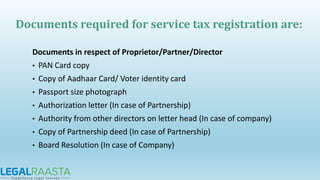

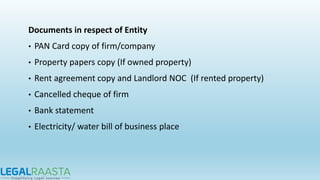

Service tax is a tax paid to the government for enjoying services from various providers. It is currently charged at 12.36% of the gross value of the service. To pay service tax, one must first register for it. The required documents for service tax registration include PAN cards, identity documents, authorization letters, property documents, and bank statements of the individual or business. Once registered, service tax must be paid either quarterly or monthly depending on the business type, with payment due by the 5th of the month following the tax period.