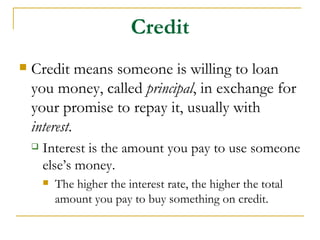

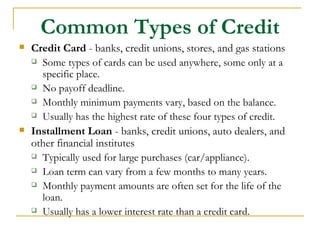

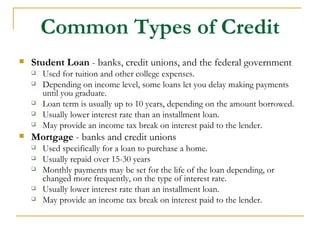

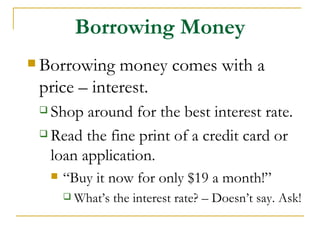

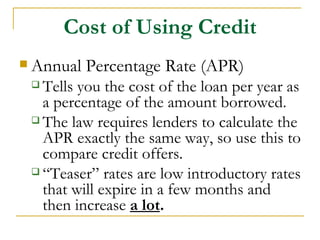

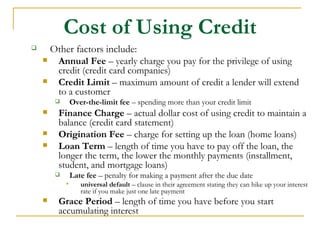

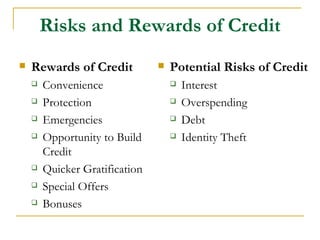

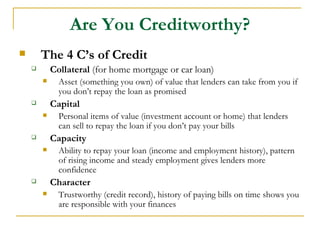

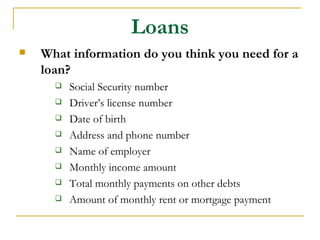

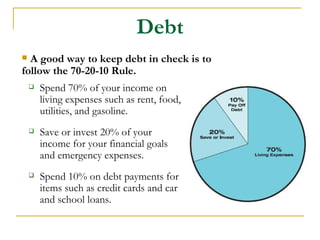

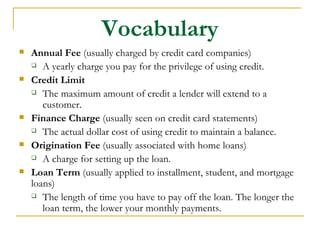

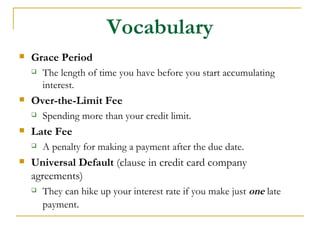

This document discusses credit and managing personal finances responsibly. It covers key topics like the advantages and disadvantages of using credit, applying for and establishing credit, maintaining a good credit history and credit report, and the consequences of excessive debt. Specific areas covered include different types of credit (credit cards, loans, mortgages), understanding interest rates and fees, building creditworthiness, checking your credit report and score, and the risks of poor credit management.