Quarterly analyst themes of oil and gas earnings, Q1 2022

•

0 likes•1,171 views

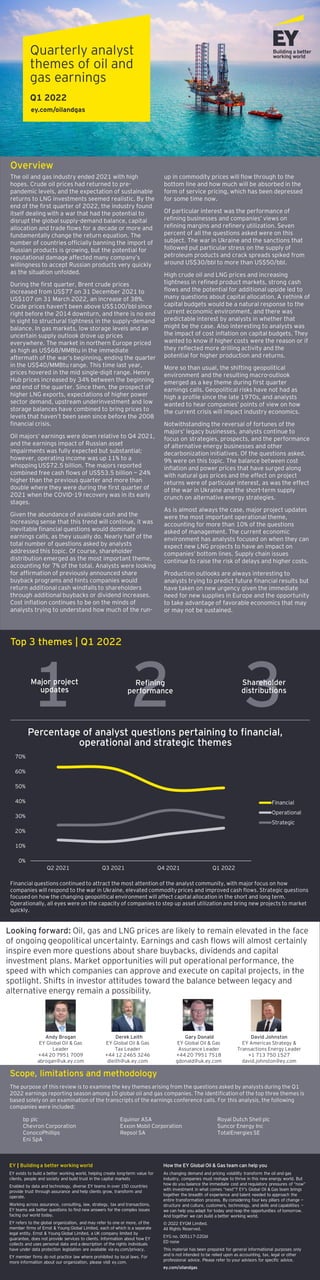

Financial questions continued to attract the most attention of the analyst community, with major focus on how companies will respond to the war in Ukraine, elevated commodity prices and improved cash flows. Strategic questions focused on how the changing geopolitical environment will affect capital allocation in the short and long term. Operationally, all eyes were on the capacity of companies to step up asset utilization and bring new projects to market quickly. Explore the latest EY quarterly analysts themes.

Report

Share

Report

Share

Download to read offline

Recommended

EY Price Point: global oil and gas market outlook, Q2, April 2020

The first quarter of this year has seen some extraordinary events. As if chronic oversupply, prices stuck below sustainable levels, the looming energy transition, and investor pressure to decarbonize weren’t enough, our industry now faces a dramatic, but hopefully temporary, downturn in demand as a result of the ongoing COVID-19 outbreak.

EY Price Point Q3 2022

The theme for this quarter is momentum meets uncertainty. The upward trend in crude oil, natural gas, LNG and refined product prices that began in Q1 continued into Q2. Crude oil markets began the quarter just below $100/bbl and have closed below that level on only two days since late April. As we begin Q3, there are increasing concerns about the health of the global economy and how that might affect oil and gas demand.

EY Price Point: global oil and gas market outlook (Q4, October 2020)

Oil and gas prices have recovered steadily from their lows and are relatively stable, but that stability is supported by the combination of purposeful withholding of production by oil-producing countries and economic stress on upstream independents. Oil prices closed the quarter roughly where they started it, while refining spreads were down slightly. LNG spreads were substantially higher at the end of Q3 than they were at the beginning of the quarter but are still roughly half of what is generally thought of as sustainable.

Going forward, the market will be looking closely at how the economy and demand respond to new developments with respect to a potential COVID-19 vaccine and the US election.

EY Price Point: global oil and gas market outlook, Q2 | April 2022

The theme for this quarter is rearrangement. The loss, or potential loss, of Russian oil and gas supplies is forcing producers, refiners and traders to rethink the flow of crude oil and refined products from the wellhead to the gas pump in light of sanctions, potential sanctions and the risk of reputational damage. Countries, companies and consumers will all be searching for ways to adapt, and the outcome of the race to bring alternatives to market could alter the global energy landscape for years to come.

It is likely crude oil and LNG prices will remain elevated for some time. The process of diverting Russian oil through countries unwilling to sanction it will take time and there is little indication OPEC members are willing (or able) to increase production to make up for the loss of Russian crude. Spare capacity sat at 3.7 mbpd at the end of 2021, just above where it was in January 2020. Currently, sanctioned Venezuelan and Iranian production (about 3 mbpd below their peak) could fill the gap, but political and commercial obstacles remain. At today’s prices, US shale production is attractive, but the fastest the industry has been able to grow is between 1mbpd and 2mbpd per year. The LNG infrastructure was already stretched before the war in Ukraine and there is little prosect of finding new supplies soon.

As the largest buyer of Russian energy, Europe will be the epicenter. There is a deeply embedded bias there in favor for renewable energy, and the current crisis is certain to result in an all-out effort to accelerate the build-out of wind and solar power. The capacity to add new green energy is limited though by the project pipeline and supply chains for solar panels and wind turbines, and it is likely that much of the shortfall will be made up with the new LNG infrastructure.

EY Price Point: global oil and gas market outlook, Q2 April 2021

The theme for this quarter is governed. Apparent market balance at prices that could be sustainable is the product of calculated choices by market leaders and the cooperation of those who follow them. Economics played their customary role as well, with capital scarcity in North America taking about 2 million barrels per day out of the market, about half of the remaining gap in demand. While inventories are close to their pre-COVID-19 levels, there is still uncertainty. The resolution of the pandemic is in sight, but timing is unclear. Vaccine distribution in the US is having an impact but Europe is struggling to contain a third wave of infections. The taps have opened on economic stimulus, but it remains to be seen if policymakers have done enough or if they have overshot the mark.

The shape of the crude oil forward curve has fundamentally changed since the end of the last quarter. In late December of last year, the Brent forward curve was gradually increasing while today, the curve is backwardated. This is a clear sign that the market sees a short-term dynamic that is disconnected from the medium-to-long-term fundamentals. The lasting impact of the COVID-19 pandemic remains to be seen. While many have opined that COVID-19 marks a turning point in energy transition, the IEA recently released a five-year forecast of oil demand that shows steady growth, albeit at rates that are below historical expectations.

Gas markets are a paradox. At the Henry Hub and at LNG destinations, demand grows, investment lags and prices will occasionally attract attention. Traders, so far though, are unconvinced and futures prices don’t indicate imminent scarcity at any link in the value chain.

Global banking outlook 2018: pivoting toward an innovation-led strategy

Banks are seeking to become digitally mature, completing the transition from regulatory-driven transformation to innovation-led change. EY’s Global banking outlook 2018 survey provides actionable insights for banks as they prepare.

Global Capital Confidence Barometer 21st edition

The prolonged upward trend for dealmaking is set to continue despite geopolitical and economic concerns.

MAPS2018 Keynote address on EY report: Life Sciences 4.0 – Securing value thr...

Summary: This keynote address presented by Pamela Spence, EY Global Life Sciences Leader (pspence2@uk.ey.com) at MAPS 2018 – the annual meeting for Medical Affairs Professional Society – discusses our latest life sciences report and the industry demands for a customer-focused, data driven approach to health care. We describe the accelerating pace of change as technological advances and the escalating expectations of payers, physicians and patient consumers are combining to disrupt the life sciences business model. Data and algorithms that maximize health outcomes based on individual needs and preferences are becoming the ultimate health care consumable. To create value now and in a future that we call Life Sciences 4.0, life sciences companies must build – or participate in – interoperable information systems that collect, combine and share data. For more on our report, Progressions 2018 – Life Sciences 4.0, please go to www.ey.com/progressions

Recommended

EY Price Point: global oil and gas market outlook, Q2, April 2020

The first quarter of this year has seen some extraordinary events. As if chronic oversupply, prices stuck below sustainable levels, the looming energy transition, and investor pressure to decarbonize weren’t enough, our industry now faces a dramatic, but hopefully temporary, downturn in demand as a result of the ongoing COVID-19 outbreak.

