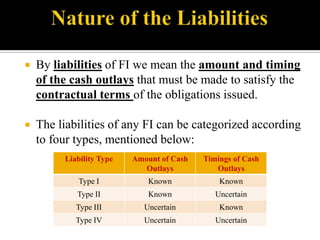

This chapter introduces financial intermediaries such as commercial banks, savings and loans associations, investment companies, insurance companies, and pension funds. Their main function is to provide an inexpensive flow of money from savers to investors and borrowers. Financial intermediaries obtain funds by issuing financial claims and then invest those funds in loans or securities. This provides indirect investment for participants who hold the financial claims. Financial intermediaries provide maturity intermediation by transforming longer-term assets into shorter-term financial claims, reduce risk via diversification, reduce contracting and information costs, and provide payment mechanisms.