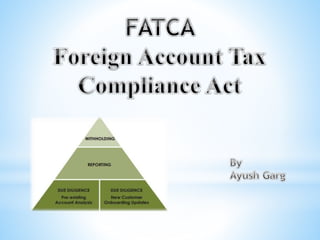

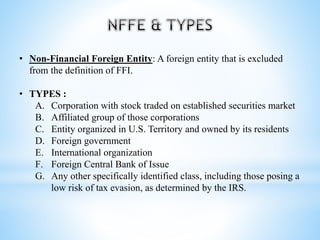

The Foreign Account Tax Compliance Act (FATCA), enacted in 2010 and effective from 2013, mandates U.S. persons to report financial accounts held outside the U.S. and requires foreign financial institutions (FFIs) to report U.S. clients to the IRS. FATCA aims to enhance IRS transparency regarding U.S. persons' investments through foreign institutions and imposes a 30% withholding tax for non-compliance. The legislation has significantly impacted FFIs, leading to considerable costs for compliance, as well as ongoing negotiations for intergovernmental agreements among countries like Jamaica and other CARICOM states.