EY Price Point Q3 2022

The theme for this quarter is momentum meets uncertainty. The upward trend in crude oil, natural gas, LNG and refined product prices that began in Q1 continued into Q2. Crude oil markets began the quarter just below $100/bbl and have closed below that level on only two days since late April. As we begin Q3, there are increasing concerns about the health of the global economy and how that might affect oil and gas demand.

EY Price Point: global oil and gas market outlook (Q4, October 2020)

Oil and gas prices have recovered steadily from their lows and are relatively stable, but that stability is supported by the combination of purposeful withholding of production by oil-producing countries and economic stress on upstream independents. Oil prices closed the quarter roughly where they started it, while refining spreads were down slightly. LNG spreads were substantially higher at the end of Q3 than they were at the beginning of the quarter but are still roughly half of what is generally thought of as sustainable.

Going forward, the market will be looking closely at how the economy and demand respond to new developments with respect to a potential COVID-19 vaccine and the US election.

EY Price Point: global oil and gas market outlook, Q2 | April 2022

The theme for this quarter is rearrangement. The loss, or potential loss, of Russian oil and gas supplies is forcing producers, refiners and traders to rethink the flow of crude oil and refined products from the wellhead to the gas pump in light of sanctions, potential sanctions and the risk of reputational damage. Countries, companies and consumers will all be searching for ways to adapt, and the outcome of the race to bring alternatives to market could alter the global energy landscape for years to come.

It is likely crude oil and LNG prices will remain elevated for some time. The process of diverting Russian oil through countries unwilling to sanction it will take time and there is little indication OPEC members are willing (or able) to increase production to make up for the loss of Russian crude. Spare capacity sat at 3.7 mbpd at the end of 2021, just above where it was in January 2020. Currently, sanctioned Venezuelan and Iranian production (about 3 mbpd below their peak) could fill the gap, but political and commercial obstacles remain. At today’s prices, US shale production is attractive, but the fastest the industry has been able to grow is between 1mbpd and 2mbpd per year. The LNG infrastructure was already stretched before the war in Ukraine and there is little prosect of finding new supplies soon.

As the largest buyer of Russian energy, Europe will be the epicenter. There is a deeply embedded bias there in favor for renewable energy, and the current crisis is certain to result in an all-out effort to accelerate the build-out of wind and solar power. The capacity to add new green energy is limited though by the project pipeline and supply chains for solar panels and wind turbines, and it is likely that much of the shortfall will be made up with the new LNG infrastructure.

EY Price Point: global oil and gas market outlook, Q2 April 2021

The theme for this quarter is governed. Apparent market balance at prices that could be sustainable is the product of calculated choices by market leaders and the cooperation of those who follow them. Economics played their customary role as well, with capital scarcity in North America taking about 2 million barrels per day out of the market, about half of the remaining gap in demand. While inventories are close to their pre-COVID-19 levels, there is still uncertainty. The resolution of the pandemic is in sight, but timing is unclear. Vaccine distribution in the US is having an impact but Europe is struggling to contain a third wave of infections. The taps have opened on economic stimulus, but it remains to be seen if policymakers have done enough or if they have overshot the mark.

The shape of the crude oil forward curve has fundamentally changed since the end of the last quarter. In late December of last year, the Brent forward curve was gradually increasing while today, the curve is backwardated. This is a clear sign that the market sees a short-term dynamic that is disconnected from the medium-to-long-term fundamentals. The lasting impact of the COVID-19 pandemic remains to be seen. While many have opined that COVID-19 marks a turning point in energy transition, the IEA recently released a five-year forecast of oil demand that shows steady growth, albeit at rates that are below historical expectations.

Gas markets are a paradox. At the Henry Hub and at LNG destinations, demand grows, investment lags and prices will occasionally attract attention. Traders, so far though, are unconvinced and futures prices don’t indicate imminent scarcity at any link in the value chain.

Global banking outlook 2018: pivoting toward an innovation-led strategy

Banks are seeking to become digitally mature, completing the transition from regulatory-driven transformation to innovation-led change. EY’s Global banking outlook 2018 survey provides actionable insights for banks as they prepare.

Global Capital Confidence Barometer 21st edition

The prolonged upward trend for dealmaking is set to continue despite geopolitical and economic concerns.

MAPS2018 Keynote address on EY report: Life Sciences 4.0 – Securing value thr...

Summary: This keynote address presented by Pamela Spence, EY Global Life Sciences Leader (pspence2@uk.ey.com) at MAPS 2018 – the annual meeting for Medical Affairs Professional Society – discusses our latest life sciences report and the industry demands for a customer-focused, data driven approach to health care. We describe the accelerating pace of change as technological advances and the escalating expectations of payers, physicians and patient consumers are combining to disrupt the life sciences business model. Data and algorithms that maximize health outcomes based on individual needs and preferences are becoming the ultimate health care consumable. To create value now and in a future that we call Life Sciences 4.0, life sciences companies must build – or participate in – interoperable information systems that collect, combine and share data. For more on our report, Progressions 2018 – Life Sciences 4.0, please go to www.ey.com/progressions

2018 EY-Parthenon Price Perception Airlines

Understanding price perception in the airline industry is essential given the large differences between propositions. However, perception of consumers does not reflect actual price positioning.

This and other insights are derived from recent EY-Parthenon consumer research across 6 countries and multiple travel & leisure categories

The following slides contain just a snap shot of the results. Learn more? Please reach out to EY-Parthenon, wouter.vincken@parthenon.ey.com

18th Annual Global CEO Survey - Technology industry key findings

Tech CEOs are optimistic about the global economy and both near term and future revenue growth. They view strategic alliances, including partnering with competitors, as a primary means to grow their businesses. We invite you to explore the analysis and contact us to discuss how we can help your business capitalise on the new - but challenging - opportunities for growth. Learn more http://pwc.to/1DaolqY

Website: http://www.pwc.com/gx/en/ceo-survey/2015/industry/technology.jhtml

Bain Covid 19 situation report & action agenda

A very useful report and tool to help companies to make rapid and practical decisions while navigating the path forward.

Whole Brain Leadership: New Rules of Engagement for the C-Suite| Accenture St...

Whole-brain leadership prepares C-suites for the digital challenges ahead, ensuring seamless growth and high-value problem solving capabilities.

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Hadoop Summit is an industry-leading Hadoop community event for business leaders and technology experts (such as architects, data scientists and Hadoop developers) to learn about the technologies and business drivers transforming data. PwC is helping organizations unlock their data possibilities to make data-driven decisions.

Global Challengers 2018: Digital Leapfrogs

BCG’s 2018 global challengers—100 rapidly globalizing companies from emerging markets—are getting ahead of the competition by using digital technologies.

EY Price Point Q4 2022.pdf

The theme for this quarter is apprehension. In September, the US Federal Reserve announced a third 75 basis point increase in the federal funds rate. In the aftermath, the two-year treasury rate reached the highest level since before the 2008 financial crisis and the spread between two and ten-year rates went below negative 50basis points for the first time since the early eighties. Equity markets have begun to price in the likelihood of a recession and, if history is any indication, the impact on oil markets could be profound.

