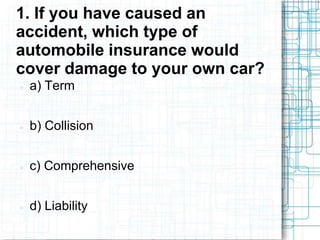

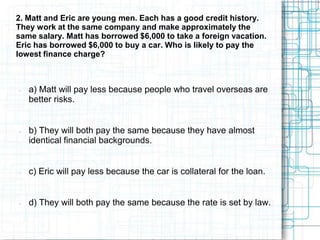

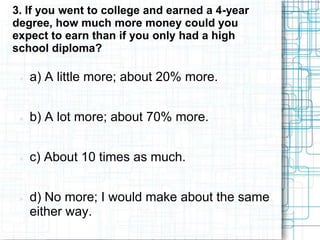

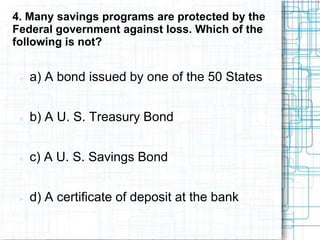

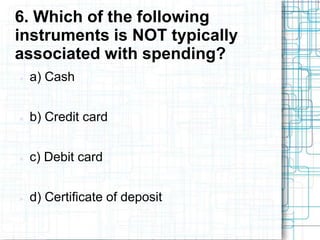

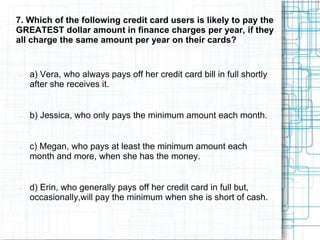

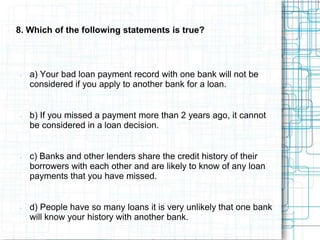

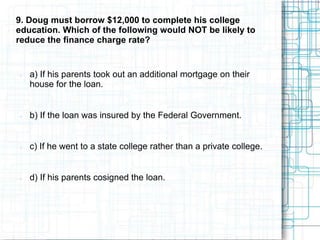

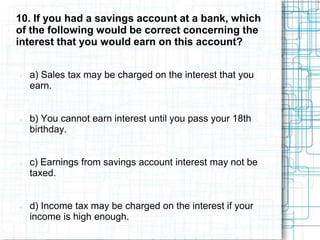

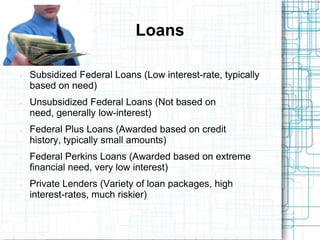

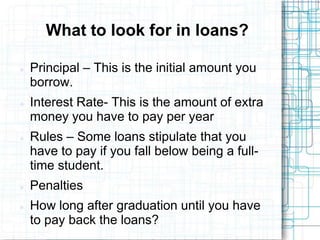

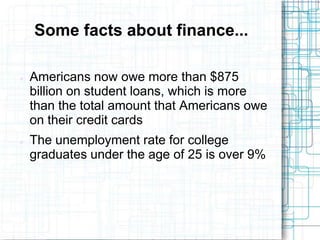

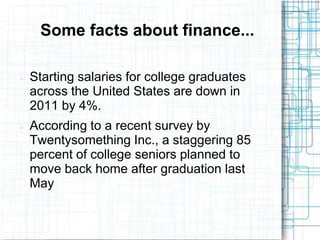

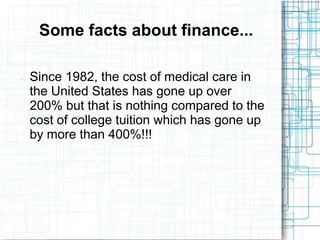

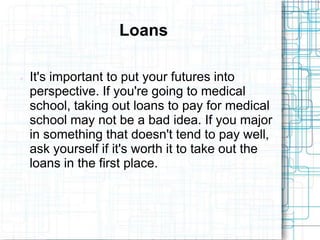

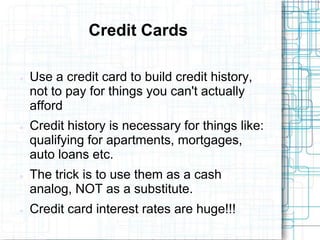

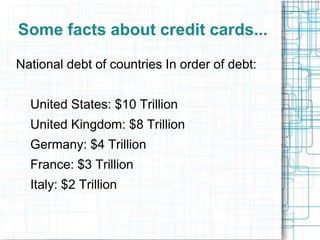

This document provides an introduction to financial literacy concepts for college-bound students. It includes a quiz testing knowledge of topics like insurance, loans, credit cards, and interest rates. It finds that the average American adult scores only 40% on such quizzes. The document then discusses various types of student loans and factors to consider in loans. It provides facts about the large amount of student debt in the US and increasing tuition costs. It also covers credit scores, interest rates, budgeting, and the importance of savings. The overall message is that students should educate themselves on personal finance topics to avoid debt traps.