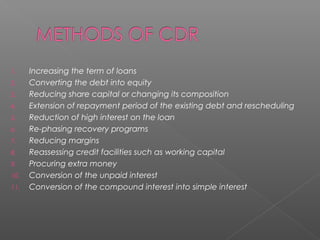

Corporate debt restructuring (CDR) is a voluntary mechanism in India for restructuring debt obligations of viable companies facing financial difficulties. It aims to preserve economically valuable companies and minimize losses to creditors. The CDR process involves creditors coming together to restructure debt by delaying repayments, converting debt to equity, or reducing interest rates. It is implemented through a three-tier structure and helps revive sick companies by improving their liquidity and restoring balance between debt and equity.