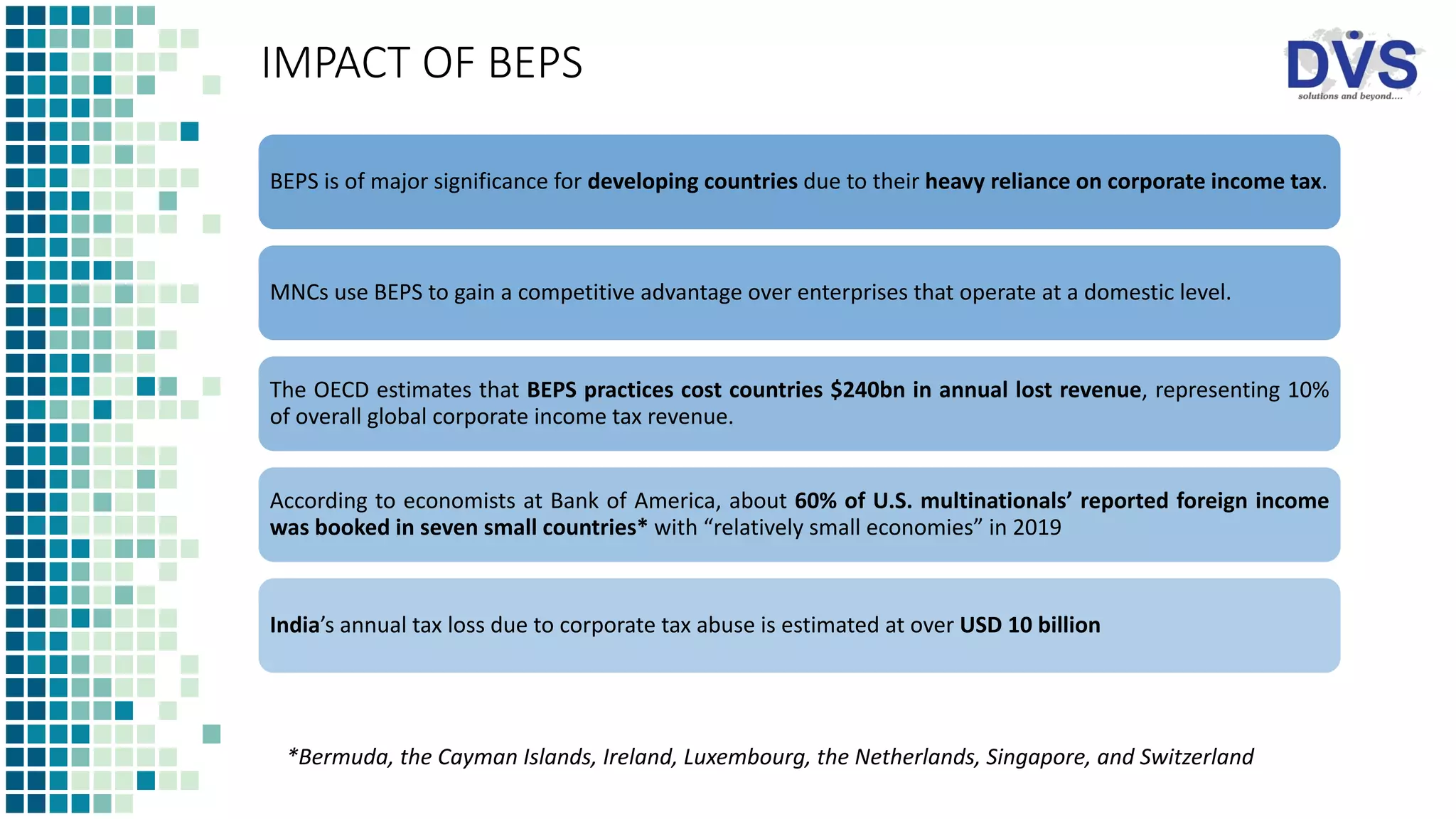

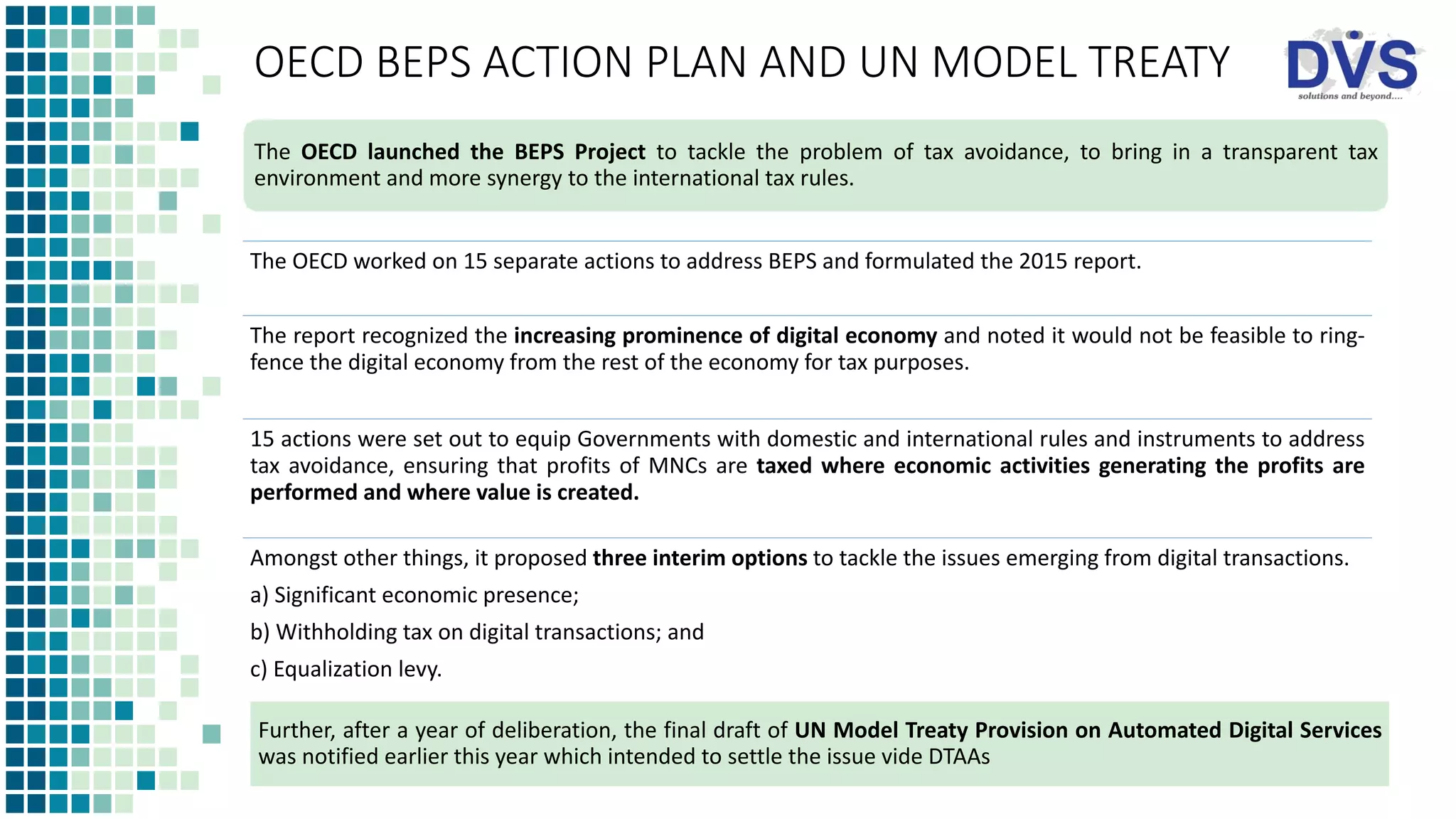

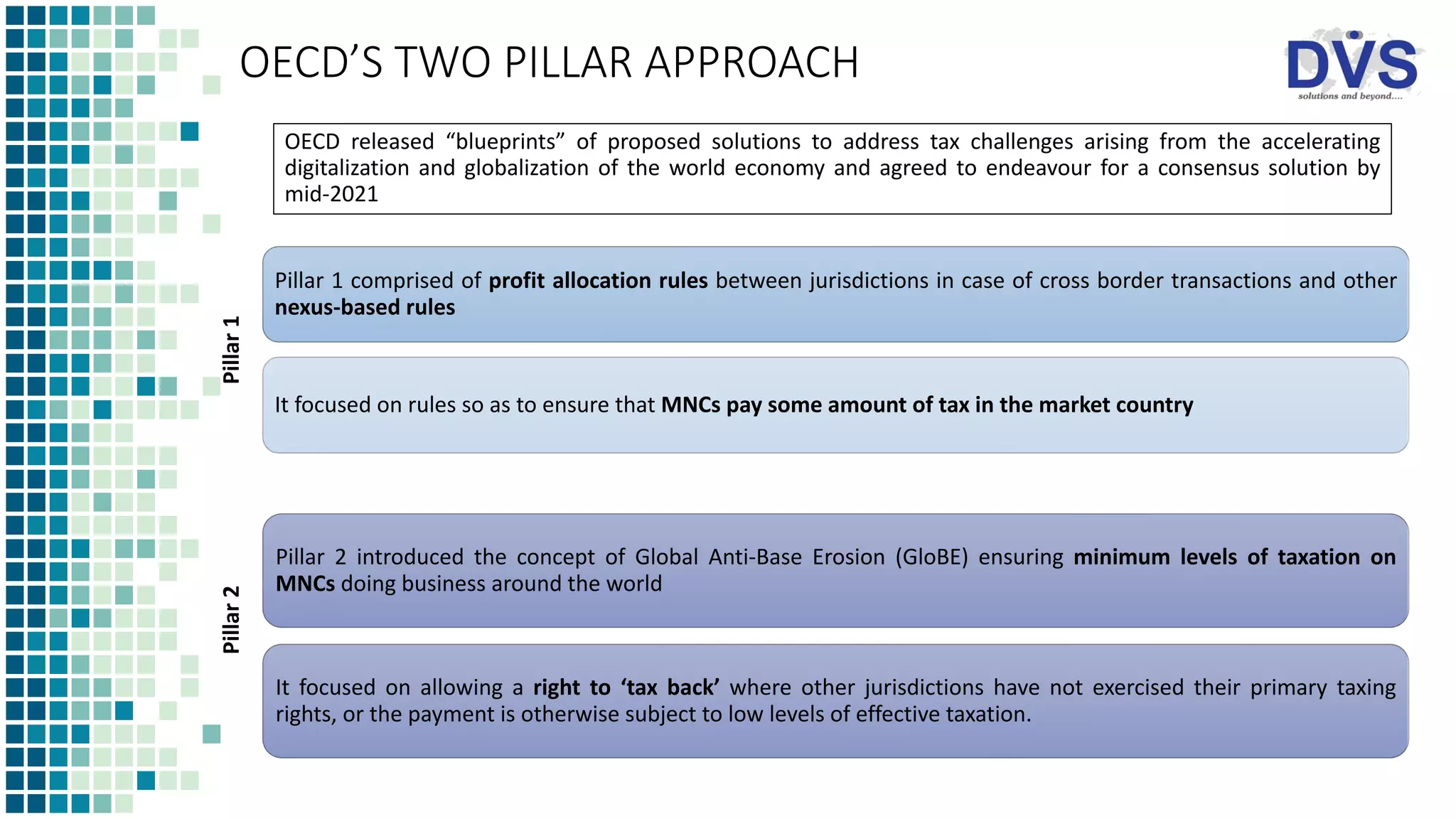

