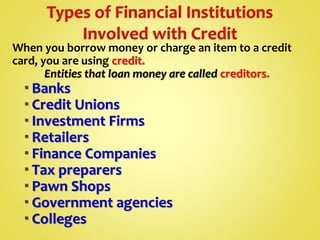

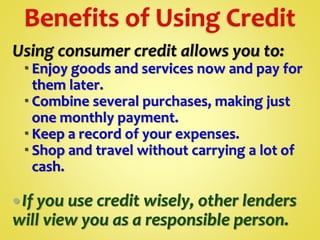

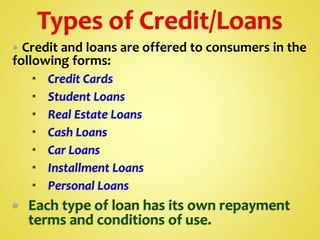

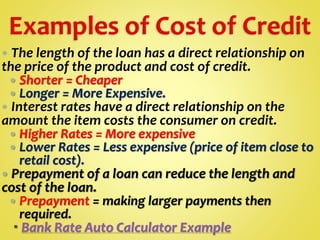

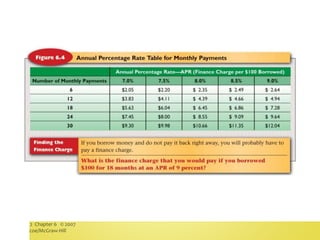

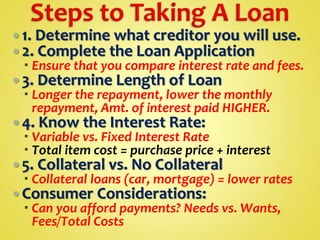

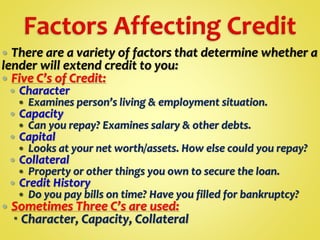

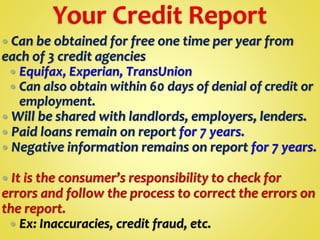

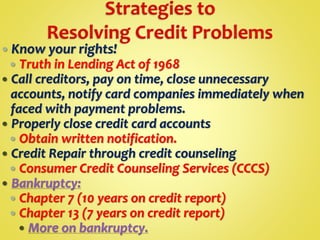

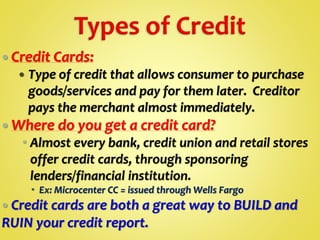

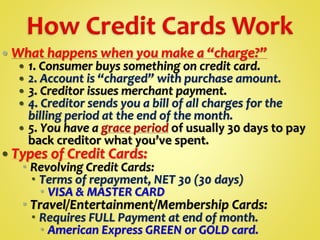

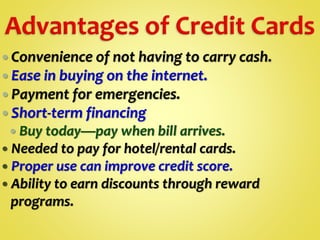

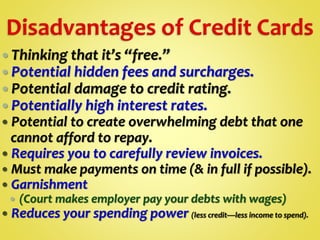

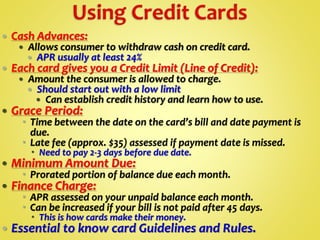

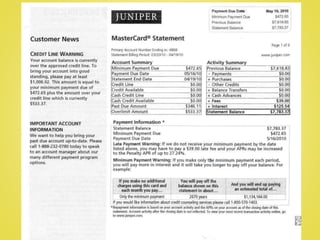

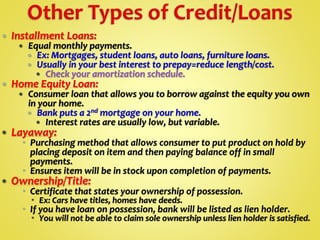

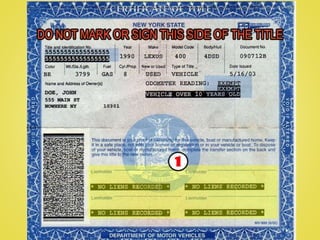

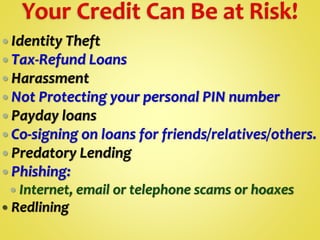

This document provides information about different types of consumer credit. It defines credit as an arrangement to receive goods or services now and pay for them later. It discusses how credit works, including borrowing money from a creditor and paying interest. It also covers the costs and benefits of using credit, factors to consider before financing a purchase, and the various forms consumer credit can take, such as credit cards, loans, and layaway plans. It emphasizes the importance of understanding interest rates, fees, repayment terms, and your ability to repay before taking on debt.