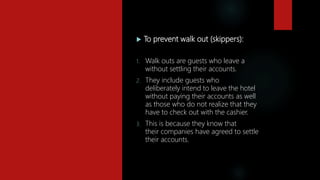

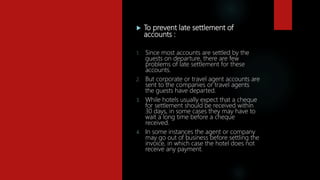

The case study examines cash and credit control measures in hotels, detailing their definitions, objectives, and the importance of maintaining a healthy cash flow. It emphasizes the roles of cash management and credit control in preventing issues such as guests leaving without payment and late settlements, while providing strategies to mitigate these problems. The document concludes with a discussion on hotel credit policies and limits to ensure that guests are capable of settling their bills before being granted credit.