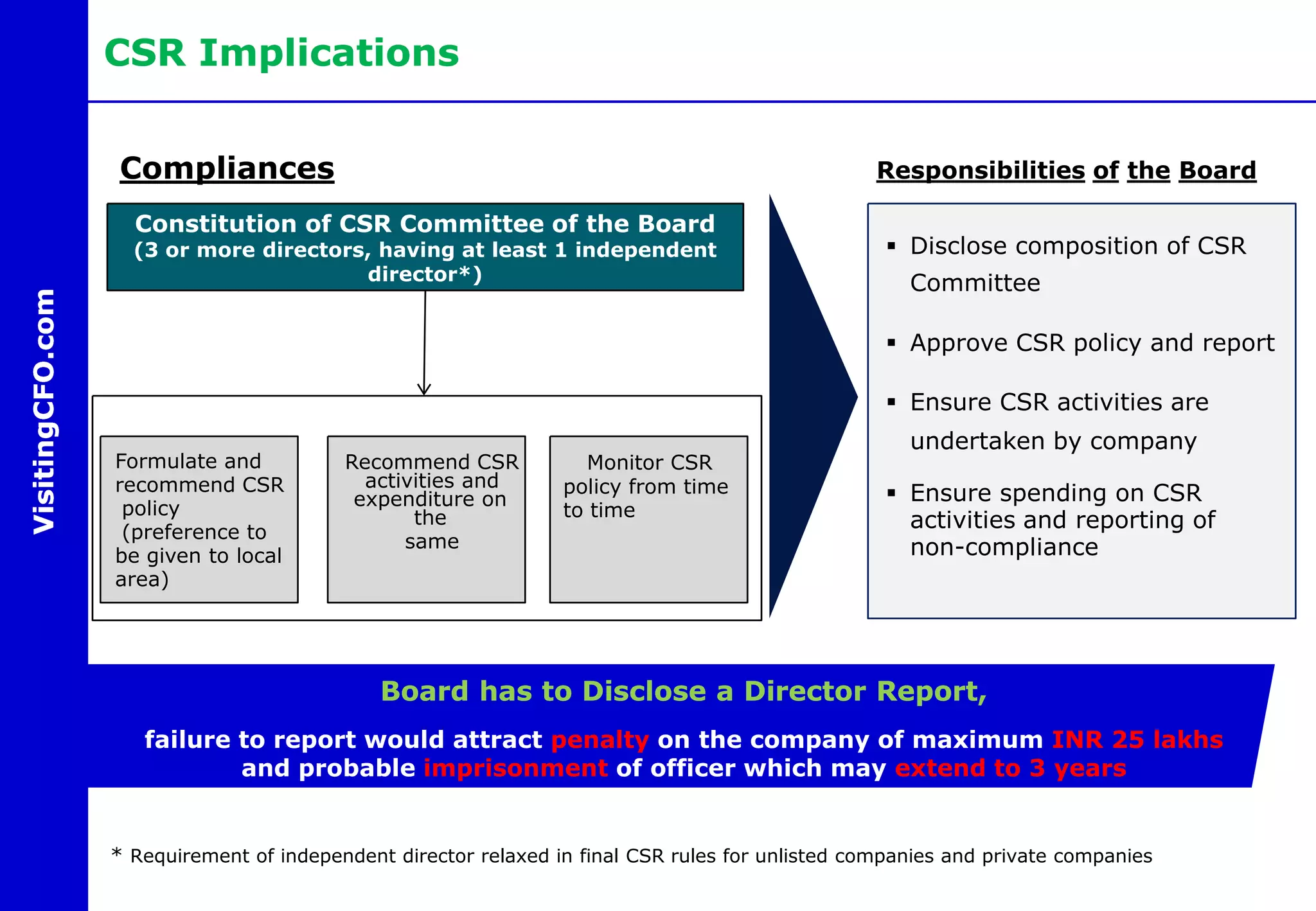

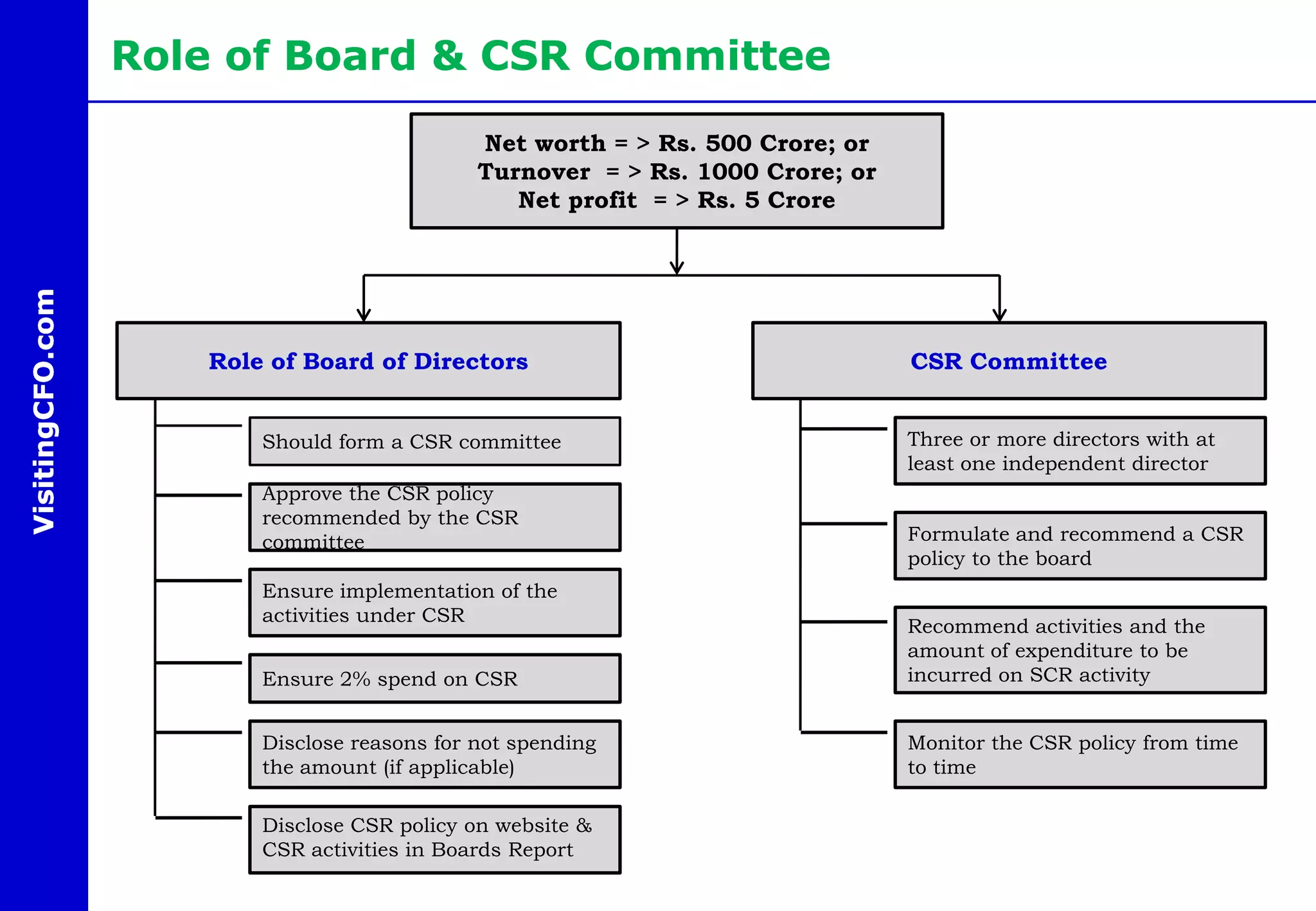

The document outlines India's Corporate Social Responsibility (CSR) mandate under the Companies Act, 2013, which requires eligible companies to spend 2% of their average net profit on designated CSR activities starting from the financial year 2014-15. It details the responsibilities of companies' boards and CSR committees in formulating and monitoring the CSR policy and outlines the types of activities considered eligible for CSR funding. It also discusses compliance requirements and implications for both domestic and foreign companies operating in India.