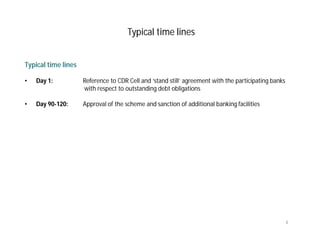

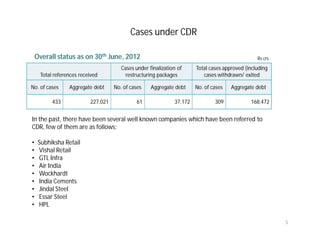

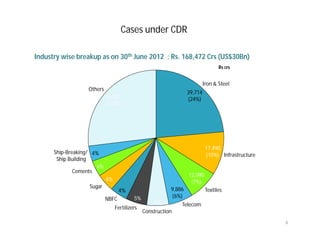

The Corporate Debt Restructuring (CDR) mechanism, established by the Reserve Bank of India in 2001, is a voluntary process for reorganizing outstanding debt obligations of viable companies. It aims to provide a structured approach for companies facing challenges while ensuring minimal disruption to business operations and timely restructuring for the benefit of creditors and stakeholders. As of June 30, 2012, multiple companies have utilized this mechanism, which involves a coordinated restructuring program without impacting vendor and customer contracts.