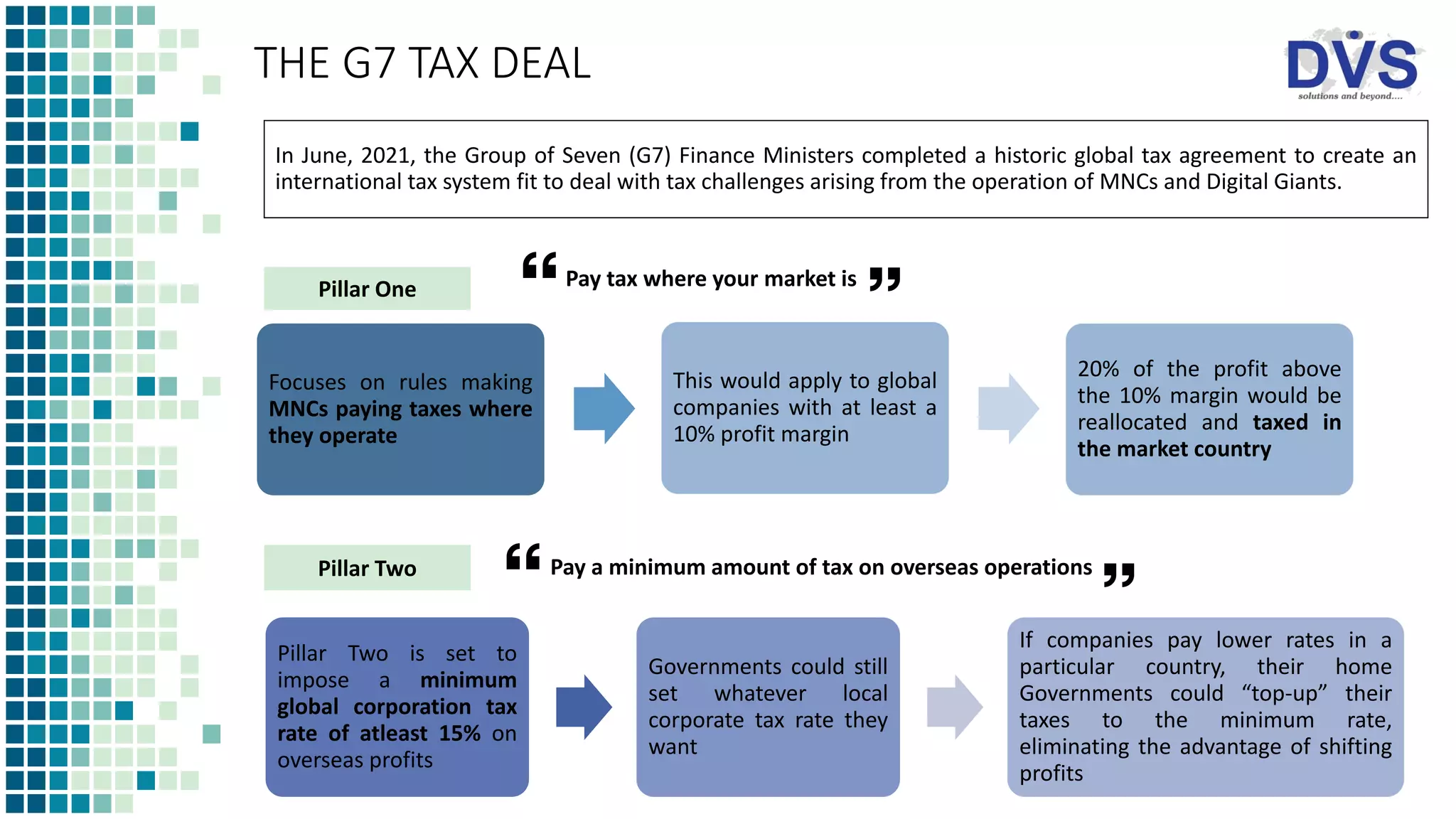

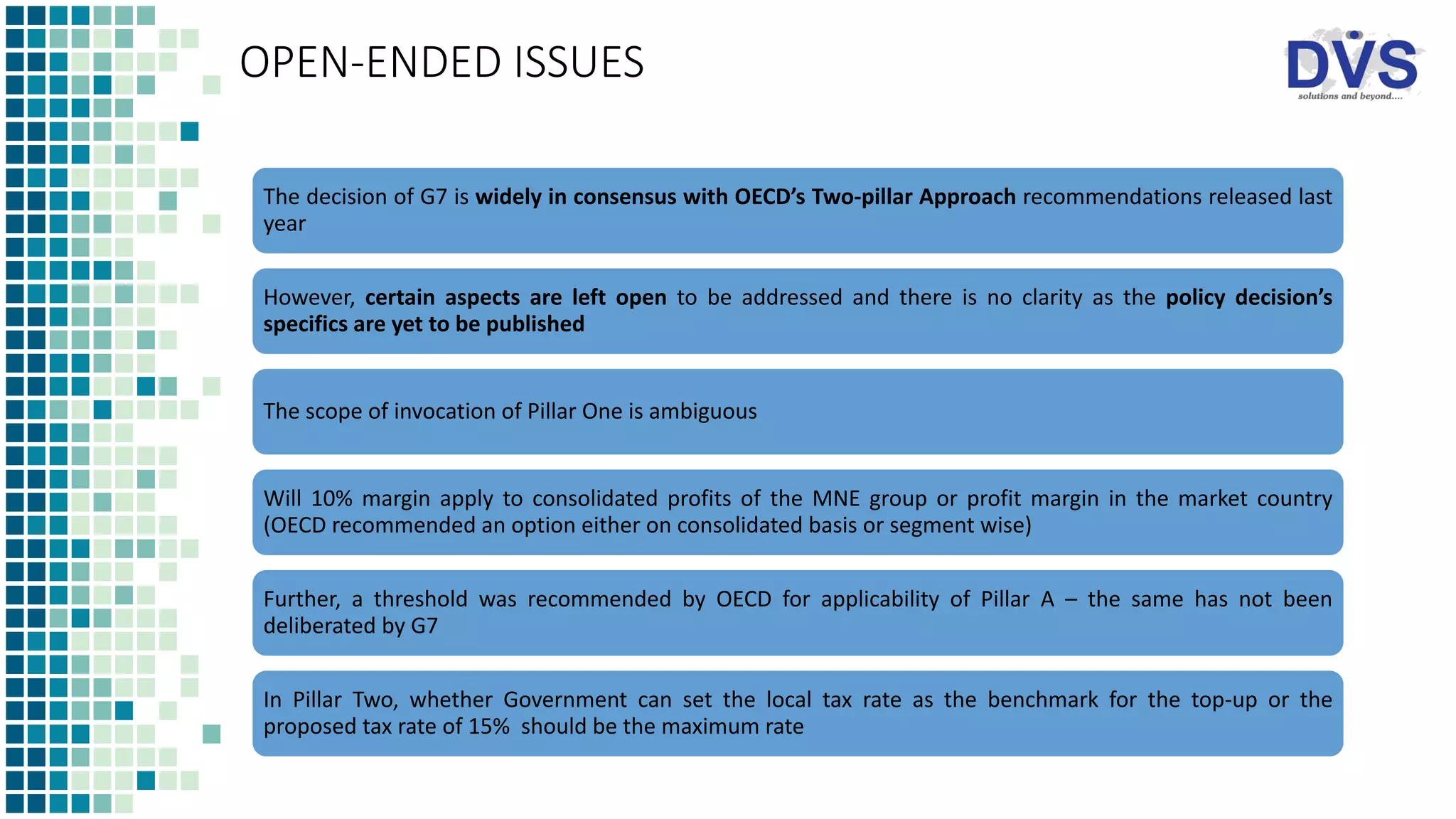

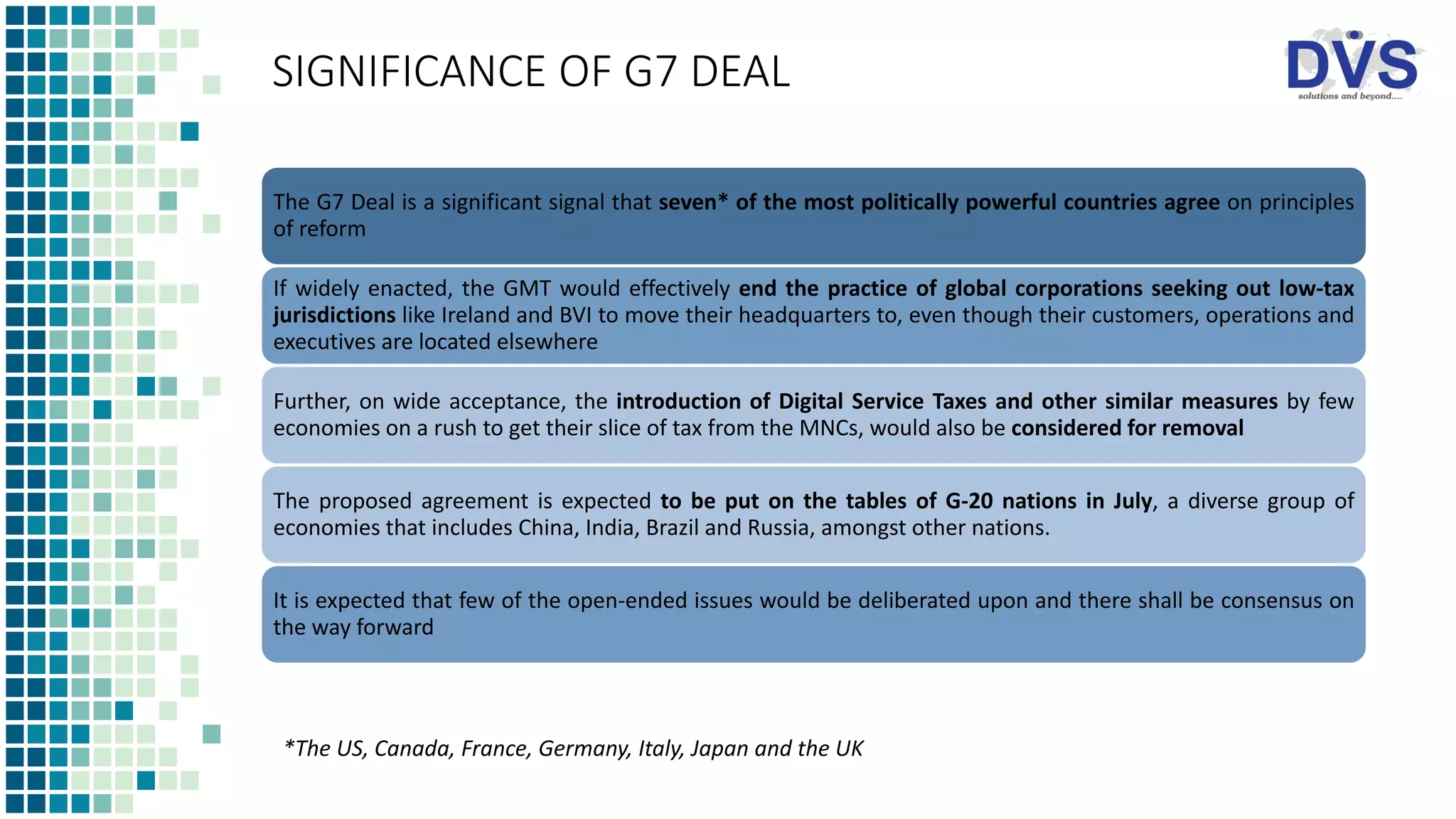

