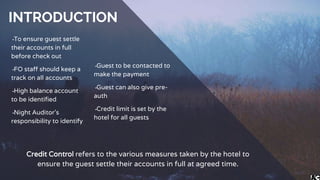

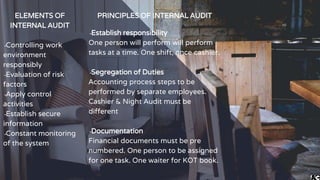

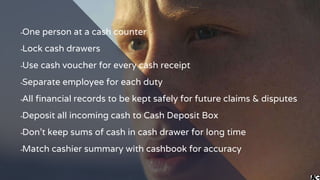

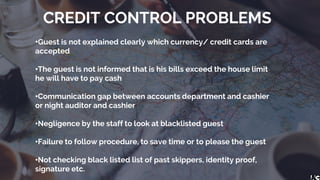

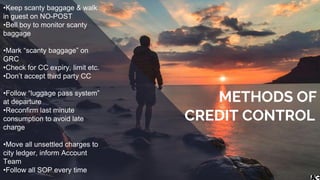

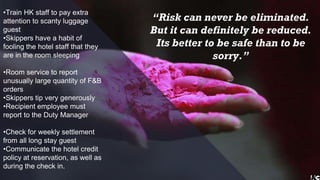

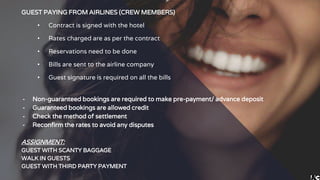

The document outlines credit control measures in front office operations of hotels, emphasizing the importance of ensuring guests settle their accounts on time. It discusses the roles of front office staff and night auditors in managing cash flow, establishing internal controls, and addressing common credit control issues. Additionally, it highlights methods to prevent potential credit risks and the procedures for handling payments from various guest types, including those using credit cards, travel agents, and corporate clients.