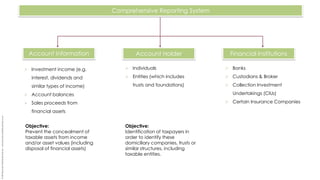

The document outlines the automatic exchange of financial account information under the Common Reporting Standard (CRS) to identify taxable entities and prevent asset concealment. It details the reporting obligations for financial institutions regarding pre-existing and new accounts, with deadlines spanning from 2015 to 2018. Furthermore, it lists participating jurisdictions globally and emphasizes the compliance processes and data handling related to taxpayer identification.