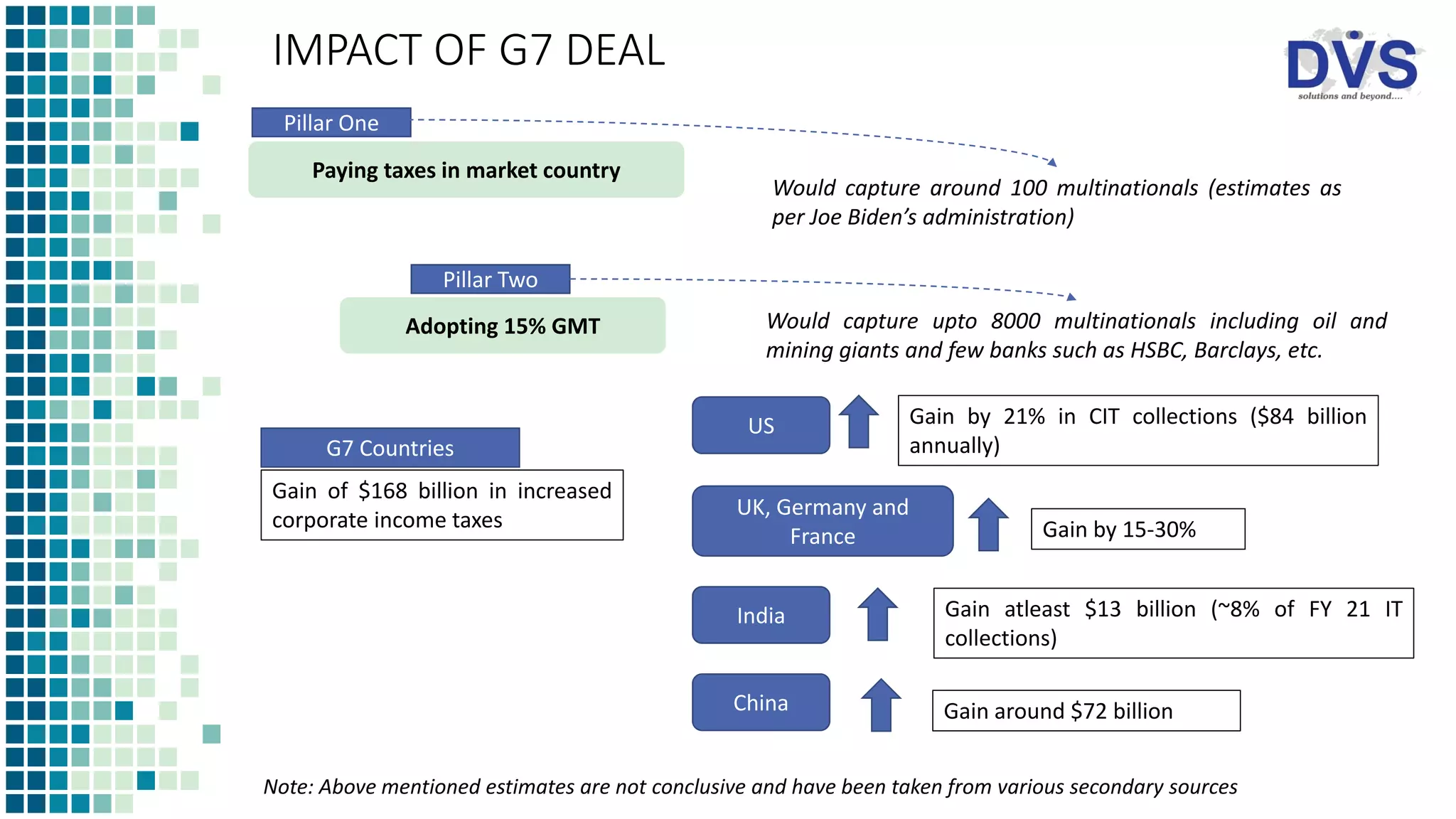

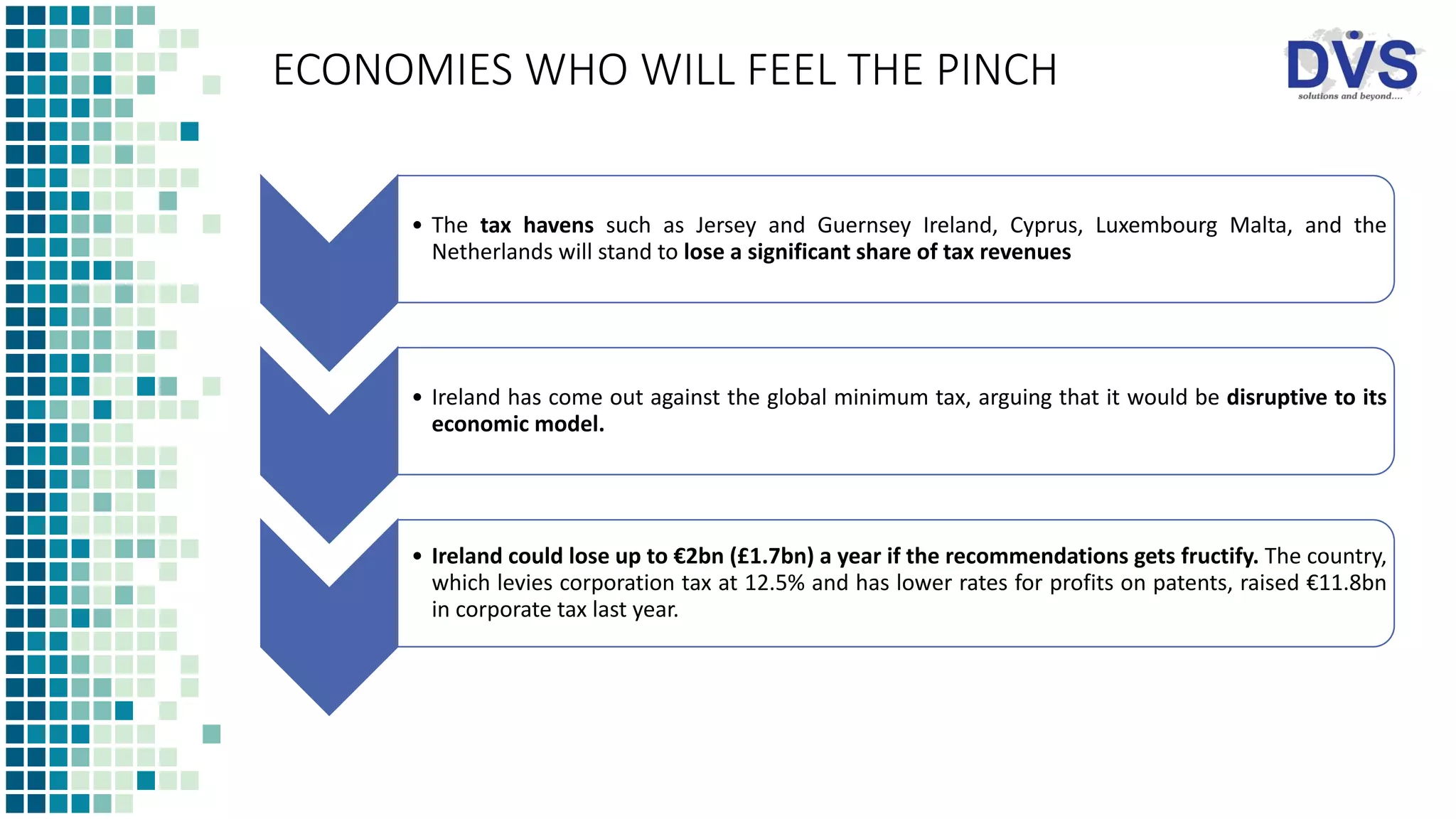

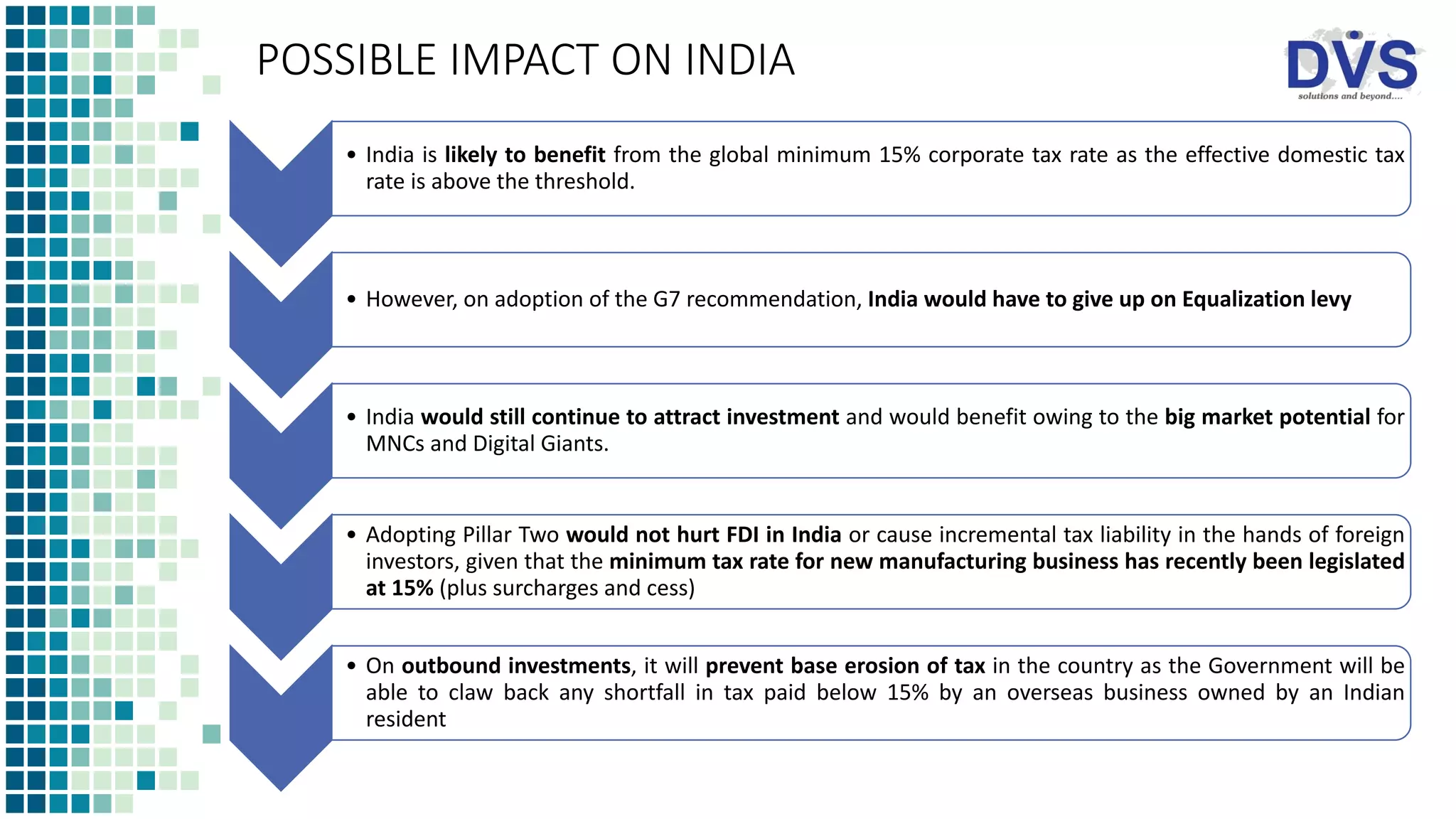

