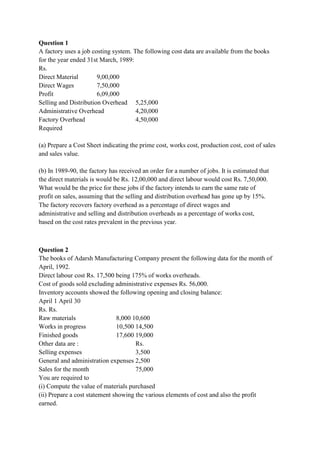

This document contains two questions regarding job costing systems. Question 1 provides cost data for a factory for the year ending March 1989, including direct material costs, direct wages, profit, overhead costs, and more. It asks to prepare a cost sheet and calculate the price for future jobs if materials and labor costs increase but profit rate and overhead cost allocation remains the same. Question 2 provides additional financial data for Adarsh Manufacturing Company for the month of April 1992, including direct labor costs, inventory balances, expenses, and sales. It asks to calculate materials purchased and prepare a cost statement showing costs and profit.