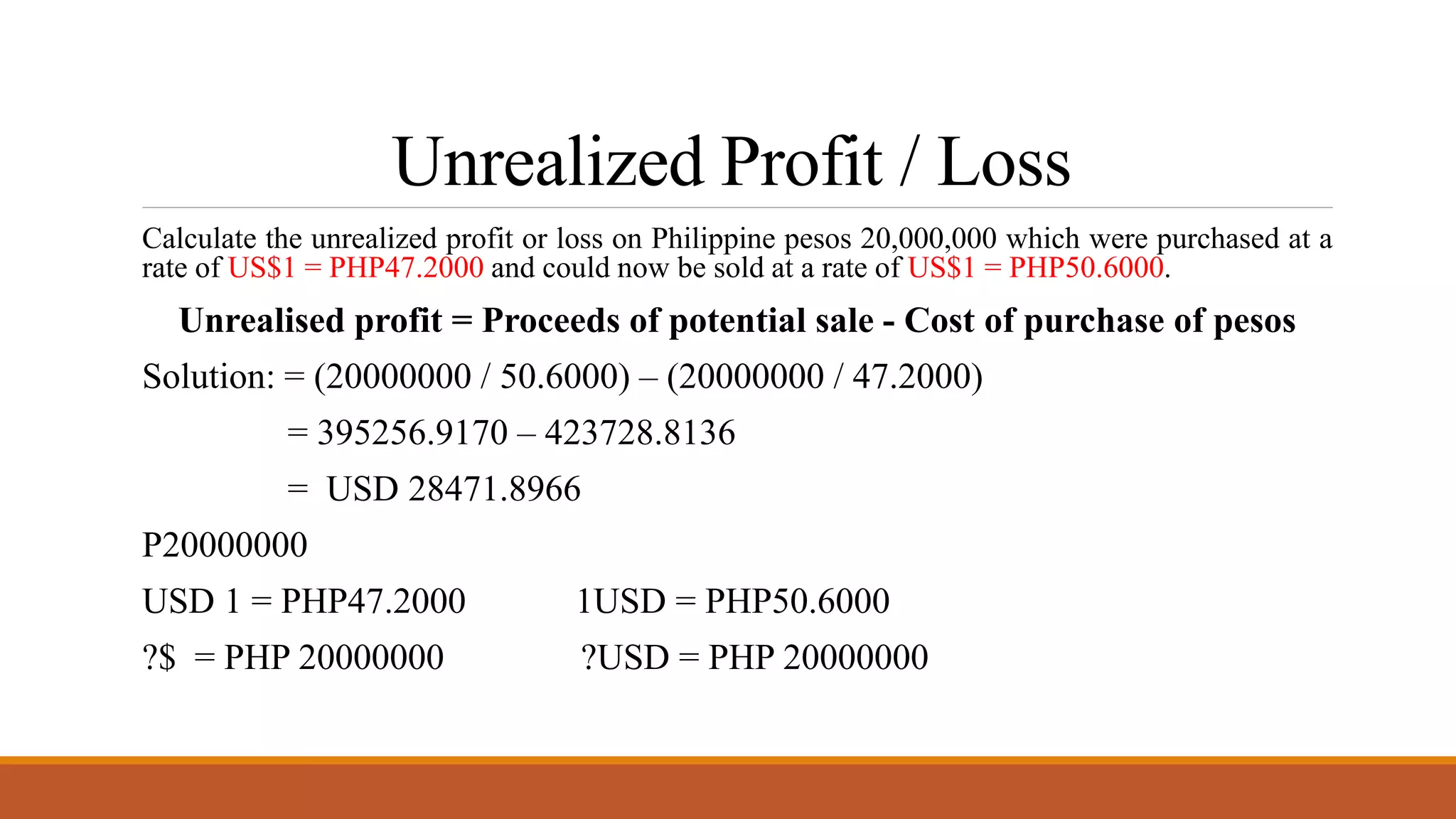

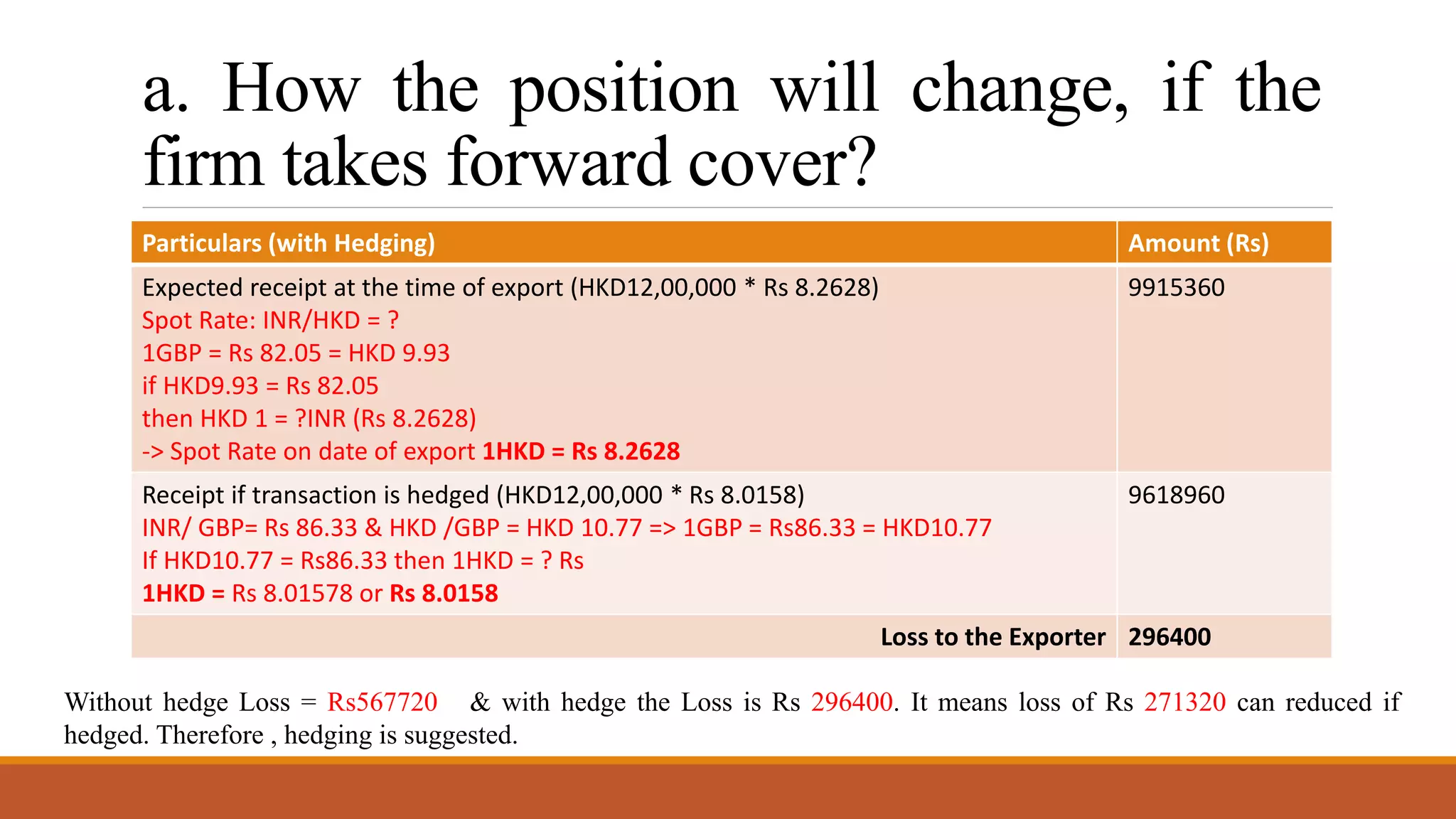

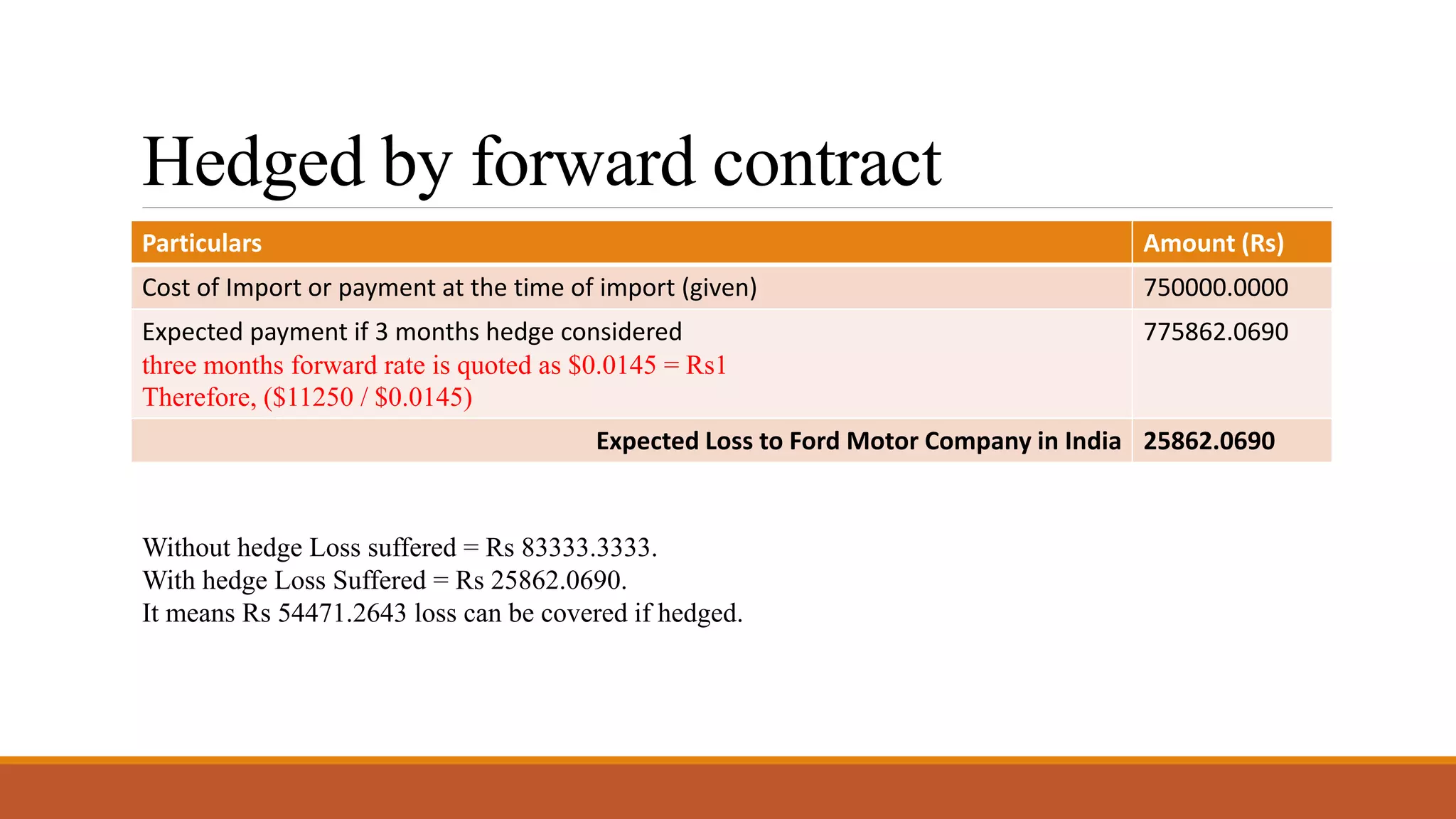

Airbus sold an aircraft to an American company for $30 million payable in six months. To hedge against currency risk, Airbus considered three options: a forward contract, money market hedge, or put options.

