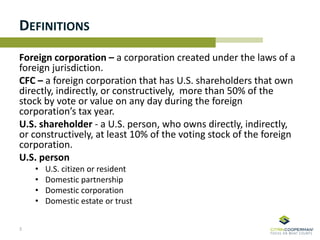

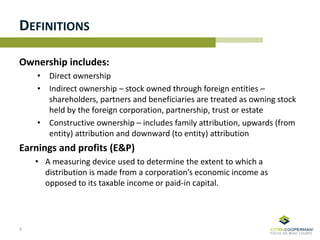

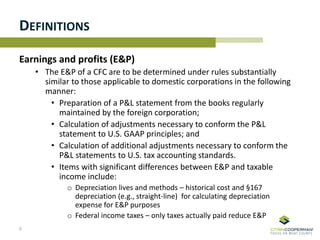

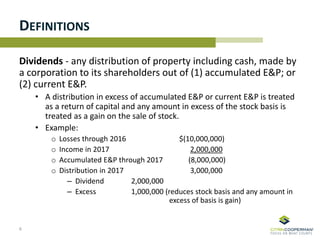

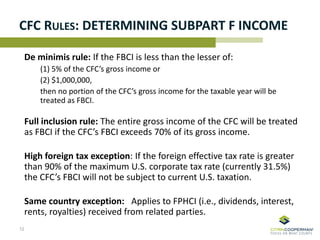

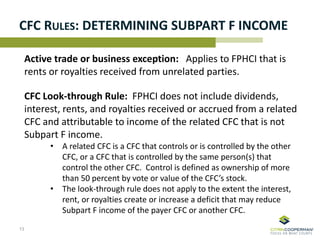

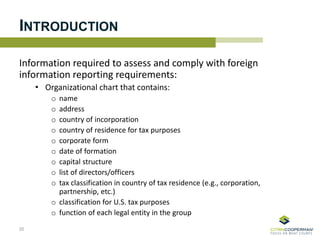

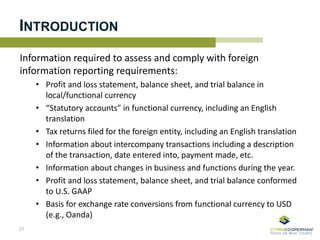

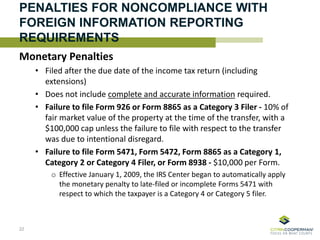

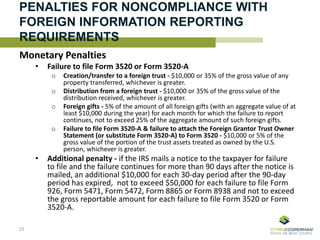

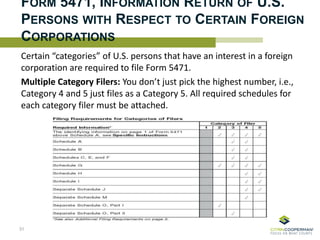

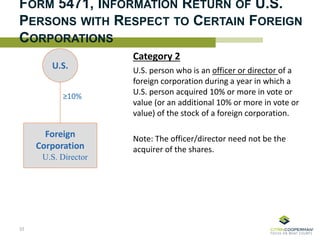

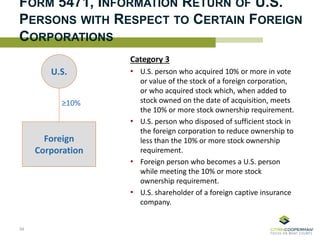

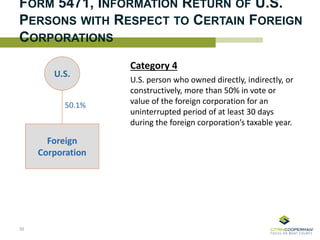

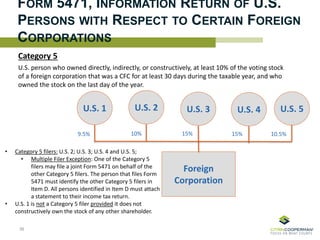

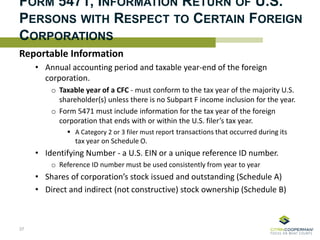

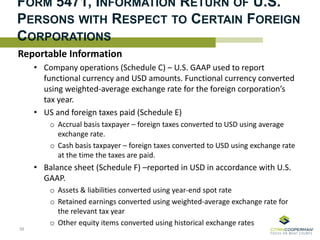