A.T. Kearney 2017 State of Logistics Report: Accelerating into Uncertainty

2017 could be a pivotal year for logistics. Demand patterns are shifting, technological advances are altering industry economics, and new competitors are challenging old business models. This year could bring significant moves that reshape individual sectors and even the industry as a whole. Major business combinations, large-scale shifts in distribution flows, deep capacity cuts, massive infrastructure investments–anything is possible. Here are the ten key takeaways from the 2017 State of Logistics report, as well as the four potential scenarios for the future of logistics.

Digital and Innovation Strategies for the Infrastructure Industry: Tim McManu...

Productivity in the engineering and construction industry has been stagnant for decades. The proliferation of digital solutions has made it difficult for users to develop a coherent strategy. Companies who are able to successfully navigate the new digital landscape are on the brink of a transformation that will see top performers reduce overall project costs by 20-45%. However, digital transformations require developing digital capability across all aspects of the organization. Therefore, each entity involved in the industry must understand its critical challenges in order to guide its path to increased digital capability.

A step-by-step overview of a typical cybersecurity attack—and how companies c...

A typical cybersecurity breach has a predictable pattern of incident and response. Here's a step-by-step overview of what would happen in a typical attack—not just to prove the effectiveness of the company’s security capabilities but also to familiarize individuals with potential threats so they might recognize them when they encounter deviations from the norm.

This infographic is from the related article, "Hit or myth? Understanding the true costs and impact of cybersecurity programs," on McKinsey.com:

http://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/hit-or-myth-understanding-the-true-costs-and-impact-of-cybersecurity-programs

IP Theft

Cyber attacks against corporate intellectual property

Learn more: http://www.cyberhub.com/research/IP_threat

EY Germany FinTech Landscape

FinTech-Standort Deutschland wächst

Mehr Unternehmen, Finanzierung legt zu, Banken wollen kooperieren.

How fit is your capital allocation strategy?

Summary: Even in a time of high biopharma valuations, adopting an activist mentality adds rigor to capital allocation and strategic decision-making, improving not just returns to shareholders but long-term value creation. Therefore, biopharma management teams and boards of directors should proactively assess the “fitness” of their capital allocation strategies and their alignment with operational performance goals by taking an outsider’s view of the business even when times are good — and before a material stumble provides a compelling reason for an outsider to act. For more on this topic, go to http://www.ey.com/GL/en/Industries/Life-Sciences/EY-vital-signs-how-fit-is-your-capital-allocation-strategy.

Power transactions and trends Q2 2019

Is your energy investment strategy built on the best evidence?

As the energy sector transforms, capital and investment plans must adapt too. Is it time to review your strategies in light of global utilities investment trends? Our latest Power transactions and trends report offers insight and evidence into the major themes and emerging trends driving global power and utilities M&A. Updated quarterly, the report delivers deep insights into each major region.

PwC Trends in the workforce

PwC’s Trends in People Analytics report highlights our recently published 2015 PwC Saratoga US benchmark data, as well as the implications for people analytics functions and key trends for consideration.

Intelligent Operations for Future-Ready Businesses | Accenture

Accenture reveals that the relationship between intelligent operations and business value creation is key to becoming a future-ready organization. Read More.

Medical Cost Trend: Behind the Numbers 2017

On June 21st, PwC’s Health Research Institute (HRI) released its annual Medical Cost Trend: Behind the Numbers 2017 report. PwC’s HRI anticipates a 6.5% growth rate for 2017—the same as was projected for 2016. The report identifies the key inflators and deflators as well as historical context to better understand the medical cost trend for 2017. Increases in the trend due to utilization of convenient care access points and an uptick in behavioral healthcare benefits for employees are being offset by more aggressive strategies by pharmacy benefit

When, Where & How AI Will Boost Federal Workforce Productivity

Accenture developed an economic model to understand how AI will impact the U.S. federal workforce, through automation and augmentation. Learn more: https://accntu.re/3hsRG8O

EY Price Point: global oil and gas market outlook

As the last quarter of the second pandemic year draws to a close, we continue to see heightened contrast

between the medical and economic points of view. While COVID-19 cases are close to their all-time highs, so

are equity prices, and a leading investment bank declared (on 2 December, 2021 after the Omicron outbreak in South Africa) that it was “optimistic about the possibility of a vibrant 2022.” When news of the variant hit in

late November, the markets were rocked by the prospect of yet another round of local mobility restrictions and

an interrupted return to normal international travel patterns, on top of the Biden Administration’s announced

release of 50 million barrels of crude from the US Strategic Petroleum Reserve. So far though, with OPEC

standing by its planned gradual return to normal production, oil prices have stabilized, albeit below where they

were in mid-November. Henry Hub prices, always at the mercy of the weather, responded predictably to a

warmer-than-normal early winter in the US, falling from US$6.60/MMBtu in early October to below

US$4.00/MMBtu by mid-December. In Europe and Asia, following a short reprieve at the start of the quarter,

piped natural gas prices have spiked again on concerns triggered by Russian troop buildups on the Ukraine

border and uncertainties surrounding the Nordstream 2 pipeline. Looking forward, OPEC and the U.S. Energy

Information Administration (EIA) in their last forecasts of the year both projected that 2022 oil demand would

be above what we saw in 2019. Although time will tell if those forecasts are realized and other events could

intervene, the response to new virus outbreaks is well-practiced and the trade-off between public health and

economic reality has tipped toward a cautiously optimistic view.

Quarterly analyst themes of oil and gas earnings

As it almost always is, oil and gas profitability was driven by crude oil, refined product and natural gas market conditions in Q2 2019. Oil prices seesawed, rising steadily during the first half of the quarter, falling during most of the second half of the quarter, before rising again at the end.

Quarterly trends in oil and gas

Optimism abounds, as companies reiterate efficiency, capital discipline and portfolio optimization.

More Related Content

What's hot

2018 EY-Parthenon Price Perception Airlines

Understanding price perception in the airline industry is essential given the large differences between propositions. However, perception of consumers does not reflect actual price positioning.

This and other insights are derived from recent EY-Parthenon consumer research across 6 countries and multiple travel & leisure categories

The following slides contain just a snap shot of the results. Learn more? Please reach out to EY-Parthenon, wouter.vincken@parthenon.ey.com

18th Annual Global CEO Survey - Technology industry key findings

Tech CEOs are optimistic about the global economy and both near term and future revenue growth. They view strategic alliances, including partnering with competitors, as a primary means to grow their businesses. We invite you to explore the analysis and contact us to discuss how we can help your business capitalise on the new - but challenging - opportunities for growth. Learn more http://pwc.to/1DaolqY

Website: http://www.pwc.com/gx/en/ceo-survey/2015/industry/technology.jhtml

Bain Covid 19 situation report & action agenda

A very useful report and tool to help companies to make rapid and practical decisions while navigating the path forward.

Whole Brain Leadership: New Rules of Engagement for the C-Suite| Accenture St...

Whole-brain leadership prepares C-suites for the digital challenges ahead, ensuring seamless growth and high-value problem solving capabilities.

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Hadoop Summit is an industry-leading Hadoop community event for business leaders and technology experts (such as architects, data scientists and Hadoop developers) to learn about the technologies and business drivers transforming data. PwC is helping organizations unlock their data possibilities to make data-driven decisions.

Global Challengers 2018: Digital Leapfrogs

BCG’s 2018 global challengers—100 rapidly globalizing companies from emerging markets—are getting ahead of the competition by using digital technologies.

