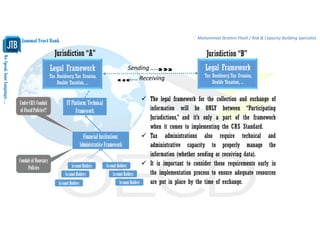

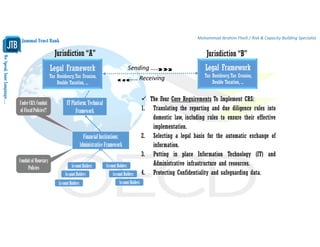

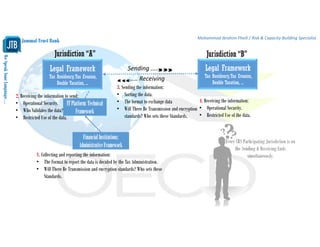

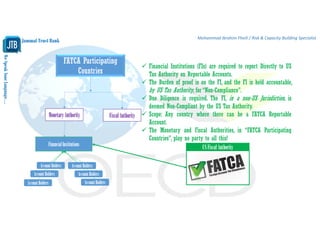

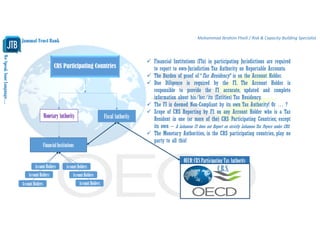

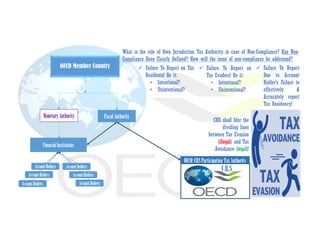

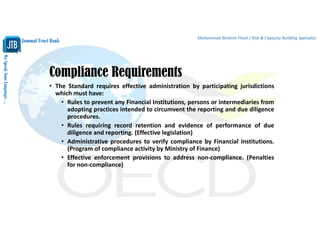

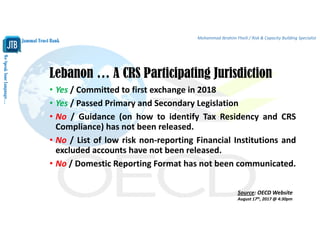

The document discusses the Common Reporting Standard (CRS) as a tool designed to combat tax evasion and enhance tax compliance through automatic information exchange between participating jurisdictions. It outlines the legal framework, implementation requirements, and administrative responsibilities of financial institutions in relation to tax reporting and due diligence, while also highlighting the shift in the banking model and the implications for both surplus and deficit spending units. Furthermore, it addresses Lebanon's current status as a CRS participant and the challenges related to guidance and compliance in the context of tax residency and reportable accounts.