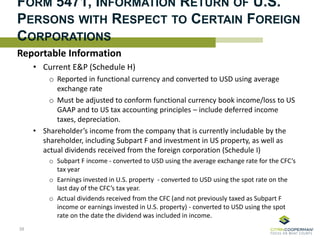

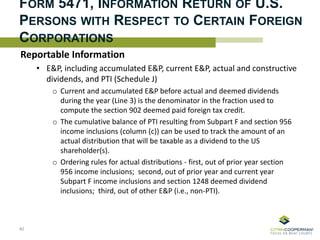

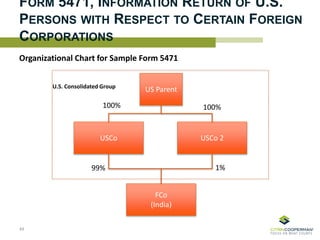

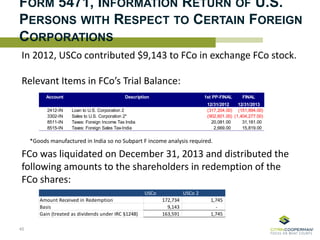

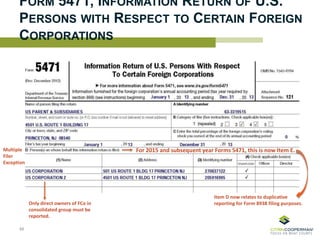

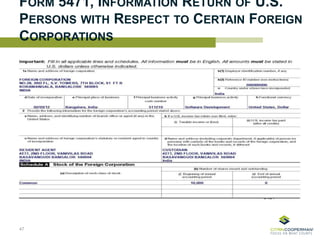

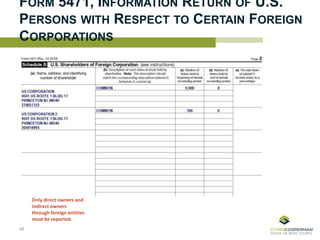

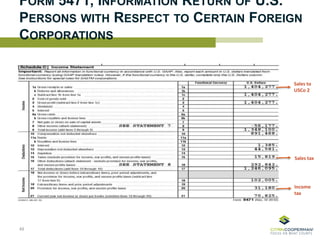

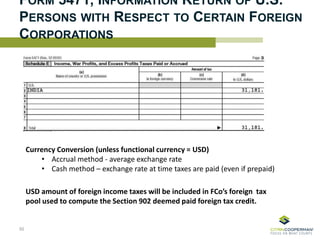

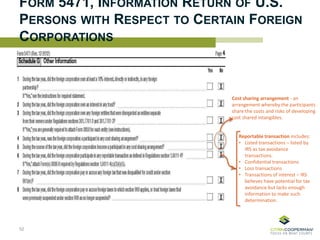

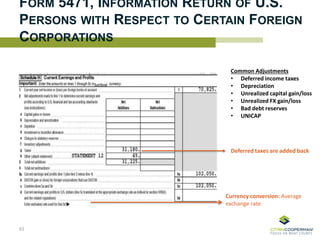

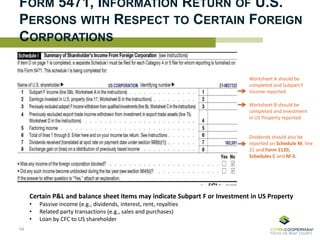

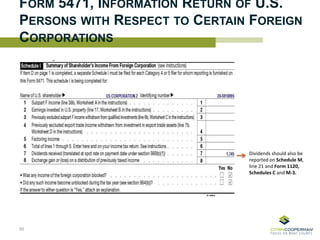

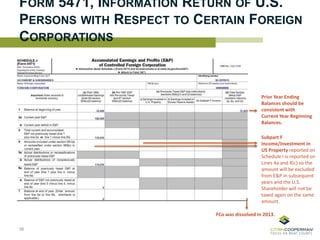

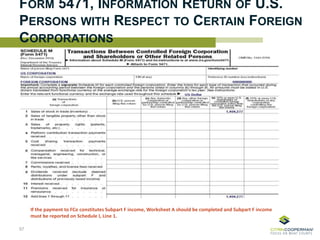

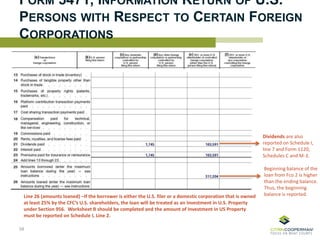

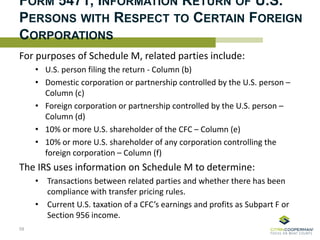