EY Price Point Q4 2022.pdf

The theme for this quarter is apprehension. In September, the US Federal Reserve announced a third 75 basis point increase in the federal funds rate. In the aftermath, the two-year treasury rate reached the highest level since before the 2008 financial crisis and the spread between two and ten-year rates went below negative 50basis points for the first time since the early eighties. Equity markets have begun to price in the likelihood of a recession and, if history is any indication, the impact on oil markets could be profound.

A.T. Kearney 2017 State of Logistics Report: Accelerating into Uncertainty

2017 could be a pivotal year for logistics. Demand patterns are shifting, technological advances are altering industry economics, and new competitors are challenging old business models. This year could bring significant moves that reshape individual sectors and even the industry as a whole. Major business combinations, large-scale shifts in distribution flows, deep capacity cuts, massive infrastructure investments–anything is possible. Here are the ten key takeaways from the 2017 State of Logistics report, as well as the four potential scenarios for the future of logistics.

Digital and Innovation Strategies for the Infrastructure Industry: Tim McManu...

Productivity in the engineering and construction industry has been stagnant for decades. The proliferation of digital solutions has made it difficult for users to develop a coherent strategy. Companies who are able to successfully navigate the new digital landscape are on the brink of a transformation that will see top performers reduce overall project costs by 20-45%. However, digital transformations require developing digital capability across all aspects of the organization. Therefore, each entity involved in the industry must understand its critical challenges in order to guide its path to increased digital capability.

A step-by-step overview of a typical cybersecurity attack—and how companies c...

A typical cybersecurity breach has a predictable pattern of incident and response. Here's a step-by-step overview of what would happen in a typical attack—not just to prove the effectiveness of the company’s security capabilities but also to familiarize individuals with potential threats so they might recognize them when they encounter deviations from the norm.

This infographic is from the related article, "Hit or myth? Understanding the true costs and impact of cybersecurity programs," on McKinsey.com:

http://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/hit-or-myth-understanding-the-true-costs-and-impact-of-cybersecurity-programs

IP Theft

Cyber attacks against corporate intellectual property

Learn more: http://www.cyberhub.com/research/IP_threat

EY Germany FinTech Landscape

FinTech-Standort Deutschland wächst

Mehr Unternehmen, Finanzierung legt zu, Banken wollen kooperieren.

How fit is your capital allocation strategy?

Summary: Even in a time of high biopharma valuations, adopting an activist mentality adds rigor to capital allocation and strategic decision-making, improving not just returns to shareholders but long-term value creation. Therefore, biopharma management teams and boards of directors should proactively assess the “fitness” of their capital allocation strategies and their alignment with operational performance goals by taking an outsider’s view of the business even when times are good — and before a material stumble provides a compelling reason for an outsider to act. For more on this topic, go to http://www.ey.com/GL/en/Industries/Life-Sciences/EY-vital-signs-how-fit-is-your-capital-allocation-strategy.

Power transactions and trends Q2 2019

Is your energy investment strategy built on the best evidence?

As the energy sector transforms, capital and investment plans must adapt too. Is it time to review your strategies in light of global utilities investment trends? Our latest Power transactions and trends report offers insight and evidence into the major themes and emerging trends driving global power and utilities M&A. Updated quarterly, the report delivers deep insights into each major region.

PwC Trends in the workforce

PwC’s Trends in People Analytics report highlights our recently published 2015 PwC Saratoga US benchmark data, as well as the implications for people analytics functions and key trends for consideration.

Intelligent Operations for Future-Ready Businesses | Accenture

Accenture reveals that the relationship between intelligent operations and business value creation is key to becoming a future-ready organization. Read More.

Medical Cost Trend: Behind the Numbers 2017

On June 21st, PwC’s Health Research Institute (HRI) released its annual Medical Cost Trend: Behind the Numbers 2017 report. PwC’s HRI anticipates a 6.5% growth rate for 2017—the same as was projected for 2016. The report identifies the key inflators and deflators as well as historical context to better understand the medical cost trend for 2017. Increases in the trend due to utilization of convenient care access points and an uptick in behavioral healthcare benefits for employees are being offset by more aggressive strategies by pharmacy benefit

When, Where & How AI Will Boost Federal Workforce Productivity

Accenture developed an economic model to understand how AI will impact the U.S. federal workforce, through automation and augmentation. Learn more: https://accntu.re/3hsRG8O

EY Price Point: global oil and gas market outlook

As the last quarter of the second pandemic year draws to a close, we continue to see heightened contrast

between the medical and economic points of view. While COVID-19 cases are close to their all-time highs, so

are equity prices, and a leading investment bank declared (on 2 December, 2021 after the Omicron outbreak in South Africa) that it was “optimistic about the possibility of a vibrant 2022.” When news of the variant hit in

late November, the markets were rocked by the prospect of yet another round of local mobility restrictions and

an interrupted return to normal international travel patterns, on top of the Biden Administration’s announced

release of 50 million barrels of crude from the US Strategic Petroleum Reserve. So far though, with OPEC

standing by its planned gradual return to normal production, oil prices have stabilized, albeit below where they

were in mid-November. Henry Hub prices, always at the mercy of the weather, responded predictably to a

warmer-than-normal early winter in the US, falling from US$6.60/MMBtu in early October to below

US$4.00/MMBtu by mid-December. In Europe and Asia, following a short reprieve at the start of the quarter,

piped natural gas prices have spiked again on concerns triggered by Russian troop buildups on the Ukraine

border and uncertainties surrounding the Nordstream 2 pipeline. Looking forward, OPEC and the U.S. Energy

Information Administration (EIA) in their last forecasts of the year both projected that 2022 oil demand would

be above what we saw in 2019. Although time will tell if those forecasts are realized and other events could

intervene, the response to new virus outbreaks is well-practiced and the trade-off between public health and

economic reality has tipped toward a cautiously optimistic view.

What's hot (20)

18th Annual Global CEO Survey - Technology industry key findings

18th Annual Global CEO Survey - Technology industry key findings

Whole Brain Leadership: New Rules of Engagement for the C-Suite| Accenture St...

Whole Brain Leadership: New Rules of Engagement for the C-Suite| Accenture St...

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

A.T. Kearney 2017 State of Logistics Report: Accelerating into Uncertainty

A.T. Kearney 2017 State of Logistics Report: Accelerating into Uncertainty

Digital and Innovation Strategies for the Infrastructure Industry: Tim McManu...

Digital and Innovation Strategies for the Infrastructure Industry: Tim McManu...

A step-by-step overview of a typical cybersecurity attack—and how companies c...

A step-by-step overview of a typical cybersecurity attack—and how companies c...

Intelligent Operations for Future-Ready Businesses | Accenture

Intelligent Operations for Future-Ready Businesses | Accenture

When, Where & How AI Will Boost Federal Workforce Productivity

When, Where & How AI Will Boost Federal Workforce Productivity

Similar to Quarterly analyst themes of oil and gas earnings, Q1 2022

Quarterly analyst themes of oil and gas earnings

As it almost always is, oil and gas profitability was driven by crude oil, refined product and natural gas market conditions in Q2 2019. Oil prices seesawed, rising steadily during the first half of the quarter, falling during most of the second half of the quarter, before rising again at the end.

Quarterly trends in oil and gas

Optimism abounds, as companies reiterate efficiency, capital discipline and portfolio optimization.

