The document discusses the implications of the Finance Act 2012 and Finance Bill 2013 on business restructuring, emphasizing its necessity for survival and growth in changing markets. It outlines various types of restructuring, the features and circumstances necessitating it, and the related tax issues arising from mergers and acquisitions, particularly regarding indirect transfers. Additionally, the document highlights recommendations from the Shome Committee addressing the complexities and uncertainties introduced by new tax regulations.

![Expansion in scope of Transfer Pricing applicability

[Section 92B]

Section 92B : An explanation is inserted with retrospective effect from 01.04.2002 to clarify the

meaning of the expression “ International Transaction “.

The Expression “ International Transaction” shall include –

• A transaction of Business restructuring or reorganization, entered into by an enterprise with an

associated enterprise, irrespective of the fact that it has bearing on the profit, income ,losses or

assets of such enterprises at the time of the transaction or at any future date.

This has been done in light of recent judicial precedents in

Goodyear Tire and Rubber Company [2011] 11 taxmann.com 43 (AAR)

Dana Corporation [2010] 186 Taxman 187 (AAR)

Amiantit International Holding Ltd [2010] 189 Taxman 149 (AAR)

Facts :

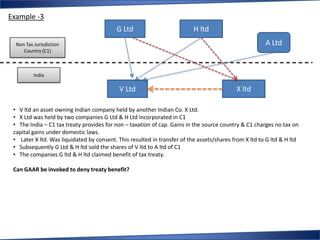

1.Transfer of shares from Indian company to foreign company is without consideration

2. As the full value consideration received on transfer of shares of Indian co. is Nil the

mechanism to charge the capital gains to tax, as provided under Section 48 of the Act fails.

3. Since there is no income chargeable under the ITA, the transfer pricing provisions also cannot be

made applicable.

• Capital Financing, including any type of long term or short term borrowing, lending or

guarantee, purchase or sale of marketable securities or any type of advance, payments or deferred

payment or receivable or any other debt arising during the course of business.](https://image.slidesharecdn.com/businessrestructuring-130418065629-phpapp02/85/Business-Restructuring-49-320.jpg)

![Transfer Pricing

Sec. 92 C – Computation of ALP

The words “specified domestic transaction” has been inserted appropriately in various sub-sec.

(1) Any of the following methods, being most appropriate method :

(a) Comparable uncontrolled price method;

(b) Resale price method;

(c) Cost plus method; refer rule 10B

(d) Profit split method;

(e) Transactional net margin method;

(f) other method of determination of arm’s length price

(any method that takes in to account the price which has been charged or paid or would have been

charged or paid for same or similar uncontrolled transaction with or between non – associated

enterprises)

(2) Most appropriate method as per criteria laid down in rule 10C considering FAR analysis also.

FAR : Functions performed, Assets employed, Risks assumed [Rule 10C(2)]](https://image.slidesharecdn.com/businessrestructuring-130418065629-phpapp02/85/Business-Restructuring-56-320.jpg)

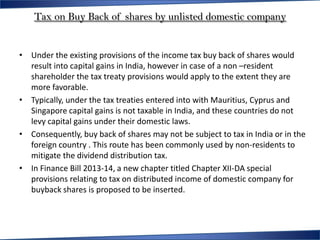

![Tax on Buy Back of shares by unlisted domestic company

• Accordingly, besides the standard corporate income tax will be charged on

any amount of distributed income of unlisted companies. The company

implementing the buy back scheme shall be liable to pay the taxes at the

rate of 20% on the difference between consideration received by the

shareholder on buyback as reduced by the amount received by the

company for issue of such shares.

• With this new proposal the shareholder is exempt from tax on such

capital gains [Section 10(34A)].

• Hence the non –resident shareholders shall be liable to get taxed in India.](https://image.slidesharecdn.com/businessrestructuring-130418065629-phpapp02/85/Business-Restructuring-66-320.jpg)