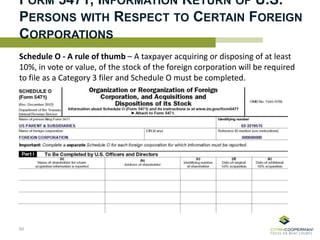

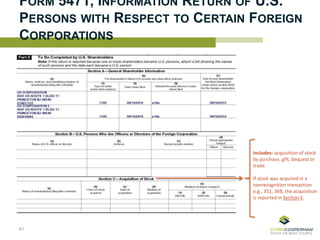

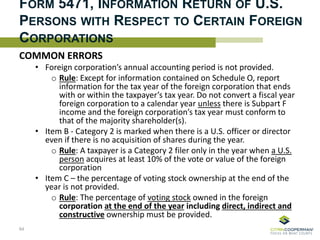

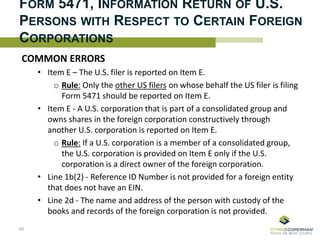

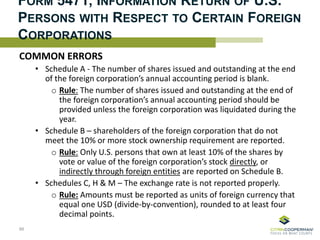

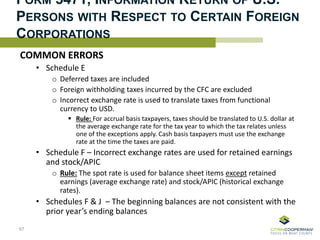

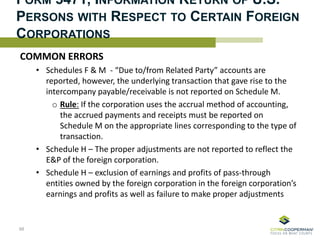

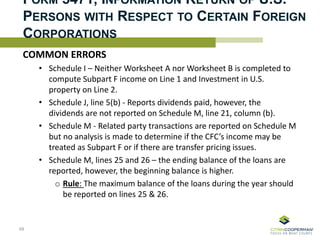

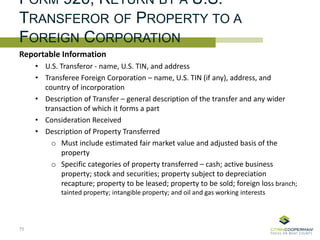

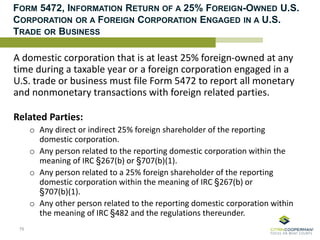

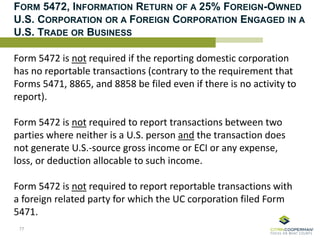

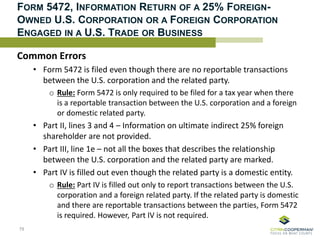

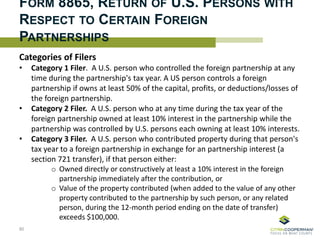

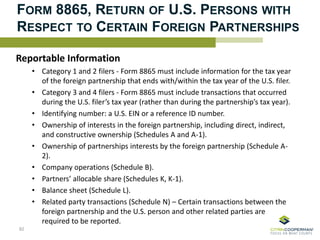

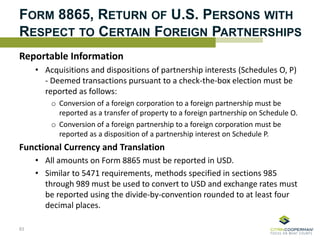

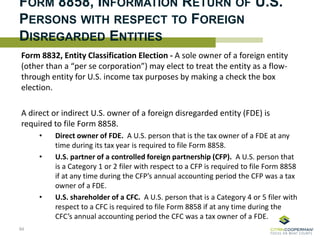

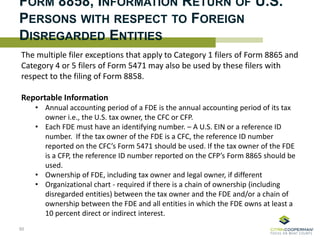