EY Analyst themes of quarterly oil & gas earnings: 3Q18

Oil & gas companies are reporting stronger cash flows and improved bottom lines. Analysts are focused on how that cash will be put to work. Do they return cash to shareholders or do they expand portfolios, possibly taking advantage of stronger market indicators? Macro factors and timing are likely to play a greater role as markets reset.

EY Price Point 8.17.20

The sustainability of trading profits has always been questioned. Volatility has returned to pre-crisis levels and, absent more disruption, the size of the opportunity will shrink.

See this week's edition of EY Price Point

Q2 – Analyst Themes of Quarterly Oil & Gas Earnings

Most companies reported strong earnings growth in the second quarter, but investors were disappointed. Expectations had risen in line with oil prices and profits, but cash flow generation of some companies fell short of consensus estimates.

Digital Future of Oil & Gas

Digital Future of oil & gas & energy

Marco Annunziata, Chief Economist, GE

Mercer Capital's Value Focus: Energy Industry | Q1 2021 | Region Focus: Eagle...

Mercer Capital's Energy Industry newsletter provides perspective on valuation issues. Each newsletter also typically includes macroeconomic trends, industry trends, and guideline public company metrics.

Outlook for oilfield services

This is the first edition of the Deloitte Outlook for oilfield services. The forward-looking report is based on in-depth interviews with 12 executives of oilfield services companies. Its purpose is to obtain companies’ views of their current business environment and where they think the market is heading, both in the short and long term.

EY Global Capital Confidence Barometer (12th Edition)

Innovation, complexity and disruption define the new M&A market.

Our 12th Global Capital Confidence Barometer finds the global M&A market maintaining the positive momentum that developed during 2014. For the first time in five years, more than half our respondents are planning acquisitions in the next 12 months, as deal pipelines continue to expand.

Deloitte Oil & Gas Mergers and Acquisitions Report – Midyear 2014

Uber consulting firm Deloitte's regular mid-year update/analysis of oil & gas mergers and acquisitions. There were 299 deals in the first half of 2014, with 61% of those deals involving U.S. and Canadian companies. The report provides a high level view of what's happening by each major energy sector (upstream, midstream, downstream). It's no surprise that shale continues to dominate the energy picture in 2014.

Analyst themes of quarterly oil and gas earnings Q4 2018

The oil and gas industry started the fourth quarter of 2018 with high hopes. Oil prices had risen in the last half of the third quarter and indicators were pointing upward. As is often the case, events took over and oil prices erased all the gains made since the beginning of 2017.

Exxon Mobil Investor Presentation Deck 2017 May

Long-term view of supply and demand informs investment plans based on Energy Outlook

- Non-OECD nations drive growth in GDP and energy demand

- Middle class more than doubling to reach almost 5 billion people

- Non-OECD energy use per person remains well below OECD

- Efficiency gains keep OECD demand flat

- Without efficiency gains, global demand growth could be four times projected amount

Mergers and acquisitions in oil and gas

Nach einem eher verhaltenen Jahr 2013 nahmen 2014 M&A-Transaktionen in der Öl- und Gasindustrie deutlich zu. Angesichts des weiter sinkenden Ölpreises und der Entscheidung der OPEC gegen eine Drosselung der Fördermengen werden 2015 noch intensivere M&A-Aktivitäten in der gesamten Wertschöpfungskette stattfinden. Diese strategischen Deals sind für die Unternehmen wichtig, um Wertzuwächse zu erzielen, sich für kommende Marktturbulenzen zu rüsten und die Wettbewerbslandschaft zu ihren Gunsten zu formen.

Similar to Quarterly analyst themes of oil and gas earnings, Q1 2022 (20)

EY Analyst themes of quarterly oil & gas earnings: 3Q18

EY Analyst themes of quarterly oil & gas earnings: 3Q18

Q2 – Analyst Themes of Quarterly Oil & Gas Earnings

Q2 – Analyst Themes of Quarterly Oil & Gas Earnings

Mercer Capital's Value Focus: Energy Industry | Q1 2021 | Region Focus: Eagle...

Mercer Capital's Value Focus: Energy Industry | Q1 2021 | Region Focus: Eagle...

Solution To Part 1 Ratio Analysis Details Shell Bp.pdf

Solution To Part 1 Ratio Analysis Details Shell Bp.pdf

EY Global Capital Confidence Barometer (12th Edition)

EY Global Capital Confidence Barometer (12th Edition)

Deloitte Oil & Gas Mergers and Acquisitions Report – Midyear 2014

Deloitte Oil & Gas Mergers and Acquisitions Report – Midyear 2014

Business processes and risk management -former to business

Business processes and risk management -former to business

Analyst themes of quarterly oil and gas earnings Q4 2018

Analyst themes of quarterly oil and gas earnings Q4 2018

More from EY

Tax Alerte - Principales dispositions loi de finances 2021

Note about the main provisions of Finance bill 2021

EY Price Point: global oil and gas market outlook

We enter 2021 on a note of cautious optimism for global health, the world economy, and the oil and gas markets. The first weeks of December brought approval in the US and the UK of the first of several COVID-19 vaccines. The speed with which vaccine development occurred is unprecedented, but certainly welcome. In the weeks following the early November announcement of 90+% effectiveness by the manufacturer of the first approved vaccine, the price of WTI crude oil increased by US$10/bbl to US$48/bbl, the highest level since early March. Sustainability hasn’t returned yet, and whatever time it takes to get the world to normal, it will take even longer for normalization within the oil and gas markets. Inventories remain at historically high levels and, optimistically, it will take until April before inventory returns to levels observed in the preceding five years. That’s an estimate, and there has obviously been some difficulty properly calibrating the expectations of how balance will return and how long it will take. In late November, OPEC met to adjust its output plans because of the anemic rebound in demand. In mid-December, the IEA lowered its demand forecast for 2021 due mostly to continued sluggishness in aviation fuel demand.

A mild winter has interrupted a recovery in North American natural gas prices after a run-up motivated by curtailed capital expenditures, upstream activity and production. After an initial meltdown, with cargo cancellations and dramatic price reversal, LNG markets have made a remarkable comeback, and the spread between Asia and Henry Hub has reached a level we haven’t seen in almost three years. It may be the case that interruption in FIDs has brought us to the cusp of a balance that can support reliable returns.

Tax Alerte - prix de transfert - PLF 2021

L'alerte détaillant les propositions PLF pour l’année 2021 relatives à la documentation des prix de transfert.

EY Price Point: global oil and gas market outlook

As we close the second quarter of 2020, in most of Europe and Asia, the first (and hopefully last) wave of the COVID-19 crisis appears to be abating. In the parts of the US where the virus hit early, the profile has largely matched Europe’s, while in other parts, the urge to reopen businesses has trumped the desire to contain the virus and uncertainty looms. In the developing world, the crisis has just begun, but without the economic headroom and resources necessary to contain it. As the crisis unfolded, the effect on oil and gas demand has been predictable but difficult to gauge precisely and therefore difficult to manage.

Oil prices have crept up steadily as production has been curtailed through coordinated action (OPEC+) and because of economic reality (unconventional oil in North America). That trend has been subject to momentary spasms when bad news hit the market. It would be understandable if traders were nervous, and it seems that they are. Although nowhere near where it was at the peak of the crisis, option implied volatility is still at historically high levels. Gas markets, without the benefit of coordination on the supply side, continue to deal with the market implications of storage at or near capacity. Interfuel competition in power generation has always provided something of a floor, but those lows have been, and will continue to be, tested.