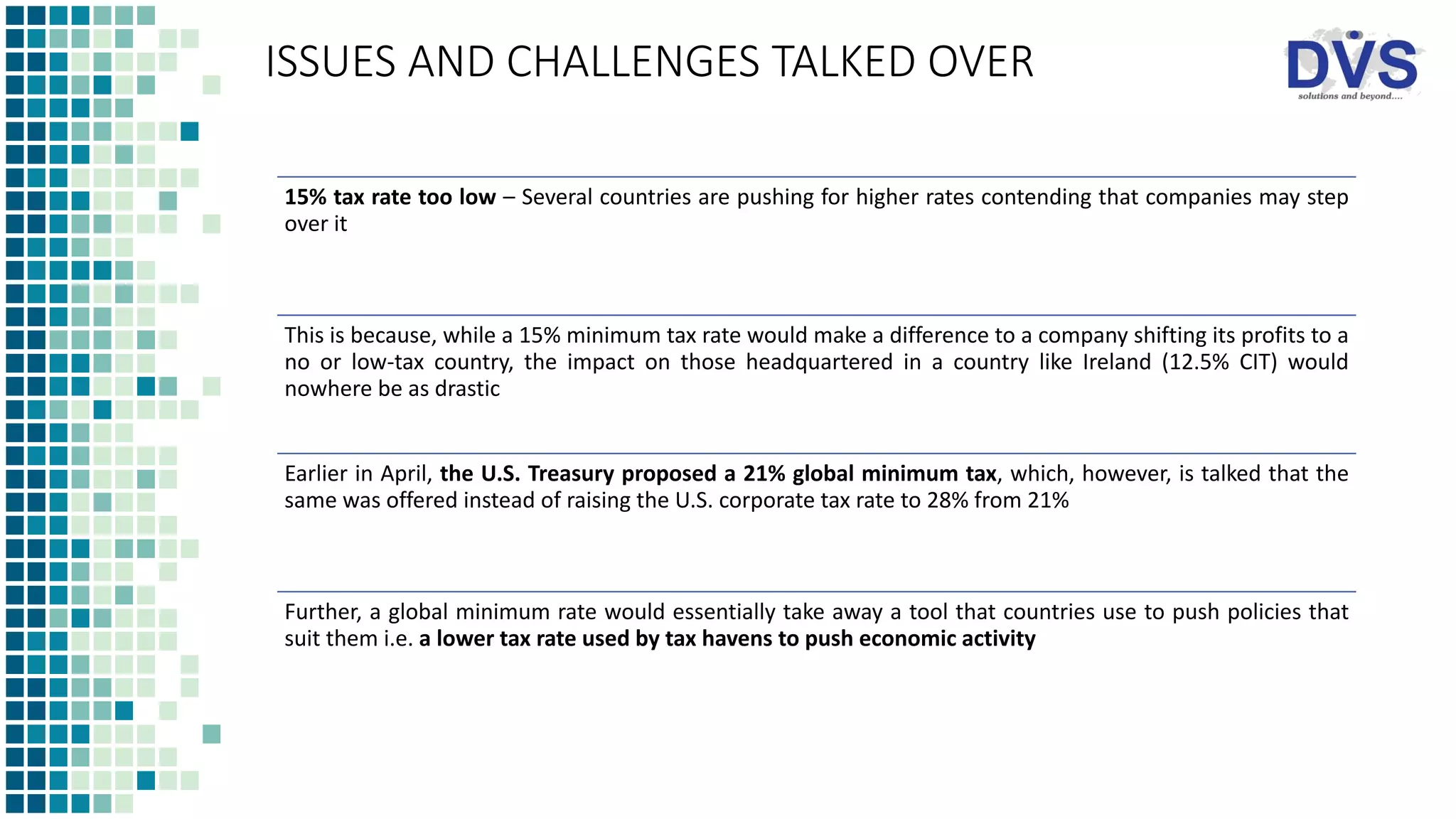

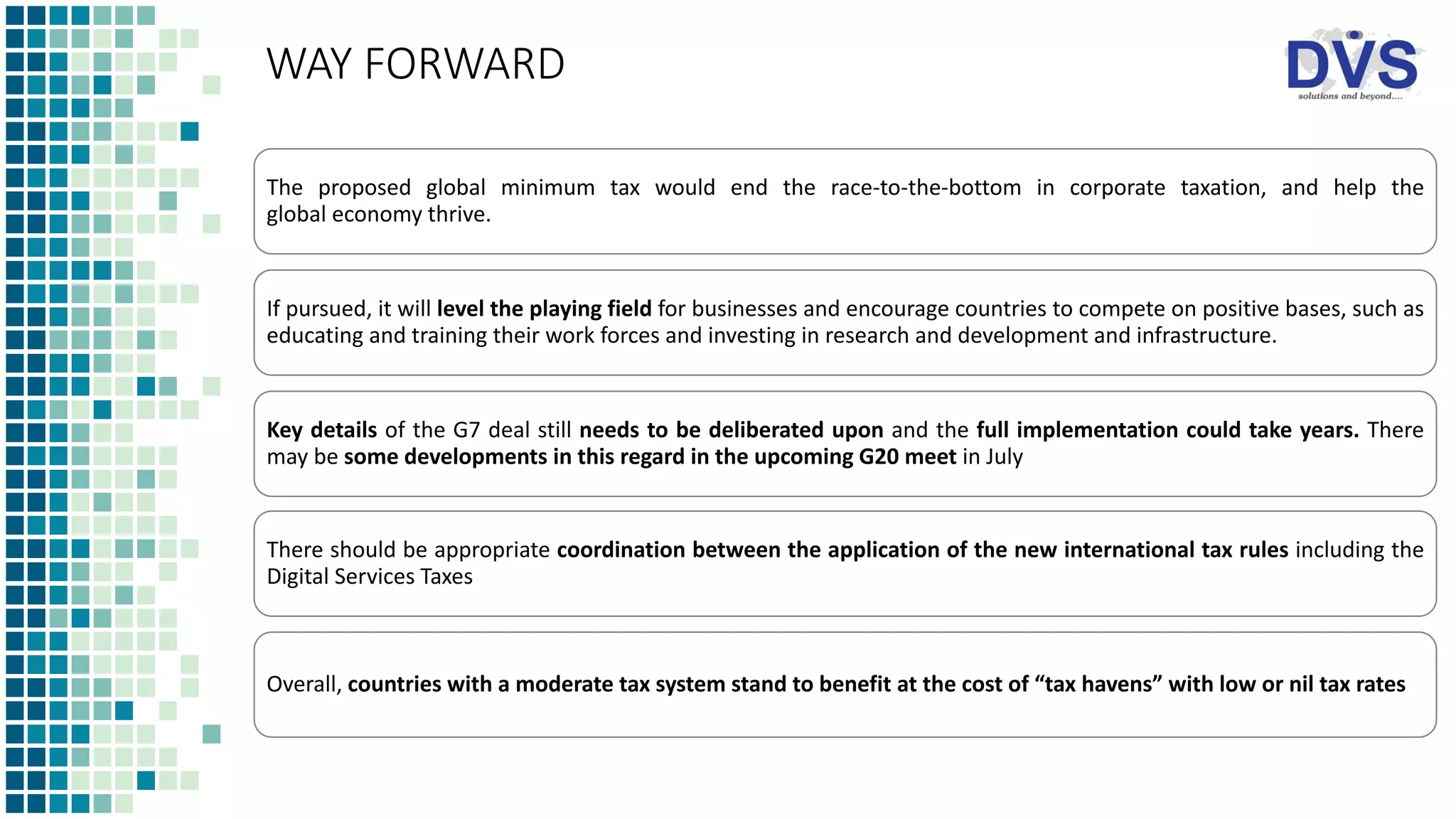

The document summarizes the global efforts to reform international corporate taxation of multinational corporations (MNCs). It discusses existing issues like base erosion and profit shifting (BEPS) and measures taken by OECD and countries. It then summarizes the recent agreement by G7 countries to support OECD's two pillar approach for taxing MNCs. Pillar One aims to reallocate some profits to market jurisdictions. Pillar Two proposes a global minimum corporate tax of 15%. The agreement could significantly impact tax havens and boost tax revenues but also faces challenges in implementation.