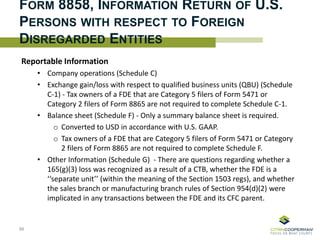

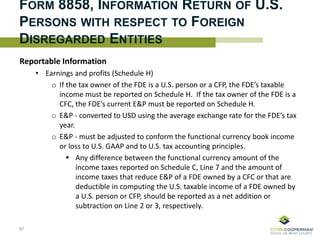

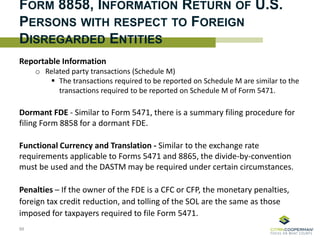

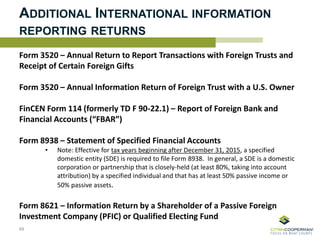

The document provides an overview of international tax reporting, particularly in relation to U.S. shareholders of foreign corporations, defining key terms like foreign corporations and earnings and profits. It explains U.S. taxation principles for foreign corporations and U.S. shareholders, including the treatment of subpart F income and the related compliance and reporting requirements. Additionally, it details penalties for noncompliance with foreign information reporting requirements, emphasizing the IRS's scrutiny on U.S. persons with foreign activities.