Zahl der Gewinnwarnungen steigt auf Rekordniveau

Immer mehr deutsche börsennotierte Unternehmen müssen ihre eigenen Umsatz- oder Gewinnprognosen nach unten korrigieren. Im ersten Quartal stieg die Zahl der Prognosekorrekturen auf ein neues Rekordniveau: Insgesamt 77 Gewinn- oder Umsatzwarnungen wurden registriert.

Versicherer rechnen mit weniger Neugeschäft

Die Corona-Krise trifft auch die Versicherungsbranche mit voller Wucht. Die Versicherer rechnen mit weniger Neugeschäft. Jeder Fünfte mit Personalabbau und Prämienerhöhungen.

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

With a global economy in crisis due to Covid-19 our liquidity and cash management deck for advanced manufacturing and

mobility companies looks at how these companies should best respond.

IBOR transition: Opportunities and challenges for the asset management industry

EY Wealth & Asset Management explores the practical implications and the way forward for the transition to the new risk-free rates. This presentation aims to help asset managers and asset owners explore IBOR transition strategies that are compliant and future-focused.

Fusionen und Übernahmen dürften nach der Krise zunehmen

Folgt auf die Corona-Krise ein M&A-Boom? Laut Capital Confidence Barometer von #EY hoffen 40 Prozent der deutschen Unternehmen auf sinkende Bewertungen von Übernahmekandidaten.

Start-ups: Absturz nach dem Boom?

2019 stiegen die Start-up-Investitionen um 46% auf 31 Mrd. Euro. Für 2020 wir mit massivem Einbruch gerechnet.

Riding the crest of digital health in APAC

A primer on key areas where Life Sciences companies can prioritize digital investments across the value chain in APAC.

EY Chemical Market Outlook - February 2020

Our Global Chemical Industry Leader Frank Jenner explores the trends and drivers that will shape the chemical industry of tomorrow in our latest Chemical Market Outlook.

Jobmotor Mittelstand gerät ins Stocken

Die Geschäftslage im Mittelstand hat sich leicht verschlechtert, ist in den meisten Branchen aber weiter überwiegend gut - die Einstellungsbereitschaft sinkt.

Trotz Rekordumsätzen ist die Stimmung im Agribusiness durchwachsen

Das Agribusiness hat sich im Jahr 2019 trotz zunehmenden Drucks gut behauptet und sogar neue Rekordwerte eingefahren.

Rekordsummen für deutsche Start-ups

Investitionen stiegen 2019 auf 6,2 Mrd. Euro. Standort Berlin bleibt vorn, München holt auf. Die Zahl der Investitionsrunden kletterte um 13% auf 704.

Deutschlands börsennotierte Unternehmen werden weiblicher

Der Frauenanteil in den Vorstandsetagen der DAX-, MDAX- und SDAX-Unternehmen ist seit Juli 2015 kontinuierlich von 5,0 auf jetzt 9,2 Prozent gestiegen.

EY Q1 2020 price point

The theme for this quarter is inorganic. Although prices climbed in the fourth quarter as the balance of supply and demand tilted in favour of demand, OPEC + restraint was fundamental.

The market is conscious of downside pressures that loom. OPEC + has announced production cuts through to the end of the first quarter. Beyond the first quarter, there is a risk that OPEC + grows weary of supporting the market and reverts to a strategy of growing production, protecting market share and placing pressure on the economics of unconventional producers. Production growth in Brazil and Norway has the potential to consume a significant portion of demand growth expected in 2020. Whether, or the extent to which, US shale output growth continues despite escalating financial strain across the E&P sector will be key in determining whether OPEC + cuts will be sufficient to balance the market in 2020.

In the longer-term, focus remains on the energy mix of the future and its impact on the demand for petroleum products. A number of significant uncertainties remain, including electric vehicle (EV) penetration. EY’s ‘Fueling the Future’ analyzes the outlook under four distinct scenarios. The analysis shows that an inflection point in EV penetration is required by 2022 if the terms of the Paris Accord are to be met.

Kommunen setzen auf E-Mobilität

Drei von vier Kommunen investieren in Ladeinfrastruktur oder E-Auto-Flotte. Die Immobilienwirtschaft ist hingegen noch zögerlich.

Paradigm shift in supply chain management for chemical operating models

Presentation by Dr. Frank Jenner at Global Chemical Supply Chain (China) Summit - 5 Dec 2019, Shanghai

Bezpieczny Podatnik - Bezpieczne ulgi podatkowe 2019.pdf

Bezpieczne ulgi podatkowe 2019 r. to jedno z zagadnień omawianych przez Tomasza Sochę, Associate Partnera #EY_Polska podczas konferencji „Bezpieczny podatnik”. Odbyła się ona w ramach projektu edukacyjnego #BezpiecznyPodatnik, którego celem jest wsparcie przedsiębiorców w efektywnym funkcjonowaniu w polskim otoczeniu prawno-podatkowym. #ulgipodatkowe #podatki2020 #podatki

More from EY (20)

Tax Alerte - Principales dispositions loi de finances 2021

Tax Alerte - Principales dispositions loi de finances 2021

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

IBOR transition: Opportunities and challenges for the asset management industry

IBOR transition: Opportunities and challenges for the asset management industry

Fusionen und Übernahmen dürften nach der Krise zunehmen

Fusionen und Übernahmen dürften nach der Krise zunehmen

Trotz Rekordumsätzen ist die Stimmung im Agribusiness durchwachsen

Trotz Rekordumsätzen ist die Stimmung im Agribusiness durchwachsen

Deutschlands börsennotierte Unternehmen werden weiblicher

Deutschlands börsennotierte Unternehmen werden weiblicher

Paradigm shift in supply chain management for chemical operating models

Paradigm shift in supply chain management for chemical operating models

Bezpieczny Podatnik - Bezpieczne ulgi podatkowe 2019.pdf

Bezpieczny Podatnik - Bezpieczne ulgi podatkowe 2019.pdf

Recently uploaded

Memorandum Of Association Constitution of Company.ppt

www.seribangash.com

A Memorandum of Association (MOA) is a legal document that outlines the fundamental principles and objectives upon which a company operates. It serves as the company's charter or constitution and defines the scope of its activities. Here's a detailed note on the MOA:

Contents of Memorandum of Association:

Name Clause: This clause states the name of the company, which should end with words like "Limited" or "Ltd." for a public limited company and "Private Limited" or "Pvt. Ltd." for a private limited company.

https://seribangash.com/article-of-association-is-legal-doc-of-company/

Registered Office Clause: It specifies the location where the company's registered office is situated. This office is where all official communications and notices are sent.

Objective Clause: This clause delineates the main objectives for which the company is formed. It's important to define these objectives clearly, as the company cannot undertake activities beyond those mentioned in this clause.

www.seribangash.com

Liability Clause: It outlines the extent of liability of the company's members. In the case of companies limited by shares, the liability of members is limited to the amount unpaid on their shares. For companies limited by guarantee, members' liability is limited to the amount they undertake to contribute if the company is wound up.

https://seribangash.com/promotors-is-person-conceived-formation-company/

Capital Clause: This clause specifies the authorized capital of the company, i.e., the maximum amount of share capital the company is authorized to issue. It also mentions the division of this capital into shares and their respective nominal value.

Association Clause: It simply states that the subscribers wish to form a company and agree to become members of it, in accordance with the terms of the MOA.

