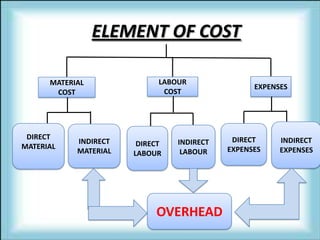

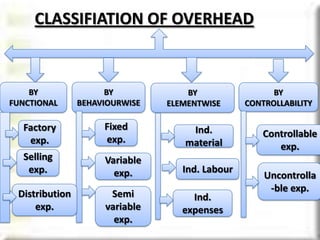

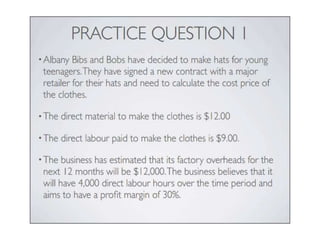

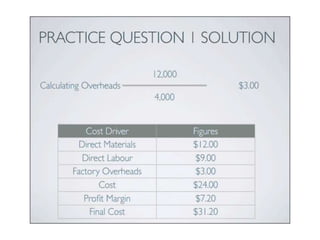

This document discusses cost accounting and the classification of costs. It explains that cost accounting involves classifying, recording, and allocating expenditures to determine the costs of products and services. There are three main elements of cost: material cost, labor cost, and overhead. Overhead includes indirect materials, indirect labor, and other expenses that cannot be directly traced to a product. The document then describes different ways to classify overhead, such as by function, behavior, element, or controllability. It also explains that overhead must be allocated to production and service departments.