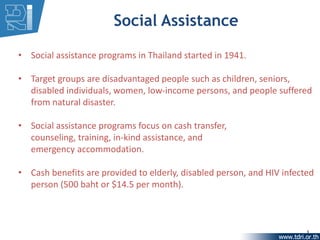

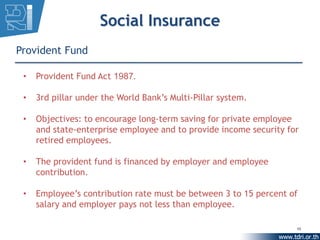

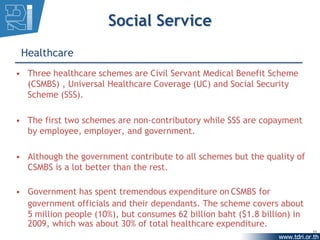

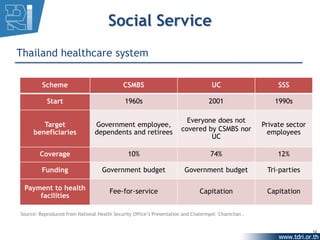

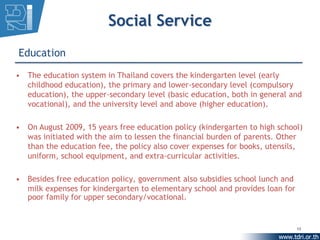

1) Thailand provides social protection through social assistance programs that target disadvantaged groups, social insurance programs like the Social Security Fund and Provident Fund, and social services like universal healthcare and free education.

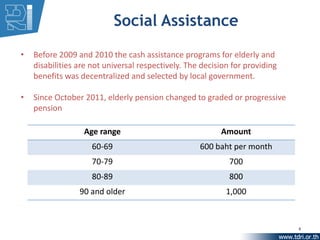

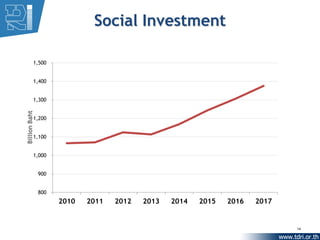

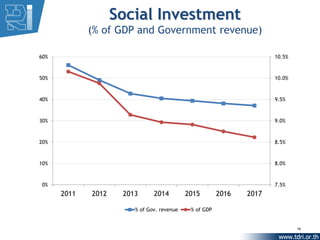

2) Government spending on social protection has been increasing but remains low, at less than 1% of the budget for social assistance programs.

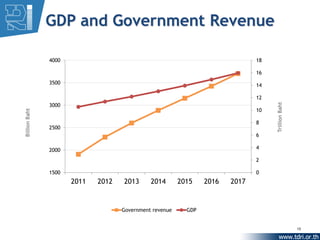

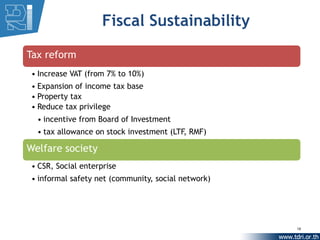

3) Future challenges include expanding coverage of benefits and improving benefit levels given Thailand's aging population and increasing burden on the healthcare system. Fiscal sustainability of social protection programs is also a concern.