Importance of Memorandum of Association:

Legal Requirement: The MOA is a legal requirement for the formation of a company. It must be filed with the Registrar of Companies during the incorporation process.

Constitutional Document: It serves as the company's constitutional document, defining its scope, powers, and limitations.

Protection of Members: It protects the interests of the company's members by clearly defining the objectives and limiting their liability.

External Communication: It provides clarity to external parties, such as investors, creditors, and regulatory authorities, regarding the company's objectives and powers.

https://seribangash.com/difference-public-and-private-company-law/

Binding Authority: The company and its members are bound by the provisions of the MOA. Any action taken beyond its scope may be considered ultra vires (beyond the powers) of the company and therefore void.

Amendment of MOA:

While the MOA lays down the company's fundamental principles, it is not entirely immutable. It can be amended, but only under specific circumstances and in compliance with legal procedures. Amendments typically require shareholder

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey through Full Sail University. Below, you’ll find a collection of my work showcasing my skills and expertise in digital marketing, event planning, and media production.

5 Things You Need To Know Before Hiring a Videographer

Dive into this presentation to discover the 5 things you need to know before hiring a videographer in Toronto.

Affordable Stationery Printing Services in Jaipur | Navpack n Print

Looking for professional printing services in Jaipur? Navpack n Print offers high-quality and affordable stationery printing for all your business needs. Stand out with custom stationery designs and fast turnaround times. Contact us today for a quote!

Putting the SPARK into Virtual Training.pptx

This 60-minute webinar, sponsored by Adobe, was delivered for the Training Mag Network. It explored the five elements of SPARK: Storytelling, Purpose, Action, Relationships, and Kudos. Knowing how to tell a well-structured story is key to building long-term memory. Stating a clear purpose that doesn't take away from the discovery learning process is critical. Ensuring that people move from theory to practical application is imperative. Creating strong social learning is the key to commitment and engagement. Validating and affirming participants' comments is the way to create a positive learning environment.

20240425_ TJ Communications Credentials_compressed.pdf

"𝑩𝑬𝑮𝑼𝑵 𝑾𝑰𝑻𝑯 𝑻𝑱 𝑰𝑺 𝑯𝑨𝑳𝑭 𝑫𝑶𝑵𝑬"

𝐓𝐉 𝐂𝐨𝐦𝐬 (𝐓𝐉 𝐂𝐨𝐦𝐦𝐮𝐧𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬) is a professional event agency that includes experts in the event-organizing market in Vietnam, Korea, and ASEAN countries. We provide unlimited types of events from Music concerts, Fan meetings, and Culture festivals to Corporate events, Internal company events, Golf tournaments, MICE events, and Exhibitions.

𝐓𝐉 𝐂𝐨𝐦𝐬 provides unlimited package services including such as Event organizing, Event planning, Event production, Manpower, PR marketing, Design 2D/3D, VIP protocols, Interpreter agency, etc.

Sports events - Golf competitions/billiards competitions/company sports events: dynamic and challenging

⭐ 𝐅𝐞𝐚𝐭𝐮𝐫𝐞𝐝 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐬:

➢ 2024 BAEKHYUN [Lonsdaleite] IN HO CHI MINH

➢ SUPER JUNIOR-L.S.S. THE SHOW : Th3ee Guys in HO CHI MINH

➢FreenBecky 1st Fan Meeting in Vietnam

➢CHILDREN ART EXHIBITION 2024: BEYOND BARRIERS

➢ WOW K-Music Festival 2023

➢ Winner [CROSS] Tour in HCM

➢ Super Show 9 in HCM with Super Junior

➢ HCMC - Gyeongsangbuk-do Culture and Tourism Festival

➢ Korean Vietnam Partnership - Fair with LG

➢ Korean President visits Samsung Electronics R&D Center

➢ Vietnam Food Expo with Lotte Wellfood

"𝐄𝐯𝐞𝐫𝐲 𝐞𝐯𝐞𝐧𝐭 𝐢𝐬 𝐚 𝐬𝐭𝐨𝐫𝐲, 𝐚 𝐬𝐩𝐞𝐜𝐢𝐚𝐥 𝐣𝐨𝐮𝐫𝐧𝐞𝐲. 𝐖𝐞 𝐚𝐥𝐰𝐚𝐲𝐬 𝐛𝐞𝐥𝐢𝐞𝐯𝐞 𝐭𝐡𝐚𝐭 𝐬𝐡𝐨𝐫𝐭𝐥𝐲 𝐲𝐨𝐮 𝐰𝐢𝐥𝐥 𝐛𝐞 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐨𝐮𝐫 𝐬𝐭𝐨𝐫𝐢𝐞𝐬."

Kseniya Leshchenko: Shared development support service model as the way to ma...

Kseniya Leshchenko: Shared development support service model as the way to make small projects with small budgets profitable for the company (UA)

Kyiv PMDay 2024 Summer

Website – www.pmday.org

Youtube – https://www.youtube.com/startuplviv

FB – https://www.facebook.com/pmdayconference

3.0 Project 2_ Developing My Brand Identity Kit.pptx

A personal brand exploration presentation summarizes an individual's unique qualities and goals, covering strengths, values, passions, and target audience. It helps individuals understand what makes them stand out, their desired image, and how they aim to achieve it.

Premium MEAN Stack Development Solutions for Modern Businesses

Stay ahead of the curve with our premium MEAN Stack Development Solutions. Our expert developers utilize MongoDB, Express.js, AngularJS, and Node.js to create modern and responsive web applications. Trust us for cutting-edge solutions that drive your business growth and success.

Know more: https://www.synapseindia.com/technology/mean-stack-development-company.html

VAT Registration Outlined In UAE: Benefits and Requirements

Vat Registration is a legal obligation for businesses meeting the threshold requirement, helping companies avoid fines and ramifications. Contact now!

https://viralsocialtrends.com/vat-registration-outlined-in-uae/

ENTREPRENEURSHIP TRAINING.ppt for graduating class (1).ppt

entreprenuership training for graduating students

What is the TDS Return Filing Due Date for FY 2024-25.pdf

It is crucial for the taxpayers to understand about the TDS Return Filing Due Date, so that they can fulfill your TDS obligations efficiently. Taxpayers can avoid penalties by sticking to the deadlines and by accurate filing of TDS. Timely filing of TDS will make sure about the availability of tax credits. You can also seek the professional guidance of experts like Legal Pillers for timely filing of the TDS Return.

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.

Recently uploaded (20)

Memorandum Of Association Constitution of Company.ppt

Memorandum Of Association Constitution of Company.ppt

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey throu...

5 Things You Need To Know Before Hiring a Videographer

5 Things You Need To Know Before Hiring a Videographer

Affordable Stationery Printing Services in Jaipur | Navpack n Print

Affordable Stationery Printing Services in Jaipur | Navpack n Print

20240425_ TJ Communications Credentials_compressed.pdf

20240425_ TJ Communications Credentials_compressed.pdf

Kseniya Leshchenko: Shared development support service model as the way to ma...

Kseniya Leshchenko: Shared development support service model as the way to ma...

3.0 Project 2_ Developing My Brand Identity Kit.pptx

3.0 Project 2_ Developing My Brand Identity Kit.pptx

Premium MEAN Stack Development Solutions for Modern Businesses

Premium MEAN Stack Development Solutions for Modern Businesses

VAT Registration Outlined In UAE: Benefits and Requirements

VAT Registration Outlined In UAE: Benefits and Requirements

ENTREPRENEURSHIP TRAINING.ppt for graduating class (1).ppt

ENTREPRENEURSHIP TRAINING.ppt for graduating class (1).ppt

What is the TDS Return Filing Due Date for FY 2024-25.pdf

What is the TDS Return Filing Due Date for FY 2024-25.pdf

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

The Influence of Marketing Strategy and Market Competition on Business Perfor...

