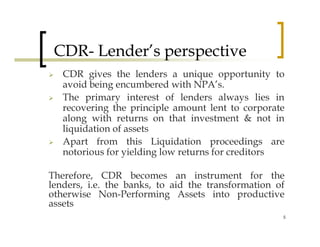

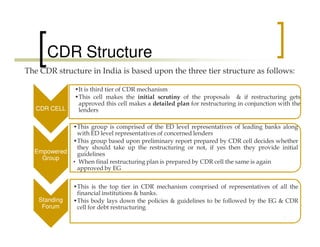

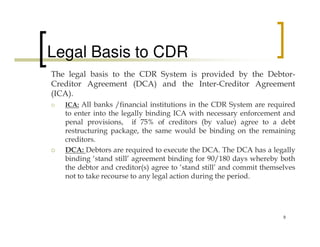

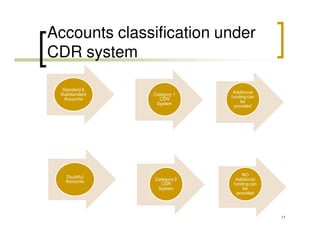

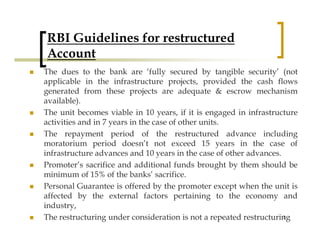

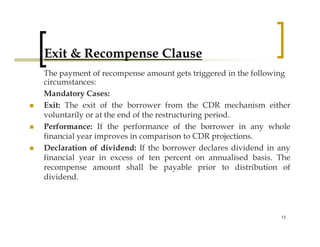

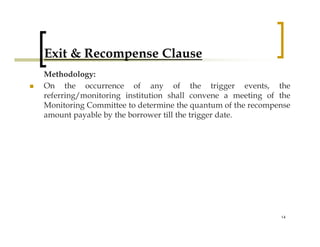

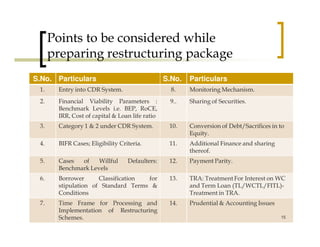

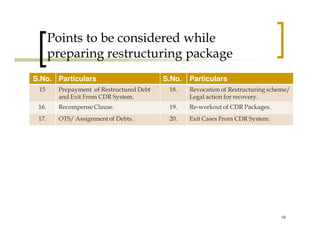

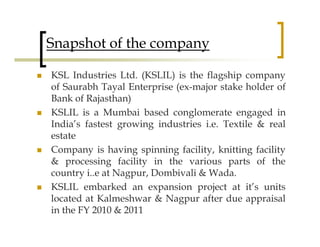

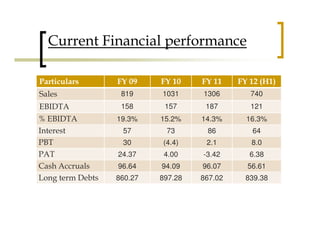

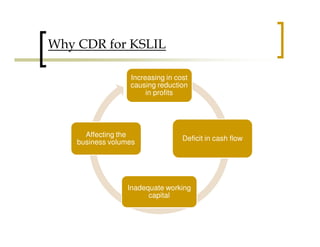

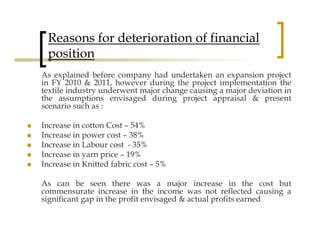

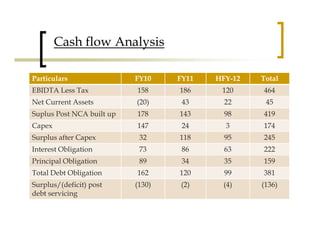

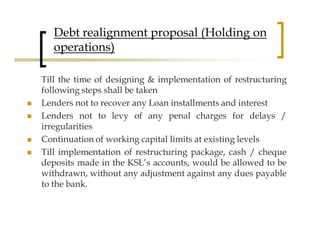

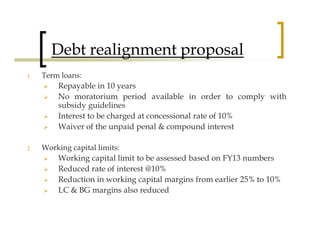

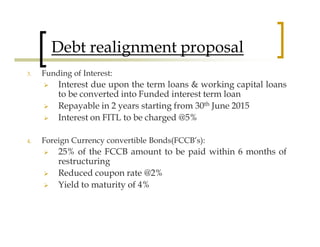

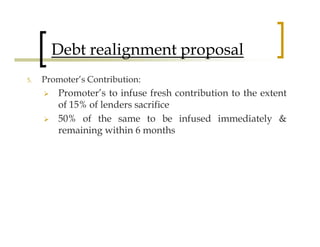

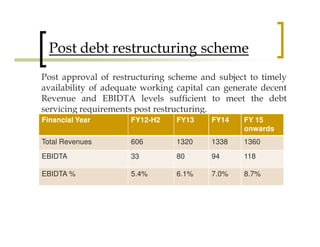

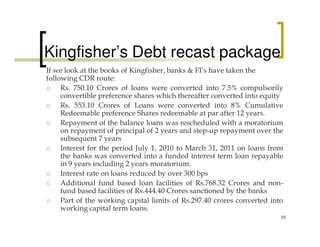

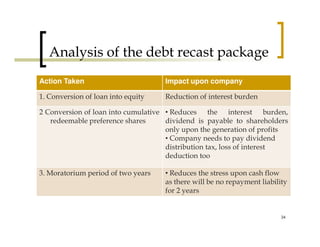

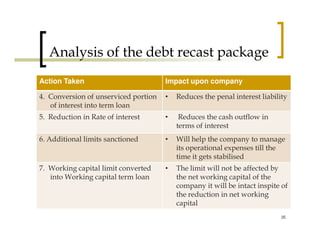

The document discusses corporate debt restructuring (CDR) in India, including what CDR is, why companies pursue it, the CDR structure, legal basis, objectives, and case studies of companies that underwent CDR including KSL Industries and Kingfisher Airlines. It provides an overview of the key mechanisms and considerations for corporate debt restructuring in India.