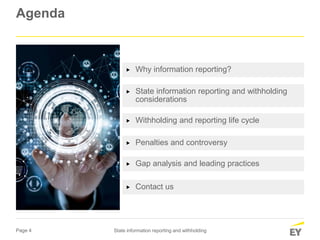

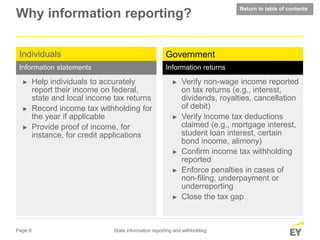

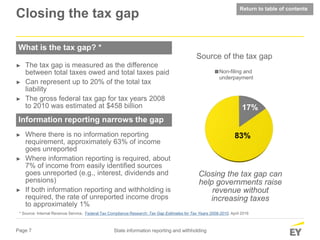

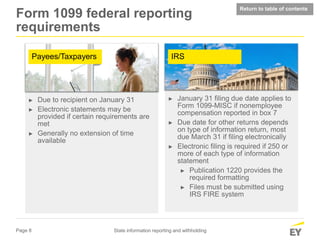

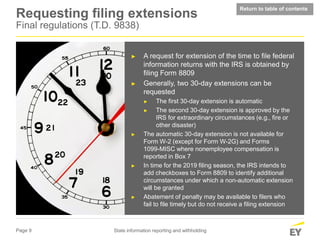

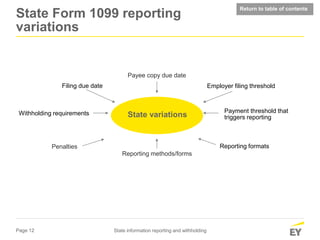

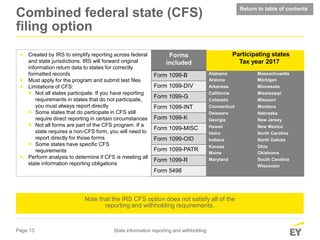

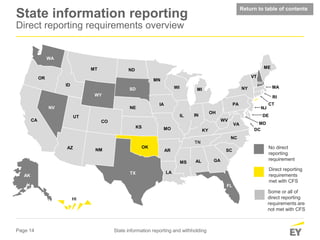

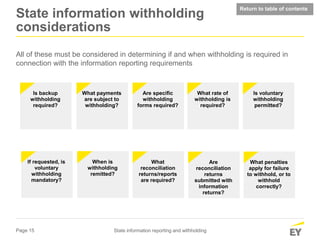

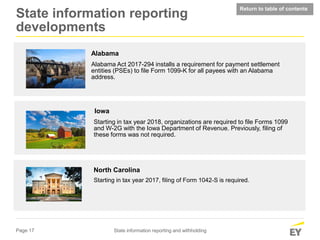

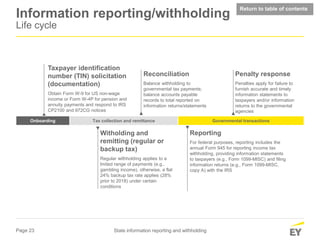

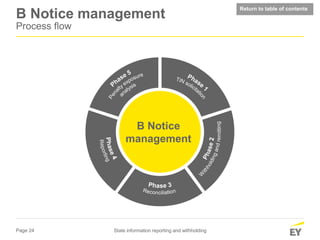

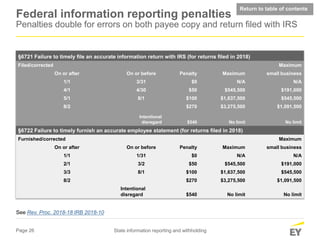

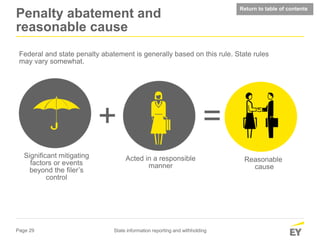

This presentation discusses the complexities of state information reporting and withholding, emphasizing the importance of accurate reporting to close the tax gap. It covers federal requirements, penalties for non-compliance, and variations among states, along with the Combined Federal-State (CFS) filing option. The document serves as an educational resource for understanding obligations and best practices in tax reporting.