The Influence of Marketing Strategy and Market Competition on Business Perfor...

Quarterly analyst themes of oil and gas earnings, Q1 2022

- 1. 1 The oil and gas industry ended 2021 with high hopes. Crude oil prices had returned to pre- pandemic levels, and the expectation of sustainable returns to LNG investments seemed realistic. By the end of the first quarter of 2022, the industry found itself dealing with a war that had the potential to disrupt the global supply-demand balance, capital allocation and trade flows for a decade or more and fundamentally change the return equation. The number of countries officially banning the import of Russian products is growing, but the potential for reputational damage affected many company’s willingness to accept Russian products very quickly as the situation unfolded. During the first quarter, Brent crude prices increased from US$77 on 31 December 2021 to US$107 on 31 March 2022, an increase of 38%. Crude prices haven’t been above US$100/bbl since right before the 2014 downturn, and there is no end in sight to structural tightness in the supply-demand balance. In gas markets, low storage levels and an uncertain supply outlook drove up prices everywhere. The market in northern Europe priced as high as US$68/MMBtu in the immediate aftermath of the war’s beginning, ending the quarter in the US$40/MMBtu range. This time last year, prices hovered in the mid single-digit range. Henry Hub prices increased by 34% between the beginning and end of the quarter. Since then, the prospect of higher LNG exports, expectations of higher power sector demand, upstream underinvestment and low storage balances have combined to bring prices to levels that haven’t been seen since before the 2008 financial crisis. Oil majors’ earnings were down relative to Q4 2021, and the earnings impact of Russian asset impairments was fully expected but substantial; however, operating income was up 11% to a whopping US$72.5 billion. The majors reported combined free cash flows of US$53.5 billion — 24% higher than the previous quarter and more than double where they were during the first quarter of 2021 when the COVID-19 recovery was in its early stages. Given the abundance of available cash and the increasing sense that this trend will continue, it was inevitable financial questions would dominate earnings calls, as they usually do. Nearly half of the total number of questions asked by analysts addressed this topic. Of course, shareholder distribution emerged as the most important theme, accounting for 7% of the total. Analysts were looking for affirmation of previously announced share buyback programs and hints companies would return additional cash windfalls to shareholders through additional buybacks or dividend increases. Cost inflation continues to be on the minds of analysts trying to understand how much of the run- up in commodity prices will flow through to the bottom line and how much will be absorbed in the form of service pricing, which has been depressed for some time now. Of particular interest was the performance of refining businesses and companies’ views on refining margins and refinery utilization. Seven percent of all the questions asked were on this subject. The war in Ukraine and the sanctions that followed put particular stress on the supply of petroleum products and crack spreads spiked from around US$30/bbl to more than US$50/bbl. High crude oil and LNG prices and increasing tightness in refined product markets, strong cash flows and the potential for additional upside led to many questions about capital allocation. A rethink of capital budgets would be a natural response to the current economic environment, and there was predictable interest by analysts in whether that might be the case. Also interesting to analysts was the impact of cost inflation on capital budgets. They wanted to know if higher costs were the reason or if they reflected more drilling activity and the potential for higher production and returns. More so than usual, the shifting geopolitical environment and the resulting macro-outlook emerged as a key theme during first quarter earnings calls. Geopolitical risks have not had as high a profile since the late 1970s, and analysts wanted to hear companies’ points of view on how the current crisis will impact industry economics. Notwithstanding the reversal of fortunes of the majors’ legacy businesses, analysts continue to focus on strategies, prospects, and the performance of alternative energy businesses and other decarbonization initiatives. Of the questions asked, 9% were on this topic. The balance between cost inflation and power prices that have surged along with natural gas prices and the effect on project returns were of particular interest, as was the effect of the war in Ukraine and the short-term supply crunch on alternative energy strategies. As is almost always the case, major project updates were the most important operational theme, accounting for more than 10% of the questions asked of management. The current economic environment has analysts focused on when they can expect new LNG projects to have an impact on companies’ bottom lines. Supply chain issues continue to raise the risk of delays and higher costs. Production outlooks are always interesting to analysts trying to predict future financial results but have taken on new urgency given the immediate need for new supplies in Europe and the opportunity to take advantage of favorable economics that may or may not be sustained. Overview EY | Building a better working world EY exists to build a better working world, helping create long-term value for clients, people and society and build trust in the capital markets Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate. Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com. 3 Shareholder distributions Top 3 themes | Q1 2022 2 Refining performance Major project updates Percentage of analyst questions pertaining to financial, operational and strategic themes Financial questions continued to attract the most attention of the analyst community, with major focus on how companies will respond to the war in Ukraine, elevated commodity prices and improved cash flows. Strategic questions focused on how the changing geopolitical environment will affect capital allocation in the short and long term. Operationally, all eyes were on the capacity of companies to step up asset utilization and bring new projects to market quickly. Quarterly analyst themes of oil and gas earnings Q1 2022 ey.com/oilandgas The purpose of this review is to examine the key themes arising from the questions asked by analysts during the Q1 2022 earnings reporting season among 10 global oil and gas companies. The identification of the top three themes is based solely on an examination of the transcripts of the earnings conference calls. For this analysis, the following companies were included: Scope, limitations and methodology bp plc Chevron Corporation ConocoPhillips Eni SpA Royal Dutch Shell plc Suncor Energy Inc TotalEnergies SE Looking forward: Oil, gas and LNG prices are likely to remain elevated in the face of ongoing geopolitical uncertainty. Earnings and cash flows will almost certainly inspire even more questions about share buybacks, dividends and capital investment plans. Market opportunities will put operational performance, the speed with which companies can approve and execute on capital projects, in the spotlight. Shifts in investor attitudes toward the balance between legacy and alternative energy remain a possibility. Derek Leith EY Global Oil & Gas Tax Leader +44 12 2465 3246 dleith@uk.ey.com Andy Brogan EY Global Oil & Gas Leader +44 20 7951 7009 abrogan@uk.ey.com Gary Donald EY Global Oil & Gas Assurance Leader +44 20 7951 7518 gdonald@uk.ey.com David Johnston EY Americas Strategy & Transactions Energy Leader +1 713 750 1527 david.johnston@ey.com 0% 10% 20% 30% 40% 50% 60% 70% Q2 2021 Q3 2021 Q4 2021 Q1 2022 Financial Operational Strategic How the EY Global Oil & Gas team can help you As changing demand and pricing volatility transform the oil and gas industry, companies must reshape to thrive in this new energy world. But how do you balance the immediate cost and regulatory pressures of “now” with investment in what comes “next”? EY’s Global Oil & Gas team brings together the breadth of experience and talent needed to approach the entire transformation process. By considering four key pillars of change — structure and culture, customers, technology, and skills and capabilities — we can help you adapt for today and reap the opportunities of tomorrow. And together we can build a better working world. © 2022 EYGM Limited. All Rights Reserved. EYG no. 005117-22Gbl ED none This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, legal or other professional advice. Please refer to your advisors for specific advice. ey.com/oilandgas Equinor ASA Exxon Mobil Corporation Repsol SA