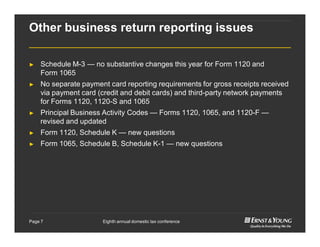

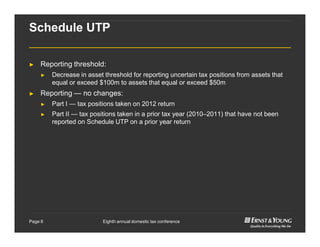

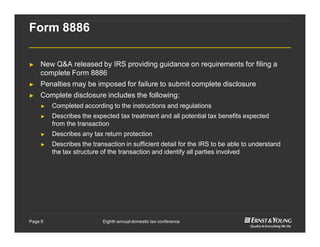

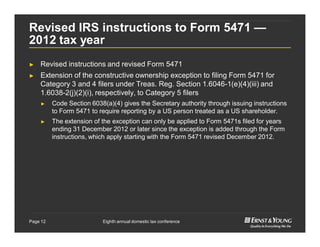

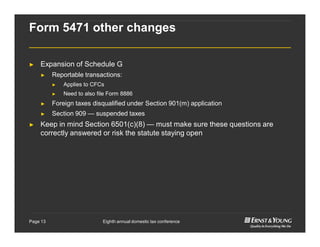

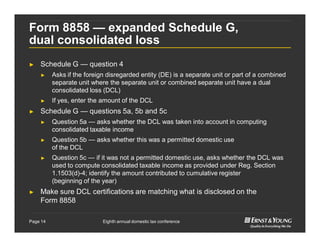

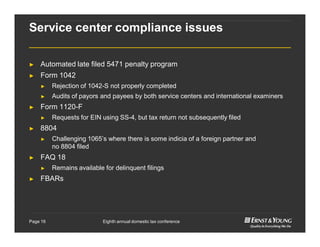

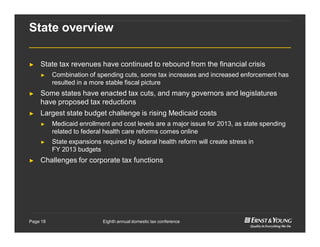

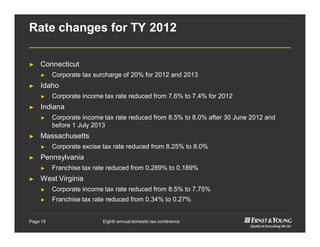

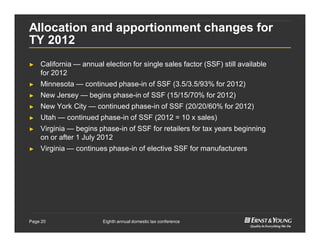

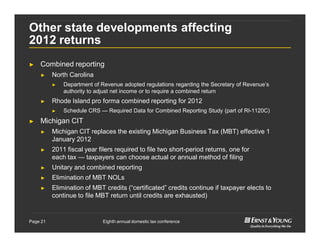

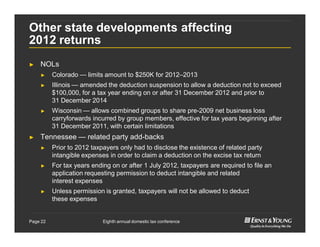

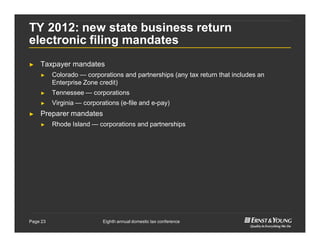

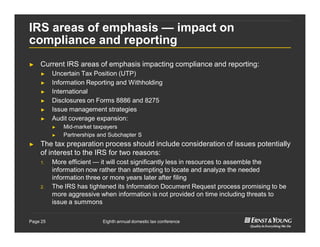

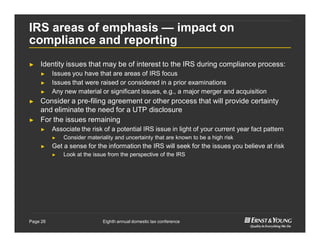

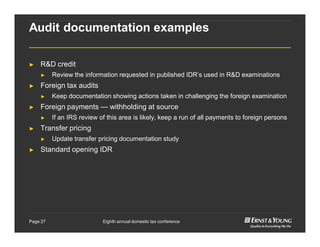

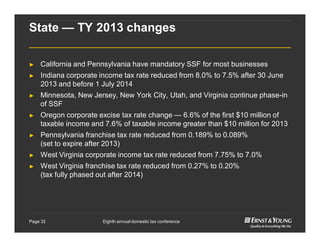

The document summarizes recent developments in tax compliance and reporting for tax year 2012. It discusses new requirements for Form 8949, Schedule M-3, Schedule UTP, and Form 8886. It also addresses changes to reporting of foreign operations, such as expanded reporting on Form 5471 and Form 8858. Additionally, the summary discusses IRS service center compliance issues and state tax return reporting developments for 2012, including rate changes, allocation and apportionment modifications, and new electronic filing mandates.