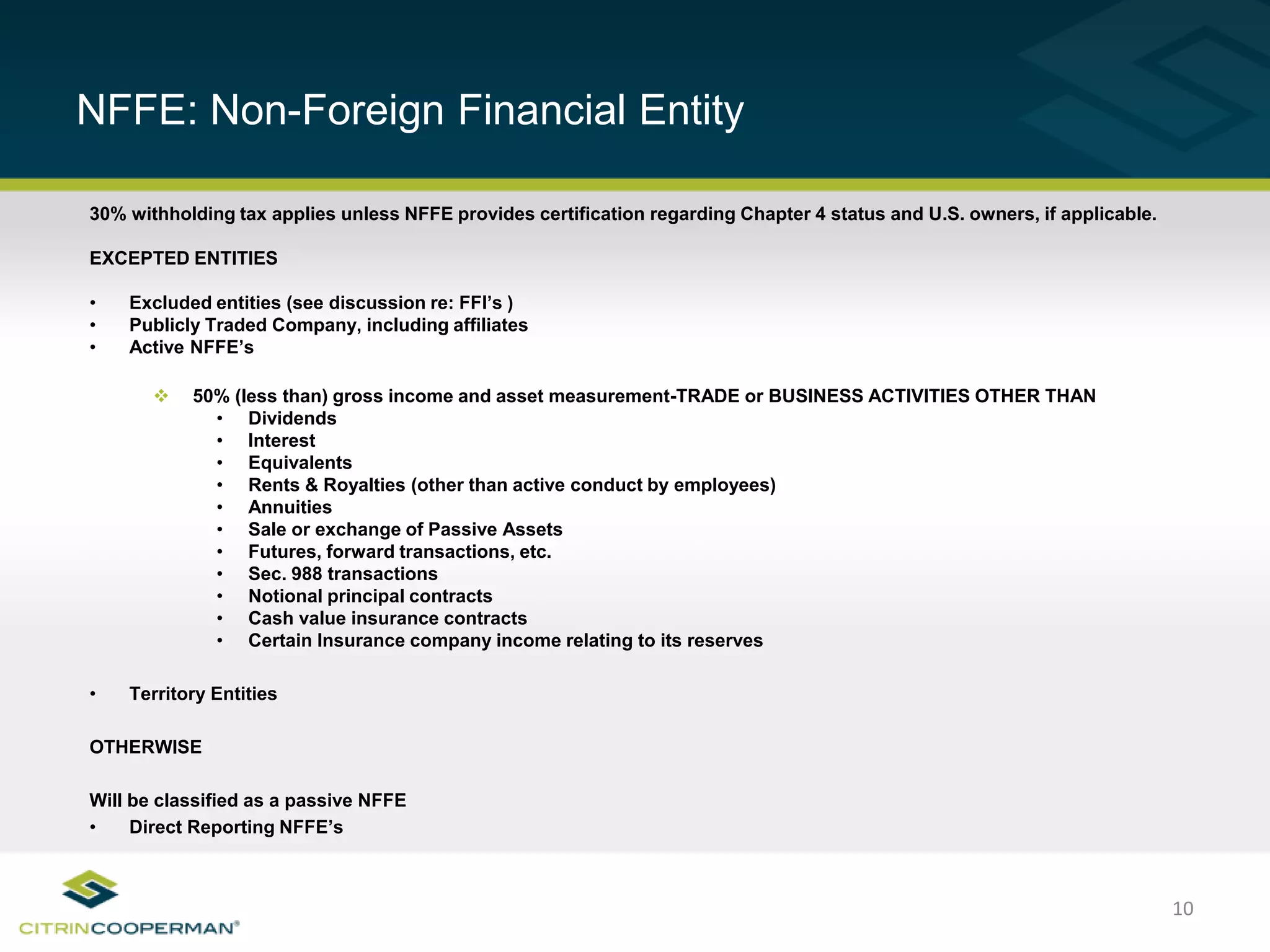

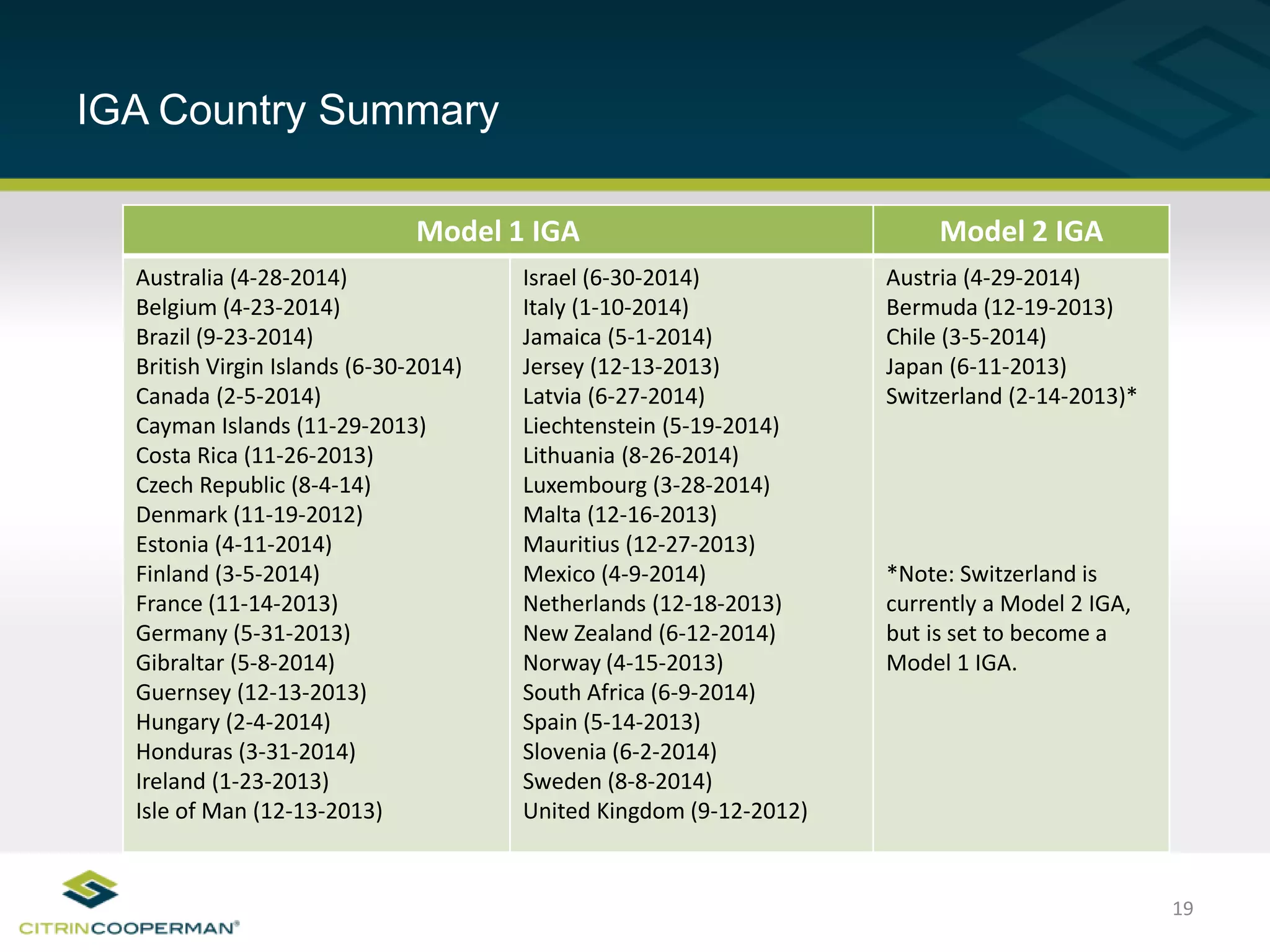

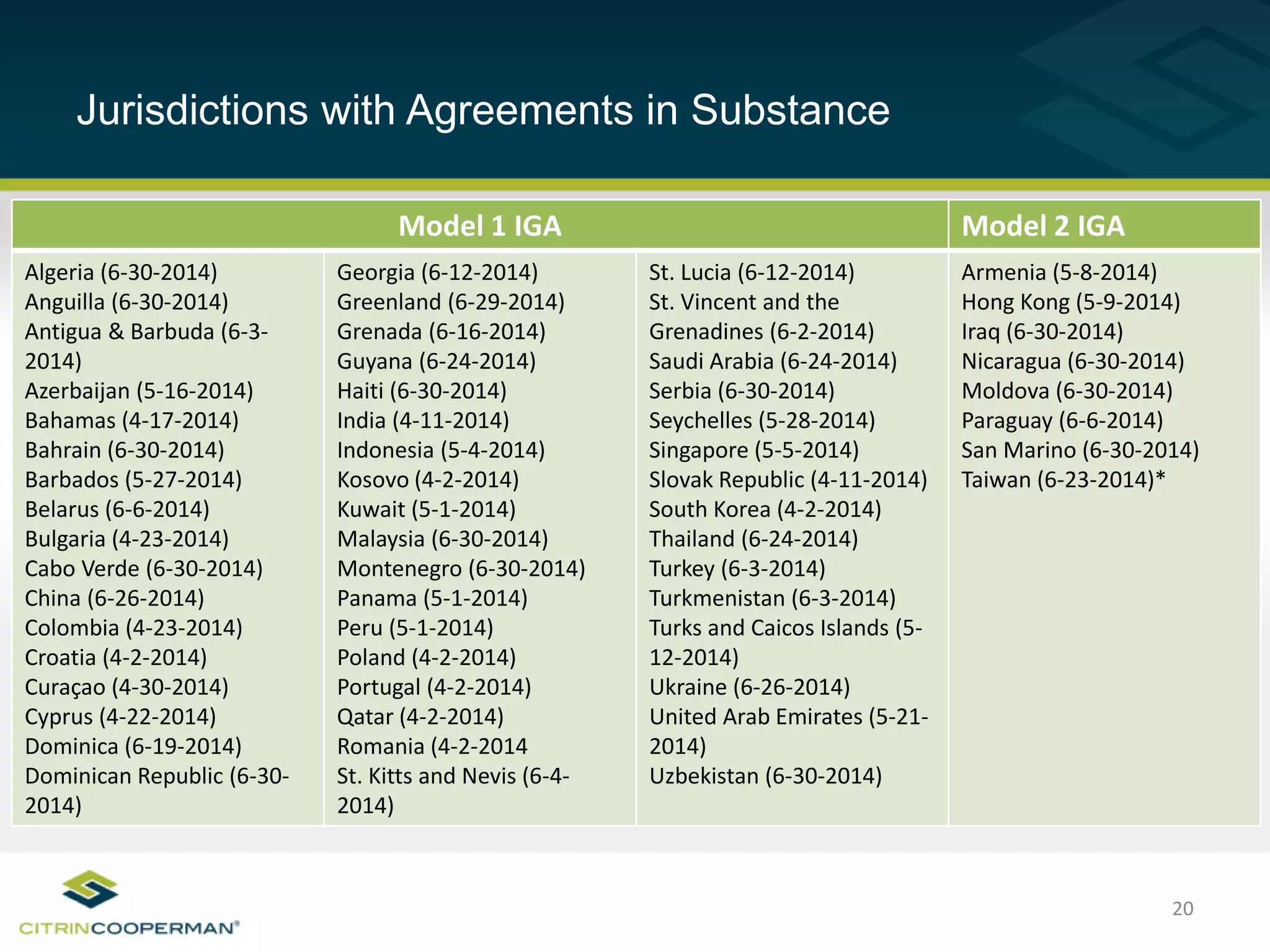

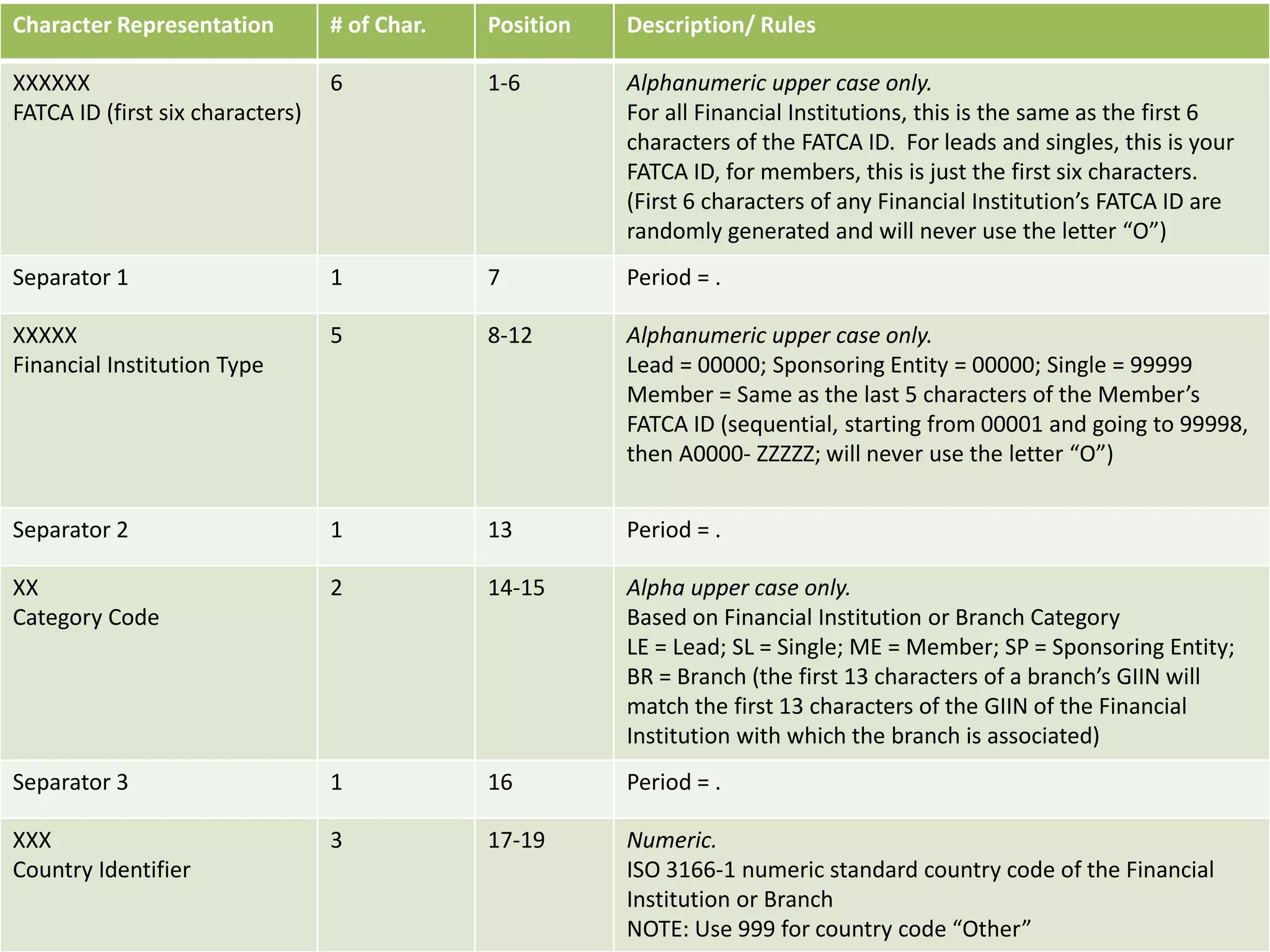

