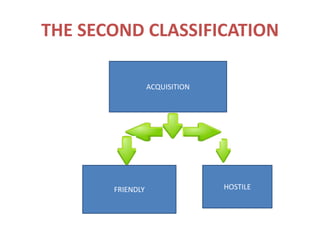

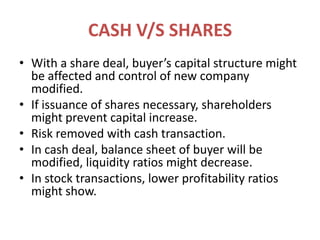

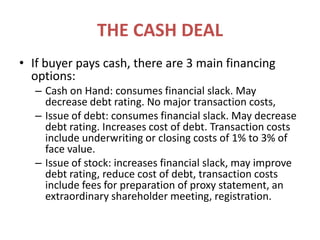

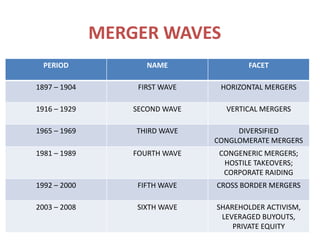

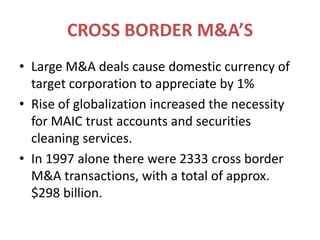

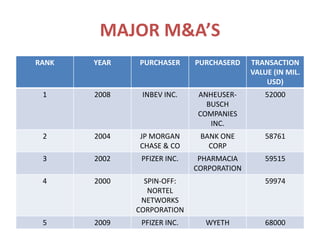

This document provides an introduction to mergers and acquisitions (M&A). It defines M&A as aspects of corporate strategy and finance that involve combining companies. The document outlines different types of acquisitions and mergers. It also discusses common business valuation methods, financing options, the roles of advisory firms, and potential motivations for and effects of M&A deals. Special topics covered include brand considerations after mergers, historical trends in merger activity, and cross-border M&A.