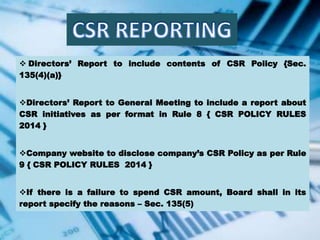

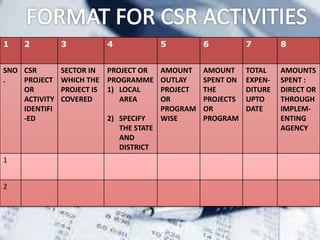

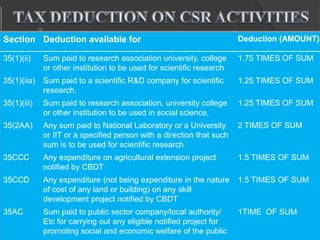

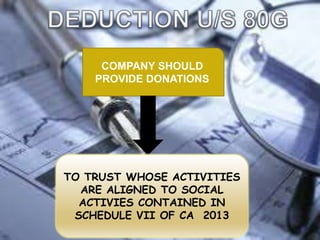

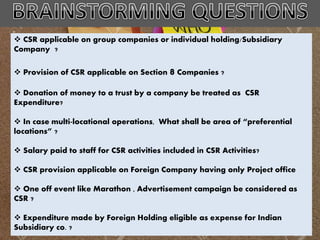

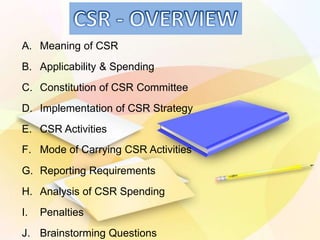

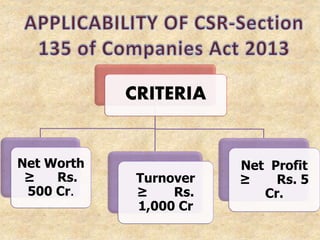

The document discusses the key aspects of corporate social responsibility (CSR) requirements for companies in India according to the Companies Act 2013. It covers topics such as the criteria for applicability of CSR spending requirements, computation of net profits, constitution of CSR committees, eligible CSR activities, modes of implementation, reporting requirements, deductions available, and penalties for non-compliance. It also provides a comparison of CSR practices in other countries and poses some questions for further discussion on interpreting certain aspects of India's CSR rules.

![5

Every company that satisfies prescribed threshold is required to spend

at least 2% of its average net profit of 3 preceding financial years on

specified CSR activities

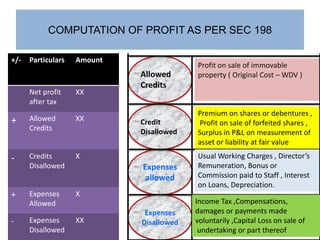

Section 3(d) of the proposed CSR Rules, defines Net Profit for

domestic company as: “Net profit before tax as per books of

accounts and shall not include profits arising from branches

outside India‘

“Net profit” for a foreign company means the net profit as per profit

and loss account prepared in terms of section 381(a)(1) read with

section 198 of the Companies Act, 2013.

The ‘average net profit’ shall be calculated in accordance with

section 198 [i.e., calculation of net profit prescribed for the purpose of

determining the maximum managerial remuneration]

AMOUNT TO BE SPENT ON CSR ACTIVITIES](https://image.slidesharecdn.com/csrcompaniesact13-150110000144-conversion-gate01/85/Corporate-Social-Responsibility-from-Tax-Perspective-5-320.jpg)