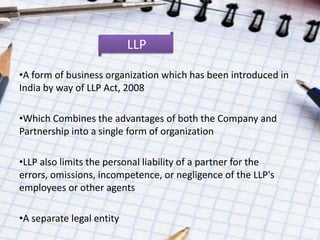

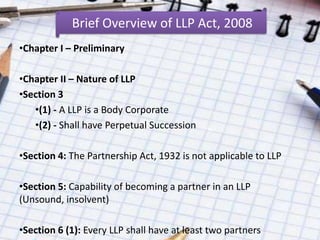

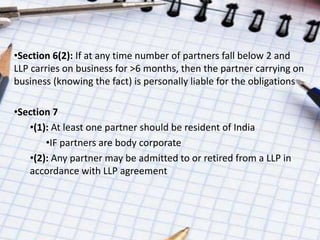

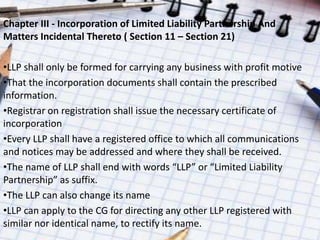

The document provides an overview of Limited Liability Partnerships (LLPs) under Indian law, including key aspects of the LLP Act 2008 such as incorporation, partners' relationships, taxation, foreign investment, and comparisons to other business forms. It discusses merits and demerits of LLPs, taxation implications on conversion to/from LLPs, and allows foreign investment in LLPs in sectors allowing 100% FDI.