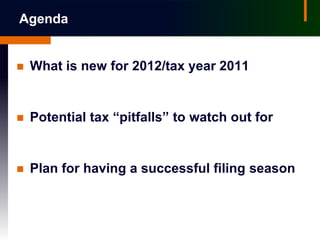

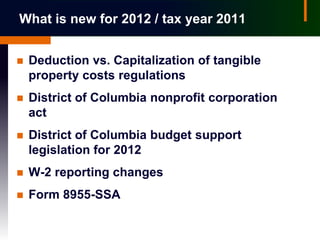

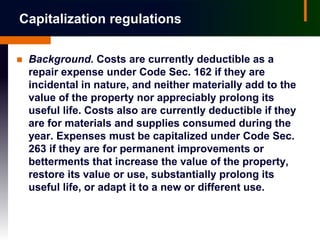

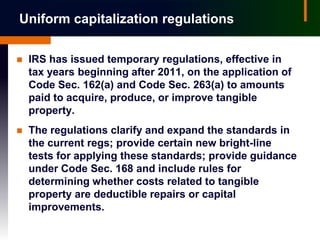

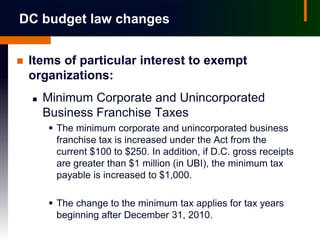

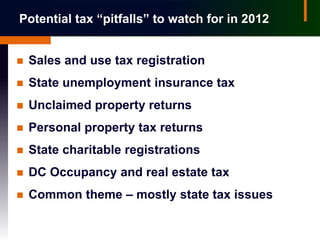

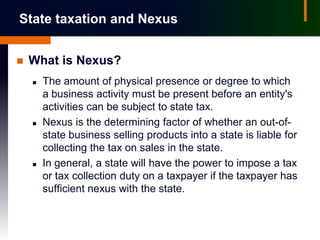

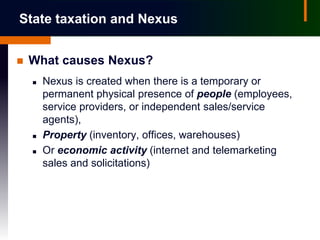

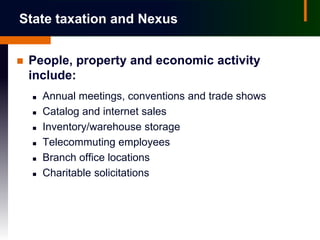

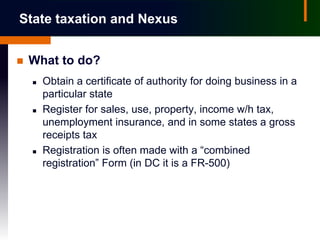

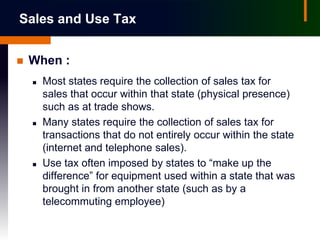

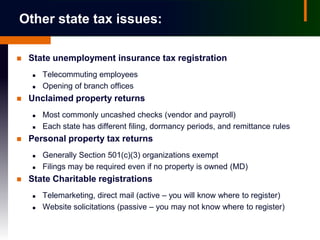

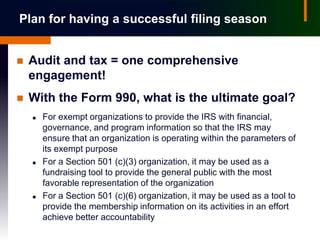

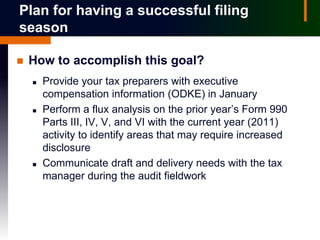

Fred Longwood, a tax manager, presented an agenda on new developments for 2012 affecting tax-exempt organizations. Key points included new regulations clarifying capitalization rules, changes to DC nonprofit law and budget laws increasing some taxes, and W-2 reporting of health insurance costs. Longwood warned of increased state efforts to assert nexus and collect taxes. He advised preparing early for 990 filings and performing a flux analysis to identify disclosure areas.