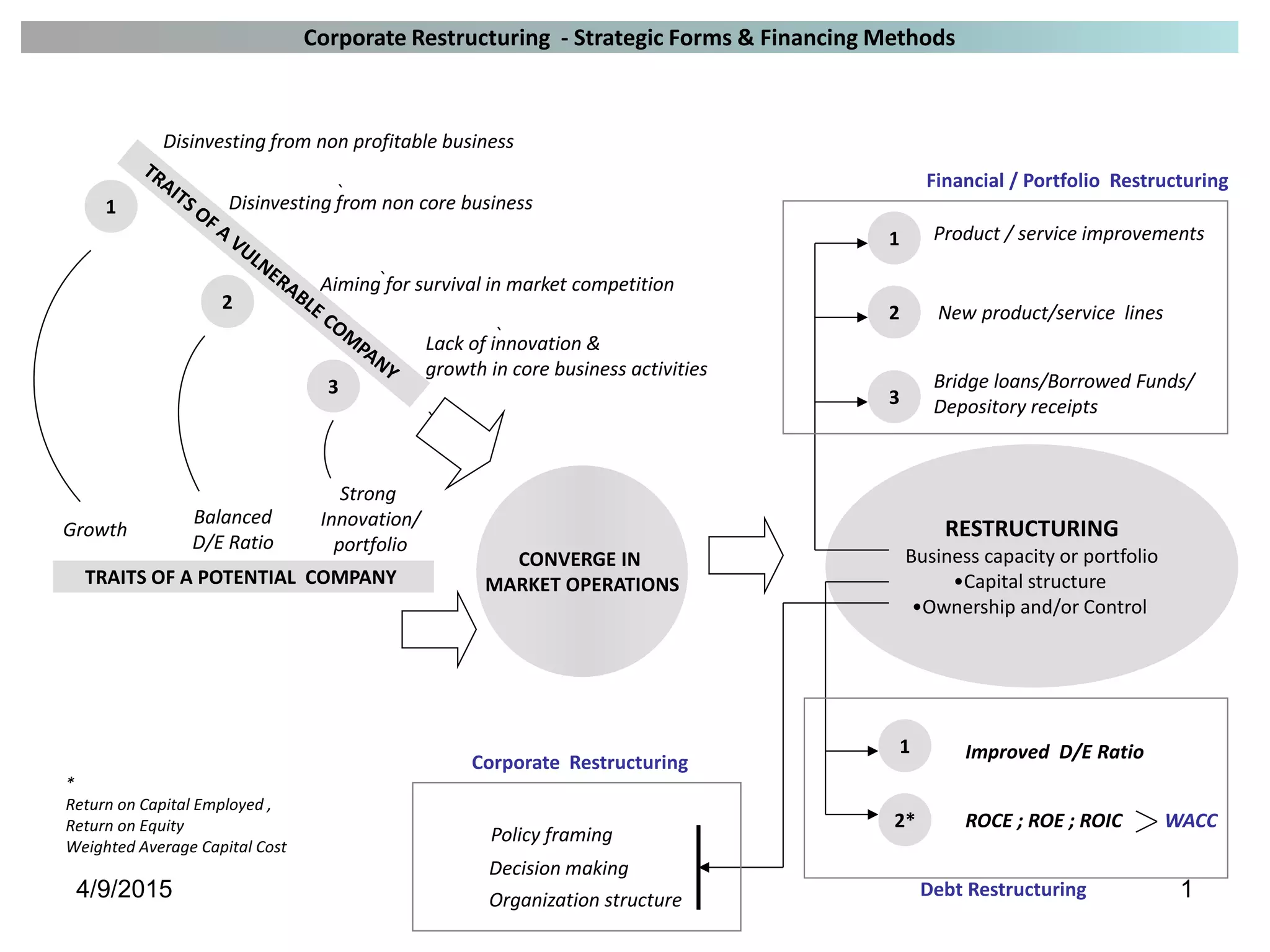

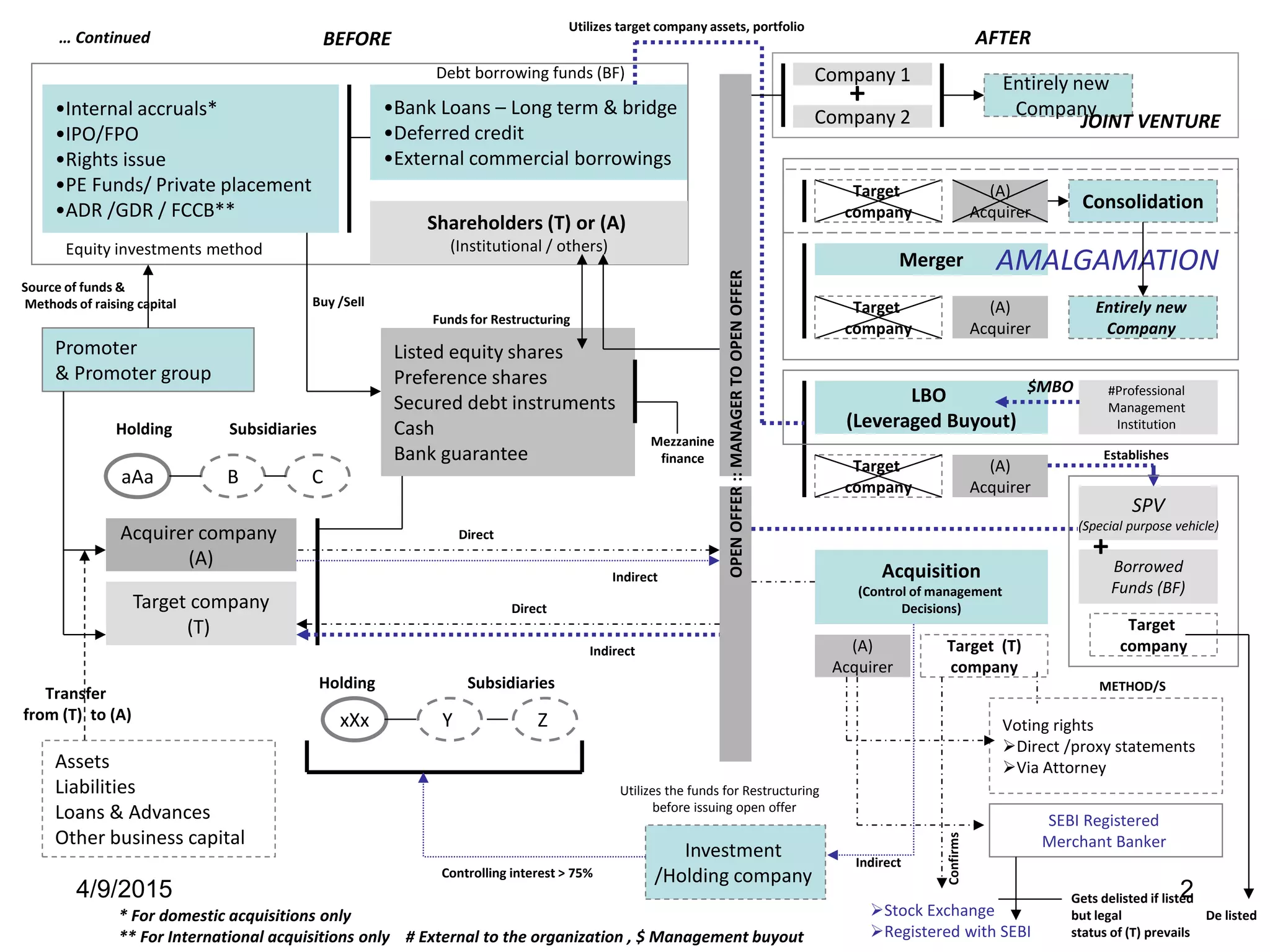

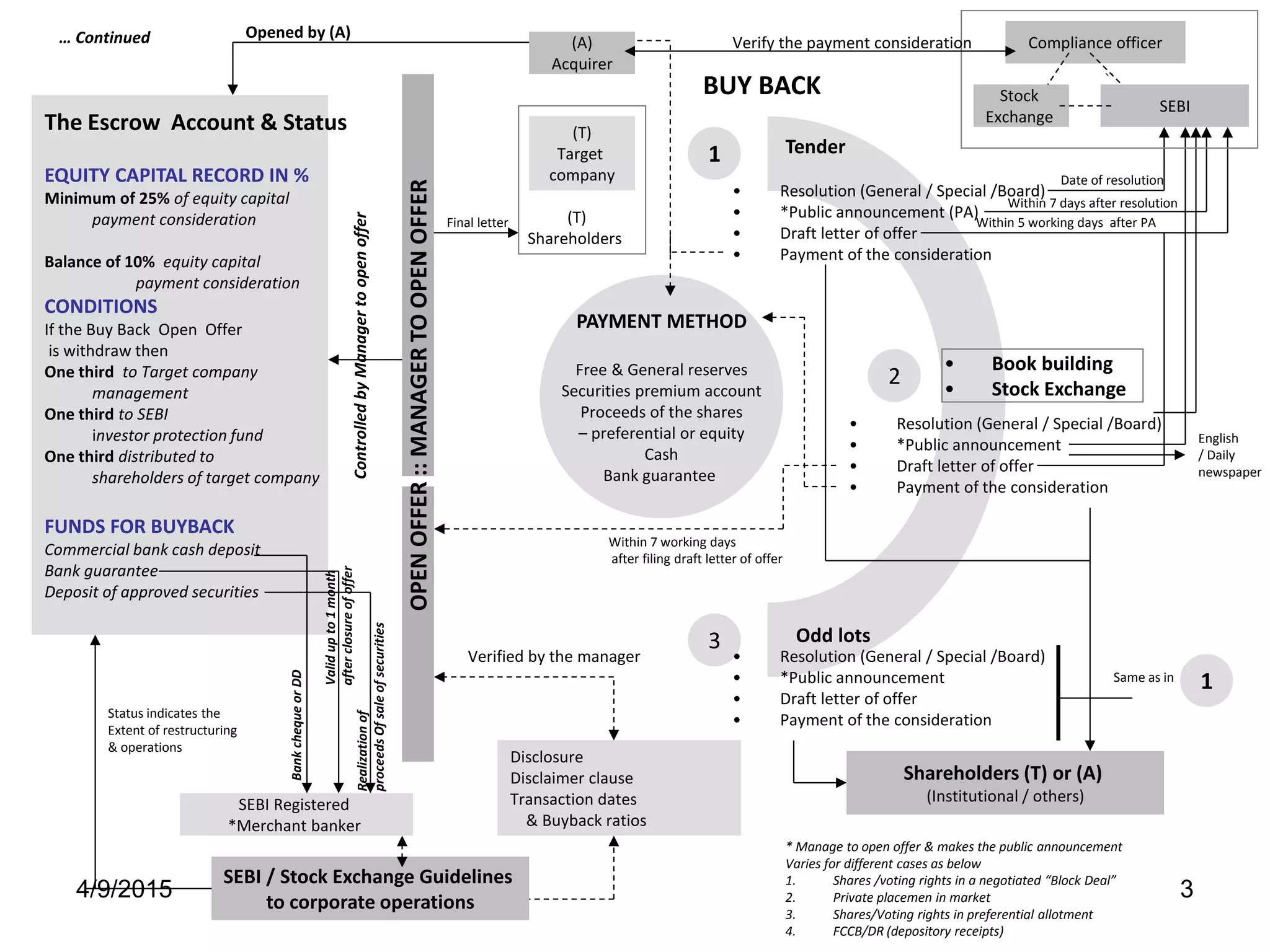

The document outlines various strategies and methods for corporate restructuring, focusing on capital structure, financing, and management decisions. It discusses disinvestment from non-core and unprofitable businesses, as well as options for raising capital such as IPOs, private placements, and loans. Additionally, it includes details on mergers, acquisitions, and compliance requirements for public offerings.