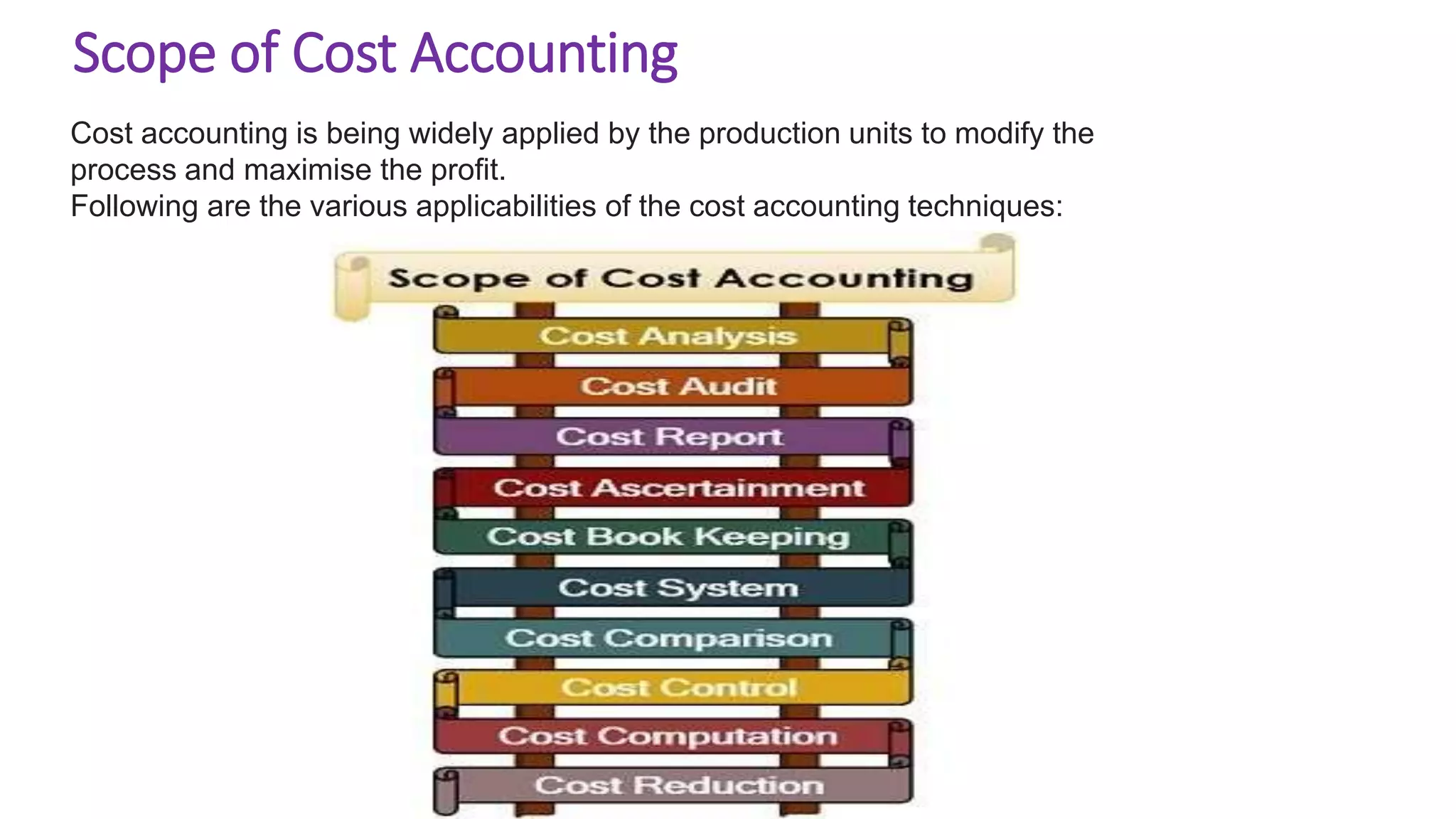

This document provides an overview of cost accounting, defining it as a method for ensuring cost-effectiveness in manufacturing through detailed analysis of expenses. It outlines the advantages, limitations, and objectives of cost accounting, highlighting its role in identifying inefficiencies, aiding management decisions, and assisting in price fixation. Additionally, it compares cost accounting with financial accounting to illustrate the distinct purposes and methodologies of each accounting practice.