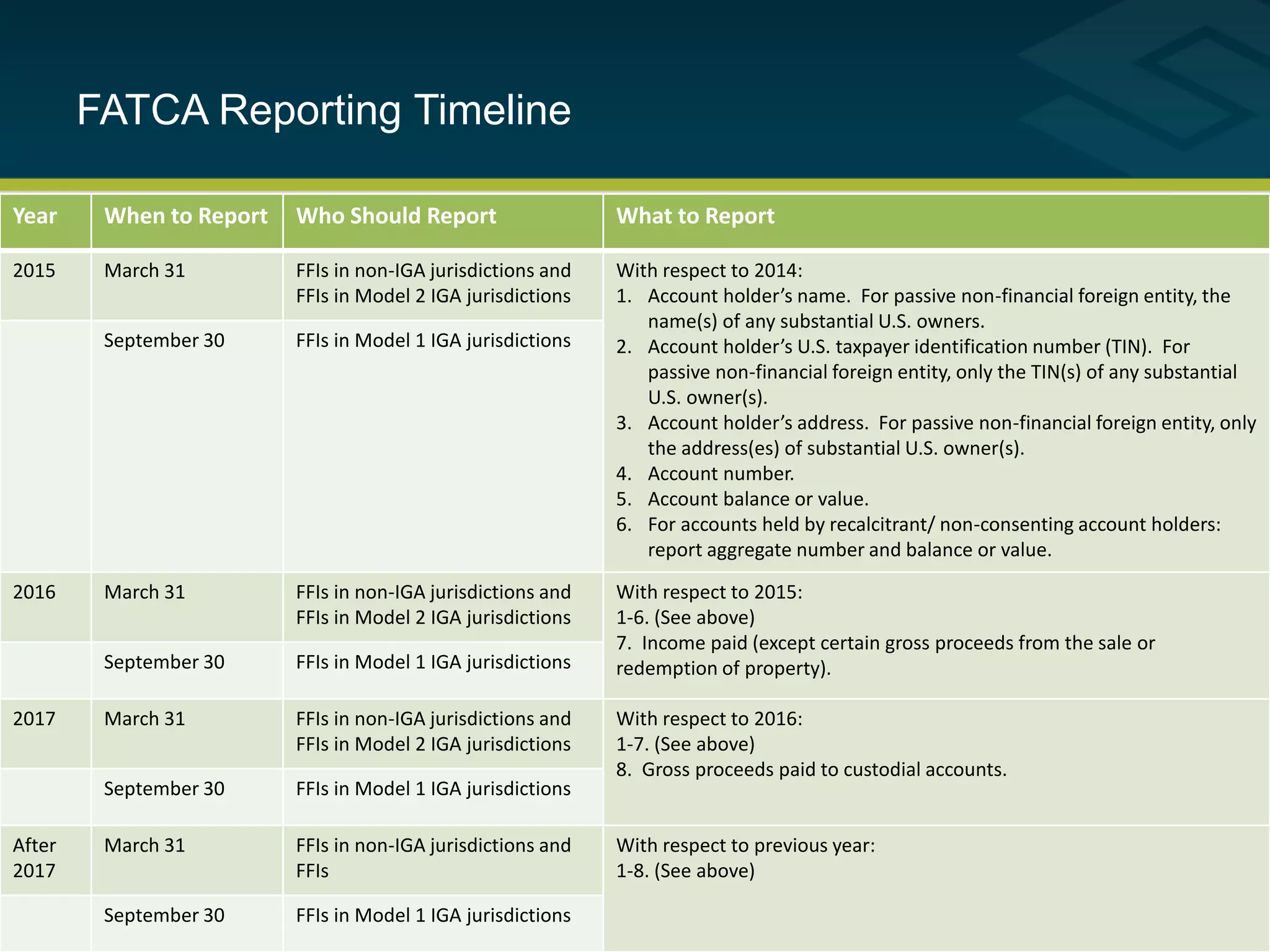

The document outlines the key components of the Foreign Account Tax Compliance Act (FATCA), detailing requirements for foreign financial institutions (FFIs) and non-financial foreign entities (NFFEs) regarding U.S. account holders to prevent tax evasion. It addresses the classification of FFIs, the types of entities involved, and the implications of non-compliance, such as a 30% withholding tax. The document also discusses Intergovernmental Agreements (IGAs) that facilitate compliance with local laws while reporting to the IRS.