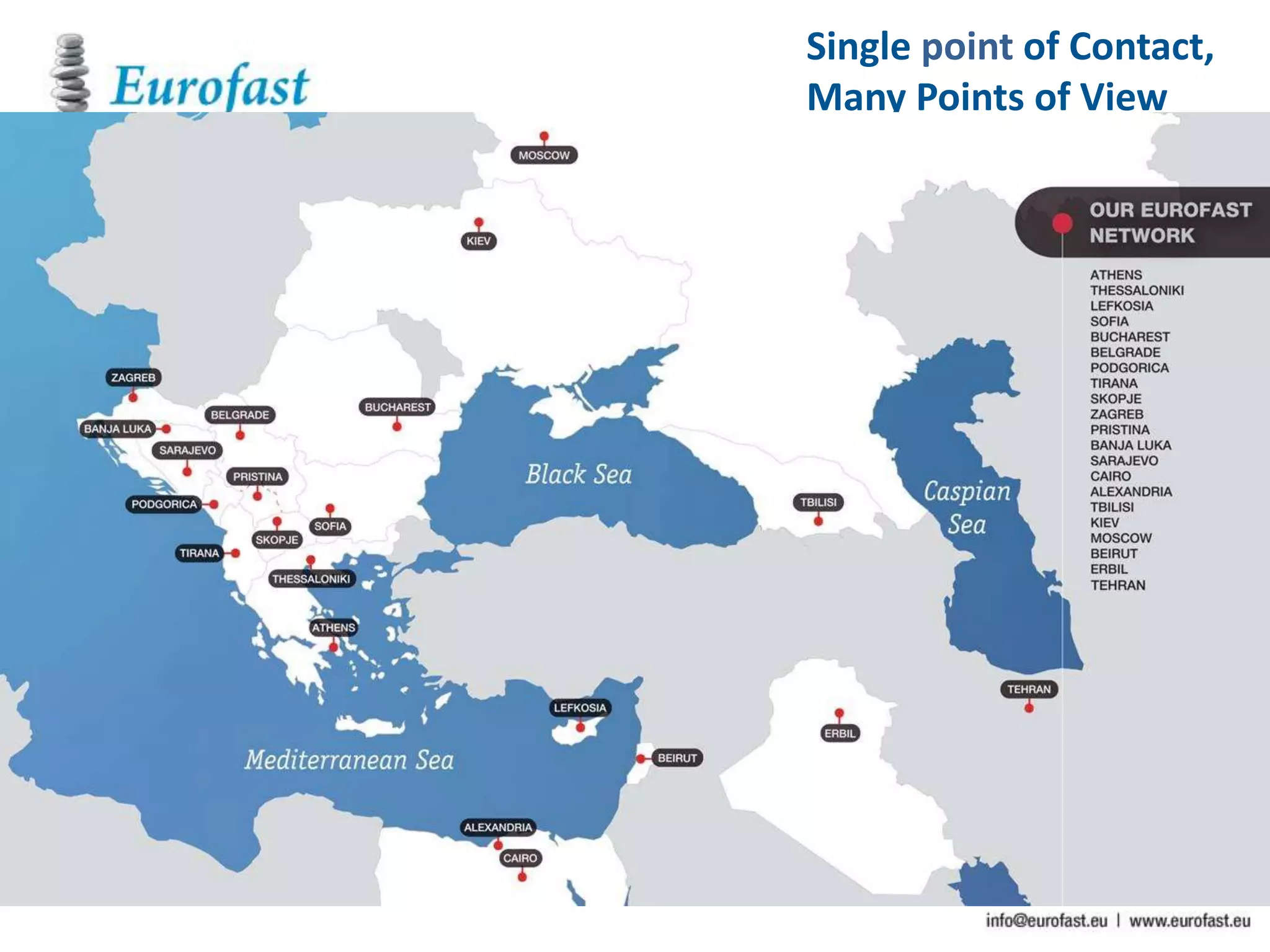

The document outlines the implementation of the Common Reporting Standard (CRS) in Cyprus, detailing its goals to combat tax evasion, money laundering, and other financial crimes through automatic information exchange among countries. It discusses the classification of financial and non-financial institutions, compliance requirements, and the timeline for early adopters starting in 2016. Additionally, the document emphasizes the sanctions for non-compliance and highlights the services offered by Eurofast as a regional business advisory organization.