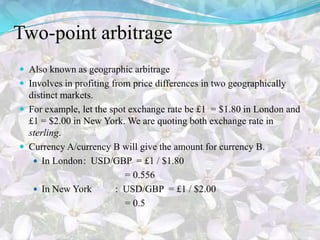

Foreign exchange markets allow for the trading of one country's currency for another. This facilitates international trade and investment. The global foreign exchange market consists of major international banks trading various currencies. The major currencies traded are the US dollar, euro, yen, and pound. Arbitrage opportunities can exist when temporary price discrepancies allow traders to profit from buying low and selling high across different currency exchanges.