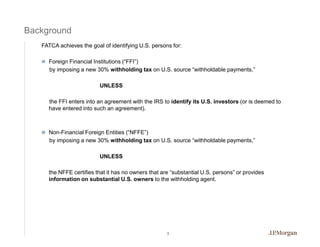

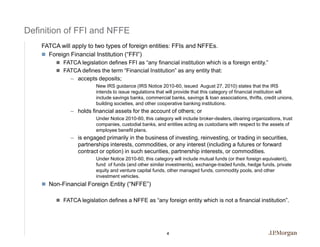

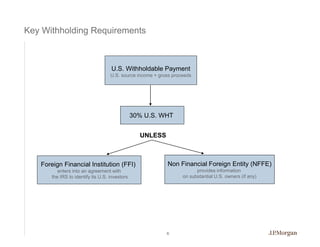

This document summarizes a seminar by J.P. Morgan on the Foreign Account Tax Compliance Act (FATCA). FATCA aims to identify U.S. persons invested in foreign accounts by imposing new reporting and withholding requirements on foreign financial institutions (FFIs) and non-financial foreign entities (NFFEs). FFIs must enter agreements to report U.S. account information to the IRS or face 30% withholding on U.S. payments, while NFFEs must certify they have no substantial U.S. owners or provide owner information to avoid withholding. The seminar covers key FATCA definitions, requirements, exceptions, and timeline, as well as preliminary IRS guidance that requests industry comments