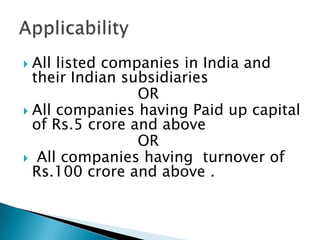

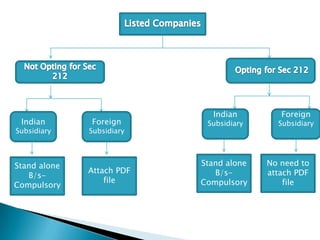

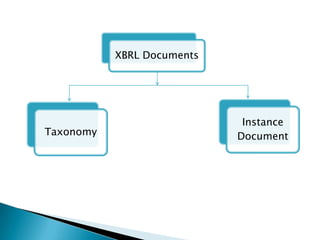

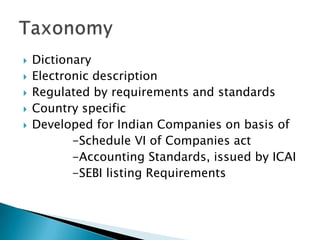

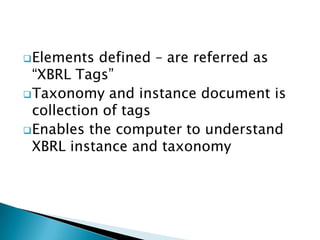

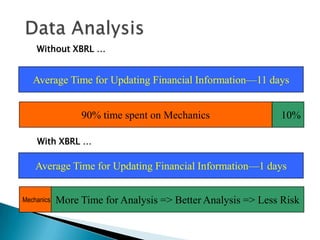

XBRL (eXtensible Business Reporting Language) is an open standard for electronic communication of business and financial data, using XML. It allows companies to store and efficiently publish financial reports by facilitating the preparation, analysis and exchange of business information between organizations. The document outlines the requirements for Indian companies to file financial statements in XBRL format with regulatory authorities like the Ministry of Corporate Affairs.