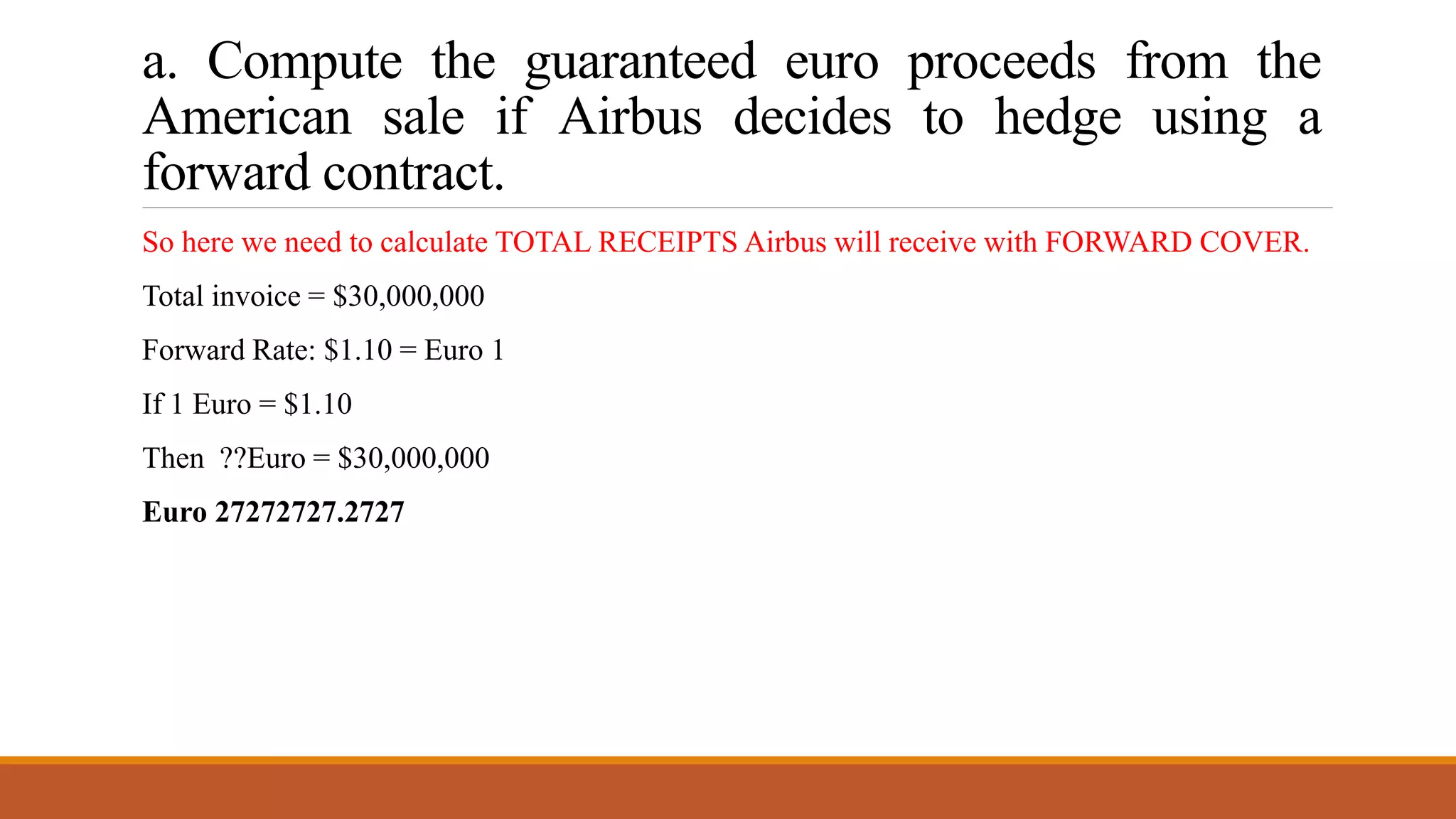

If Airbus used a forward contract with a rate of $1.10/Euro, their guaranteed euro proceeds would be $30 million / $1.10 per euro = Euro 27.27 million. Using money market instruments, Airbus would deposit dollars at 3% interest and euros at 2.5% interest to receive Euro 27.27 million. With put options costing $0.02 per euro and a strike of $0.95/euro, Airbus's expected euro proceeds

![b. If Airbus decides to hedge using money market instruments,

what action does Airbus need to take? What would be the

guaranteed euro proceeds from the American sale in this case?

Airbus will borrow the PRESENT VALUE of the $ receivable

FR = SR * [1+ (Dr * T)]

[1+(Fr *T)]

FR = $1.0474

$30000000 = $28642352.4918

Airbus want currency denomination in Euro and not in $. Therefore , Airbus will exchange

$28642352.4918 with SPOT RATE

$1.05 = Euro 1

= Euro 27278430.9445 = Guaranteed proceeds](https://image.slidesharecdn.com/numericalsonif-221217135806-4c21a89d/75/Numericals-on-IF-pptx-23-2048.jpg)